India’s latest GDP numbers have surprised both domestic and global markets, with real GDP growing 8.2% in Q2 of FY 2025-26, significantly higher than the 5.6% growth recorded in the same quarter of the previous year. A key contributor to this momentum is the newly implemented GST 2.0 reforms, which came into effect in September 2025. Their impact is already visible! GST collections in October rose to around Rs. 1.95 lakh crore, up 4.6% from Rs. 1.87 lakh crore in the same month last year, signalling steady demand and resilient economic activity despite global uncertainties. For investors, these numbers sound encouraging, but what do they actually mean for your portfolio? More importantly, do GST reforms make consumption-focused funds a smarter bet today? Let us break down how these changes shape the consumption theme and what it means for investors going forward.

Consumption funds are equity mutual funds that primarily invest in companies linked to everyday spending, such as FMCG, retail, automobiles, consumer durables, food & beverages, entertainment, e-commerce, travel, and other sectors driven by household consumption. The idea is simple, i.e., as people earn more and spend more, businesses that cater to their needs can grow, and these funds aim to benefit from that long-term trend. Consumption funds offer exposure to a theme that is deeply connected to India’s rising middle class, growing urbanisation, and increasing disposable incomes. These funds often reflect stable demand, as people continue to purchase daily essentials even during slowdowns, along with exposure to brands with strong pricing power, and a long-term structural growth story backed by demographics and lifestyle upgrades. However, they can be concentrated in specific sectors. Thus, returns may vary depending on consumer trends and economic cycles. Overall, they can be a useful addition for long-term investors who believe in India’s consumption-led growth.

GST 2.0 has brought down the rates on essentials, particularly in sectors such as FMCG, consumer durables, to the minimum slab of 5% and ‘zero’ in cases of products like critical drugs, food items, life and health insurance, stationery and more. The impact of GST reforms on consumption funds is explained below.

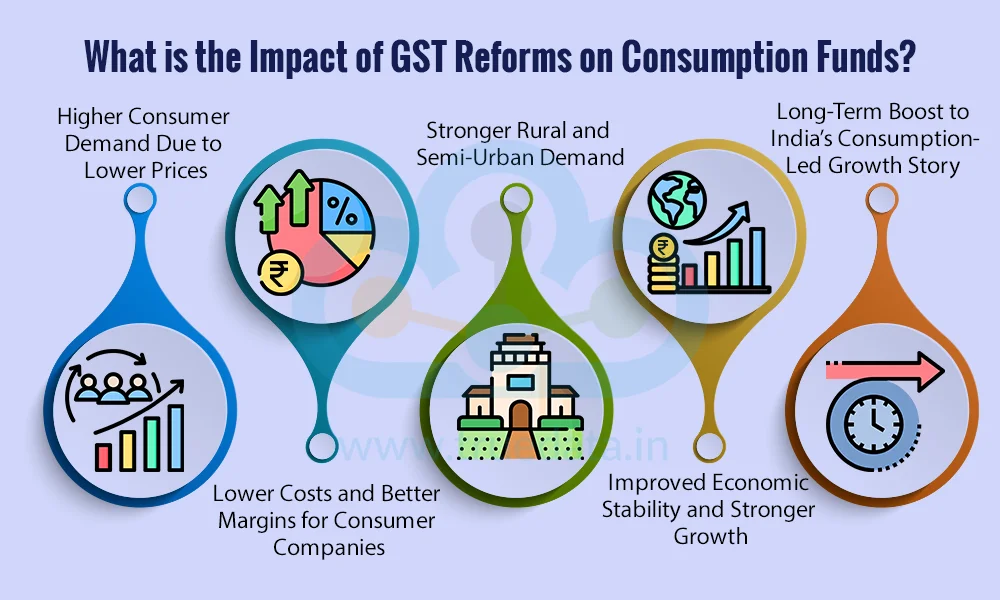

One of the biggest impacts of GST 2.0 is the reduction of tax rates on many everyday consumer goods. Items in the FMCG, basic personal care, and common household products have moved to lower GST slabs. When taxes are reduced, the final price consumers pay also drops. Lower prices usually mean more people can afford these goods, especially in a price-sensitive country like India. As demand rises, companies selling these products can see higher sales and better quarterly results. Since consumption funds invest heavily in such companies, this increased demand can directly support better long-term returns for investors.

GST reforms also simplify the tax system for businesses. With fewer slabs and lower compliance hurdles, companies spend less money on tax management and more on expanding their business. The removal of ‘tax-on-tax’ and smoother logistics under GST reduces distribution costs, particularly helpful for FMCG and retail companies that operate large supply chains. Lower costs and higher efficiency usually mean better profit margins, and this can enhance the overall health of their companies within consumption funds.

Price reductions and simpler taxation benefit not just cities but also rural and semi-urban India. These regions are more sensitive to price changes and account for a large part of India’s consumption story. With goods becoming more affordable, demand in these areas can rise significantly. This broader and more stable market supports companies in sectors like FMCG, autos (entry-level), and retail, which are the major holdings in many consumption funds. As consumption spreads across geographies, the growth of these companies becomes more balanced and less dependent on urban demand, which is beneficial for investors seeking stability and diversification.

GST 2.0 is not just a tax change, it is a structural economic reform. Simplifying tax slabs, reducing disputes, and increasing transparency improve India’s overall ease of doing business. Stronger GST collections to the tune of Rs. 1.95 lakh crore in October, up 4.6% from the same period last year, indicate that economic activity is healthy and rising. Combined with India’s impressive 8.2% real GDP growth in Q2 FY 2025-26, this signals a strong and stable economic environment. A stable, growing economy boosts consumer confidence. When people feel secure about their jobs and incomes, they spend more, directly benefiting sectors held within consumption funds.

GST 2.0 supports long-term structural improvements

Faster movement of goods

Better compliance

Wider access to markets

Reduced costs for companies

More organised retail growth

Higher formalisation of the economy

These changes enable consumer-facing companies to scale more quickly and reach a broader customer base. This means a steadier and more predictable growth path for consumption funds over the coming years.

The sectors that are part of the consumption fund theme include FMCS, healthcare, retail, automobile, entertainment and leisure, e-commerce, financial services and more. The detailed impact of the GST reforms on the consumption funds is explained below.

The FMCG sector (soaps, packaged foods, beverages, toothpaste, detergents) benefits the most from GST 2.0. Many items have been reclassified to lower GST rates, making them cheaper for consumers. When essential and frequently used items become more affordable, people tend to buy more, especially in rural and semi-urban regions. At the same time, FMCG companies benefit from lower logistics and compliance costs, improving their profit margins. Since consumption funds have a large portion of their holdings in FMCG, this sector gives the strongest positive push to fund performance.

Organised retail, both offline stores and online platforms, benefits greatly from simplified and uniform GST rates. GST 2.0 reduces tax confusion across states, helping retailers move goods faster and manage inventory more efficiently. Lower tax rates on several consumer goods also encourage more impulse and festival shopping, driving higher sales. For consumption funds, this means exposure to retail companies that may experience faster expansion, better margins, and higher customer footfall.

The auto sector sees a mixed impact from GST reforms. Entry-level two-wheelers and small cars may become more affordable if placed in lower GST brackets, which could boost sales, especially in rural and middle-income groups. However, premium vehicles or luxury cars may face higher GST, which could reduce demand in that segment. Overall, for consumption funds that hold companies with strong mass-market presence, the reforms are mostly positive, as they support higher demand in the largest volume segment.

Items such as washing machines, refrigerators, air conditioners, LED TVs, and kitchen appliances are major contributors to consumption funds. Under GST 2.0, several of these products have moved into lower tax slabs, making them more affordable. Lower prices often encourage household upgrades and replacement purchases. With improved supply chains and rising urban incomes, demand for consumer durables can grow steadily, helping consumption funds benefit from better profitability and higher sales cycles in this sector.

Simplified GST and lower tax rates support the entertainment sector, i.e., cinemas, OTT platforms, amusement parks, and leisure services. More disposable income (thanks to lower taxes on essentials and consumer goods) means people are more willing to spend on leisure and experiences. Although this sector is more cyclical, the long-term outlook remains positive, offering consumption funds additional growth opportunities.

Restaurants, quick-service chains, and food delivery companies benefit when GST rates are reduced, and compliance gets easier. Lower taxes on dining and prepared foods can make eating out more attractive, especially for middle-income households. As a result, companies in the food services industry may experience higher footfall, more orders, and stronger sales, contributing positively to consumption fund returns.

GST reforms make inter-state movement and warehousing simpler for online marketplaces.

With lower taxes on many consumer products, e-commerce platforms can offer better prices and expand their reach. This supports companies linked to online retail, logistics, payment systems, and digital consumption, i.e., themes that many consumption funds increasingly tap into. This sector benefits from lower operating friction, faster deliveries, and stronger demand.

GST reforms also impact healthcare-related consumption. Recognising the need for health and life insurance as well as the growing medical costs in the country, the government has reduced the GST on these products and placed them under the zero category. Furthermore, lower or zero GST on many essential medicines makes treatment more affordable and accessible for citizens. Improved logistics under GST will also help in accelerating the movement of critical medical supplies, which are lifesaving in crucial moments. As healthcare becomes more accessible, demand for medicines, diagnostics, and preventive healthcare rises, giving a boost to the sector as a whole and thereby the economy. Consumption funds with exposure to healthcare companies will thus benefit from steadier demand, resilience of essential products, and long-term structural growth.

GST 2.0 is expected to have a strong positive impact on financial services, including banks, NBFCs, fintechs, and the mutual fund industry. With simpler taxes and smoother compliance, financial institutions operate more efficiently, and stronger GST revenues boost consumer confidence. This encourages people to borrow more for everyday needs, such as two-wheelers, appliances, and personal spending, which supports demand in sectors held by consumption funds. The mutual fund industry also benefits from lower GST on essential goods increases household savings and allows more people to invest through SIPs and equity funds. Better market sentiment and rising interest in thematic funds, particularly focused on consumption, can drive higher inflows into mutual funds. Overall, GST reforms strengthen both consumer spending and investment participation, creating a more supportive environment for the growth of consumption funds.

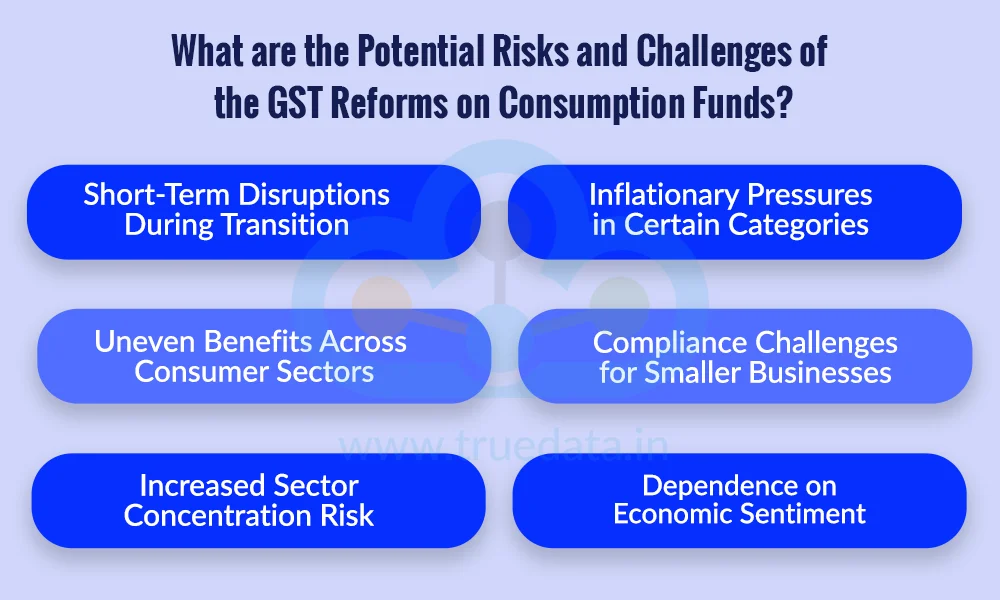

While GST reforms offer numerous long-term benefits, it is essential for investors in consumption funds to be aware of a few limitations that can affect the performance or the desired impact of the reforms on such funds. Some of these limitations are mentioned below.

Short-Term Disruptions During Transition - Whenever a new tax system or rate change is introduced, businesses need time to adjust. Companies may face issues like re-pricing products, updating billing systems, or clearing outdated inventory. These short-term disruptions can temporarily impact sales and earnings, potentially creating volatility in consumption funds.

Inflationary Pressures in Certain Categories - Although some goods become cheaper due to lower GST, others may experience price increases because of higher tax slabs or supply-chain adjustments. These price hikes can reduce demand for certain products, especially discretionary items, which may limit growth opportunities for consumption funds.

Uneven Benefits Across Consumer Sectors - Not all consumer-facing industries gain equally from GST reforms. Essential and mass-market products may get cheaper, however, luxury, premium, or ‘sin’ goods may face higher GST rates. If a consumption fund has exposure to segments that are subject to higher taxes, those companies may experience weaker demand, which can affect the fund’s overall performance.

Compliance Challenges for Smaller Businesses - Large companies adjust quickly to tax reforms, but small retailers and local manufacturers may struggle with the new GST rules. If they encounter compliance issues or increased costs, it can affect their ability to compete, reducing the overall growth potential of the informal consumption ecosystem.

Increased Sector Concentration Risk - Consumption funds invest mainly in FMCG, retail, auto, durables, and similar sectors. In the event that any of these sectors face unexpected pressure after GST reforms (such as regulatory changes, pricing issues, or supply-chain disruptions), the fund may feel the impact more strongly due to limited diversification.

Dependence on Economic Sentiment - GST reforms alone cannot drive consumption growth if overall economic conditions weaken. High inflation, job uncertainty, or slower income growth can reduce consumer spending even when taxes are lower. Since consumption funds depend heavily on steady demand, any slowdown in the economy can impact returns.

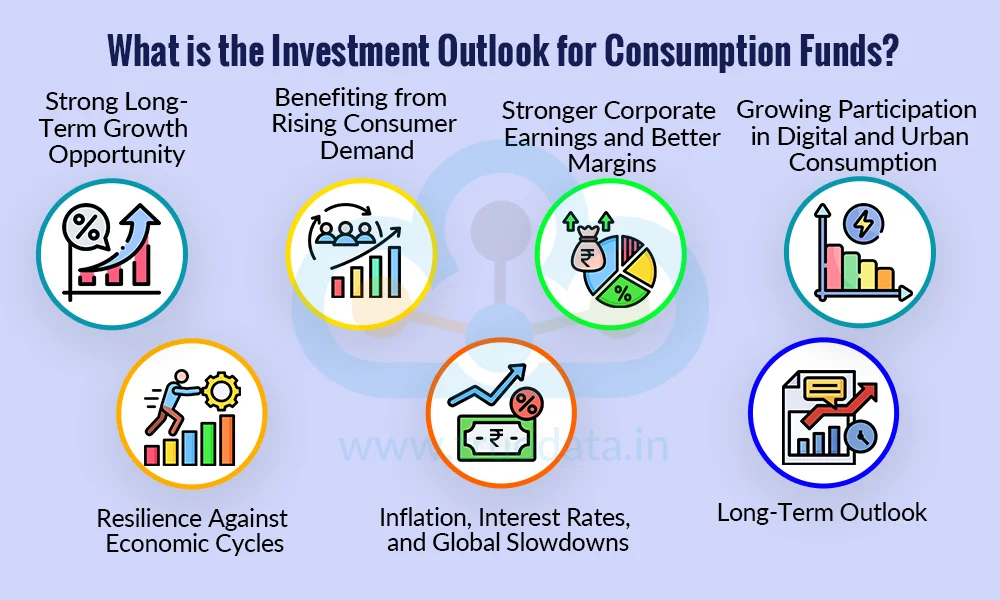

Consumption funds focus on many of the core sectors of the economy. Any changes in micro or macro factors that have a direct impact on these sectors will also affect consumption funds. With GST 2.0 paving the way for increased economic activity, here is the detailed investment outlook for consumption funds.

India’s consumption story continues to be one of the most significant long-term economic themes. With rising incomes, a growing middle class, urbanisation, and lifestyle upgrades, people are spending more on essentials as well as discretionary products. GST reforms further support this trend by making many goods more affordable and improving supply-chain efficiency. This creates a steady and long-term growth runway for the companies held in consumption funds.

Lower GST rates on many everyday items increase affordability, especially in rural and semi-urban markets. When products become cheaper, demand rises across categories like FMCG, retail, consumer durables, and entry-level automobiles. These sectors form the core of most consumption funds. As a result, investors can expect stable demand-driven growth, which can translate into healthier fund performance.

GST reforms help companies reduce logistics costs, streamline tax compliance, and operate more efficiently. This leads to better profit margins, particularly for FMCG and consumer goods companies. With the economy growing at a strong pace and demand staying resilient, corporate earnings in the consumption sector are likely to remain robust. This provides a supportive backdrop for the long-term performance of consumption funds.

Digital adoption, online shopping, and app-based retail are experiencing rapid growth in India. E-commerce, fintech platforms, and direct-to-consumer brands are gaining market share. Many consumption funds are increasing exposure to these new-age consumption themes. With GST reforms supporting smoother logistics and inter-state movement, digital consumption is expected to grow faster, offering new avenues of growth for investors.

Many sectors within consumption funds, such as FMCG, healthcare, basic retail, and staples, tend to show stable performance even during economic slowdowns because consumers continue to buy essential goods. This makes consumption funds relatively defensive compared to other thematic funds. In a volatile market environment, these funds can offer more stability and lower downside risk.

While the overall outlook is positive, investors should remain aware of macro risks. High inflation, weaker job growth, or rising interest rates can temporarily slow down consumption, especially for discretionary sectors like consumer durables or automobiles. Global slowdowns may also affect exports and income levels. Being mindful of these risks helps investors maintain realistic expectations.

Overall, the investment outlook for consumption funds remains structurally strong. India’s young population, rising incomes, improving tax system, and growing digital economy create a favourable environment for long-term consumption growth. For investors with a medium to long-term horizon, consumption funds can be a good addition to a diversified portfolio.

GST 2.0 has created a strong foundation for India’s consumption-led growth by lowering taxes on essential goods, improving supply-chain efficiency, and boosting economic stability. These reforms support higher consumer demand, better company margins, and stronger participation across various sectors that are part of the consumption theme. At the same time, the mutual fund industry also benefits from rising investor confidence and higher disposable incomes. While short-term disruptions and uneven sector impact may create challenges, the long-term outlook for consumption funds remains positive, making these funds a promising option for steady, demand-driven growth within a well-diversified portfolio.

This article talks about an integral part 0of our daily lives and its impact on consumption funds. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

TIll then, Happy Reading!

Read More: How to Declare Mutual Funds Returns in ITR?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...