The stock markets have seen massive volatility over the past few months. The economic conditions today have led to increasing uncertainty, massive outflow of FDIs from the country, rising inflation, and a depreciating rupee. To sum it up, things look quite bleak o the surface. However, there is a silver lining in this scenario and that is an opportunity to invest in quality stocks when they are available at competent prices. The first through in such cases are the blue-chip stocks. While they are definitely a good bet, another lucrative option is the multi-bagger penny stocks. Given here are the meaning and other related details of the penny stocks to help investors make suitable investment decisions. Read More: How to buy your first stock?

The stock markets have seen massive volatility over the past few months. The economic conditions today have led to increasing uncertainty, massive outflow of FDIs from the country, rising inflation, and a depreciating rupee. To sum it up, things look quite bleak o the surface. However, there is a silver lining in this scenario and that is an opportunity to invest in quality stocks when they are available at competent prices. The first through in such cases are the blue-chip stocks. While they are definitely a good bet, another lucrative option is the multi-bagger penny stocks. Given here are the meaning and other related details of the penny stocks to help investors make suitable investment decisions. Read More: How to buy your first stock?

Penny stocks are stocks that are traded at a very low price in the market usually Rs. 10 per share in India and US$ 5 in the US markets. These stocks are considered to be quite risky as the companies are usually new or have a history of financial difficulty. Investing in such stocks can give investors potentially high returns provided they are backed by strong fundamentals and growth opportunities.

Multibagger stocks refer to stocks of companies that generate significant returns for investors over a period of time, typically more than 100% or several times the initial investment. These stocks have the potential to increase in value exponentially due to factors such as strong fundamentals, high growth potential, or a positive industry outlook. The term "multi-bagger" implies that the stock has the potential to generate returns that are several times the original investment, making it a very attractive investment opportunity. On these lines, multi-bagger penny stocks are penny stocks that have the potential to provide exponential returns of more than 100%. These stocks have low market capitalisation and trade at a very low price per share and can provide substantial returns over a short period of time.

Multibagger stocks refer to stocks of companies that generate significant returns for investors over a period of time, typically more than 100% or several times the initial investment. These stocks have the potential to increase in value exponentially due to factors such as strong fundamentals, high growth potential, or a positive industry outlook. The term "multi-bagger" implies that the stock has the potential to generate returns that are several times the original investment, making it a very attractive investment opportunity. On these lines, multi-bagger penny stocks are penny stocks that have the potential to provide exponential returns of more than 100%. These stocks have low market capitalisation and trade at a very low price per share and can provide substantial returns over a short period of time.

Identifying multi-bagger penny stocks can be a challenging task, but there are certain factors that can help investors in India to spot such stocks. Here are some tips to identify multi-bagger penny stocks:

This is the primary requirement while investing in any company. It includes evaluating factors such as revenue growth, profit margins, debt levels, and return on equity. Companies with strong fundamentals are more likely to generate consistent growth and become multi-baggers over time.

This is the primary requirement while investing in any company. It includes evaluating factors such as revenue growth, profit margins, debt levels, and return on equity. Companies with strong fundamentals are more likely to generate consistent growth and become multi-baggers over time.

Look for companies with experienced and competent management teams that have a proven track record of success. Good management is often a key factor in the success of a company.

Look for companies with experienced and competent management teams that have a proven track record of success. Good management is often a key factor in the success of a company.

Companies with innovative business models or disruptive technologies can often generate significant growth and become multi-baggers in the long run. So it is important to also consider evaluating the business model of the company for investment.

Companies with innovative business models or disruptive technologies can often generate significant growth and become multi-baggers in the long run. So it is important to also consider evaluating the business model of the company for investment.

Another important point is to look for industries that are growing rapidly, have strong demand, or are poised for growth in the future. Companies in such industries may have the potential to become multi-baggers.

Another important point is to look for industries that are growing rapidly, have strong demand, or are poised for growth in the future. Companies in such industries may have the potential to become multi-baggers.

Look for companies that are undervalued relative to their peers or have a low price-to-earnings ratio. Such companies may have the potential to generate significant returns in the future.

Look for companies that are undervalued relative to their peers or have a low price-to-earnings ratio. Such companies may have the potential to generate significant returns in the future.

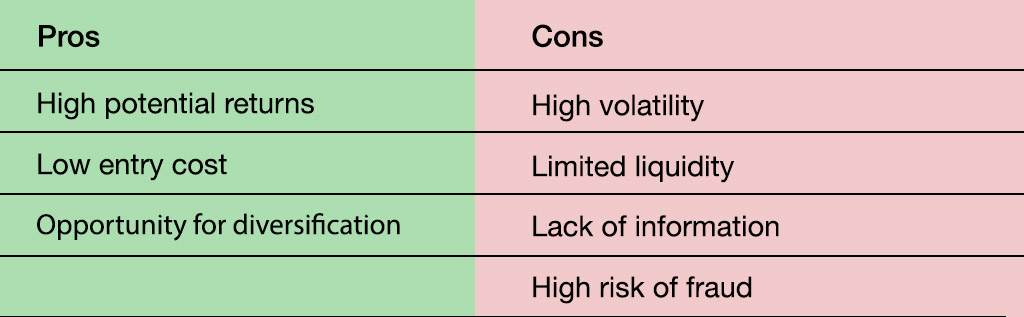

Some of the pros and cons of investing in multi-bagger penny stocks are mentioned hereunder.

Some of the prime benefits of investing in multi-bagger stocks are discussed below.

One of the biggest advantages of investing in multi-bagger penny stocks is the potential for high returns. Due to their low price, these stocks have the potential to increase in value exponentially, and if the investor can identify a company with strong fundamentals and growth potential, they can potentially make significant gains on their investment.

Another advantage of penny stocks is their low entry cost. These stocks are typically priced at a few rupees, which makes them affordable for investors who have a limited budget. This allows investors to invest in the stock market without having to put a lot of capital at risk.

Investing in multi-bagger penny stocks can provide an opportunity for diversification. By investing in several penny stocks across different industries, the investor can minimize their risk by spreading their investment across different companies and sectors.

Some of the shortcomings of investing in multi-bagger penny stocks are discussed below.

One of the biggest risks associated with penny stocks is their high volatility. These stocks can experience rapid price swings, and the investor can suffer significant losses if the stock price drops. This is why it is crucial for the investor to do thorough research and analysis before investing in any penny stock.

Another disadvantage of penny stocks is their limited liquidity. These stocks often have low trading volumes, which means that they may be difficult to sell quickly when the investor wants to exit their position. This can make it challenging for the investor to lock in gains or minimize losses.

Penny stocks may have limited information available to investors, making it difficult to evaluate their true value and potential. These companies may not be widely followed by analysts, and may not have the same level of transparency as larger companies.

Penny stocks are often associated with fraudulent schemes and scams. These companies may engage in pump-and-dump schemes, where they artificially inflate the stock price before selling their shares and leaving investors with worthless stocks. This is why it is crucial for investors to do thorough research and analysis before investing in any penny stock, and to be cautious of companies that promise high returns with little risk.

Penny stocks are a very good investment opportunity for investors with a high-risk appetite as the capital outflow for investment is low and the returns potential is quite high. Multibagger penny stocks on the other hand are a better version of penny stocks that provide exponential returns. Hence, they are an excellent addition to any investment portfolio. Hope this article was able to provide sound information on multi-bagger penny stocks. Let us know if you need more information relating to these stocks or ave any queries regarding the same. Till then Happy Reading!

Sago

June 04, 2023I sincerely appreciate the valuable and applicable guidance you have shared. Your extensive knowledge and sincere dedication to assisting individuals in attaining financial stability truly emanates from your writing. I am grateful for coming across your blog post and eagerly anticipating delving into more of your insightful material in the times to come.