India’s Digital India journey continues to redefine how we live, connect, and celebrate. What began with the revolutionary UPI transformed the nation’s financial landscape and showcased India’s digital prowess to the world. Now, this festive season, technology meets tradition once again with a fresh and thoughtful innovation, i.e., the e-RUPI P2P Gifting System. Designed to make festive gifting more seamless, secure, and meaningful, this new feature adds a modern twist to age-old customs. Curious to know how it works and how you can use it to spread joy this season? Let us dive in!

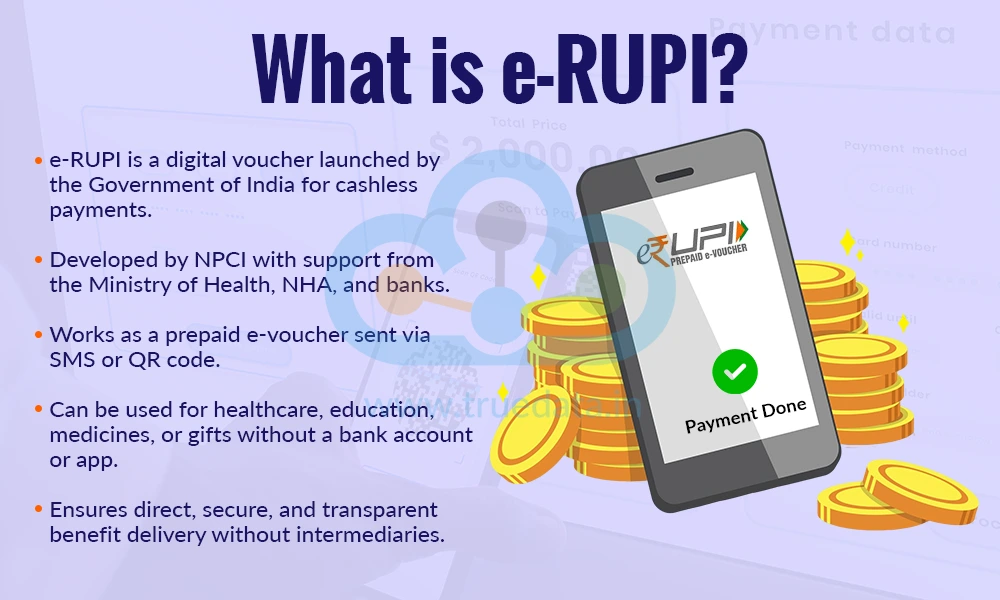

e-RUPI is a digital voucher system launched by the Government of India to make payments simple, secure, and cashless. It was introduced by the National Payments Corporation of India (NPCI) in August 2021, in collaboration with the Ministry of Health and Family Welfare, the National Health Authority (NHA), and various banks. Think of e-RUPI as an e-voucher or prepaid digital coupon that can be sent directly to a person’s mobile phone through SMS or QR code. The receiver can use it to pay for specific services or purchases, for example, health check-ups, medicines, education, or now, even gifts, without needing a bank account, card, or digital payment app. The main idea behind e-RUPI is to ensure that money or benefits from the government or any organisation are used exactly for their intended purpose, without any middlemen or misuse. It is a simple, secure, and transparent way to make targeted digital payments, and it represents another big step forward in India’s journey towards a fully digital economy.

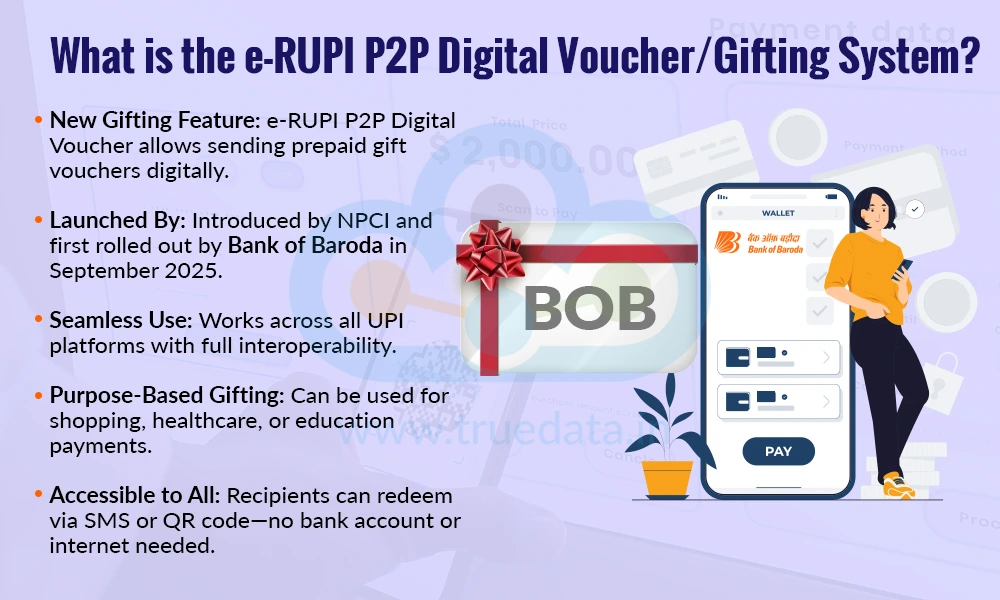

The e-RUPI P2P Digital Voucher or Gifting System is a new feature built on the earlier e‑RUPI framework. It is a new way to send prepaid gift vouchers directly to someone’s mobile, without needing cash, cards, or apps. It was launched in India by the National Payments Corporation of India (NPCI) and first introduced by Bank of Baroda in September 2025 on its bob इ Pay UPI app. The feature works seamlessly across all UPI platforms, making it fully interoperable. This system lets a person gift money for a specific purpose, like shopping, health checkups, or school fees, by using a secure SMS or QR code. The person receiving it can use the voucher at selected places without needing a bank account or internet access. This makes it easy for people in India to send useful gifts digitally, even to those who do not use smartphones or online banking.

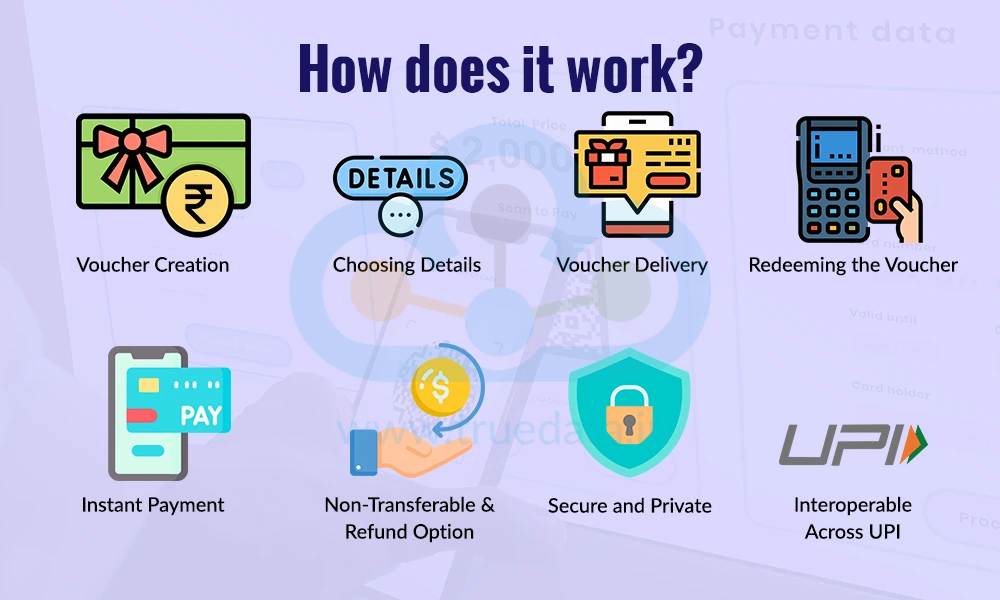

The framework for using the e-RUPI Gifting System is explained below.

Voucher Creation - A person uses their bank’s UPI app (for example, the Bank of Baroda ‘bob इ Pay’ app) to create a digital voucher for another person.

Choosing Details - The sender selects the amount (from Re.1 to Rs. 10,000), purpose (like food, shopping, or healthcare), and the recipient’s mobile number.

Voucher Delivery - The recipient receives the e-RUPI voucher as a QR code or SMS link on their phone.

Redeeming the Voucher - The recipient can visit any merchant or store that accepts that voucher category (for example, a UPI-enabled food outlet) and redeem it easily, without needing a bank account, debit card, or UPI PIN by showing the QR code or SMS to make the payment.

Instant Payment - The payment goes directly from the sender’s account to the merchant instantly. Thus, no cash, cards, or UPI PIN are needed.

Non-Transferable & Refund Option - The voucher is non-transferable, which means only the intended recipient can use it. If it is not used within its validity period, the amount is automatically refunded to the sender.

Secure and Private - The system is built on India’s existing UPI framework by the National Payments Corporation of India (NPCI), giving digital gifting a secure and user-friendly twist.

Interoperable Across UPI - The feature works smoothly across all UPI platforms, so both sender and receiver can use their preferred apps.

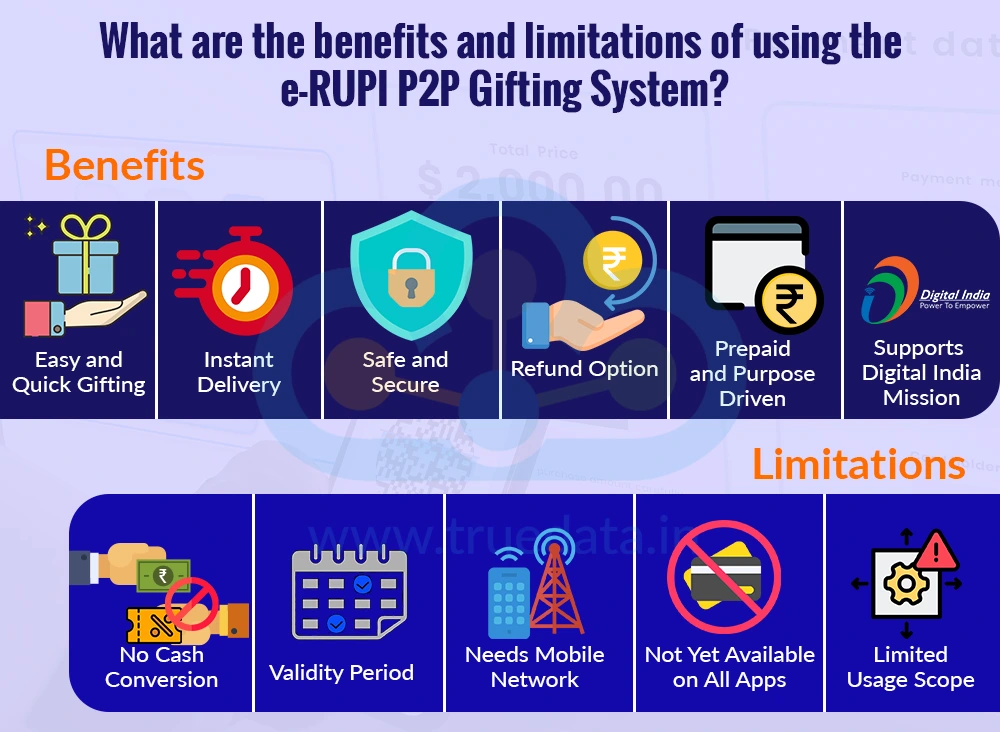

The e-RUPI P2P Gifting System is a revolutionary step that is aimed at blending digital transactions with our traditions. Although it is at a nascent stage, its use and adoption could transform the way India connects and celebrates its festivals. The benefits and limitations of using the e-RUPI P2P Gifting System are explained below.

The benefits of using the e-RUPI P2P Gifting System include,

Easy and Quick Gifting - Sending a digital gift takes only a few taps on a UPI app, and there is no need to buy physical vouchers or handle cash.

Instant Delivery - The receiver gets the voucher immediately via SMS or QR code, making it perfect for last-minute gifting.

Safe and Secure - Each voucher is linked to a specific person and purpose, so it cannot be misused or transferred to someone else.

Refund Option - If the voucher is not used before it expires, the unused amount is refunded to the sender’s account.

Prepaid and Purpose Driven - The e-RUPI is a prepaid voucher and purpose-driven, thus ensuring that it is used only for its intended purpose and keeps spending focused.

Supports Digital India Mission - The feature encourages people to adopt cashless and transparent transactions, contributing to India’s growing digital economy.

The limitations of using the e-RUPI P2P Gifting System include,

Limited Usage Scope - The voucher can be spent only for the selected purpose and at specific merchants, not everywhere.

Not Yet Available on All Apps - Right now, only some banks and UPI apps (like Bank of Baroda’s bob इ Pay) have launched this feature.

Needs Mobile Network - The receiver must have a mobile signal to get and use the voucher.

Validity Period - Each voucher has a limited validity, so the receiver must use it before it expires.

No Cash Conversion - The receiver cannot convert the voucher into cash, as it is meant for specific spending only.

The e-RUPI P2P Gifting System is a thoughtful step forward in India’s digital journey, blending technology with the joy of gifting. Built on the trusted UPI infrastructure by NPCI, it allows people to send secure, cashless, and purpose-based digital vouchers directly to others through their bank’s UPI app. With features like instant delivery, non-transferable use, refund options, and full interoperability across UPI platforms, it makes gifting easier, safer, and more meaningful. Though its use is currently limited to specific purposes and partner banks, it represents a modern, eco-friendly, and inclusive way to share happiness, perfectly suited for India’s growing digital economy and festive spirit.

This article talks about the new feather in the digital economy landscape of the country and its merits. Let us know your thoughts on the topic, and watch this space for more such updates on the digital economy details of the country.

Till then, Happy Reading!

The world is rapidly embracing digitisation, and India is proudly leading the ch...

The second half of the year is always buzzing with excitement of festivals, fami...

Share prices of a company are affected by numerous external and internal factors...