The world is rapidly embracing digitisation, and India is proudly leading the charge. Our homegrown innovation, UPI, has already made waves globally and is now accepted in eight countries beyond our borders, a remarkable achievement that showcases India’s fintech prowess. However, the journey does not stop here. Taking a bold leap forward, the Reserve Bank of India (RBI) has introduced ‘e₹’, i.e., India’s very own digital currency. This marks the next big step in our digital economy, one that promises to redefine how we transact, save, and experience money. Curious to know what the Central Bank Digital Currency (CBDC) is all about and how it could reshape your wallet? Let’s dive in!

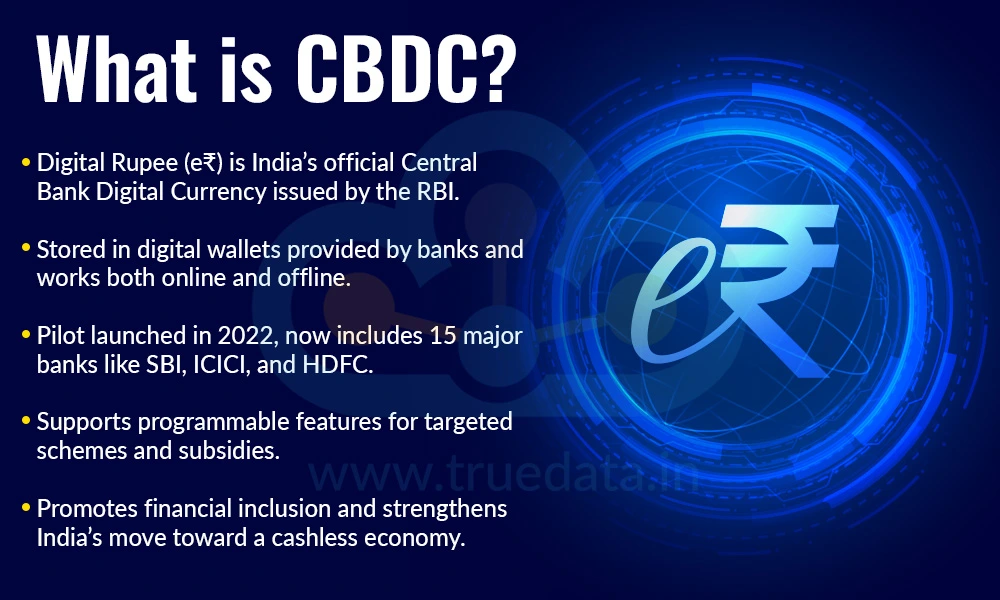

The Digital Rupee (e₹) is India’s Central Bank Digital Currency (CBDC). It is a digital version of the physical rupee (₹) issued directly by the Reserve Bank of India (RBI). It works just like cash but in electronic form, offering the same trust, safety, and convenience. The e₹ is stored in a digital wallet provided by banks and on the mobile phone. It can be used to send or receive money, or make payments to anyone, even without the internet, using offline or tap-based (NFC) technology. The pilot program for retail users began on December 1, 2022, and now includes 15 banks (private and public), like SBI, ICICI Bank, HDFC Bank, and Union Bank of India. These banks help users download e? wallets through the Google Play Store or Apple App Store.

A major update announced at the Global Fintech Fest 2025 in Mumbai introduced offline digital rupee payments, enabling seamless transactions even in remote or rural areas. The e₹ also supports programmable features, allowing funds to be set for specific uses, expiry dates, or locations. This feature is already in use in government schemes like Gujarat’s G-SAFAL and Andhra Pradesh’s DEEPAM 2.0 to deliver targeted subsidies. By providing a secure, RBI-backed digital currency that combines the trust of cash with the ease of digital payments, the e₹ strengthens India’s Digital Public Infrastructure, promotes financial inclusion, and marks a significant milestone in the country’s journey toward a cashless, connected economy.

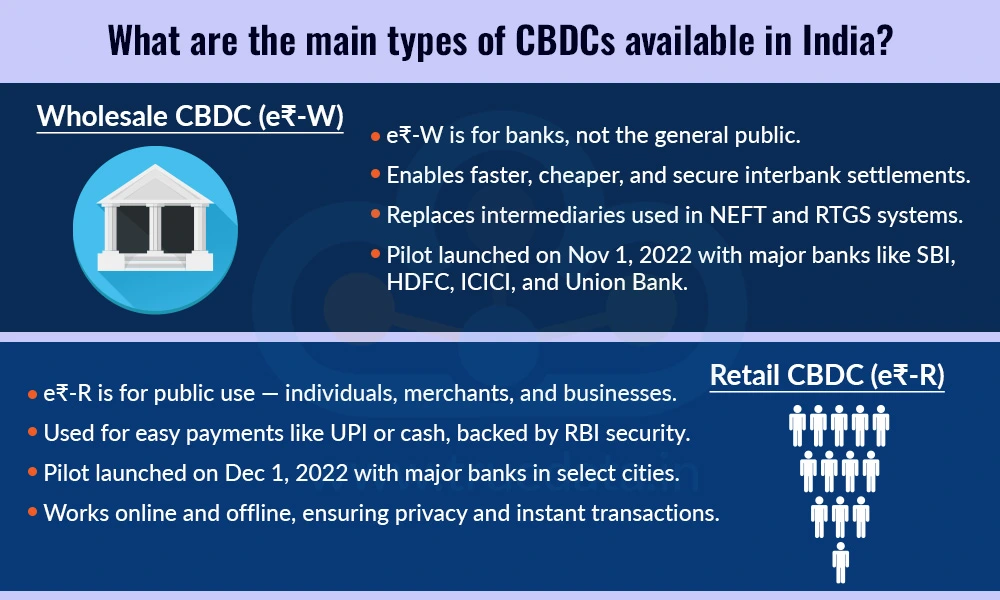

The Reserve Bank of India (RBI) has introduced two main types of Central Bank Digital Currency (CBDCs), i.e., the Wholesale CBDC (e₹-W) and the Retail CBDC (e₹-R). Both represent the Digital Rupee, but they serve different purposes and are used by different groups of people.

The Wholesale Digital Rupee, or e₹-W, is designed mainly for banks and large financial institutions. It is not meant for the general public. The main goal of the wholesale CBDC is to make interbank transactions (i.e., money transfers and settlements between banks) faster, cheaper, and more secure. Traditionally, banks settle transactions through systems like NEFT or RTGS, which can involve several intermediaries. With e₹-W, the process becomes instant and direct, reducing the time and cost involved. The RBI started the e₹-W pilot on November 1, 2022, with a few selected banks, including State Bank of India, HDFC Bank, ICICI Bank, and Union Bank of India. These banks use the digital rupee for activities such as the settlement of government securities and other high-value financial transactions.

The Retail Digital Rupee, or e₹-R, is the version meant for everyday use by the public, i.e., individuals, merchants, and businesses. It can be used to make person-to-person payments or person-to-merchant payments, similar to UPI or cash, but with the security and trust of the RBI behind it. The e₹-R pilot began on December 1, 2022, in select cities, with participation from major banks such as SBI, HDFC, ICICI, and others. Users can download an e? wallet app from the Google Play Store or Apple App Store, open a wallet through their bank, and start using the Digital Rupee for transactions. The Retail CBDC works both online and offline, even in areas with poor connectivity and can offer programmable features. It also provides privacy similar to cash, as small-value transactions can be done without revealing personal banking details, making payments instant, simple, and secure.

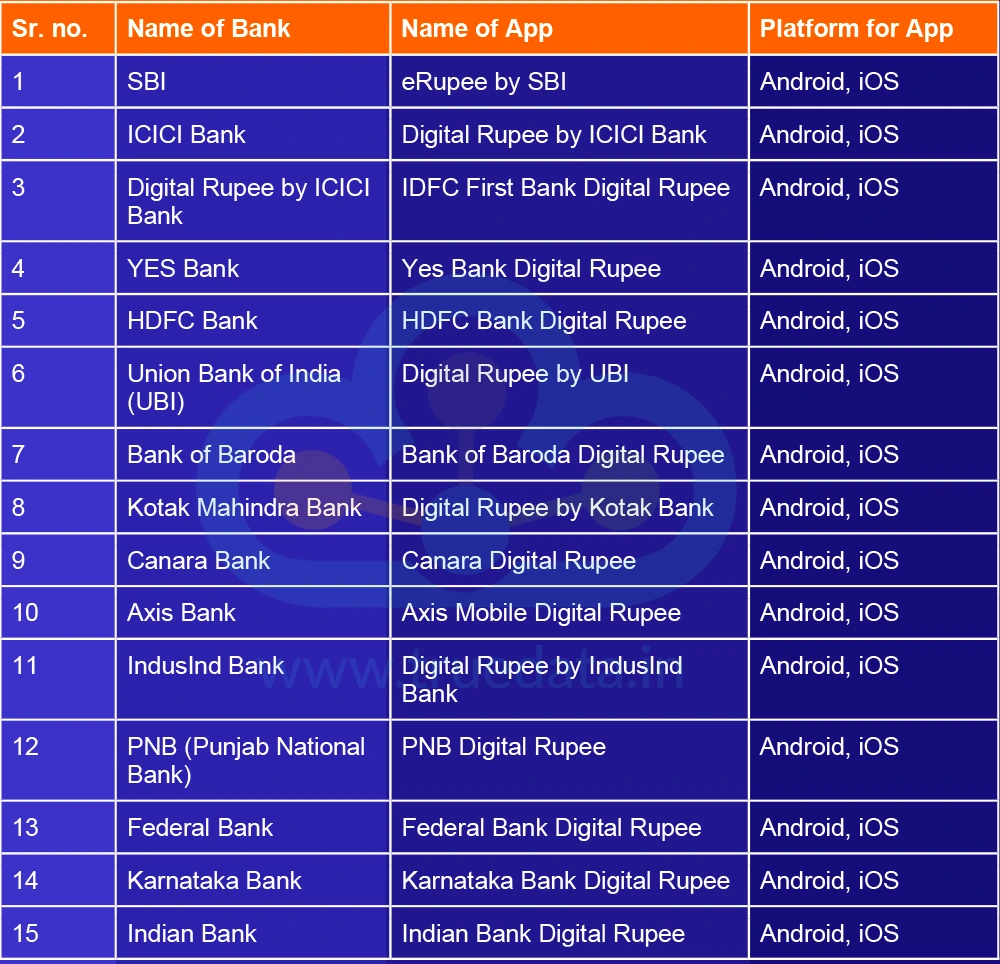

The RBI pilot program currently has 15 banks that are part of the CBDC program. The names of the banks and the apps that provide the e₹ are mentioned below.

India’s financial system is already becoming highly digital through UPI, online banking, and mobile payments. However, the Digital Rupee (e₹) goes a step further. It aims to create a secure, efficient, and inclusive digital form of money, directly issued by the Reserve Bank of India (RBI). The need for CBDC and its importance are explained below.

To Provide a Safe and Trusted Digital Currency -

Digital payments in India (like UPI, wallets, or cards) are linked to banks or private companies. The CBDC, on the other hand, is issued by the RBI, making it completely safe and guaranteed by the government. This gives people a trusted digital alternative to physical cash without relying on private intermediaries.

To Reduce Dependency on Physical Cash -

Printing, transporting, and storing paper money costs the government thousands of crores every year. With CBDC, money exists in digital form, reducing the cost and effort involved in managing cash. It also makes it easier to send, receive, and handle money instantly, anywhere in the country.

To Promote Financial Inclusion -

Millions of people in India still do not have full access to banking services. The Digital Rupee can be used through a mobile wallet without needing a bank account, allowing everyone, even in rural or remote areas, to access digital money. This supports the goal of a truly inclusive financial system.

To Curb the Risks of Private Cryptocurrencies -

Private cryptocurrencies (like Bitcoin) are unregulated and volatile, posing risks to the economy. The Digital Rupee is the digital form of the country's fiat currency and thus it offers a legal, stable, and government-backed digital alternative, ensuring that citizens can use digital currency safely within the law.

To Support Offline and Remote Payments -

Unlike UPI or internet banking, CBDC can work offline using simple technologies like Bluetooth or NFC tap payments. This helps people in villages and low-connectivity areas make digital transactions easily, without depending on the internet.

To Make Payments Faster and More Efficient -

CBDC allows instant transactions between individuals and businesses or even between banks, without waiting times or intermediaries. This helps make interbank settlements, cross-border payments, and retail transactions quicker and cheaper.

To Improve Transparency and Reduce Fraud -

CBDC transactions are recorded securely on digital ledger systems, making them traceable, tamper-proof, and transparent. This helps reduce money laundering, counterfeit currency, and illegal financial activities, ensuring a cleaner and more accountable financial system.

To Enhance India’s Global Financial Position -

By adopting CBDC early, India positions itself as a global leader in digital finance. It helps the country set standards for cross-border digital transactions, making international trade and remittances faster, cheaper, and more secure.

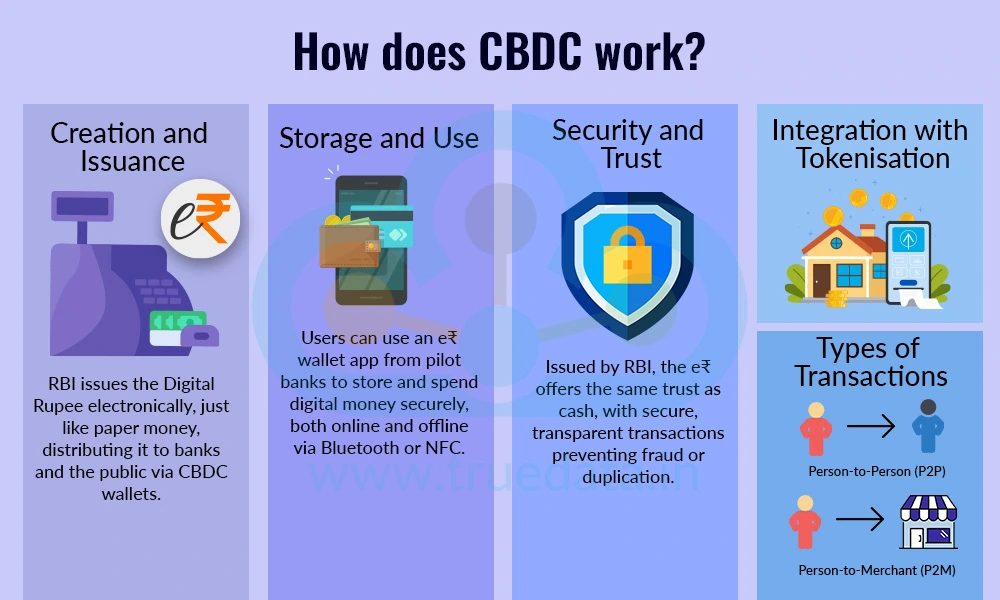

CBDC is the next step in the digital revolution in India. RBI is set to use the latest technology through CBDC and tokenisation to build a next-generation financial infrastructure that combines the trust of RBI-backed currency with the innovation of blockchain technology. This will make payments instant, secure, and efficient, while also modernising markets and improving access to financial services for everyone. The process of creation and distribution of CBDC is explained below.

The RBI creates the Digital Rupee just like it prints paper notes, but in electronic form. This digital currency is then issued to banks and financial institutions, which distribute it to the public and businesses through CBDC wallets.

Users can download an e₹ wallet app (offered by pilot banks) and store their digital money securely. The wallet works like a virtual purse, allowing people to send, receive, or spend e₹ easily. For example, to pay a merchant, transfer money to a friend, or buy goods and services. The Digital Rupee can be used both online and offline, which makes it especially useful in rural or low-connectivity areas. Offline transactions are possible through technologies like Bluetooth or NFC tap payments.

The Digital Rupee supports two types of payments:

Person-to-Person (P2P) - For transferring money directly between individuals.

Person-to-Merchant (P2M) - For paying shops or businesses.

These transactions happen instantly and securely, without the need for intermediaries like traditional payment systems.

As the e₹ is issued by the RBI, it carries the same trust and safety as physical currency. Transactions are recorded on a secure digital ledger, ensuring transparency and reducing risks of fraud or duplication.

The RBI is now developing a Unified Markets Interface, a new financial market infrastructure that uses wholesale CBDC for advanced settlement systems. This platform introduces asset tokenisation, i.e., the process of converting real-world assets like gold or deposits into digital tokens using blockchain or other distributed ledger technology.

Asset Tokenisation - It turns tangible assets (like gold) into digital tokens that can be traded or transferred easily. This brings transparency, efficiency, and global accessibility to financial markets.

Deposit Tokenisation - In this system, bank deposits are represented as digital tokens, where 1 token = 1 unit of deposit. These tokens can move freely across different systems, improving market efficiency, speed, and liquidity.

The RBI’s pilot on tokenised deposits, led under Governor Sanjay Malhotra, showed promising results, proving that such systems can make transactions faster, more transparent, and less costly. In this setup, a customer deposits money with a bank, which then issues digital tokens representing that deposit. The customer can then trade or transfer these tokens across platforms, enjoying greater flexibility and liquidity than with traditional deposits.

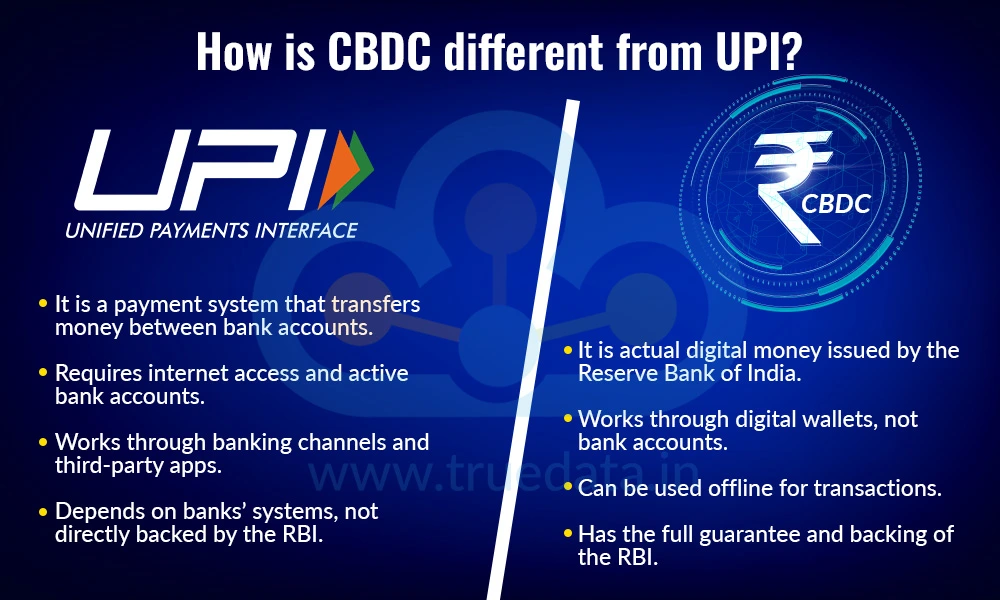

The CBDC (Digital Rupee) and UPI may look similar because both allow digital payments, but they are fundamentally different. UPI is a payment system that transfers money between bank accounts, while CBDC is actual digital money issued directly by the Reserve Bank of India (RBI). When a person pays through UPI, the money moves from one bank account to another using existing banking channels. However, when they use CBDC, the transfer happens directly between wallets, just like handing over physical cash and with no bank in between. CBDC also works offline, can function without a bank account, and carries the full guarantee of the RBI, whereas UPI depends on internet access and the banks’ systems. In short, UPI moves money, while CBDC is money in digital form.

While CBDC is being touted as the next big thing in the financial fabric of the country, there are certain risks and challenges that also need to be considered. These challenges include,

Need for Strong Cybersecurity -

Since CBDC is completely digital, it is vulnerable to cyberattacks, hacking, or technical glitches. The RBI and banks must ensure strong protection against any digital theft or misuse.

Risk of Technical Failures -

Any system error, app malfunction, or network issue could temporarily stop transactions. Reliable digital infrastructure is needed to keep the system running smoothly at all times.

Privacy Concerns -

Unlike cash, digital transactions leave a record. Some people may worry that CBDC could lead to less financial privacy, as authorities might be able to track how and where money is spent.

High Implementation Cost -

Developing, maintaining, and securing the CBDC network will require significant investment in technology, training, and infrastructure across the country.

Resistance to Change -

Many people still prefer cash due to habit and trust. Convincing them to shift to a fully digital form of money may take time and consistent awareness efforts.

Limited Digital Awareness -

Many people in rural areas still lack digital literacy or access to smartphones. Educating citizens and building confidence in using digital money will be a big challenge.

Cross-Border and Legal Challenges -

As digital currencies grow, international transactions and regulations may become complex. Clear laws and cooperation between countries will be needed to handle cross-border CBDC use.

The Central Bank Digital Currency (CBDC) or Digital Rupee (e₹) is a major step in India’s journey toward a modern, cashless, and inclusive economy. Being issued by the Reserve Bank of India (RBI), it combines the trust of physical money with the speed and convenience of digital payments. However, it is still at a very nascent stage and may take some time and resistance to be fully integrated with the financial structure of the country. Thus, India needs to adapt the CBDC with careful planning and awareness to strengthen India’s digital financial infrastructure and position the country as a global leader in digital innovation and financial inclusion.

This article talks about the next big thing in the financial framework of India. We hope this piece clarifies various aspects of CBDC and the need for a stable digital currency for a country. Let us know your thoughts on this topic or if you need further information on the same.

Till then, Happy Reading!

Read More: What is DTAA in Income Tax?

The Japanese Yen (JPY) has long been one of the world’s major currencies, ...

The second half of the year is always buzzing with excitement of festivals, fami...

Share prices of a company are affected by numerous external and internal factors...