The U.S. dollar is not just another currency. It is the backbone of global trade, finance, and investment. Any shift in its value and the world sees the ripple effects right from commodity prices to stock markets. However, how do we actually measure the dollar’s strength, and what makes it hold such power? The answers lie in understanding the U.S. Dollar Index (DXY). Check out this blog to learn all about the US Dollar Index and why understanding the DXY can give you a sharper edge in today’s global markets.

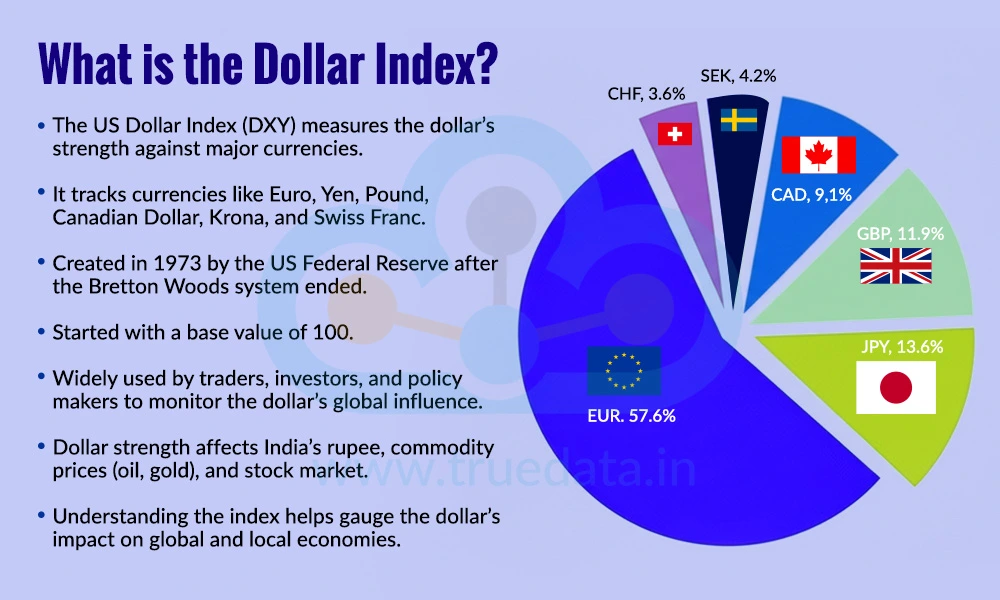

The US Dollar Index (DXY) is a measure of how strong or weak the US dollar is compared to a group of major world currencies. Think of it like a report card for the dollar’s performance against other important currencies such as the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. The index was first created in 1973 by the US Federal Reserve, right after the Bretton Woods system (which had fixed exchange rates) came to an end. The index started with a base value of 100. Over the years, the Dollar Index has become one of the most widely used tools for traders, investors, and policymakers to track the dollar’s global influence. The dollar’s strength can directly impact crucial parameters in India, like the value of the Indian rupee, commodity prices like oil and gold, and even the stock market. Hence, it is important to understand the Dollar Index and the factors affecting it to understand the overall influence it has on economies.

The US Dollar Index is the barometer of global currency strength. The relevance of the US Dollar Index and how it works is explained below.

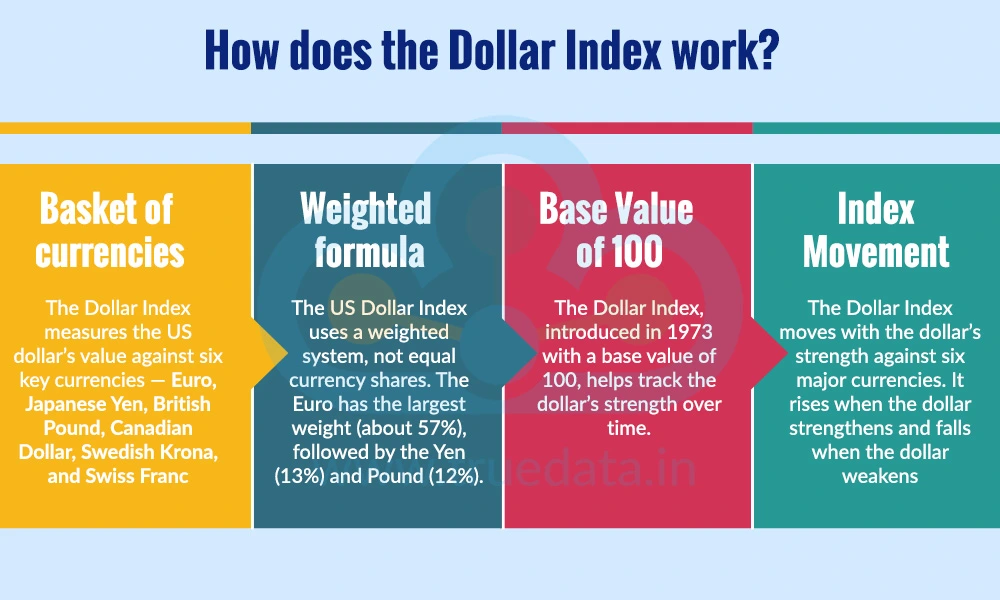

The Dollar Index does not compare the US dollar with every currency in the world. Instead, it uses a ‘basket’ of six major currencies that are most important for US trade. These are

Euro

Japanese Yen

British Pound

Canadian Dollar

Swedish Krona

Swiss Franc.

Among these, the Euro has the biggest share because the European Union is the US’s largest trading partner. Thus, if the Euro becomes stronger or weaker against the dollar, it affects the Dollar Index much more than the other currencies.

The calculation of the US Dollar Index is based on the basket of currencies as mentioned above. However, each of the six currencies in the basket does not count equally. Instead, the Dollar Index uses a weighted system. For example, the Euro makes up nearly 57% of the index, while the Japanese Yen has about 13%, the British Pound around 12%, and the others have smaller percentages. This means that if the Euro moves sharply, the index will change a lot, but if the Swedish Krona moves, the effect will be small.

When the Dollar Index was first introduced in 1973, it was set to a starting value of 100. This makes it easy to compare over time. If the index moves to 110, it indicates the US dollar is 10% stronger than it was in 1973, compared to the basket of currencies. On the other hand, if the index shows 90, it indicates that the dollar is 10% weaker. This ‘base value of 100’ is like setting a starting point in a race, thereby helping in measuring how far ahead or behind the dollar has moved over the years.

The Dollar Index rises or falls depending on how the US dollar performs against the six currencies in the basket. If the dollar becomes stronger (for example, if 1 dollar can now buy more Japanese Yen than before), the index goes up. If the dollar weakens (for example, if 1 dollar buys fewer Euros than before), the index goes down. In simple terms, when the dollar flexes its muscles, the index climbs, and when it loses strength, the index falls.

The Dollar Index indicates the strength of the US Dollar and, thereby, the power of the US economy. However, to understand the overall impact of the index, it is also important to understand the factors that drive its movement. Some of these key factors are explained hereunder.

One of the biggest factors that strengthen the Dollar Index is the level of interest rates set by the US Federal Reserve (the American central bank). When interest rates in the US are high, investors around the world tend to allocate their funds to US bonds and assets, as they offer better returns. This increases the demand for US dollars, making the dollar stronger compared to other currencies. It is similar to how people prefer fixed deposits in banks that offer higher interest, as more returns attract more money.

The US dollar is considered a ‘safe-haven’ currency. This means that during times of global uncertainty, like wars, financial crises, or pandemics, investors around the world rush to buy US dollars as they trust them to hold value. As demand for the dollar rises, the Dollar Index also becomes stronger. For example, during the COVID-19 pandemic and again during the Russia-Ukraine war, the dollar became stronger because investors wanted safety.

A strong performance of the US economy, characterised by favourable macroeconomic factors such as robust growth, low unemployment, and high consumer spending, can have a direct impact on the strengthening of the dollar. This is because a healthy economy attracts global investors, who need dollars to invest in American companies, stocks, and industries. This is similar to a situation in India, when the economy does well, foreign investors bring money into the Indian stock market (FII inflows), which strengthens the rupee. The same logic applies, but on a global scale for the U.S. dollar.

The US dollar is the world’s primary trade currency, with most global commodities, like crude oil, natural gas, and gold, priced in dollars. This creates a constant global demand for US dollars, as countries need them to pay for imports. An example of this is the oil imports across the globe, which are done mainly in dollars. The global demand for the US dollar thus keeps it strong and makes the Dollar Index a powerful tool.

Sometimes the Dollar Index becomes strong not just because the dollar is powerful, but also due to the weaknesses of other currencies in the basket (Euro, Yen, Pound, etc.). For example, if the European economy is facing problems or the Japanese Yen is falling, the Dollar Index will rise automatically since the dollar looks stronger in comparison. Thus, the Dollar Index gets stronger when global money flows into the US, when investors seek safety, when the U.S. economy is healthy, and when other major currencies face trouble.

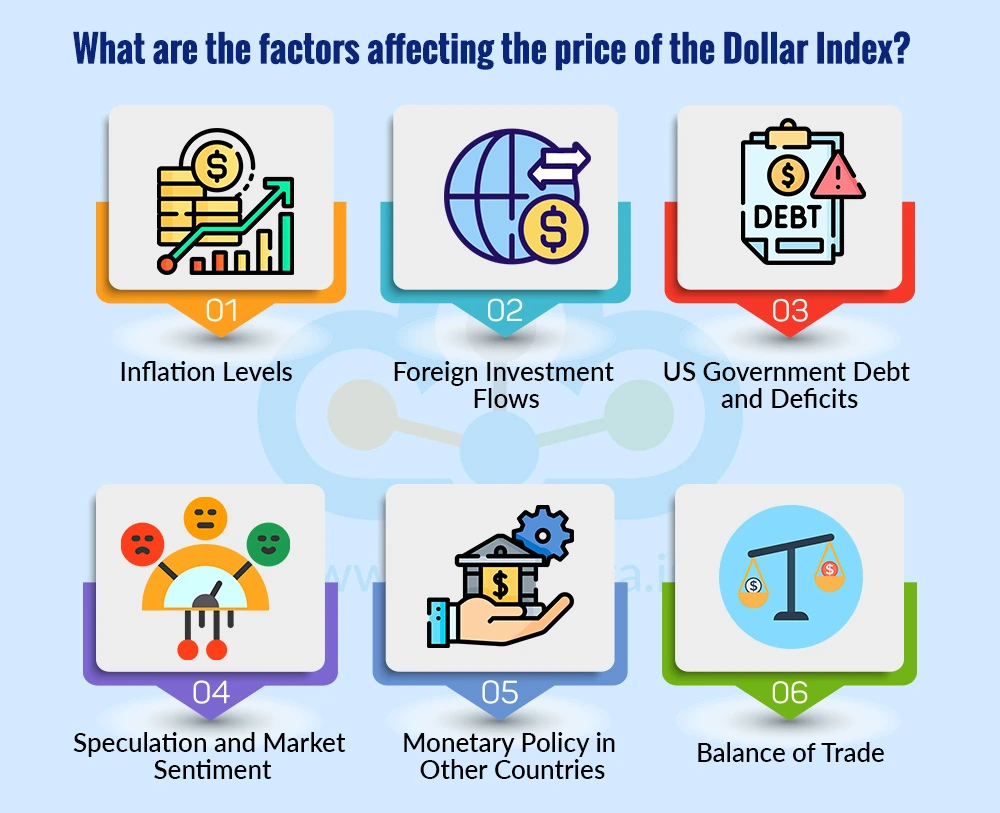

We have seen the key factors that strengthen the US dollar index. These factors also have a direct impact on the price of the US dollar. However, apart from these factors mentioned above, there are several other factors that can affect the price of the US dollar. Some of these factors are explained below.

Inflation in the US has a big effect on the Dollar Index. High inflation often pushes the Federal Reserve to raise interest rates to control prices, which in turn strengthens the dollar. On the flip side, low inflation may lead to lower rates, weakening the dollar.

When global investors put money into US assets like stocks, bonds, and real-estate, they need dollars to complete those transactions. This increases the demand for the dollar and lifts the Dollar Index. If investments shift away from the US to other markets, demand for the dollar falls. This is similar to Foreign Institutional Investors (FIIs) buying Indian stocks, which strengthens the rupee.

The US government borrows money by issuing bonds. If debt levels rise too high, it can sometimes reduce confidence in the dollar, putting downward pressure on the index. But at the same time, US debt markets are considered the safest in the world, so many investors still prefer holding US bonds, which supports the dollar.

Currency traders and hedge funds also influence the Dollar Index. If traders believe the dollar will strengthen, they buy dollars in advance, pushing the index higher. On the other hand, if they expect weakness, selling pressure can bring the index down. This is similar to how stock prices rise or fall not just on facts, but also on investor expectations and moods.

The Dollar Index is a relative measure, so decisions by other central banks also matter. For example, if the European Central Bank or Bank of Japan keeps their interest rates low while the US raises rates, the dollar looks stronger and the index rises. However, if Europe or Japan raises rates aggressively, it reduces the gap with the US, which can weaken the Dollar Index.

The US trade balance, i.e., the difference between exports and imports, affects the dollar. When the US exports increase, foreign countries need to buy dollars to pay for American goods, thereby strengthening the dollar. However, if imports are higher, US dollars flow out of the US, which can weaken it.

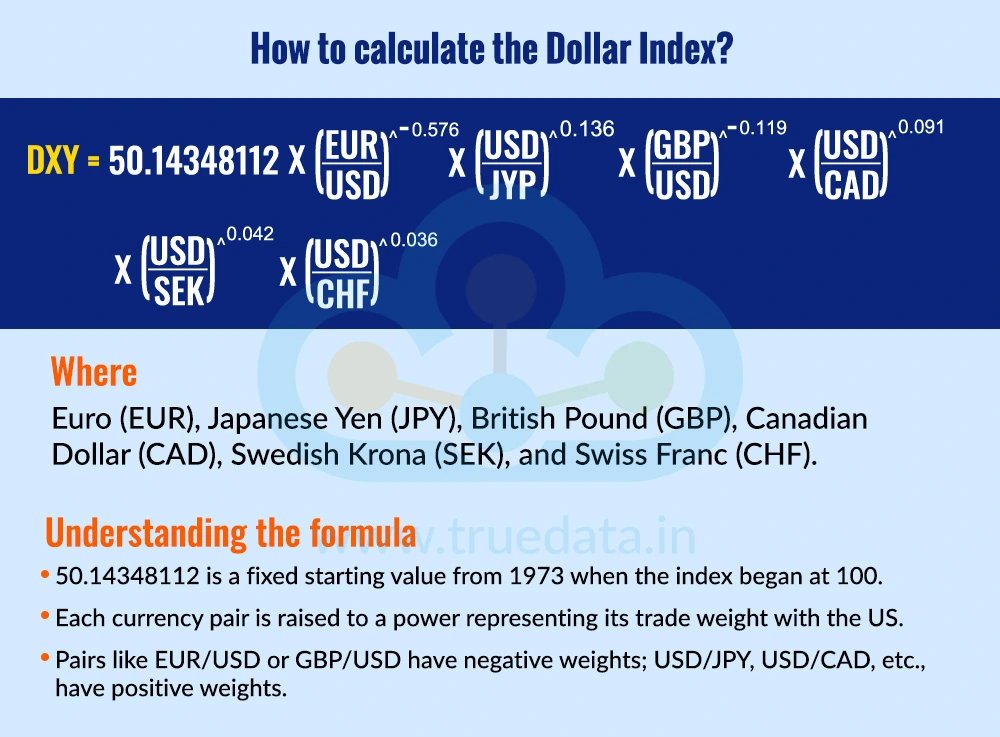

The index is calculated using a weighted geometric mean of six major currencies, i.e., Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF).

The formula to calculate the US Dollar Index is,

DXY = 50.14348112 * (EUR / USD) ^?°·576 * (USD / JYP)^°·¹³6 * (GBP / USD)^?°·¹¹? * (USD / CAD)^°·°?¹ * (USD / SEK)^°·°4² * (USD / CHF)^°·°³6

Understanding the formula

The number 50.14348112 is just a fixed starting value set in 1973 when the index began at 100.

Each currency pair is raised to a power (like 0.576 or 0.136). These powers are the weights that show how important that currency is in global trade with the US.

Some pairs are written as EUR/USD or GBP/USD (where the euro or pound is first), so they have a negative weight. Others are written as USD/JPY, USD/CAD, etc., so they have a positive weight.

The US Dollar Index (DXY) tells us how strong or weak the US dollar is compared to a group of six major world currencies. It acts basically like a scorecard where the index going up indicates the dollar gaining strength and vice versa. The interpretation of the movement of the US Dollar Index is explained below.

Index Above 100 = Dollar is Stronger

When the Dollar Index is above its base level of 100 (set in 1973), it means the US dollar has become stronger compared to those six currencies. A higher value shows that investors around the world trust the dollar more, global demand for dollars is high, or other currencies are weak. A stronger dollar usually makes the rupee weaker, because more rupees are needed to buy one dollar. This often increases the cost of imports like crude oil, machinery, and electronics. It can also make gold prices rise in India since gold is traded in dollars.

Index Below 100 = Dollar is Weaker

When the Dollar Index is below 100, it means the US dollar has lost strength compared to those currencies. This often happens when the US economy slows down, the Federal Reserve cuts interest rates, or other currencies become stronger. A weaker dollar can be good news. It usually helps the rupee strengthen, makes imports like oil cheaper, and may reduce pressure on inflation. Indian companies that rely on imported goods or raw materials benefit from this.

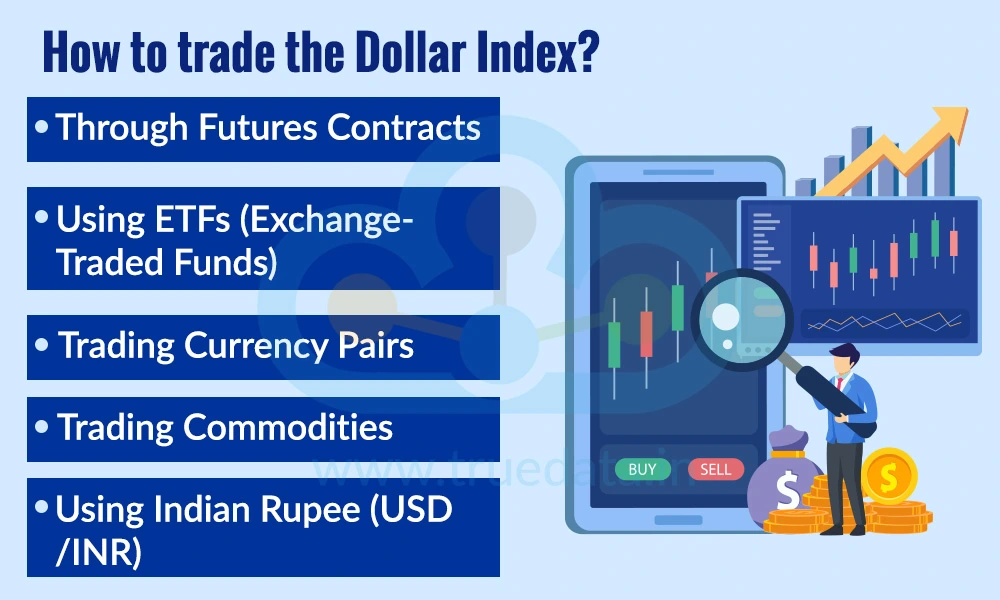

Investors and traders can use the US Dollar as a hedge against their market positions or to diversify their portfolio. The different ways to trade the Dollar Index are,

Through Futures Contracts - Dollar Index futures are traded on the ICE exchange; however, these are generally accessible only to large global investors, not retail participants in India.

Using ETFs (Exchange Traded Fund) - Investors can access US-based ETFs such as UUP (for a bullish view) or UDN (for a bearish view) by using international brokerage accounts.

Trading Currency Pairs - Traders can indirectly participate by trading major forex pairs like EUR/USD, GBP/USD, or USD/JPY, which closely mirror movements in the Dollar Index.

Trading Commodities - Commodities such as gold and crude oil often move in the opposite direction of the Dollar Index, offering an indirect way to trade its movements.

Using Indian Rupee (USD/INR) - Currency derivatives like USD/INR futures and options on NSE or BSE provide traders with a way to benefit from Dollar Index trends, as the rupee typically weakens when the DXY rises.

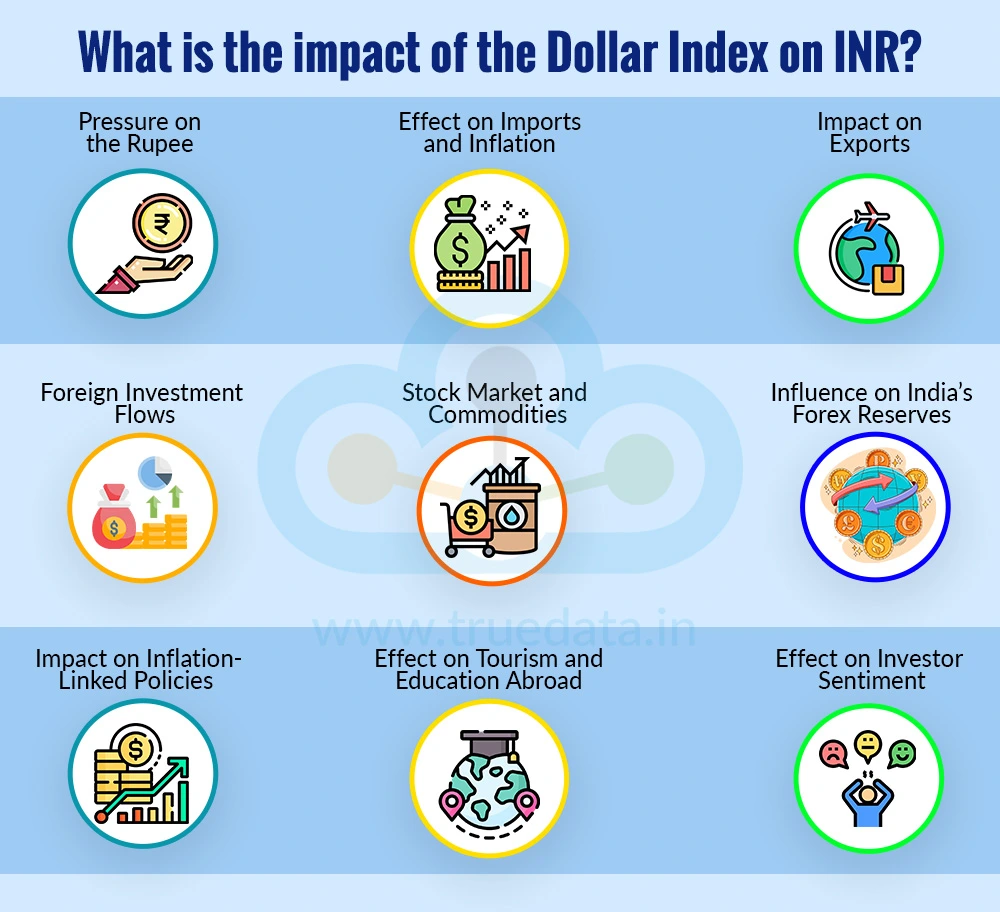

The Dollar Index has a direct impact on the Indian Rupee through various factors like imports, exports, etc., right up to the investors’ sentiment in the country. In many ways, the DXY acts like a global signal that influences not just the rupee, but India’s entire economic outlook. The detailed impact of the Dollar Index in India is explained below.

Pressure on the Rupee -

When the Dollar Index rises, it usually means the US dollar is getting stronger compared to other major currencies. This strength often puts downward pressure on the Indian Rupee, because investors prefer holding dollars over emerging market currencies. As a result, the INR tends to weaken, which means more rupees are needed to buy one US dollar.

Effect on Imports and Inflation -

A stronger Dollar Index makes imports more expensive for India, especially crude oil, which is bought in US dollars. Since India imports a large part of its oil, the cost of fuel rises when the dollar strengthens. This increase can spread to other goods and services, leading to higher inflation in the country. A weaker Dollar Index has the opposite effect, making imports cheaper and reducing inflationary pressure.

Impact on Exports -

A weaker rupee caused by a strong Dollar Index can sometimes help Indian exporters. Sectors like IT services, textiles, and pharmaceuticals benefit as they earn in dollars but spend in rupees. This makes their global earnings more valuable when converted back to INR. However, if the Dollar Index is too strong, it can also slow down global demand, which may hurt exports in the long run.

Foreign Investment Flows -

Foreign investors keep a close eye on the Dollar Index. When the index rises, many investors move their money back into the US for safety and higher returns, causing capital outflows from India, thereby further weakening the rupee. On the other hand, when the Dollar Index falls, global investors are more likely to invest in emerging markets like India, and thus, strengthening the INR.

Stock Market and Commodities -

The Dollar Index also affects the Indian stock market and commodity prices. A rising index often causes volatility in equities as foreign investors pull out their money. At the same time, commodities like gold usually become more expensive in rupee terms when the dollar strengthens. A falling index, on the other hand, often supports equities and makes gold more affordable for Indian buyers.

Influence on India’s Forex Reserves -

The Reserve Bank of India (RBI) often uses its forex reserves to stabilise the rupee when the Dollar Index is rising too sharply. If the dollar keeps strengthening, the RBI may need to sell more dollars from its reserves to support the rupee, which can reduce India’s overall reserve levels. A weaker Dollar Index reduces this pressure and helps the RBI conserve reserves.

Impact on Inflation-Linked Policies -

A rise in the Dollar Index leads to an increase in inflation in India due to costly imports, which can trigger the RBI to raise interest rates to control prices. This impacts borrowing costs for businesses and individuals in India. A weaker Dollar Index can ease inflation, giving the RBI more room to keep rates lower and support domestic growth.

Effect on Tourism and Education Abroad -

A stronger Dollar Index also impacts Indians travelling abroad or paying for foreign education. As the rupee weakens against the dollar, overseas trips, tuition fees, and living expenses in countries like the U.S. become costlier. On the contrary, a fall in the Dollar Index leads to the rupee gaining strength, thereby making foreign travel and education slightly cheaper.

Effect on Investor Sentiment -

The movement of the Dollar Index also shapes investor confidence in India. A stronger dollar may signal global uncertainty, leading investors to be cautious about emerging markets, including India. This can slow down capital inflows. On the other hand, a weaker dollar often encourages investors to take more risk, which supports Indian equities and bonds.

The Dollar Index is more than just a number. It is a key measure of the US dollar’s strength against major world currencies and a powerful signal for global markets. It reflects factors like US interest rates, economic health, global trade, inflation, and even geopolitical events. A rising Dollar Index usually means a stronger dollar and a weaker rupee, while a falling index often brings relief to India’s economy. Thus, the DXY acts like a global barometer that every trader, investor, and policymaker should track to understand both international trends and India’s financial future.

This article aims to explain the meaning and significance of the US Dollar Index, as well as how to interpret its movements. Let us know your thoughts on this topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

The Japanese Yen (JPY) has long been one of the world’s major currencies, ...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Introduction For the longest time, investment in stock markets was thought to b...