Stock trading is fast becoming one of the leading career choices of young professionals in the recent past. This increased interest in stock trading as a choice of career can be attributed to the increased awareness relating to stock markets and related products and the ease of the process due to new technologies.

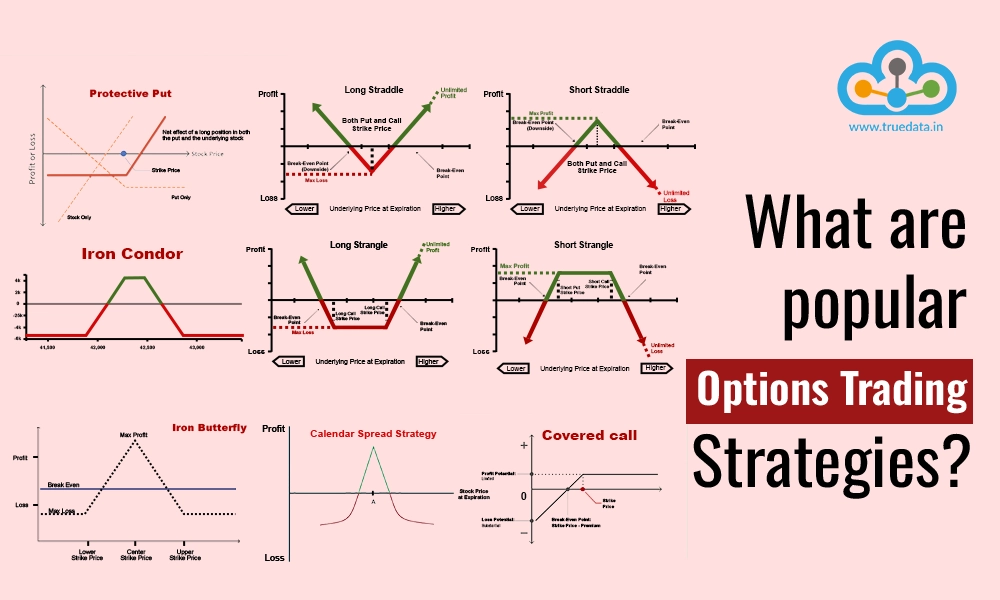

There are various choices for traders in stock markets other than trading in traditional stocks which includes trading in derivative or secondary markets. Options trading is one such option where traders can use various strategies under technical analysis to make successful trades and ensure timely entry and exit from the market. The iron condor is a popular options trading strategy that can be used by traders and makes use of a combination of call and put options to maximise their profits.

Given below is the meaning of the iron condor strategy and how to use it for options trading successfully.

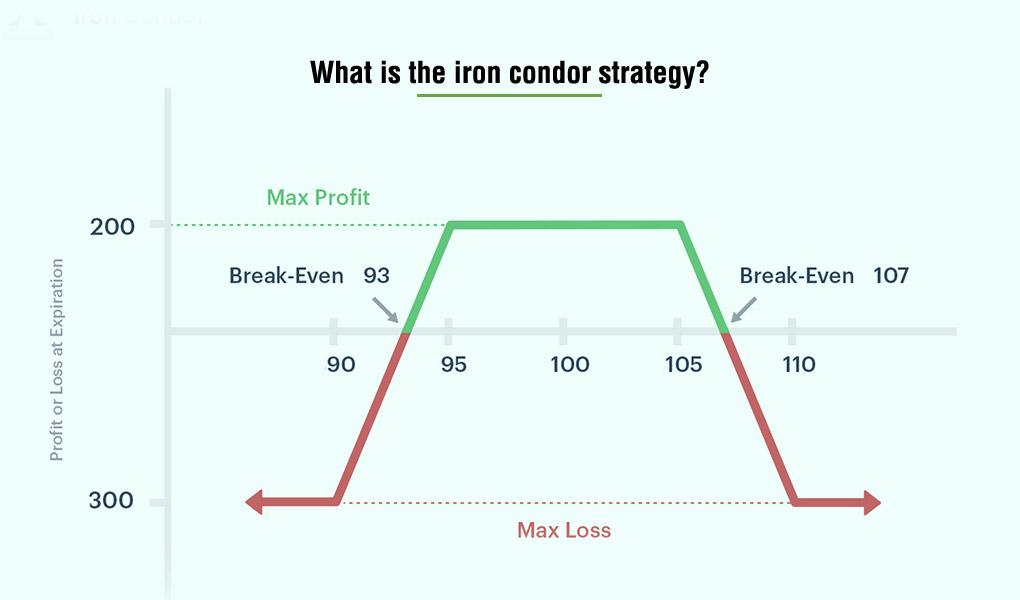

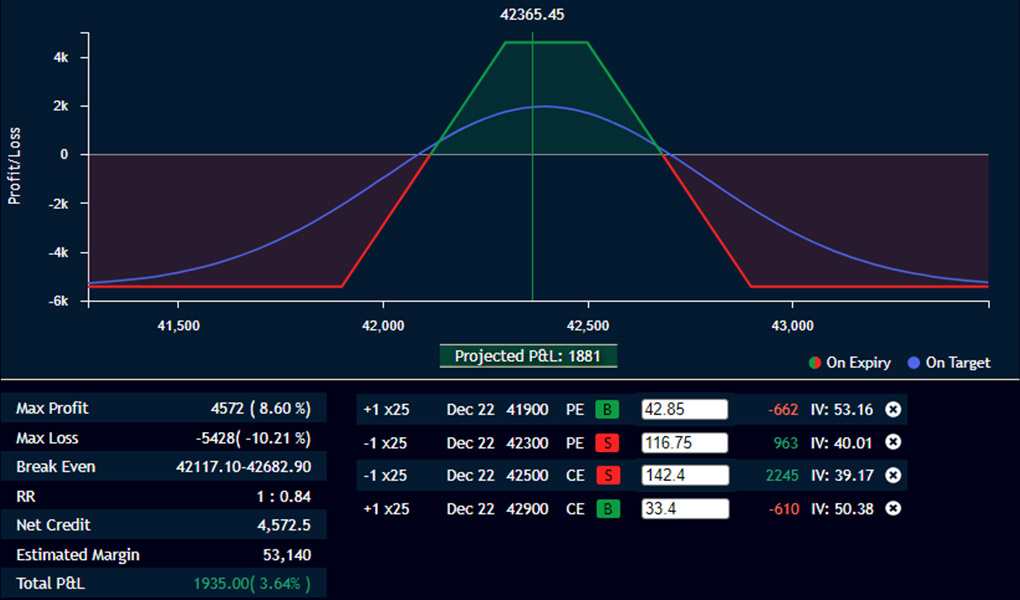

The term iron condor may sound too complicated, but it is quite simple to execute. This strategy involves the use of a bullish and bearish spread strategy where traders can buy two call options and two put options of different strike prices but the same options expiration dates. The name iron condor is taken from the graphical image that the strategy depicts when formed on the chart which looks like the bird's wings.

The use of two put and call options may sound technical but the premise or the logic behind this strategy is quite simple. There are two types of strategies that can be used under iron condor which are long iron condor and short iron condor. The meaning of these strategies and the way to use them is given below.

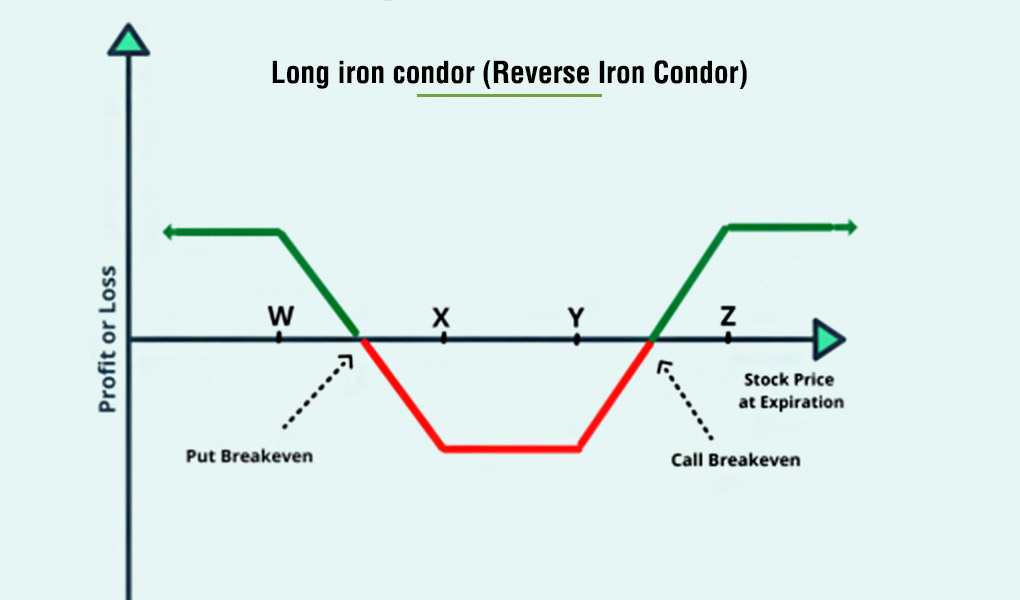

The long iron condor is also known as the reverse iron condor. The long iron condor is a net debit strategy and is used when the trader expects low volatility in the underlying asset. Under this strategy, the trader needs to take the following actions.

All the options should have the same expiration date for the iron condor strategy to form. The maximum risk or possibility of loss is restricted to the net premium paid.

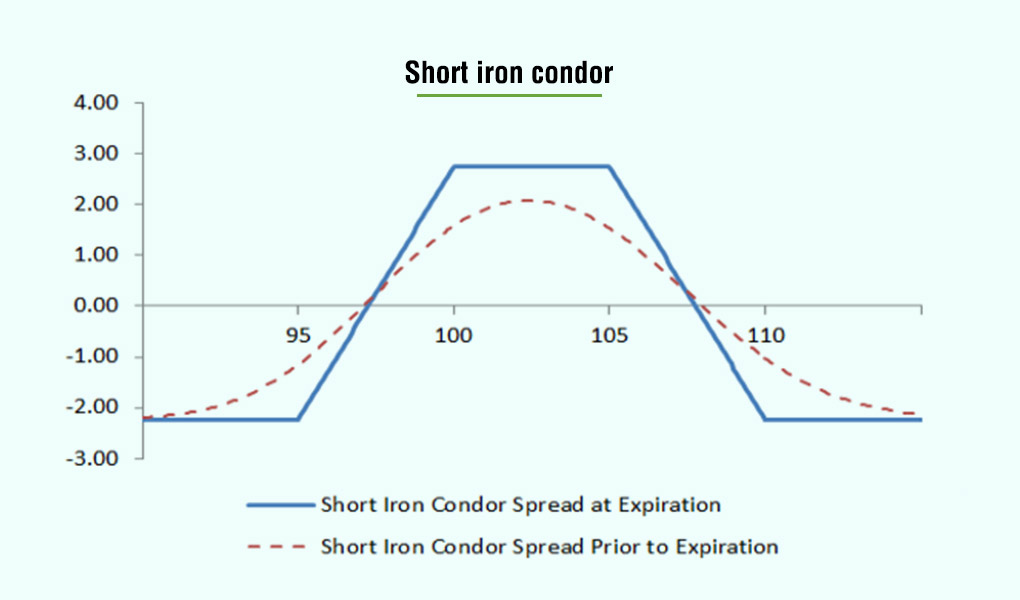

The short iron condor is a more popularly used iron condor and is generally used in speculating on high volatility with the underlying asset. The trader needs to take the following actions to execute this strategy.

This strategy is the mirror opposite of long iron condor and similar to the previous strategy, all the options must have the same expiration date for the strategy to work.

Let us understand the iron condor strategy with the help of a simple example where a trader is trading on the Nifty Index. Trader A is trading in Nifty options. Let us now see how the iron condor strategy is used to successfully trade in Nifty options at a level of 18000. The actions to be taken by Trader A will be,

The net premium received by Trader A will be Rs. 60 (60+60-30-30). The lot size of Nifty options is 50, therefore, the net gains made by Trader A is Rs. 3,000 (Rs. 60*50). The most effective trading position will be when all the four options taken will turn worthless i.e., when the Nifty will be trading between 17700 and 18300. When Nifty is at 18100, Trader A will take the following actions,

The net credit in this scenario will be Rs. 3,000 the net premium paid. When Nifty is at 17500, Trader A will take the following actions,

The net position from the options that have expired worthless will be zero (60-30-30). The gross loss from selling the put option will be Rs. 200 (17700-17500). However, this loss will be reduced to the extent of the premium received and the net loss on this position incurred by Trader A on the sell put option will be Rs. 140 (Rs. 200 - Rs. 60). The total loss incurred by Trader A on the Nifty lot size of 50 will be Rs. 7,000 (Rs. 140*50).

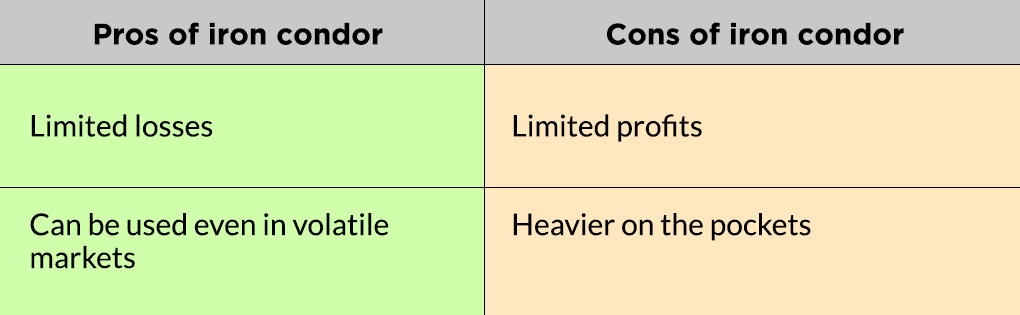

The iron condor strategy can be used to gain the maximum advantage of the bullish and bearish market. Some of the advantages of the iron condor strategy are,

The iron condor strategy is one of the most efficient tools used by traders to take advantage of the volatility of an underlying. This strategy is usually used by seasoned traders having a strong grip on market understanding and analysis of the movement of an underlying. However, there are various tools like options decoders that can be used by beginner traders too to successfully execute an iron condor strategy.

TrueData has an app specifically designed for options traders which is called TrueData Options Decoder. This app is very popular amongst option traders and can be used to take suitable trading positions including framing, tracking, and even trading an iron condor strategy.

So what do you think about the iron condor strategy? Hope this article was able to provide some clarity on it and make it sound a bit more simple. Look out for this space to learn more about such trading strategies for a better and simpler understanding.

Till then Happy Reading!

Read More: What are Popular Options Trading Strategies?

Did you know that the recent SEBI regulations have resulted in a drastic 75 redu...

When we talk about trading, which security is the most common one that comes to ...

India is increasingly becoming a dominant options trading market with the highes...