When it comes to choosing a mutual fund, returns often steal the spotlight. But which return truly matters for investors between absolute returns and CAGR? A higher return number does not always tell the full story. So should investors focus on how much a fund has grown overall, or how steadily it has grown over time? This is where the debate between absolute returns and CAGR begins. Dive into this blog to understand the meaning of these returns and how to choose the right metric when selecting a mutual fund.

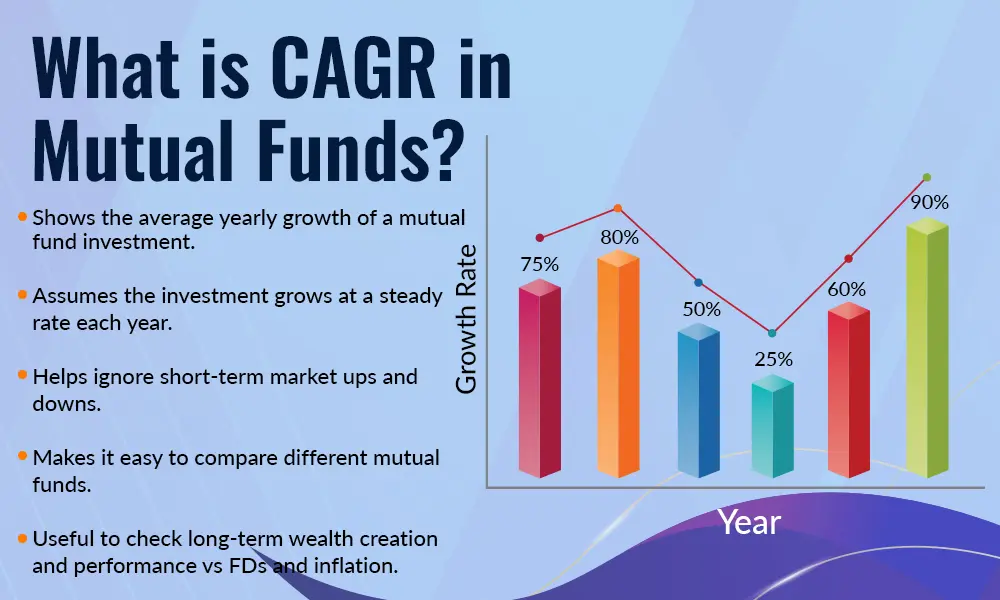

CAGR (Compound Annual Growth Rate) in mutual funds shows the average yearly growth of investments over a specific period, while assuming it grows at the same rate every year. In simple terms, it helps investors understand how steadily their money has grown, even though actual returns may fluctuate each year due to market movements. CAGR is an important metric for investors as mutual fund investments are usually long-term, and this return smoothens short-term ups and downs to give a clear picture of true performance. Thus, CAGR makes it easier to compare different mutual funds, track long-term wealth creation, and check whether a fund has beaten inflation and fixed-income options like Fixed Deposits over time.

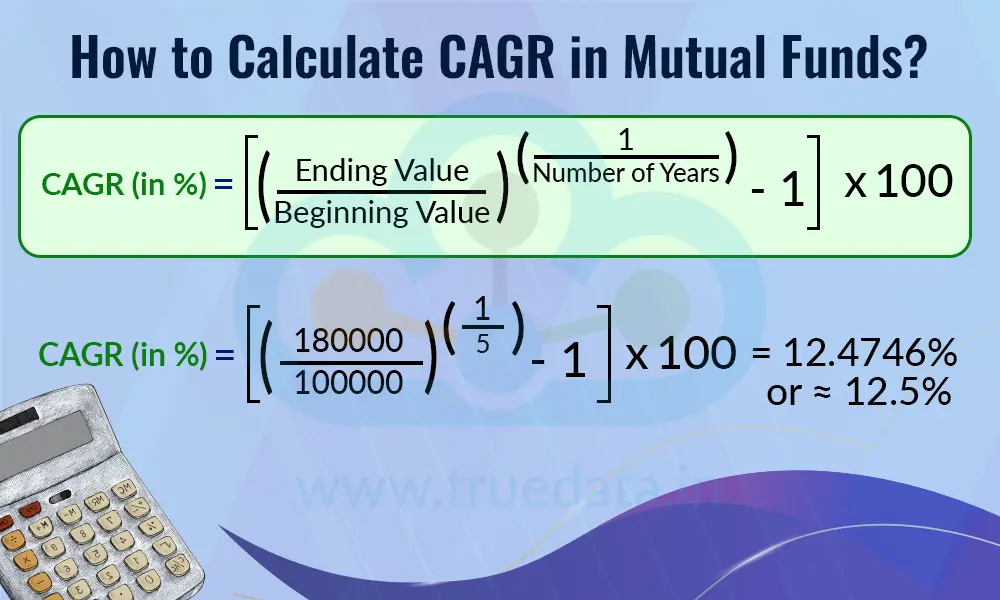

CAGR (Compound Annual Growth Rate) in mutual funds is calculated to understand the average annual growth of your investment over a period of time. The formula to calculate CAGR is,

CAGR (in %) = {[(Ending Value / Beginning Value)] ^ [(1 / Number of Years) − 1]} * 100

Understanding the Formula with an Example

Consider an investor A who invested Rs. 100000 in a mutual fund, and after 5 years, the investment value grew to Rs. 1,80,000. The CAGR for investor A is shown below,

CAGR (in %) = {[(Ending Value / Beginning Value) ^ (1 / Number of Years)] − 1} * 100

CAGR = {[(180000 / 100000) ^ (1 / 5)] - 1} * 100 = 12.4746% or ≈ 12.5%

Thus, the investment grew at an average annual rate of approximately 12.5% over the five years. This method enables investors to compare mutual fund performance clearly, even when returns fluctuate from year to year.

Absolute returns in mutual funds show the total percentage gain or loss on an investment over a specific period, without considering the duration for which the investment was held. In simple words, it tells investors how much their money has grown (or fallen) from the day they invested to the day they check its value. For example, if an investor invested Rs. 1,00,000 and it became Rs. 1,20,000, the absolute return is 20%. This return is useful for investors when evaluating short-term investments, such as funds held for less than a year, or when they want a quick snapshot of profit or loss. However, absolute returns do not show annualised growth, so they should be used carefully for long-term mutual fund comparisons.

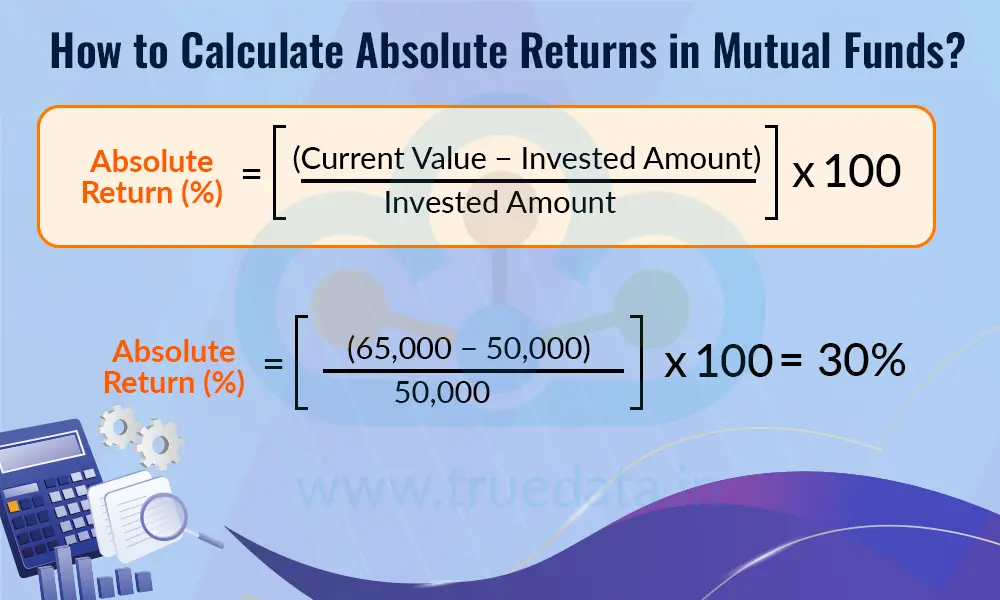

Absolute returns in mutual funds measure the total gain or loss on your investment over a given period, without adjusting for time. The formula to calculate absolute returns is,

Absolute Return (%) = [(Current Value − Invested Amount) / Invested Amount] * 100

Understanding the Formula with an Example

Suppose an investor invested Rs. 50,000 in a mutual fund, and the investment value later became Rs. 65,000 in a year. The absolute return for the investor on this investment is shown below,

Absolute Return (%) = [(Current Value − Invested Amount) / Invested Amount] * 100

Absolute Return (%) = [(65,000 − 50,000) / 50,000] * 100 = 30%.

Thus, the investment has grown by 30% overall. Absolute returns are especially useful for short-term investments or when investors want a quick view of how much profit or loss a mutual fund has made.

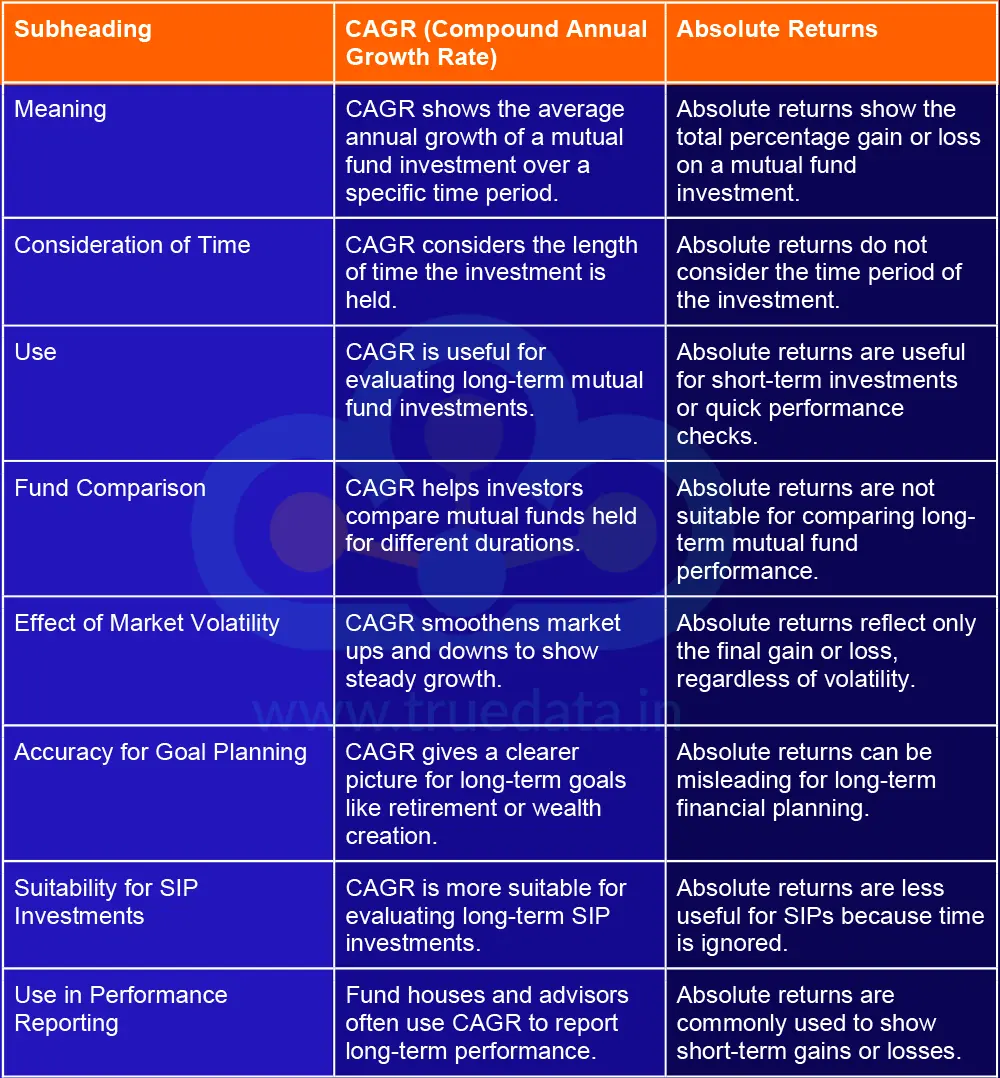

CAGR and absolute returns are the most common parameters for evaluating and picking mutual fund investments. However, they represent different versions of the returns that the fund generates and hence can be used for varied analysis. Here are the key differences between the two parameters.

Investors should choose between CAGR and absolute returns based on their investment goal and time horizon. Absolute returns are more suitable when an investor wants to check how much profit or loss has been made over a short period, such as a few months or less than a year. Since this return does not consider time, it gives a quick and easy snapshot of performance and is useful for short-term mutual fund investments or when tracking recent market movements.

CAGR, on the other hand, is more appropriate for long-term mutual fund investments, which is how most investors approach equity and hybrid funds. CAGR shows the average yearly growth of an investment and smoothens market ups and downs, making it easier to understand how steadily wealth has grown over time. It also helps investors compare different mutual funds fairly, even if they have been held for different durations.

In practical terms, investors should not rely on just one return measure. Absolute returns can help in short-term decision-making, while CAGR offers a clearer picture for long-term planning, such as retirement planning or wealth creation. Using both together allows investors to better judge mutual fund performance and make more informed investment decisions.

CAGR and absolute returns play an important role in understanding mutual fund performance, but they serve different purposes. Absolute returns are useful for getting a quick view of profit or loss, especially for short-term investments, while CAGR gives a clearer and more accurate picture of long-term growth by considering the time factor. Thus, investors can use absolute returns for short periods and CAGR for long-term goals like wealth creation or retirement, leading to better and more informed mutual fund decisions.

This article sheds light on the important metrics for evaluating the mutual fund performance and the way to go. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Read More: Total Expense Ratio in Mutual Fund

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...