If you are an avid market trader, you would have often noticed how events of the previous day trigger the market when it opens. The domestic markets are also affected by international news and events, which drive traders to place premarket orders. So what are these premarket orders, and why are they important for your portfolio? We have discussed the pre-open session in our previous blog. We are taking that discussion further here, so read on to learn more about the premarket session and the premarket order to refine your trading knowledge.

The Pre-Market Trading Session in India is a short trading window that happens before the regular market opens. It runs from 9:00 AM to 9:15 AM on NSE and BSE, and it helps the market decide the opening prices of stocks in a fair and less volatile way. This 15-minute session is divided into three parts, i.e.,

From 9:00 to 9:07 AM, where traders can place, modify, or cancel buy/sell orders;

From 9:07 to 9:08 AM, when no new orders are allowed, the exchange matches buy and sell orders to decide the ‘opening price’ for each stock. This time frame has been significantly reduced to practically a few seconds due to advancements in technology that have enabled order matching in seconds.

From 9:08 to 9:15 AM, is the buffer zone where the system is on hold to prepare for the normal trading session.

Pre-market trading is mainly useful when big news, results, or events come before market hours, as it lets prices adjust smoothly instead of suddenly jumping when the market opens at 9:15 AM.

The pre-market session and pre-market orders can help in shaping a profitable portfolio or avoiding possible losses. The importance of the pre-market session is explained hereunder.

The main job of the pre-market session is to set a fair and balanced opening price for each stock before the market opens at 9:15 AM. Without it, if big news or events happen overnight, stock prices might open with sudden jumps or drops, causing chaos. In the pre-market session, buy and sell orders are matched in a controlled way so that the market opens smoothly, with less shock for traders.

Even though trading volume is lower in the pre-market, it still provides clues about the market mood. For example, if a stock’s pre-market price is much higher than its previous close, traders can guess that market sentiment is positive. These early signs help in planning intraday strategies, especially for short-term and day traders.

If there were no pre-market session, the regular market might see huge price swings in the first few minutes as traders rush to react to news. The pre-market helps absorb this pressure by allowing price discovery before the open. This makes the first minutes of regular trading calmer, giving traders more confidence and control.

Global markets, political events, company results, or economic announcements often happen when Indian markets are closed. The pre-market session gives traders a chance to react quickly the next morning instead of waiting for the main session. This can be crucial for avoiding losses or capturing early profits.

By allowing orders to be placed and matched before the market opens, the pre-market session improves liquidity (availability of buyers and sellers) right at the start of the day. This makes it easier to execute trades without facing big gaps between buy and sell prices.

Pre-Market Orders are buy or sell orders that traders place between 9:00 AM and 9:15 AM, before the regular trading session begins on NSE and BSE. These orders help decide the opening price of each stock through a matching process carried out by the exchange. Since this is a limited 15-minute window, only certain types of orders are allowed, and they work slightly differently than during normal hours.

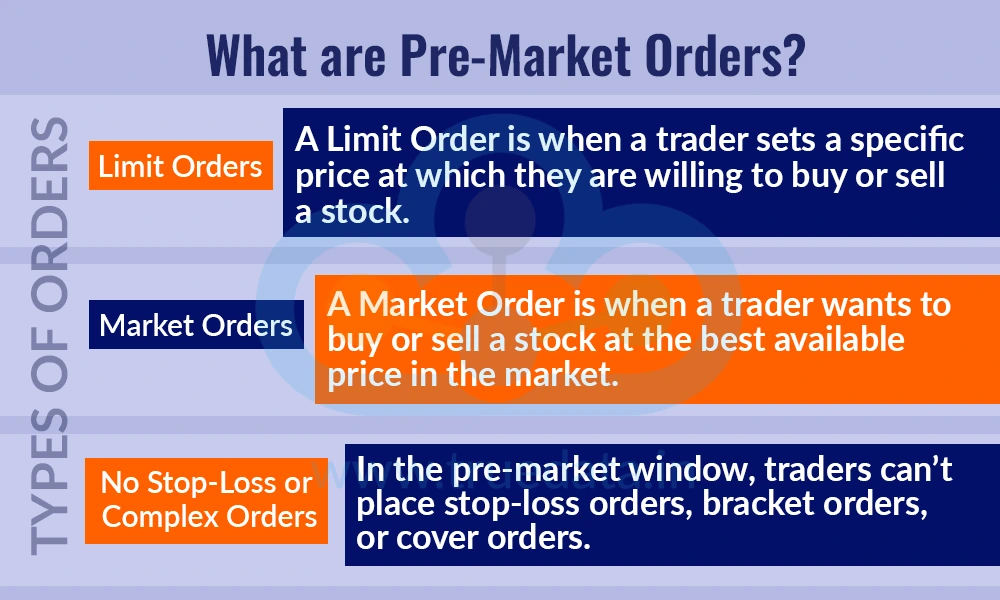

The types of orders that can or cannot be placed during the premarket session are explained below.

A Limit Order is when a trader sets a specific price at which they are willing to buy or sell a stock. For example, if they place a buy limit order at Rs. 100, the trade will only happen at Rs. 100 or lower. In the pre-market session, limit orders are the most common type, as they give traders control over the exact price at which they enter or exit the market.

A Market Order is when a trader wants to buy or sell a stock at the best available price in the market. During the pre-market session, market orders are matched based on available limit orders from other traders. However, since trading volume is low at this time, prices may move quickly, so market orders can sometimes execute at a slightly different price than expected.

In the pre-market window, traders cannot place stop-loss orders, bracket orders, or cover orders. The session is kept simple to focus on straightforward order matching for price discovery.

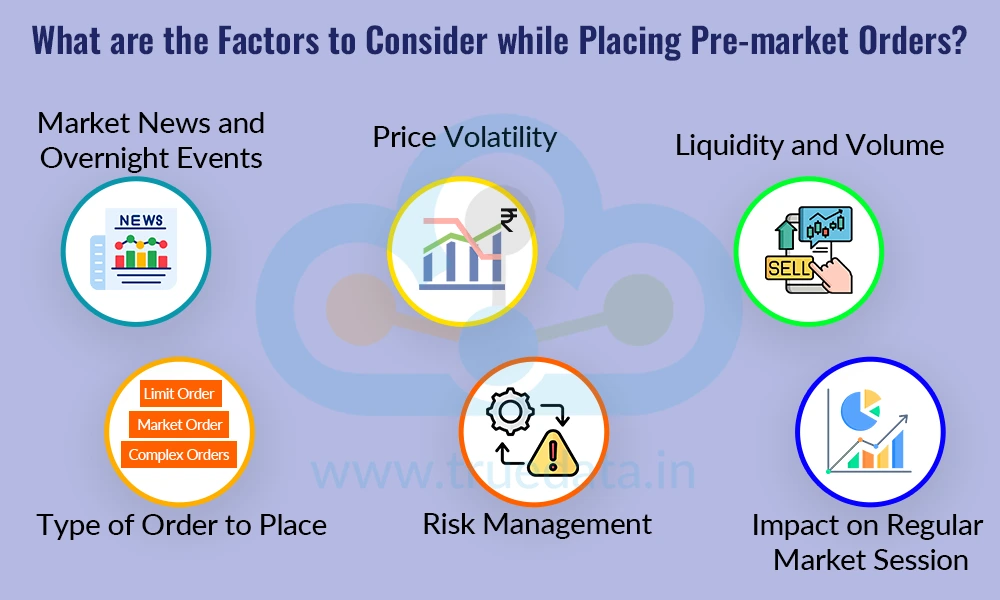

Pre-market sessions can be quite volatile, especially in response to overnight news, global market movements, or major announcements. They also have fewer players as compared to the traditional trading hours. Therefore, it is important to understand the important factors to consider for successfully trading the premarket session or placing pre-market orders. Some of these factors are explained below.

Before placing any pre-market order, a trader should check important news, global market performance, and overnight events. Company announcements, quarterly results, global stock market trends, or political and economic updates can strongly affect pre-market prices. Being aware of these factors helps the trader avoid surprises and make informed decisions.

Pre-market prices can be more volatile than regular market prices because of low participation and fresh reactions to news. Traders should be prepared for sudden price movements and set limit orders if they want more control over the execution price.

Liquidity refers to how easily a stock can be bought or sold without changing its price too much. In the pre-market session, trading volumes are usually lower, meaning there are fewer buyers and sellers. A trader must consider whether the stock they are trading has enough pre-market activity to execute their order efficiently, especially if they are using market orders.

Choosing the right order type is important in pre-market trading. Limit orders offer price control, while market orders offer faster execution but less control over the price. Traders must decide based on their strategy, the stock’s liquidity, and the urgency of their trade.

Since pre-market moves can be unpredictable, traders should decide on their maximum acceptable loss or target before placing an order. They should also avoid trading large quantities unless they are confident about the price trend, as there is no stop-loss facility in the pre-market session.

A trader should also consider how their pre-market position might perform once the regular market opens at 9:15 AM. Sometimes, prices can change direction after the main session starts due to higher participation and new orders entering the market.

The pros and cons of pre-market trading are explained below.

The Pre-Market Trading Session, held from 9:00 AM to 9:15 AM, plays an important role in deciding fair opening prices and reducing sudden volatility when the market opens. It allows traders to react early to market news and adjust positions to safeguard their portfolio or take advantage of developing situations. Successful participation requires awareness of market news, understanding of order types, careful risk management, and the ability to adapt quickly to changing conditions.

We hope this blog simplifies the concept of premarket session and premarket orders and their impact on the overall portfolio. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till Then, Happy Reading!

Read More: Importance of Order Flow and Imbalance Charts in Day Trading

Every trader's morning begins with being glued to their TV or laptop and watchin...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Introduction For the longest time, investment in stock markets was thought to b...