In today’s uncertain global economy, the need for a steady stream of passive income is more important than ever. Mutual funds are a popular choice among Indian investors, but many don’t realise that there are different ways to generate regular income from them. Two of the most commonly used options are IDCW and SWP. While both aim to provide cash flows, they work very differently and suit different investor needs. Confused about which one is right for you? Dive into this blog to understand the key differences between the two and the subtle nuances of these options to decide which way to go.

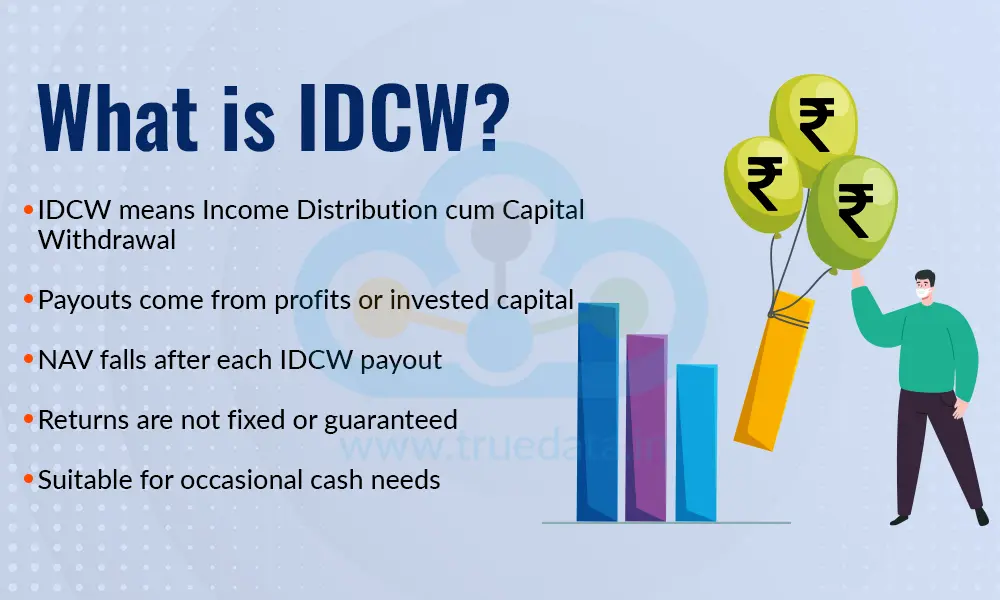

IDCW stands for Income Distribution cum Capital Withdrawal. In simple terms, it is an option in mutual funds where the fund pays out money to investors from time to time. Earlier, this option was popularly known as the ‘dividend option’, but the name was changed to IDCW to clearly show that the payout is not extra income. The money received comes from the mutual fund’s profits, or sometimes from investors’ own invested capital, and not as a guaranteed return.

When an IDCW payout is declared, the Net Asset Value (NAV) of the mutual fund falls by the same amount. This means the payout reduces the value of investments instead of adding to it. IDCW payments are not fixed or assured, and they depend on the fund’s performance and the fund house’s decision. Thus, IDCW may suit investors who need occasional cash flows, but it may not always be the most efficient option for long-term wealth creation.

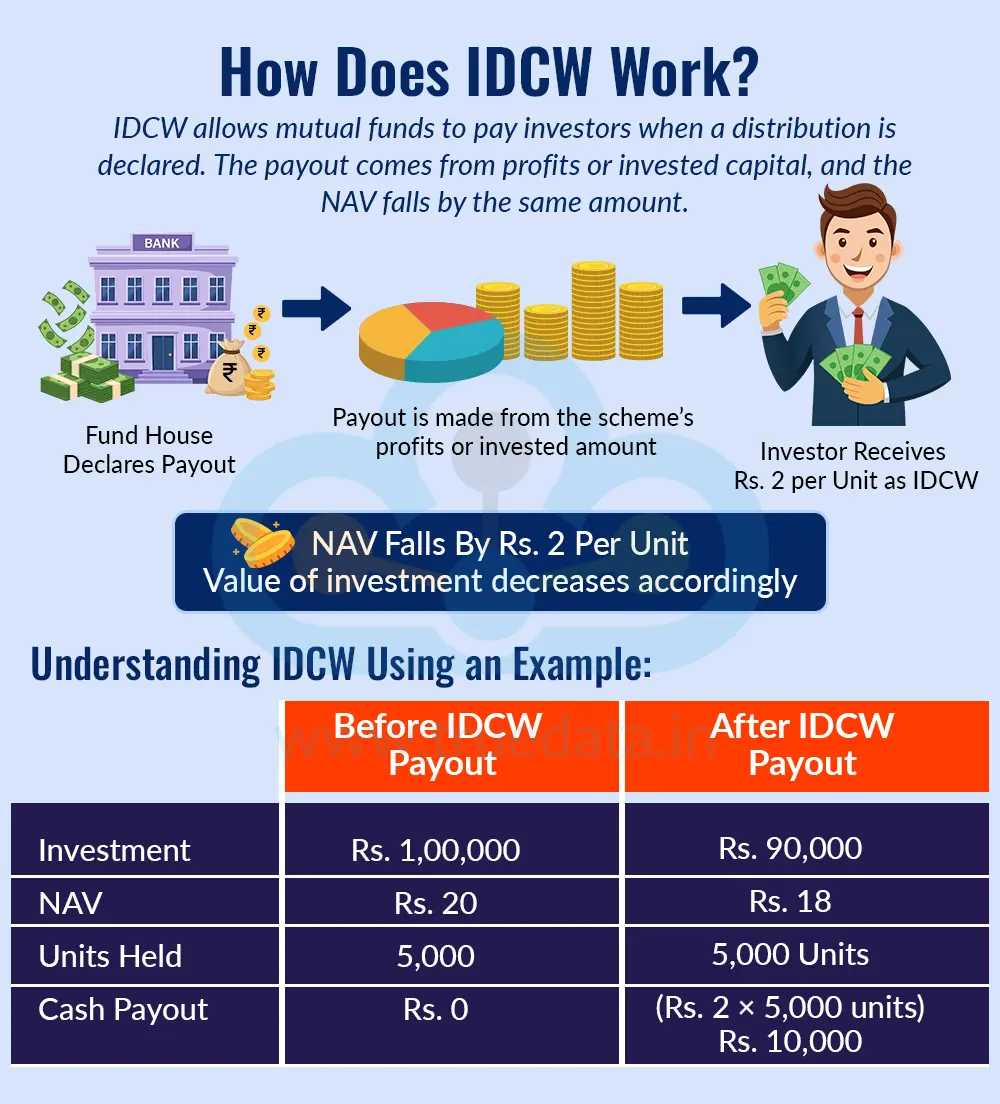

IDCW works by allowing a mutual fund to pay out money to investors whenever the fund house declares a distribution. This payout is made from the scheme’s profits or, at times, from the investor’s own invested amount. When the IDCW is paid, the Net Asset Value (NAV) of the fund falls by the same amount, which means the value of the investor’s holding reduces accordingly. These payouts are neither fixed nor guaranteed and depend on market performance and the fund manager’s decision. In India, the IDCW amount received is added to the investor’s total income and taxed as per the applicable income tax slab, making it important to understand the tax impact before choosing this option.

Understanding IDCW Using an Example

Suppose an investor has invested Rs. 1,00,000 in a mutual fund with an NAV of Rs. 20, which means they hold 5,000 units. If the fund declares an IDCW of Rs. 2 per unit, the investor receives Rs. 10,000 (Rs. 2 × 5,000 units). After this payout, the NAV falls to Rs. 18, and the total value of the investment becomes Rs. 90,000. Although the investor has received Rs. 10,000 in cash, the overall wealth remains the same before tax. Thus, we can clearly see here that IDCW is simply a payout from the existing investment and not an additional return.

SWP stands for Systematic Withdrawal Plan. It is a facility in mutual funds that allows an investor to withdraw a fixed amount of money at regular intervals, such as monthly, quarterly, or yearly, from their investment. Unlike IDCW, the withdrawal under an SWP is initiated by the investor, not the fund house. Each time an SWP payout is made, a small number of mutual fund units are redeemed, and the remaining units continue to stay invested and grow based on market performance.

SWP is often used to create a steady and predictable income, especially during retirement or when regular cash flow is needed. Since only the withdrawn amount is taxed based on capital gains rules, SWP can be more tax-efficient than IDCW, especially for investors in higher tax slabs. SWP also offers better control over cash flows, as the investor decides the withdrawal amount and frequency, while the rest of the investment continues to benefit from compounding over the long term.

A Systematic Withdrawal Plan (SWP) works by allowing an investor to withdraw a fixed amount of money from a mutual fund investment at regular intervals. Under an SWP, the mutual fund redeems a certain number of units each time to generate the required cash, while the remaining units continue to stay invested and participate in market growth. The investor decides the withdrawal amount and frequency in advance, which makes the cash flow predictable and more controlled. The profit portion of the withdrawn amount is taxed as capital gains, making SWP relatively more tax-efficient compared to IDCW for many investors.

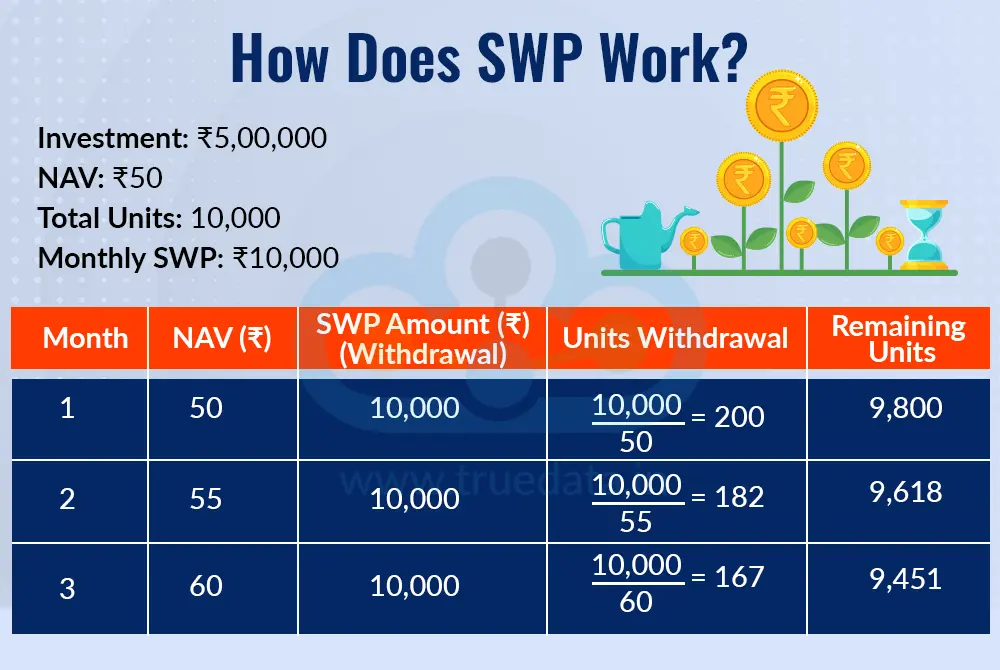

Understanding SWP Using an Example

Suppose an investor puts Rs. 500,000 in a mutual fund at an NAV of Rs. 50, which means they own 10,000 units. If they start an SWP of Rs. 10,000 per month and the NAV remains Rs. 50, then 200 units are redeemed each month (Rs. 10,000 / Rs. 50). After the first withdrawal, the investor receives Rs. 10,000 in cash and continues to hold 9,800 units. Over time, if the fund grows and the NAV increases, fewer units are redeemed for the same withdrawal amount. This helps the investor receive regular income while allowing the remaining investment to keep growing.

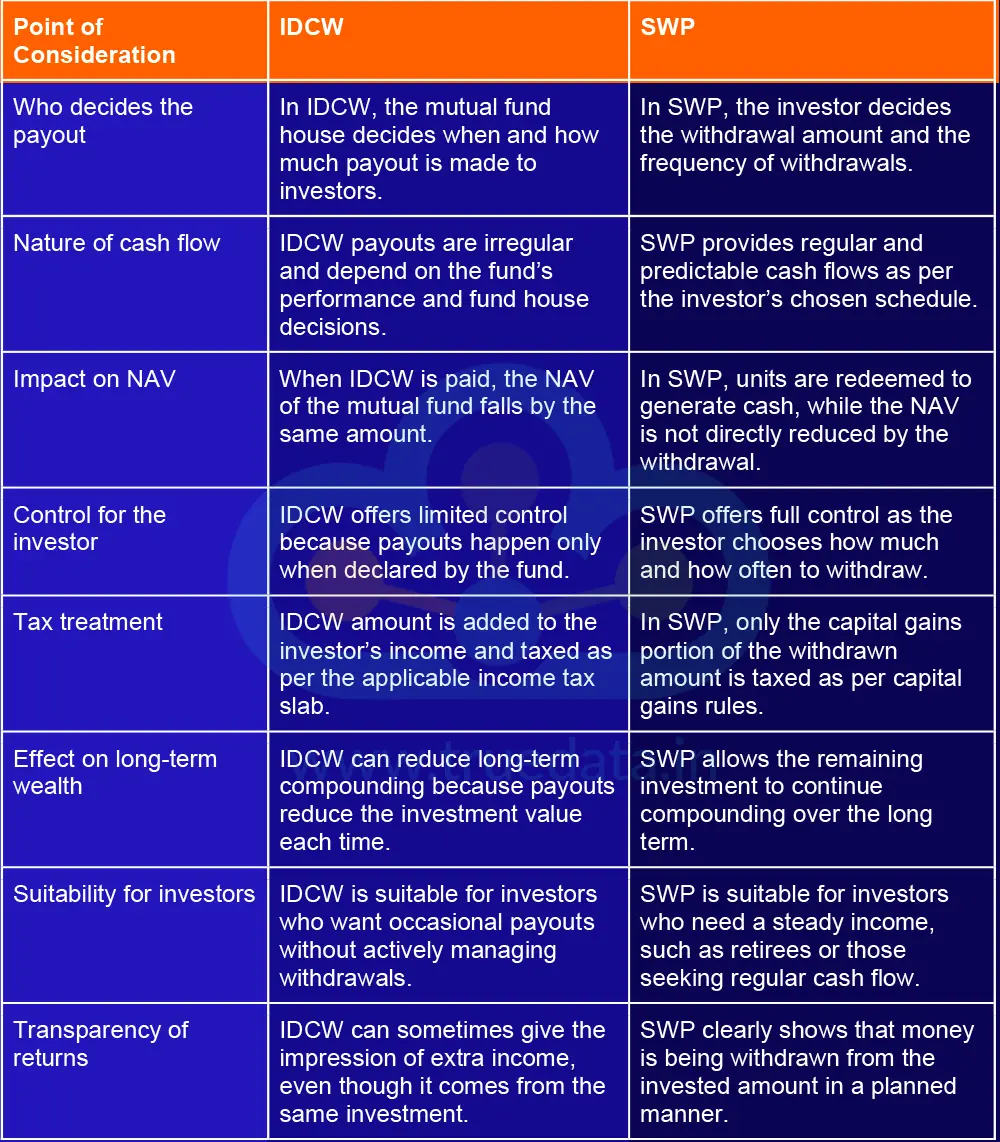

SWP and IDCW are two key pillars for generating an alternative source of income from mutual funds. Here are the key differences between these options.

Choosing between IDCW and SWP depends mainly on the investor’s income needs, tax situation, and long-term financial goals. IDCW may appear attractive because it provides payouts without the investor having to take any action, but these payouts are not fixed or guaranteed. IDCW can impact long-term wealth creation as the amounts are taxed as per the investor’s income tax slab and can also reduce the NAV of the fund. Thus, IDCW can still meet the needs of investors who need occasional cash and are not very concerned about regularity or tax efficiency.

On the other hand, SWP gives investors much better control over their cash flows. The investor decides how much money to withdraw and how often, making it easier to plan monthly expenses or retirement income. From a tax point of view, SWP is usually more efficient because only the capital gains portion of each withdrawal is taxed, and the remaining investment continues to benefit from compounding. This makes SWP a preferred choice for retirees and investors who want steady income without disturbing long-term growth too much.

In most cases, SWP turns out to be the more practical and transparent option for investors who are looking for regular income from mutual funds. However, the right choice ultimately depends on personal needs, risk comfort, and tax bracket. Understanding how each option works helps investors choose the one that aligns better with their financial journey rather than simply going by the payout label.

IDCW and SWP are both ways to generate cash flows from mutual funds, but they work very differently and suit different investor needs. SWP is often the more practical choice for most investors, especially those seeking regular income or planning for retirement, while IDCW may suit those who prefer occasional payouts without actively managing withdrawals. Thus, understanding the difference between them and how they work can help investors make informed choices that can shape their portfolio to meet their investment goals.

This article helps understand two distinct options of mutual fund investment, thereby aiding in informed decision-making. We hope this helps you in making a robust portfolio meeting your needs. Let us know your thoughts on the topic or if you need further information on the same and we will address it soon.

Till then, Happy Reading!

Read More: CAGR vs Absolute Return - Which is better for mutual funds?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...