When the Modi Government launched its first term, it introduced several transformative national missions aimed at reshaping India’s social and economic landscape. Among these, the ‘Beti Bachao Beti Padhao’ initiative stood out as a powerful movement to promote the education and empowerment of girls. As part of this vision, the government introduced the ‘Sukanya Samriddhi Yojana’, a special savings scheme designed to secure the future of the girl child and encourage long-term financial planning for her education and well-being. Nearly a decade later, this scheme continues to be one of the most trusted and rewarding investment options for parents across the country. Want to know how it works and why it is such a smart choice? Dive into this blog to explore everything you need to know about the Sukanya Samriddhi Yojana and how you can invest in it.

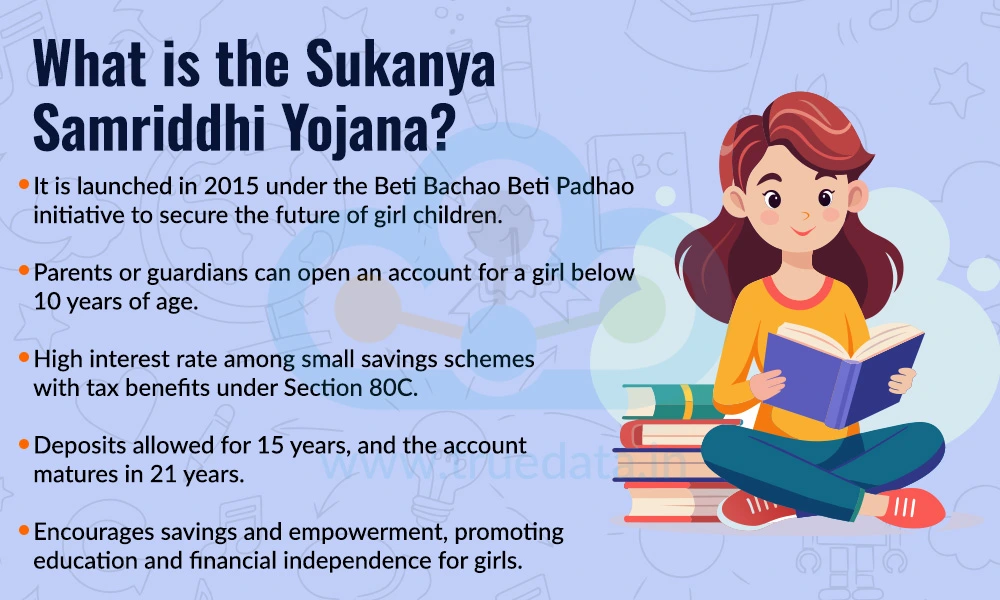

The Sukanya Samriddhi Yojana (SSY) is a government-backed small savings scheme launched in 2015 as part of the Beti Bachao Beti Padhao initiative. The scheme was introduced by the Government of India to encourage parents to build a secure financial future for their girl child. It allows parents or legal guardians to open a savings account in the name of a girl child below the age of 10 years, helping them accumulate funds for her education, marriage, and other future needs. The account offers one of the highest interest rates among small savings schemes and comes with tax benefits under Section 80C of the Income Tax Act. The deposit can be made for 15 years from the date of opening the account, and the maturity period is 21 years. This scheme is a strong blend of financial security and social purpose. It not only helps families save systematically but also promotes the importance of valuing and investing in the future of girls across India.

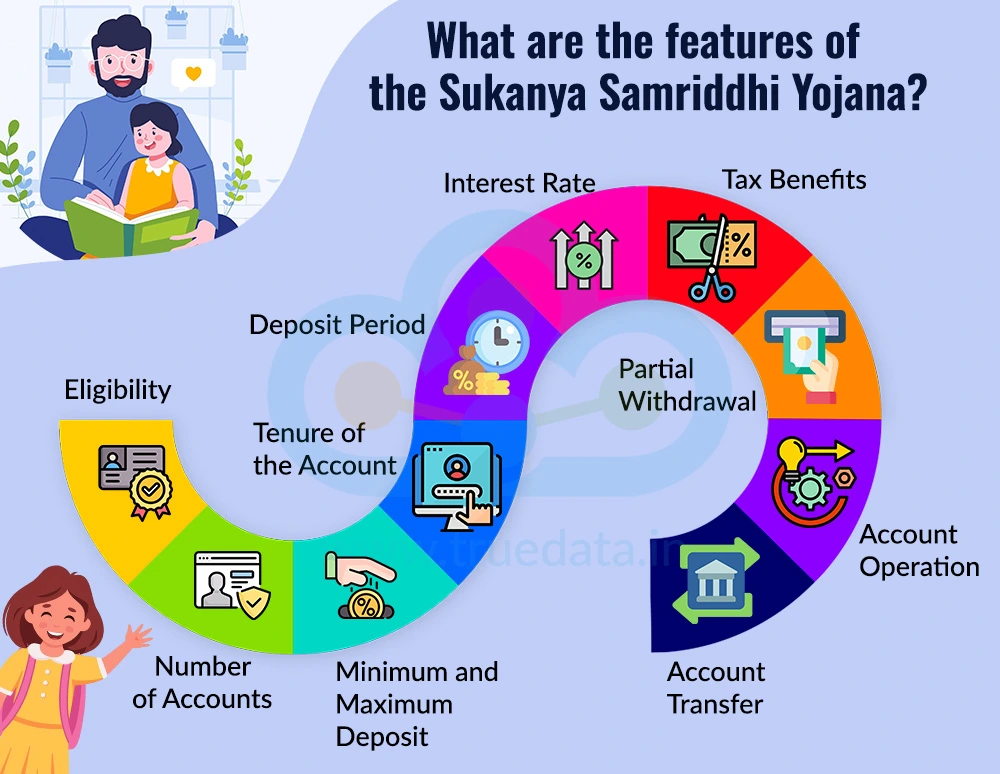

Sukanya Samriddhi Yojana is a government-backed scheme that has quietly and steadily become one of the most prominent welfare cum investment schemes of the central government. The top features of the scheme that make it attractive for investors across the country are highlighted below.

Eligibility - An account can be opened in the name of a girl child below 10 years of age by her parents or legal guardian.

Number of Accounts - Only one account per girl child is allowed, and a family can open accounts for up to two daughters (exceptions are made in case of twins or triplets).

Minimum and Maximum Deposit - The minimum deposit is Rs. 250 per year, and the maximum is Rs. 1,50,000 per year. Investors can deposit any amount in multiples of Rs. 50.

Tenure of the Account - The account matures 21 years after it is opened or when the girl gets married after turning 18, whichever is earlier.

Deposit Period - Deposits need to be made for 15 years from the date of opening the account. After that, the account continues to earn interest until maturity.

Interest Rate - The current interest rate under the SSY scheme is 8.2% per annum. It is decided by the government every quarter and is usually higher than most other small savings schemes, making it a rewarding long-term option.

Tax Benefits - Investments in the scheme qualify for tax deduction under Section 80C, and the interest earned and maturity amount are tax-free, making it a completely tax-exempt (EEE) investment.

Partial Withdrawal - After the girl turns 18 years old, up to 50% of the balance can be withdrawn for education or other important expenses.

Account Operation - The parent or guardian manages the account until the girl turns 18 years old, after which she can take control of it herself.

Account Transfer - The account can be transferred anywhere in India if the guardian or the girl child moves to a different city or state.

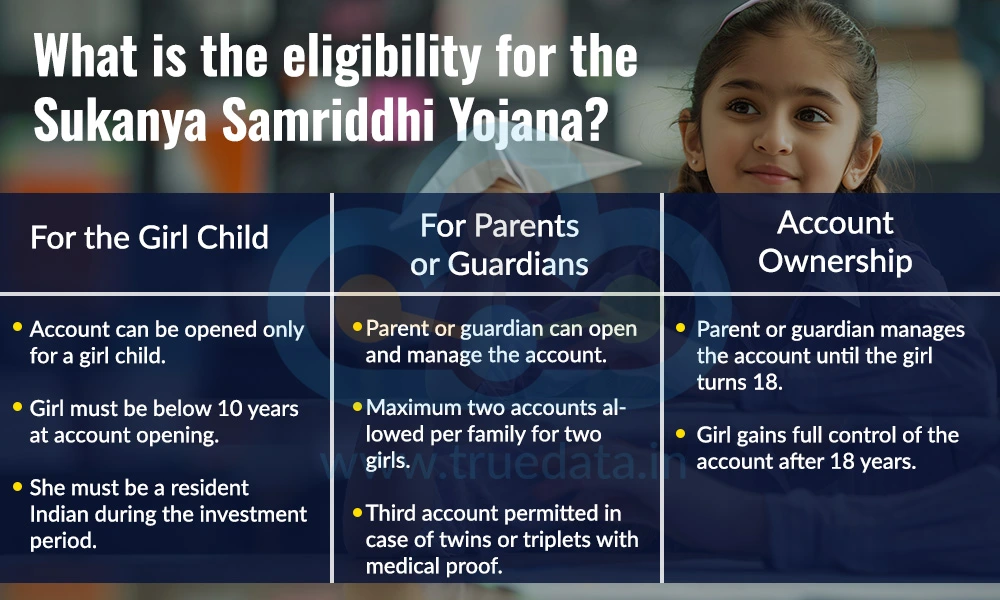

The eligibility conditions for the Sukanya Samriddhi Yojana are explained below.

For the Girl Child -

The account can be opened only in the name of a girl child.

The girl must be below 10 years of age at the time of opening the account.

She must be a resident Indian at the time of account opening and throughout the investment period.

For Parents or Guardians -

The parent or legal guardian of the girl child can open and operate the account on her behalf.

A maximum of two accounts can be opened for two different girl children in one family.

In case of twins or triplets, a third account may be allowed, provided proper medical certificates are submitted.

Account Ownership -

The girl child owns the account, but the parent or guardian manages it until she turns 18 years old.

After 18 years, the girl herself takes control of the account.

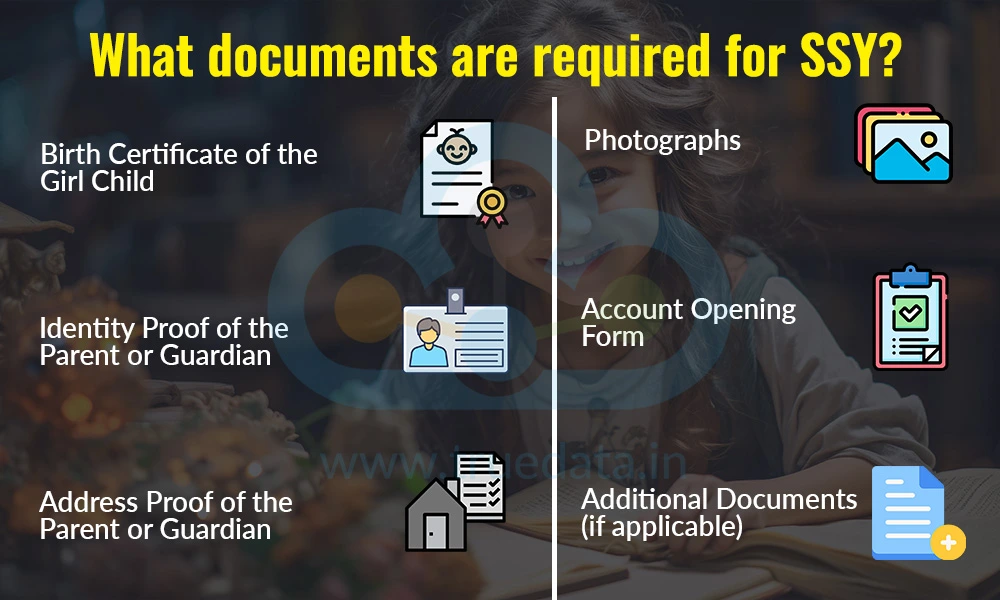

The documents required to open a Sukanya Samriddhi Yojana (SSY) account include,

Birth Certificate of the Girl Child - A copy of the birth certificate is mandatory to confirm the age and identity of the girl child.

Identity Proof of the Parent or Guardian - Any one valid ID proof, such as Aadhaar Card, PAN Card, Voter ID, Passport, or Driving Licence, must be submitted.

Address Proof of the Parent or Guardian - Documents like Aadhaar Card, Passport, Utility Bill (electricity, water, or telephone), or Ration Card can be provided as address proof.

Photographs - Passport-sized photographs of the girl child and the parent or guardian are required.

Account Opening Form - The Sukanya Samriddhi Yojana account opening form (available at post offices or authorised banks) must be filled out and submitted.

Additional Documents (if applicable) - In case of twins or triplets, a medical certificate must be provided to prove multiple births.

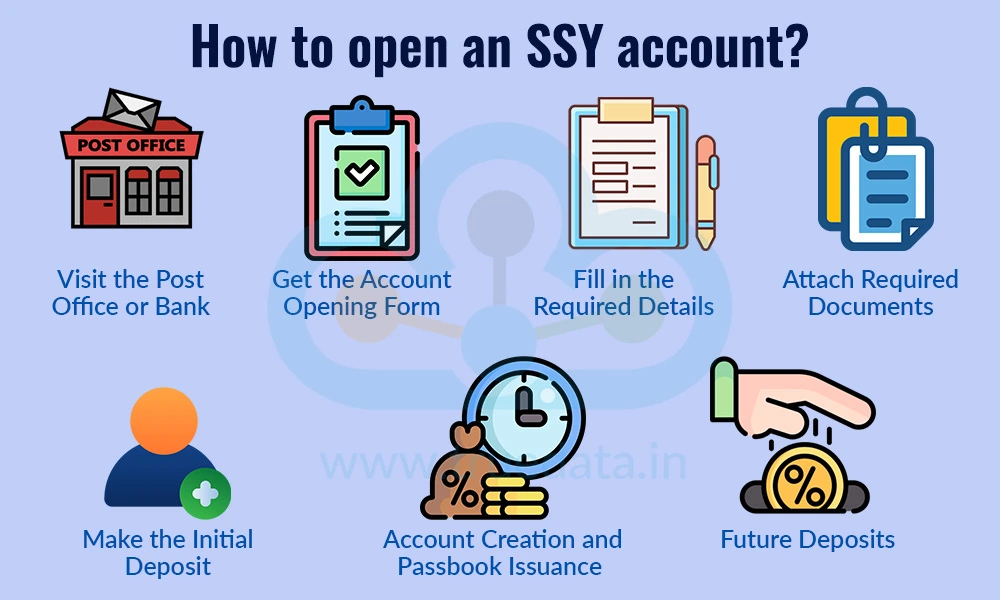

An account under the SSY scheme can be opened at any authorised post office in India. Investors can also open an SSY account at an authorised public sector bank and some private sector banks approved by the Government of India (such as SBI, PNB, HDFC Bank, ICICI Bank, etc.). The steps to open an SSY account are,

Visit the Post Office or Bank - The parent or legal guardian should visit the nearest post office or authorised bank branch that offers the Sukanya Samriddhi Yojana facility.

Get the Account Opening Form - Collect the Sukanya Samriddhi Yojana account opening form from the counter or download it from the official website of India Post or the chosen bank.

Fill in the Required Details - The form should be filled carefully with details such as the girl child’s name, date of birth, parent/guardian information, and address.

Attach Required Documents - Submit the necessary documents, including the girl child’s birth certificate, identity and address proof of the parent/guardian, and passport-sized photographs.

Make the Initial Deposit - A minimum deposit of Rs. 250 is required to open the account. The deposit can be made in cash, cheque, or demand draft.

Account Creation and Passbook Issuance - After verification, the post office or bank will open the SSY account and provide a passbook showing all account details, such as the account number, date of opening, and deposit amount.

Future Deposits - The parent or guardian can continue making deposits every year, either offline (at the branch) or online through net banking or standing instructions, if the bank supports digital transactions.

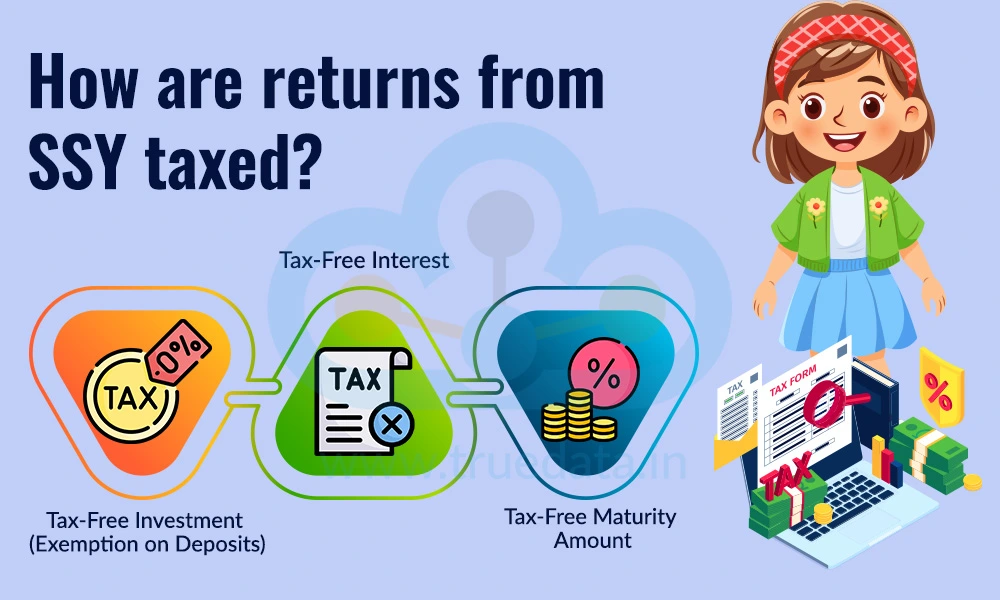

The Sukanya Samriddhi Yojana falls under the EEE category of investment schemes in India. This means that the contributions made, the interest earned and the maturity proceeds are all tax-free under the provisions of the Income Tax Act, 1961. This benefit is further explained hereunder,

The amount deposited in the SSY account every year is eligible for tax deduction under Section 80C of the Income Tax Act, 1961. An investor can claim a deduction of up to Rs. 1,50,000 per financial year for the amount invested. This benefit can be availed by the parent or legal guardian who makes the contribution.

The interest earned on the deposits under the Sukanya Samriddhi Yojana is completely tax-free. Unlike some other savings schemes where interest is taxable, SSY ensures that the entire interest amount is exempt from income tax, making it more rewarding for long-term savings.

The maturity amount, which includes both the principal and accumulated interest, is also exempt from tax. This means that when the account matures after 21 years (or at the time of the girl’s marriage after 18 years), the full amount can be withdrawn without paying any tax.

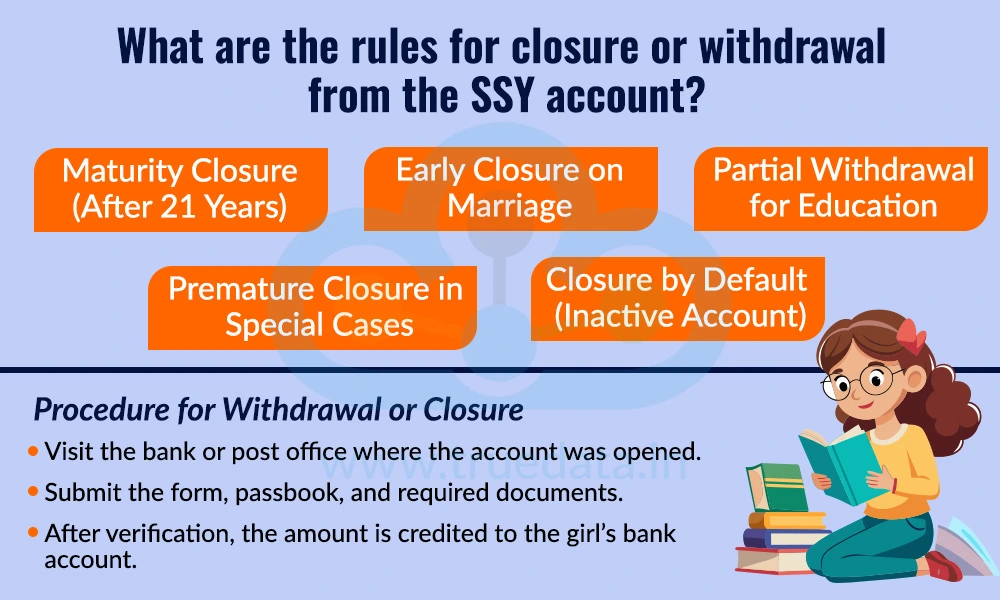

The Sukanya Samriddhi Yojana offers flexible yet secure withdrawal and closure options, which are essential for encouraging savings for long-term goals like education and marriage, while also allowing compassionate withdrawals in special situations. These provisions for closure of the account or withdrawal from the account are explained below.

Maturity Closure (After 21 Years) - The SSY account matures after 21 years from the date of opening. The full amount, including the principal and accumulated interest, can be withdrawn at this time. After maturity, the account stops earning interest, even if the money is not withdrawn immediately. The girl child must be 18 years or older at the time of closure to receive the amount in her name.

Early Closure on Marriage - The account can be closed before 21 years if the girl gets married after turning 18 years old. For this, the account holder must submit proof of age and marriage (such as a marriage certificate). The application for closure must be made at least one month before or within three months after the date of marriage. Early closure is not allowed if the girl gets married before turning 18.

Partial Withdrawal for Education - Once the girl turns 18 years old or has passed Class 10, she can withdraw up to 50% of the balance in the account. This amount can be used for higher education or vocational training. The withdrawal can be made either in one lump sum or in instalments (a maximum of 5 instalments in a financial year). Proof of admission (such as a college admission letter or fee receipt) is required for withdrawal.

Premature Closure in Special Cases -

Premature closure of the SSY account is generally not allowed, but it can be permitted under certain special circumstances.

Death of the girl child - The account will be closed immediately, and the balance amount, along with interest, will be paid to the guardian. A death certificate must be submitted for verification.

Life-threatening disease or medical emergency - The account can be closed on compassionate grounds if the girl suffers from a critical illness. Valid medical documents and hospital records must be provided.

Change in residency status - If the girl child becomes a non-resident Indian (NRI), the account must be closed within one month of the status change. Proof of NRI status must be submitted.

Closure by Default (Inactive Account) - If the account becomes inactive due to non-payment of the minimum annual deposit, it can be revived by paying Rs. 50 penalty per year and the minimum deposit amount (Rs. 250) for each missed year. If not revived, the account will continue to earn interest at the Post Office Savings Account rate, which is lower than the SSY rate.

Procedure for Withdrawal or Closure

The account holder (parent/guardian or the girl child if 18+) must visit the bank or post office where the account was opened.

Submit the withdrawal or closure form, along with the passbook and supporting documents (such as age proof, marriage certificate, or educational proof).

After verification, the withdrawal amount will be credited directly to the girl’s bank account.

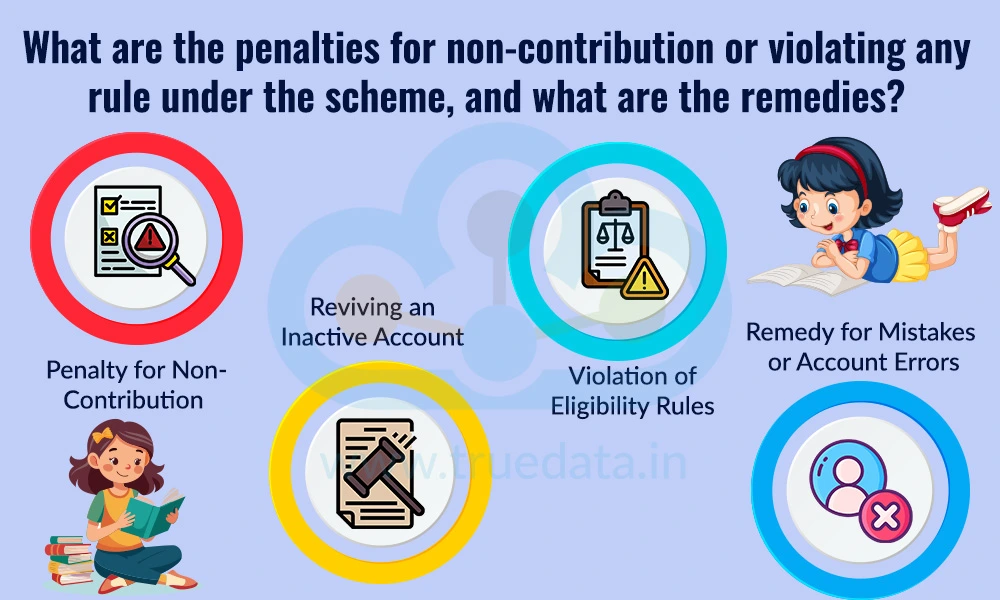

The Sukanya Samriddhi Yojana requires investors to adhere to the various rules regarding regular contributions to the account, as well as other compliances for successful investment and gaining maximum benefits from the account. Any non-compliance with these provisions can attract penalties under the provisions of the scheme. The penalties levied and the remedies available to the investors in case of a violation are explained below.

Penalty for Non-Contribution - The minimum annual deposit required to keep the SSY account active is Rs. 250. If this minimum amount is not deposited in a financial year, the account is considered ‘inactive’ or ‘defaulted’. A penalty of Rs. 50 per year is charged for each year of default.

Reviving an Inactive Account - The account can be reactivated at any time before maturity. Revival of the account requires the depositor to,

Pay the penalty of Rs. 50 per default year, and

Deposit the minimum required amount (Rs. 250) for each missed year.

Once these payments are made, the account becomes active again, and interest continues to accrue as per the government-declared rate.

Violation of Eligibility Rules - If it is later found that the account was opened in violation of SSY eligibility rules (for example, the girl was over 10 years old at account opening or more than two accounts were opened in one family), the account will be declared invalid. In such cases,

The deposits will be refunded, but

The interest will be paid only at the rate applicable to the Post Office Savings Account, which is much lower than the SSY rate.

Remedy for Mistakes or Account Errors - If there is any error in documentation or deposits, the account holder can contact the post office or bank branch where the account was opened. Minor corrections can usually be made by submitting a written application with supporting documents.

The Sukanya Samriddhi Yojana (SSY) is a thoughtful and secure savings scheme launched by the Government of India to promote the financial well-being of the girl child. It encourages parents to save systematically for their daughter’s education and marriage while enjoying attractive interest rates and complete tax exemptions. With simple eligibility rules, flexible deposit options, and easy account management through post offices and authorised banks, the scheme offers both convenience and reliability. It has become one of the most favoured investment schemes across the country.

This article talks about a very important savings scheme offered by the government and its benefits. Have you invested in this scheme? Let us know your thoughts on the topic or if you need further information on the same and we will address it soon.

Till then, Happy Reading!

Read More: What is PPF (Public Provident Fund)?

Most new investors think that investing in all mutual funds will give them tax d...

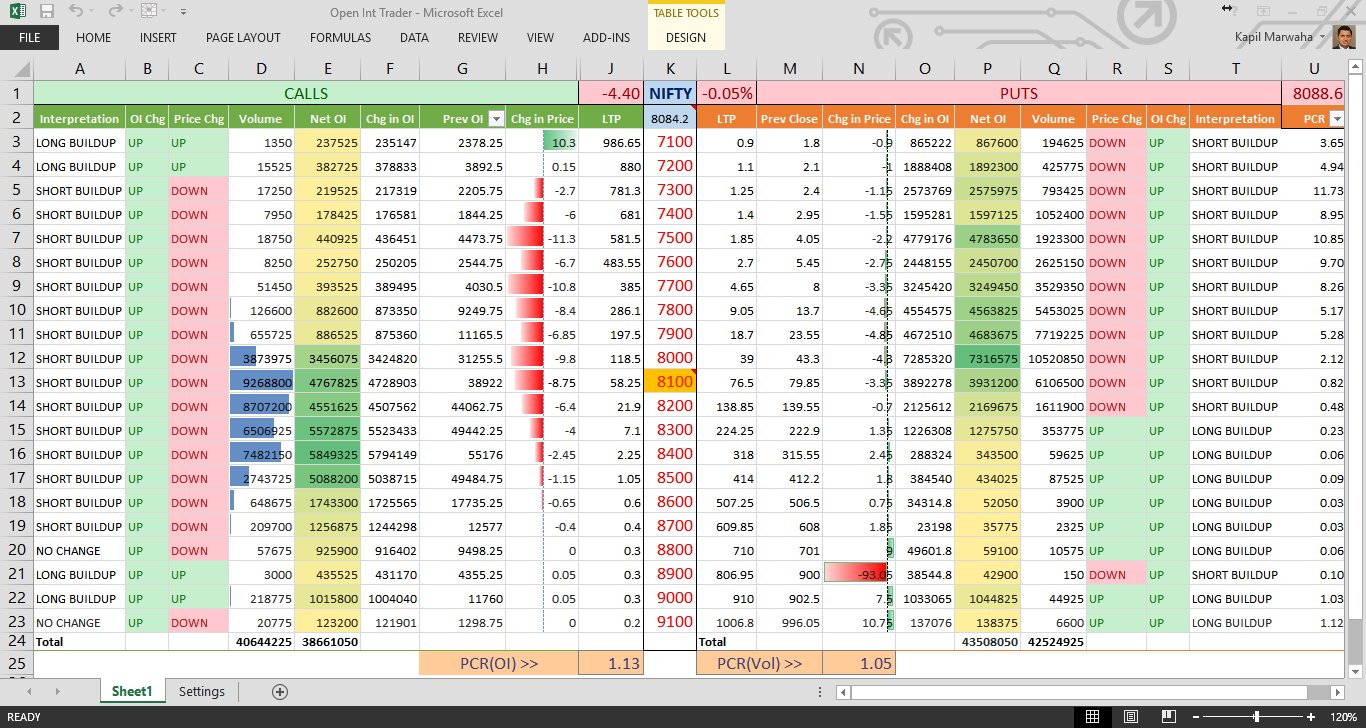

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Introduction For the longest time, investment in stock markets was thought to b...