The second half of 2023 is seeing huge swings in the Indian stock markets where the indices have reached their all-time highs and are now seeing a slight market correction. While novice investors may see this swing as a time to exit their positions, seasoned investors see this as an opportunity to implement the ‘buy the dip’ investment strategy and load their investment portfolio with quality stocks. So have you heard about this investment strategy? If not, check out this blog to learn about it and shape your investment portfolio like the pros of this game. Read More: Investment ideas for new investors in 2023

The second half of 2023 is seeing huge swings in the Indian stock markets where the indices have reached their all-time highs and are now seeing a slight market correction. While novice investors may see this swing as a time to exit their positions, seasoned investors see this as an opportunity to implement the ‘buy the dip’ investment strategy and load their investment portfolio with quality stocks. So have you heard about this investment strategy? If not, check out this blog to learn about it and shape your investment portfolio like the pros of this game. Read More: Investment ideas for new investors in 2023

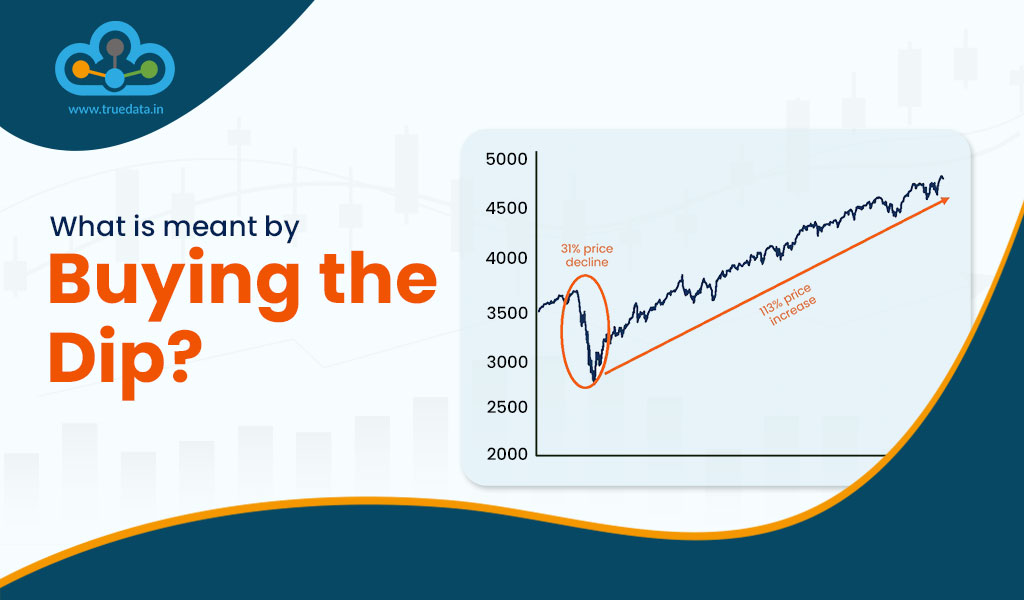

The "Buy the Dip" investment strategy is a tactic where investors purchase assets, typically stocks or cryptocurrencies, during a temporary decline or price dip in the market. This approach relies on the belief that these temporary downturns are often short-lived, and the asset's intrinsic value will eventually lead to a price recovery. By buying during the dip, investors aim to acquire assets at a lower cost than their long-term potential value. However, it's essential to conduct thorough research and have a well-defined investment strategy before implementing this approach as timing the market can be challenging, and not all dips lead to a significant recovery. Diversification, risk management, and a long-term perspective are crucial to mitigating potential losses when employing the "Buy the Dip" strategy and it is equally important for investors to consider their risk tolerance, investment goals, and market conditions before utilising this approach in their portfolio.

The "Buy the Dip" investment strategy is a tactic where investors purchase assets, typically stocks or cryptocurrencies, during a temporary decline or price dip in the market. This approach relies on the belief that these temporary downturns are often short-lived, and the asset's intrinsic value will eventually lead to a price recovery. By buying during the dip, investors aim to acquire assets at a lower cost than their long-term potential value. However, it's essential to conduct thorough research and have a well-defined investment strategy before implementing this approach as timing the market can be challenging, and not all dips lead to a significant recovery. Diversification, risk management, and a long-term perspective are crucial to mitigating potential losses when employing the "Buy the Dip" strategy and it is equally important for investors to consider their risk tolerance, investment goals, and market conditions before utilising this approach in their portfolio.

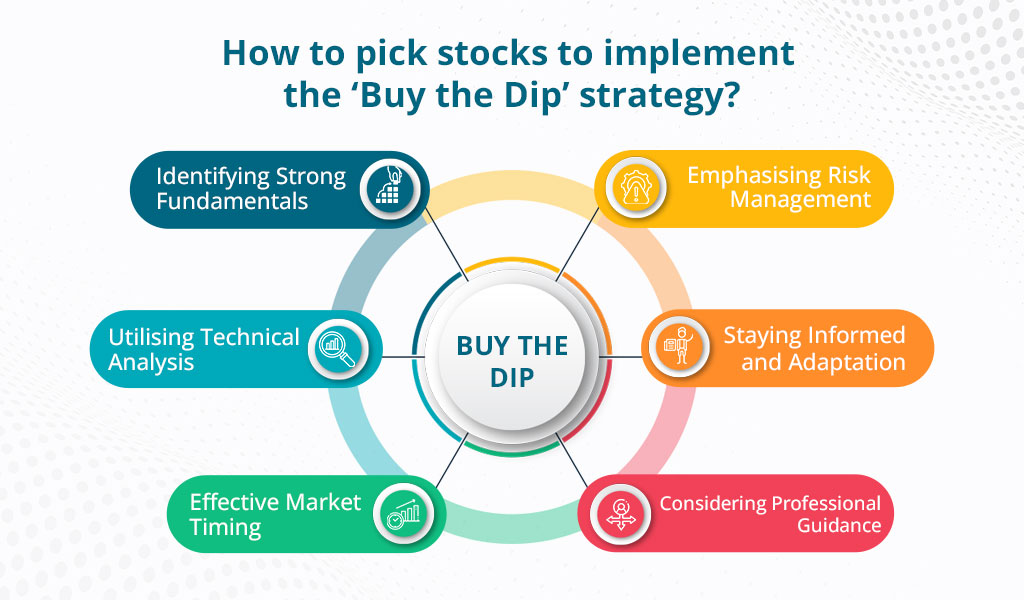

When the stock markets are in a general downtrend it can be difficult to pick out quality stocks with a long-term investment perspective. Here are a few pointers to look out for when picking quality stocks to implement the ‘buying the dip’ strategy effectively.

When the stock markets are in a general downtrend it can be difficult to pick out quality stocks with a long-term investment perspective. Here are a few pointers to look out for when picking quality stocks to implement the ‘buying the dip’ strategy effectively.

To successfully implement the "Buy the Dip" strategy when choosing stocks in India, it is imperative to begin by focusing on companies with robust fundamentals. Investors should seek businesses with a consistent history of revenue and profit growth, as well as those with low debt levels and a competitive edge in their respective industries. Analysing financial statements, and earnings reports, and staying informed about industry trends is essential for gauging a company's overall health. Identifying such companies forms the foundation of a successful "Buy the Dip" approach, as strong fundamentals increase the likelihood of a stock's recovery from a temporary dip.

In addition to fundamental analysis, technical analysis plays a significant role in identifying stocks for the "Buy the Dip" strategy. Investors should delve into stock charts to uncover patterns such as support and resistance levels. Support levels signify points where the stock's price often finds buying interest, potentially leading to a rebound during a dip. Incorporating technical analysis assists investors in choosing opportune entry points, enhancing the strategy's effectiveness.

The success of the "Buy the Dip" strategy largely hinges on the investor's ability to time the market effectively. It is crucial to remain attuned to prevailing market trends and sentiment. When the broader market witnesses a notable decline or correction, it often presents opportune moments for acquiring individual stocks. To achieve well-timed entries, staying informed about economic indicators and being aware of news that can influence market movements becomes essential. By carefully assessing these factors, investors in India can optimise their chances of success with the strategy.

Prioritising risk management is a fundamental aspect of implementing the "Buy the Dip" strategy. Diversification stands out as a central principle, spreading investments across diverse sectors and industries. Placing all resources into a single stock, even if it appears attractive during a dip, is discouraged to minimize risk. Additionally, setting stop-loss orders is advisable, serving as a protective measure to limit potential losses should the stock's decline persist. This approach safeguards the investment, ensuring that adverse price movements do not lead to significant financial setbacks. Maintaining a Long-Term Perspective: To make the "Buy the Dip" strategy effective, adopting a long-term perspective is paramount. Short-term price fluctuations are a common occurrence in the stock market, and it may take time for a stock to regain its intrinsic value. Therefore, being prepared to hold the stock over an extended period is a prudent approach. Ideally, investors should retain their positions until the stock's fundamental worth is fully realised. By maintaining this long-term perspective, investors in India can maximise the benefits of the strategy and navigate through temporary market fluctuations with confidence.

Vigilance and continuous research are equally crucial aspects of successful implementation. Regularly monitoring the performance of selected stocks is imperative. Staying informed about any developments related to the company or its industry is essential to make informed decisions. Moreover, it's crucial to remain aware of changing market conditions and adapt the investment strategy as necessary to respond to evolving circumstances. In India's dynamic market environment, staying adaptable and informed is key to investment success.

For those investors who are relatively new to stock investing or have constraints on the time available for in-depth research, seeking professional advice is a prudent choice. Consulting with a financial advisor or exploring mutual funds and exchange-traded funds (ETFs) that employ the "Buy the Dip" strategy can provide valuable insights and support for making informed investment decisions. Professional guidance is especially beneficial for those who seek to navigate the complexities of the stock market with confidence and expertise.

The pros and cons of the ‘buy and dip’ investment strategy are highlighted below.

The pros and cons of the ‘buy and dip’ investment strategy are highlighted below.

Ups and downs in the stock markets are a common feature and a never-ending cycle. The ability to profit from these market swings is the hallmark of a successful investor or trader leading to a profitable portfolio in the long term. However, it is a known fact timing the market is a difficult feat and hence, it is important to have a strong understanding of the market and of the target stocks to implement this strategy effectively. This blog was an attempt to show investment opportunities in times of market volatility and a way to create a long-term investment portfolio. Let us know if you have any queries regarding this strategy or want to know more about similar strategies to shape your investment portfolio and we will take them up in our coming blogs. Till then Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

Unless you are living under a rock, you cannot miss the increasing use of AI in...

Stock markets worldwide have been under pressure for years now following a serie...