Building a strong investment portfolio begins with understanding your goals and your comfort with risk. This helps in selecting assets that align with the parameters and adjusting the mix as and when needed. However, what happens if, over time, the assets' mix is quite different from what you started with, or the risk becomes higher than you can take? The answer to this situation is portfolio rebalancing. Dive into this blog to learn all about portfolio rebalancing, its need and how to do it to have a robust portfolio that meets your goals effectively.

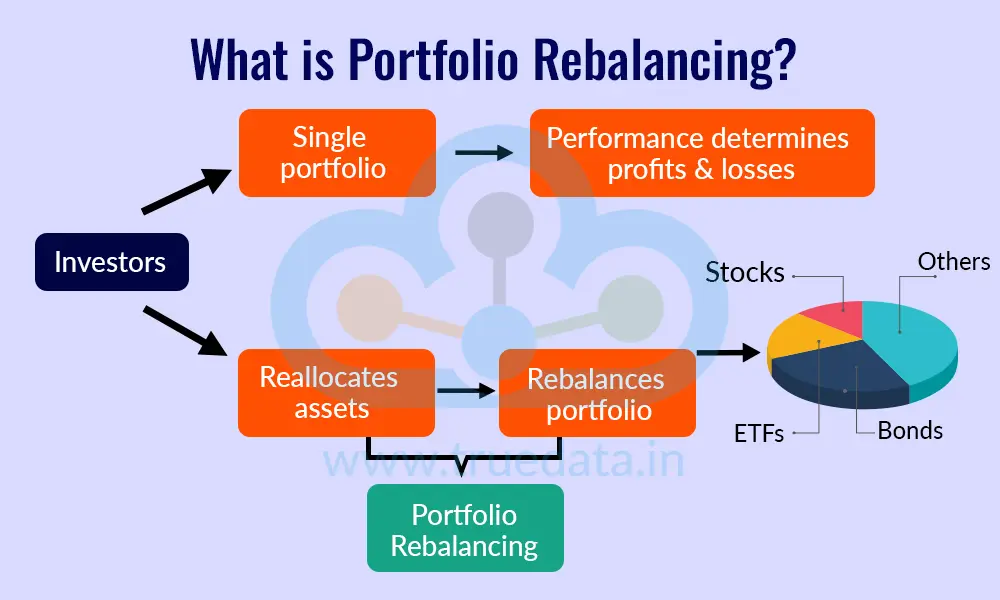

Portfolio rebalancing refers to the process of adjusting the mix of investments in an investment portfolio to ensure that it remains aligned with the investor’s original plan. When an investor begins, they decide how much to allocate into equity, debt, gold or other assets based on their goals and risk comfort. Over time, market movements can alter the value of these investments, i.e., some grow faster while others grow more slowly, causing the overall balance to shift. This can make the portfolio riskier or more conservative than what the investor intended. Rebalancing involves selling a portion of the assets that have grown too much and adding more to the ones that have decreased in proportion, so the portfolio returns to the planned mix. It helps the investor stay disciplined, manage risk better, and keep their long-term goals on track.

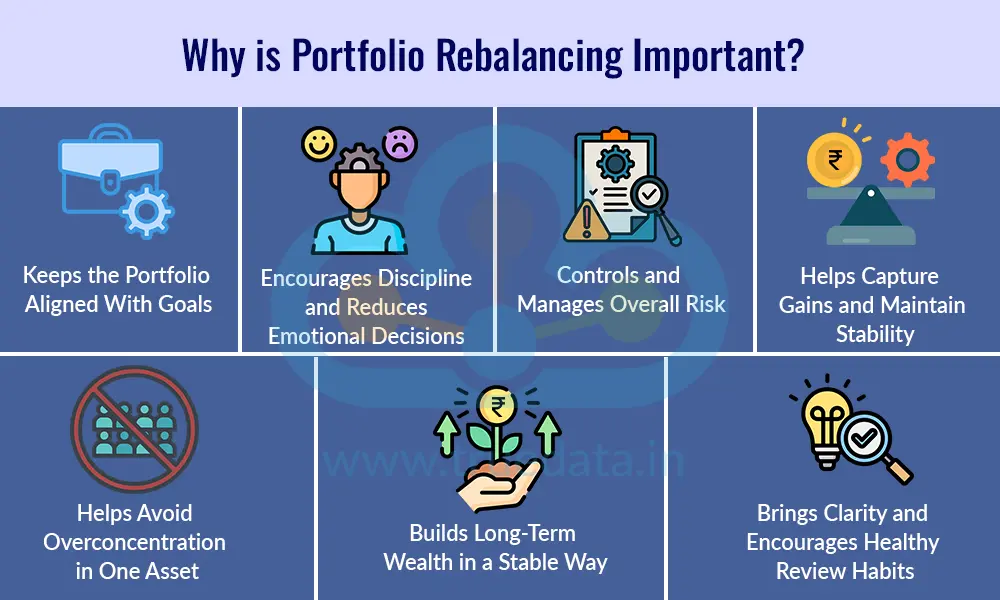

Portfolio rebalancing is the realignment of the portfolio to the expected parameters. It is an essential activity that investors need to focus on to ensure their portfolio meets their needs at various stages of life. The importance of portfolio rebalancing for investors is explained below.

Portfolio rebalancing is important because it helps an investor keep their investments aligned with their original financial goals. Over time, the values of different assets change due to market movements. Equity may rise sharply while debt may grow slowly, or the opposite may happen. This shift can cause the portfolio to stray from the investor’s planned asset mix. By rebalancing, the investor restores the portfolio to the right proportions. Hence, it continues to support long-term goals such as buying a house, funding children’s education, or retirement planning.

Rebalancing brings discipline to the investment journey. Many investors tend to hold on to winning assets due to greed or panic-sell losing ones due to fear. Rebalancing avoids such emotional decisions. It forces the investor to follow a planned, systematic approach, i,e., selling high and buying low, which is healthy for long-term wealth creation.

As markets fluctuate, a portfolio can become riskier or more conservative without the investor noticing. For example, if equity performs very well, it may start taking up a larger share of the portfolio than intended. This increases risk, especially during market corrections. Rebalancing helps investors reduce excess risk by selling some of the overgrown assets and adding to the safer ones. This maintains a steady risk level and is suitable for the investor’s comfort.

When an asset becomes too large, it may be wise to book some profits and allocate the gains to other areas that need more allocation. Rebalancing helps the investor do exactly that. It prevents overdependence on a single asset class and ensures the portfolio remains stable during market fluctuations. This balance gives the investor more confidence and smoother progress towards goals.

Without rebalancing, a portfolio can unintentionally become heavily invested in a single asset class, sector, or even one stock. This increases the risk of large losses if that particular area performs poorly. Rebalancing spreads the investments out again, making sure no single asset controls too much of the portfolio. This diversification protects the investor from sudden shocks.

Rebalancing supports steady, long-term wealth creation. Instead of chasing short-term trends, it encourages the investor to follow a consistent method that reduces unnecessary risks and captures gains gradually. This helps them grow their wealth confidently and reach their goals without taking unpredictable bets.

Rebalancing not only reduces stress during market fluctuations but also provides investors with a clear, rule-based approach to make decisions. This helps them feel more confident and avoid confusion about when to buy or sell. At the same time, the rebalancing process naturally encourages regular check-ins on income, goals, and expenses, helping investors stay aware of their overall financial health and make timely adjustments.

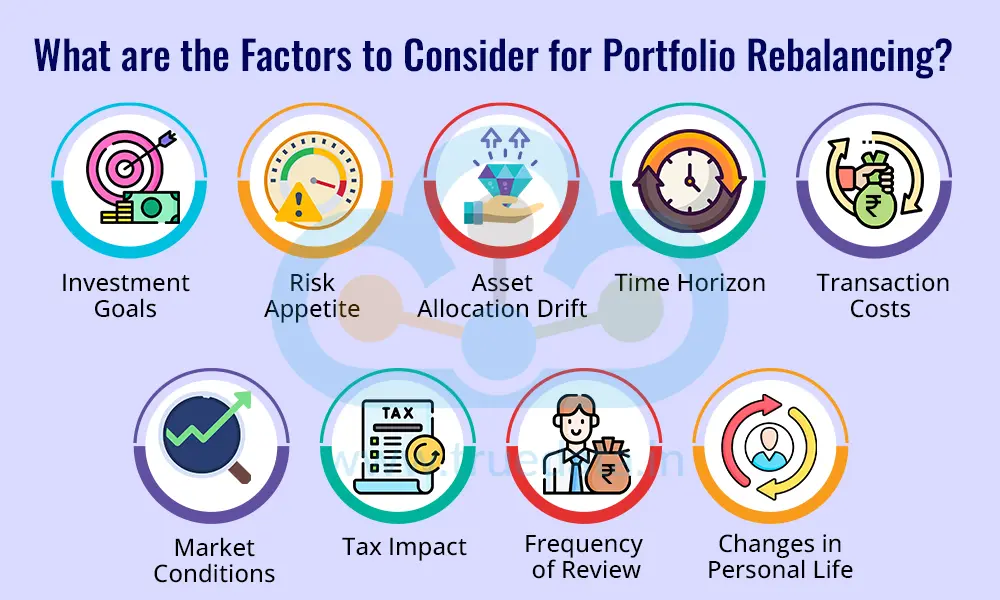

Portfolio rebalancing is a continuous process that requires careful consideration of various factors. Some of the key factors to be considered by investors in this regard include,

Investment Goals - Investors should always look at their financial goals before rebalancing. Goals such as buying a house, children’s education, or retirement determine how much risk they can take. If goals are nearing, the portfolio may need to shift from high-risk assets, such as equities, to safer ones like debt to protect the accumulated money.

Risk Appetite - Every investor has a different comfort level with risk. If the current portfolio has become riskier than what the investor can handle (due to rising equity values), it may be time to rebalance. This ensures the portfolio stays within the investor’s comfort zone.

Asset Allocation Drift - Markets are constantly in motion, causing the asset mix to shift. If equity grows too much or debt becomes too small in the portfolio, it leads to ‘allocation drift’. Rebalancing restores the proportions back to the original plan, keeping the portfolio disciplined.

Time Horizon - The time left to reach each financial goal plays a major role. Longer time horizons enable investors to take more risk through equity, while shorter horizons need more stability through debt and safer instruments. Rebalancing helps adjust the portfolio based on the amount of time remaining.

Transaction Costs - Rebalancing often involves buying and selling assets, which can incur transaction costs. These actions may incur expenses such as brokerage charges, exit loads in mutual funds, or other fees. Investors should review these costs to ensure that rebalancing does not unnecessarily reduce overall returns.

Market Conditions - While rebalancing is not about predicting markets, understanding current trends is useful. Extreme market highs or lows can significantly change the portfolio’s balance. Rebalancing during such times helps manage risk and avoid overexposure to any one asset class.

Tax Impact - In India, selling investments (equity, debt, gold, etc.) can result in capital gains tax. Before rebalancing, an investor should consider the potential tax implications and whether the switch is worth the cost. Planning rebalancing around tax-efficient methods can save money.

Frequency of Review - Investors must decide how often they want to rebalance. Some prefer a fixed schedule, like once a year, while others rebalance when the asset allocation drifts beyond a certain percentage. The method chosen should be easy to follow and suitable for their lifestyle.

Changes in Personal Life - Major life events, such as a new job, marriage, higher income, or new responsibilities, can change financial needs. Rebalancing helps adjust the portfolio to match these new realities and keep everything aligned with the updated situation.

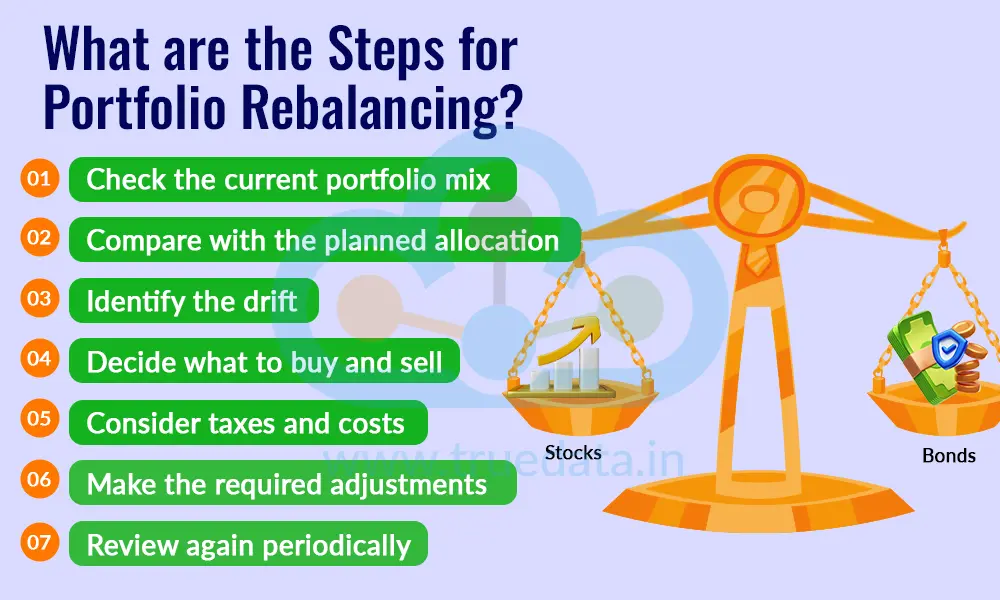

Portfolio rebalancing is a subtle art of selecting the right investment at the right time to realign the portfolio with desired parameters. The steps involved in this process are,

Check the current portfolio mix - The first step is to review the allocation of funds across various asset classes, including equity, debt, gold, and other assets.

Compare with the planned allocation - The current mix is then compared with the original target allocation based on goals and risk comfort.

Identify the drift - Note which assets have become too large or too small compared to the original plan.

Decide what to buy and sell - Sell a portion of the overgrown assets and allocate the proceeds to the underweighted ones.

Consider taxes and costs - Check any capital gains tax, exit loads, or brokerage charges before switching.

Make the required adjustments - Carry out the necessary transactions to bring the portfolio back to the target mix.

Review again periodically - Continue to review the portfolio at regular intervals, such as once or twice a year.

Understanding the limitations of portfolio rebalancing helps clarify the concept and its nuances in a better light. The key limitations of portfolio rebalancing are highlighted below.

May lead to transaction costs - Buying and selling can involve brokerage charges or exit loads, which may reduce returns.

Can trigger tax liability - Selling investments may lead to capital gains tax, especially in equity and debt mutual funds.

Requires regular monitoring - Investors must periodically review the portfolio, which requires time and attention to manage effectively.

May reduce short-term gains - Frequent rebalancing may stop an investor from fully benefiting from strong market rallies.

Not always emotionally easy - Selling winning assets or adding to underperforming ones can feel uncomfortable, even when it is logical.

Portfolio rebalancing is a simple but powerful way for an investor to keep their financial journey steady and on track. It helps them maintain the right mix of equity, debt, and other assets as per their goals, risk comfort, and time horizon. Investors can protect their wealth and grow it in a stable, disciplined manner by reviewing the portfolio regularly, understanding allocation drift, and making thoughtful adjustments.

This article talks about the need to rebalance the portfolio in detail, helping investors reach their investment goals in a strategic and timely manner. Let us know your thoughts on the topic or if you need further information on the same, and we will address it.

Till then, Happy Reading!

Read More: Types of Mutual Funds - How to Choose the Right Mutual Fund?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...