The world today is bursting with opportunities, and the spirit of hustling defines our generation. Many people are juggling multiple projects or even taking up side gigs, a trend commonly known as moonlighting. You may have heard the term, or you might already be doing it without realising! However, here is the big question. Is moonlighting actually allowed in India? And what happens to your taxes when you earn from more than one job? Let us dive in and unpack everything you need to know about the tax implications of moonlighting in India.

Moonlighting means working for more than one employer or taking up extra work in addition to your main job. In simple terms, it refers to someone who has a full-time job but also engages in side projects, freelance work, or part-time jobs after regular office hours. People typically do this to earn extra income, learn new skills, or follow their passions. For example, a software engineer who works in an IT Company during the day and takes freelance coding or content writing projects in the evening is considered to be moonlighting. Moonlighting has become increasingly common in India, particularly with the rise of remote work and digital platforms that facilitate taking on extra assignments. While it may sound like a smart way to boost earnings, it is essential to know that not all companies allow it, and it can have tax and legal implications in India.

Moonlighting is not completely illegal in India. However, it is also not fully accepted by all employers. There is no specific law that directly bans or allows it. However, the legality depends on the terms of the person’s main employment contract. Many companies include a clause that prevents employees from taking up other paid work without permission. If an employee does so, it may be considered a breach of contract and could lead to disciplinary action or even job termination. On the other hand, if the employment agreement does not restrict outside work, and the person’s extra job does not interfere with their main job’s performance or involve a competitor, moonlighting can be considered legal. In simple terms, it is allowed only when the main employer’s rules permit it, and there is no conflict of interest.

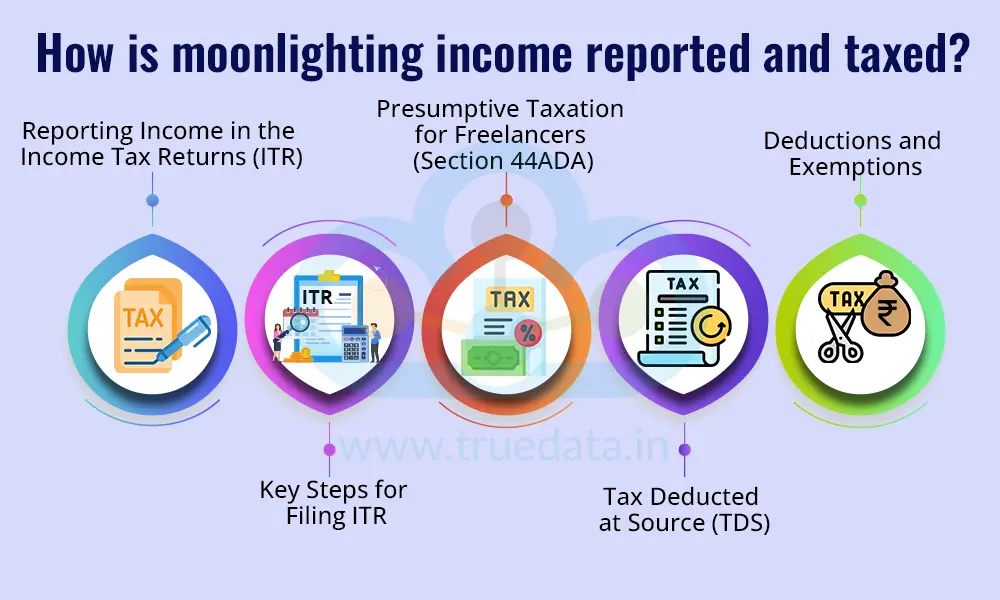

When a person earns from more than one job or takes up freelance work, it is important to report this additional income correctly while filing income tax returns (ITR). The Income Tax Department requires all income, whether from a full-time job, part-time work, or freelancing, to be duly declared and reported. Here are the key details guiding proper reporting of moonlighting income in the ITR.

Moonlighting income can fall under different categories, depending on how it is earned.

If the person is freelancing or self-employed - The income is treated as ‘Profits and Gains from Business or Profession’ or ‘Income from Other Sources’. The Act provides or allows deductions for genuine business-related expenses such as internet bills, laptop or software costs, and travel expenses.

If the person is doing another salaried job - The income is treated as ‘Salary Income’. In such cases, both salaries are combined as total taxable income and the tax liability is calculated based on such total income. The combined income may move the person into a higher tax slab.

The key steps to file the ITR for moonlighting income are,

Keep records of all payments - Save invoices, payment receipts, and bank statements as proof of income.

Choose the correct ITR form -

Use ITR-3 if the person is self-employed or freelancing.

Use ITR-1 or ITR-2 if the person has a salary and other income.

Include all income - Add moonlighting income to the total income while filing the ITR to ensure transparency.

Tax Deducted at Source (TDS) -

Each employer or client may deduct TDS separately.

The person must add all income and recalculate the total tax liability while filing the ITR.

If there is a shortfall, it should be paid as advance tax or self-assessment tax.

Claim eligible expenses (for freelancers) - Deducting legitimate work-related expenses such as

Internet or phone bills

Software or subscription costs

Laptop or equipment expenses

Travel related to work

Pay advance tax if required - If the total tax liability (after TDS) exceeds Rs. 10,000 in a year, advance tax must be paid quarterly to avoid penalties.

File before the deadline - The due date for filing the ITR is 31st July of the assessment year (for non-tax audit taxpayers) and 31st October (for tax audit taxpayers).

Freelancers or professionals earning through moonlighting can choose presumptive taxation under Section 44ADA of the Income Tax Act. This simplifies tax filing for small professionals, including consultants, designers, writers, software developers, and other self-employed individuals. However, these provisions are applicable only if the total annual receipts are up to Rs. 50,00,000.

Key provisions under this scheme are,

50% of the total income is considered as profit and taxed.

The remaining 50% is presumed to be expenses, so detailed expense records are not required.

The person must file ITR-4 if opting for presumptive taxation.

This option helps eligible taxpayers save time, reduce paperwork, and simplify compliance.

Each employer or client of the taxpayer must deduct TDS separately. The taxpayer has to add all income and recalculate the total tax liability while filing the ITR. If there is a shortfall, it should be paid as advance tax (as mentioned above) or through self-assessment tax.

Taxpayers can still claim deductions under various sections to reduce tax liability under the old tax regime.

Section 80C - Investments in PF, ELSS, or life insurance.

Section 80D - Health insurance premiums.

Section 80G - Donations to charitable institutions.

Do not hide moonlighting income - Not reporting extra income can lead to penalties or tax notices from the Income Tax Department.

Check employer policies - Some companies do not allow moonlighting, so it is important to review the employment contract before taking up side work.

Use Form 26AS and AIS - These forms show income details reported by employers, banks, and clients, thereby ensuring the information matches the details declared in the ITR.

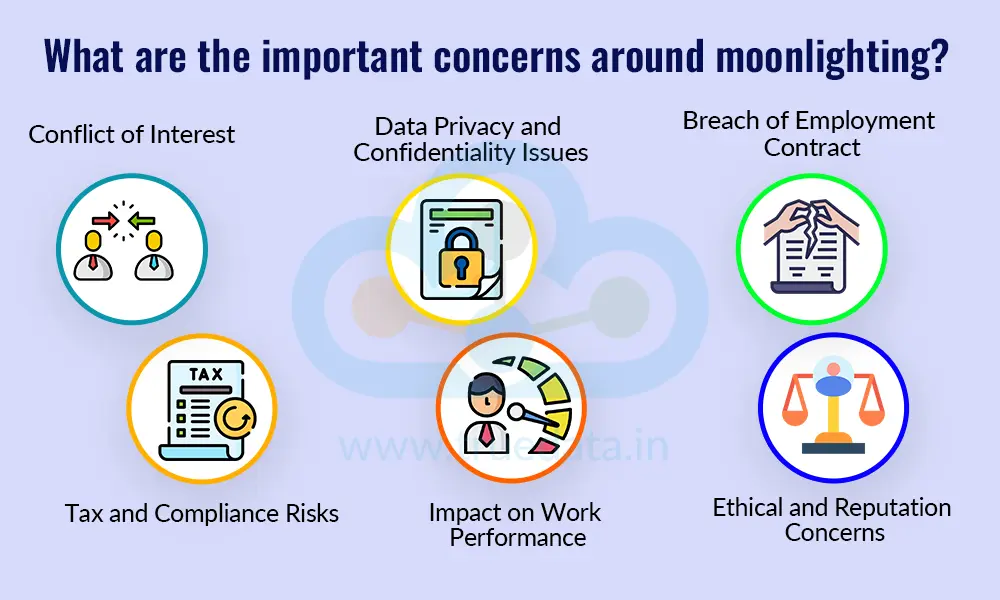

Moonlighting may seem like a great way to earn extra income. However, it comes with certain professional, legal, and ethical concerns that a person should be aware of. Some of these concerns are highlighted below.

If the side job or freelance work is with a competitor of the main employer, it can create a conflict of interest. This means the person might be using knowledge, time, or resources from their main job to benefit another company. Such situations can lead to serious disciplinary action or termination.

If an employee handles sensitive company data, working for another organisation, whether directly or indirectly, may lead to data security risks. Sharing or using company information elsewhere, whether intentionally or unintentionally, can result in legal action under data protection or employment laws.

Most companies include a clause in the employment agreement that restricts employees from taking up other paid work without prior permission. If an employee takes another job secretly, it can be treated as a breach of contract, which may lead to legal consequences or loss of job benefits.

Many people do not realise that all moonlighting income is taxable. Failing to report it in the income tax return (ITR) can attract penalties or notices from the Income Tax Department. Proper record-keeping and disclosure are essential for compliance.

Working multiple jobs can lead to fatigue, stress, and lower productivity. The person may struggle to maintain focus and efficiency in their main job. Over time, this can affect performance reviews and career growth.

Moonlighting without transparency can raise ethical questions. Employers may view it as dishonesty, especially if it affects work quality or company trust. This can harm professional reputation and future job opportunities.

Moonlighting has become increasingly common in India and across the world as people look for extra income or new learning opportunities. However, it is important to remember that all earnings from moonlighting are taxable and must be reported honestly in the Income Tax Return (ITR). While this is crucial to ensure that there are no penalties or defaults on the part of the taxpayers, it is also important to ensure proper compliance with employment contracts and consider the ethical implications of moonlighting to avoid any hassles.

This article highlights information about the growing trend of moonlighting in India. Are you part of this hustle, too? Let us know your thoughts on this topic, or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

The Union Budget 2025 created a huge buzz due to its changes in the income tax s...

Taxation is one of the key points to consider while making any career or investm...

'Mutual funds' - A generation of investors has grown up listening to these words...