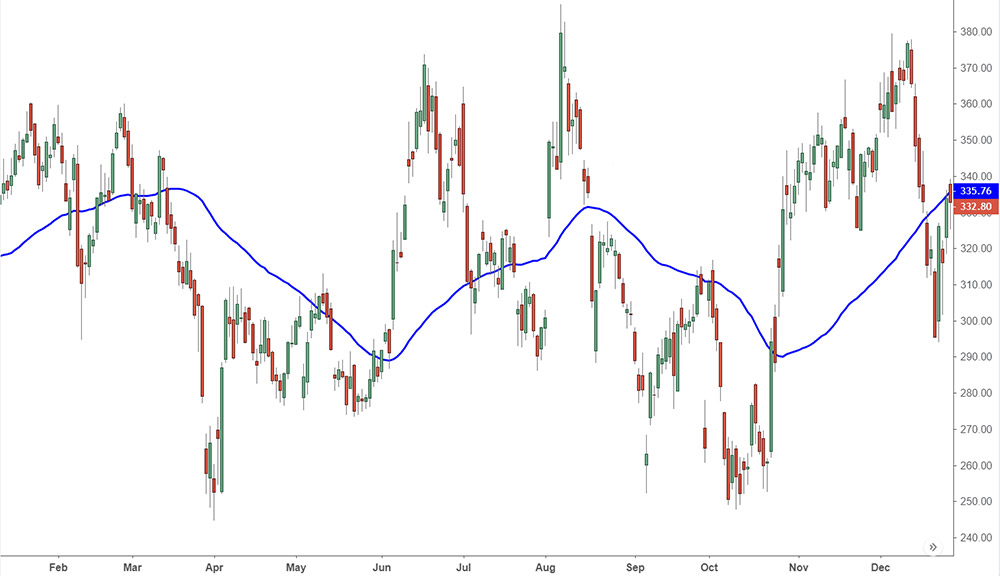

SMA is essentially the mean, or normal, of the stock value, esteems over the predetermined period. A Simple Moving Average (SMA) is a specialized pointer that can support deciding whether a resource cost will proceed or then again if it will invest a bull or bear pattern. SMAs are frequently used to decide pattern heading. If the SMA is climbing, the pattern is up, else the pattern is going down. A 200-bar SMA is a normal intermediary for the drawn-out pattern. 50-bar SMAs are commonly used to check the transitional pattern.

SMA, simple moving normal, is generally used to affirm a pattern as opposed to anticipating it. SMAs are good for longer-term exchanges. The slow speed could mean missing a decent exchange section point if you depend on SMA alone. SMA Crossing SMA is another normal exchanging signal. At the point when a brief period of SMA crosses over a significant stretch SMA, you might need to go long. SMAs utilize past security value examples to foresee future value developments. Interestingly, the central investigation is supported by long-haul financial backers. This style of examination centers around financial marketers, for example, organization income, benefit, and development to recognize likely ventures.

SMA, simple moving normal, is generally used to affirm a pattern as opposed to anticipating it. SMAs are good for longer-term exchanges. The slow speed could mean missing a decent exchange section point if you depend on SMA alone. SMA Crossing SMA is another normal exchanging signal. At the point when a brief period of SMA crosses over a significant stretch SMA, you might need to go long. SMAs utilize past security value examples to foresee future value developments. Interestingly, the central investigation is supported by long-haul financial backers. This style of examination centers around financial marketers, for example, organization income, benefit, and development to recognize likely ventures.

SMAs are ordinarily used to smooth value information and specialized markers. The more extended the time of the SMA, the smoother the outcome, however the slacker that is presented between the SMA and the source. At the point when costs cross over the SMA, you should go long or cover short; when they cross underneath the SMA, you should go short or exit long. One benefit of the basic moving normal is that the device can be utilized for both specialized and basic analysis. While the two styles are altogether different, the basic moving normal can be utilized to supplement both. For instance, a transient merchant that exchanges utilizing specialized examination might be keen on seeing if security is moving up or down over a 10-day time frame. This dealer could break down the 10-day SMA to decide the pattern. Interestingly, a drawn-out financial backer that by and large uses basic investigation may be keener on purchasing vertical moving security after a pullback to the 200-day SMA. This trader could utilize the SMA to discover how to work out an alluring section point.

SMAs are ordinarily used to smooth value information and specialized markers. The more extended the time of the SMA, the smoother the outcome, however the slacker that is presented between the SMA and the source. At the point when costs cross over the SMA, you should go long or cover short; when they cross underneath the SMA, you should go short or exit long. One benefit of the basic moving normal is that the device can be utilized for both specialized and basic analysis. While the two styles are altogether different, the basic moving normal can be utilized to supplement both. For instance, a transient merchant that exchanges utilizing specialized examination might be keen on seeing if security is moving up or down over a 10-day time frame. This dealer could break down the 10-day SMA to decide the pattern. Interestingly, a drawn-out financial backer that by and large uses basic investigation may be keener on purchasing vertical moving security after a pullback to the 200-day SMA. This trader could utilize the SMA to discover how to work out an alluring section point.

There are various pattern-based techniques including the straightforward moving normal. Two of the most well-known signs that dealers search for are bullish crossovers and bearish crossovers. A bullish crossover happens when a security's value moves back over the SMA in the wake of being underneath it. This activity flags that the downtrend or remedy is finished and a potential upswing is beginning. A bullish crossover can be utilized as a sign to enter a long exchange. During moving business sectors, this sign can be very solid. In any case, during uneven or sideways business sectors, the pointer can be less dependable in estimating market vacillations. Bullish crossovers are less significant when the drawn-out pattern is down. A bearish crossover happens when a security's value falls underneath the SMA after exchanging above it. This activity flags that the upturn is finished and the pattern may now be descending. A bearish crossover can be utilized as a sign to leave a long position or, then again, enter a short position. During rough or sideways business sectors, a bearish crossover is less significant.

There are various pattern-based techniques including the straightforward moving normal. Two of the most well-known signs that dealers search for are bullish crossovers and bearish crossovers. A bullish crossover happens when a security's value moves back over the SMA in the wake of being underneath it. This activity flags that the downtrend or remedy is finished and a potential upswing is beginning. A bullish crossover can be utilized as a sign to enter a long exchange. During moving business sectors, this sign can be very solid. In any case, during uneven or sideways business sectors, the pointer can be less dependable in estimating market vacillations. Bullish crossovers are less significant when the drawn-out pattern is down. A bearish crossover happens when a security's value falls underneath the SMA after exchanging above it. This activity flags that the upturn is finished and the pattern may now be descending. A bearish crossover can be utilized as a sign to leave a long position or, then again, enter a short position. During rough or sideways business sectors, a bearish crossover is less significant.

Short moving midpoints (5-20 periods) are most appropriate for transient patterns and exchanging. Chartists intrigued by medium-term patterns would select longer moving midpoints that may broaden 20-60 periods. Long-haul stock marketers will lean toward moving midpoints with at least 100 periods. 5-, 8- and 13-bar basic moving midpoints offer ideal contributions for informal investors looking for an edge in exchanging the market from both the long and short sides. The moving midpoints additionally function admirably as channels, telling quick-fingered market players when the hazard is excessively high for intraday sections.

Short moving midpoints (5-20 periods) are most appropriate for transient patterns and exchanging. Chartists intrigued by medium-term patterns would select longer moving midpoints that may broaden 20-60 periods. Long-haul stock marketers will lean toward moving midpoints with at least 100 periods. 5-, 8- and 13-bar basic moving midpoints offer ideal contributions for informal investors looking for an edge in exchanging the market from both the long and short sides. The moving midpoints additionally function admirably as channels, telling quick-fingered market players when the hazard is excessively high for intraday sections.

The simple moving average is a famous method that can help both momentary dealers and long-haul financial backers. The SMA smooths out value information by averaging a security's cost throughout a particular period. It is drawn as a solitary line on an outline and is useful in distinguishing patterns. The advantage of the SMA is that it rapidly empowers a broker or investor to decide if a stock is moving up or down.

What is one of the deciding factors while investing in a stock? It is its valuat...

The key tosuccessful trading is understanding price variations and the degree of...

When we take our first step into the trading game, we choose the best resource...