What is one of the biggest myths of stock trading? It is the belief that stock trading is for millionaires or that you need bucketloads of money just to enter the stock trading arena and make some money. With the newfound interest in stock trading, the number of retail participants in Indian stock markets is increasing daily. But one of the major hurdles an average retail trader faces is finances to take suitable one or more trading positions and make decent profits. What if there is a simple solution to this issue? Well, there is and it is the margin trading facility. Read on to learn all about the margin trading facility and how it can be used for trading.

Read More: What is forex trading?

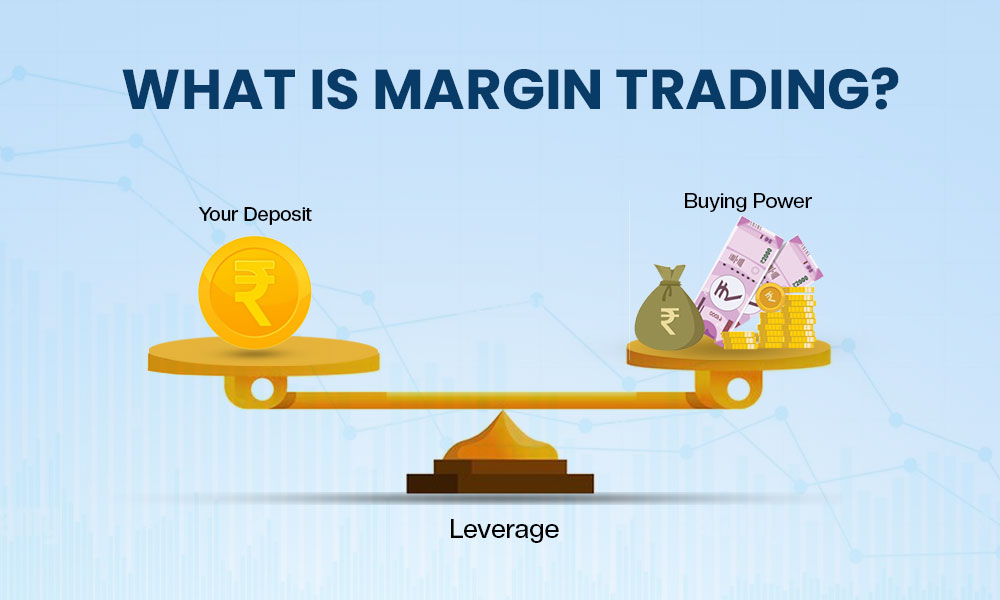

The simple meaning of margin trading is to trade with borrowed funds. In this facility, the trader can borrow funds from the broker to purchase securities thereby increasing the profitability from the trades beyond the buying power of their own capital. This facility is offered by brokers based on certain set parameters or conditions and the traders are required to maintain a minimum margin requirement to avail such facility. This margin requirement is usually in the range of 10%-20% of the total value of the securities being traded depending on the policies of the broker. In case the value of the securities falls below a certain threshold, known as the maintenance margin, the trader will have to deposit additional funds or securities to cover the shortfall. If the trader fails to do so, the broker can sell off the securities to cover their losses. While margin trading can magnify gains, it also exposes traders to higher levels of risk and potential losses. Therefore, it is essential for traders to understand the nuances of margin trading and risk management strategies before using this facility.

Some of the SEBI regulations regarding margin trading are highlighted below,

Margin trading is permitted only on securities classified within Group 1, meeting specific criteria outlined by SEBI. These securities must exhibit a mean impact cost of less than or equal to 1 and have traded on at least 80% (with a +/-5% margin) of the days over the previous eighteen months. This ensures that only actively traded and liquid securities are eligible for margin trading, reducing the risk associated with illiquid assets.

Only corporate brokers with a net worth of at least Rs. 3.00 crore are authorized to offer margin trading facilities to their clients. This requirement ensures that brokers have sufficient financial stability and regulatory compliance to provide margin trading services safely and effectively.

Before accessing margin trading facilities, the broker and the client must enter into a formal agreement. This agreement is based on the model agreement provided by SEBI, ensuring uniformity and adherence to regulatory standards. The agreement outlines the rights, obligations, interest rates on borrowed funds, handling of pledged securities, and responsibilities of both parties leading to enhanced transparency and legal clarity.

Shares pledged as collateral for margin trading remain now in the Demat account of the traders as against the previous arrangement of transferring them to the broker’s Demat account. This amendment is done to ensure transparency and security of assets and allow traders to maintain ownership of their securities while leveraging them for margin trading purposes. This arrangement further provides flexibility and control to the traders over their investment portfolios.

Brokers are required to collect margin money upfront for margin trading transactions. This upfront collection of margins ensures that traders have sufficient funds to cover potential losses and fulfil margin requirements. This further minimises the risk of default and ensures financial stability within the margin trading system.

As mentioned above, the margin trading facility is like getting a loan from a broker. Therefore, in order to avail this facility, traders need to first set up a trading account with a margin trading facility with the broker. They have to then provide the initial margin in such trading account as per the guidelines of the trader. Traders can then purchase securities using the margin trading facility up to a maximum of 5 times the margin. Margin trading involves interest charges which will be deducted from the trading account periodically thereby adding to the trading costs and a charge against the profits.

Let us understand how the margin trading facility works with the following example.

Let us consider Trader S who wants to purchase 100 shares (of Rs. 200 each) of Company XYZ. However, Trader S only has Rs. 10,000 in their trading account. With margin trading, Trader S can leverage their buying power by borrowing funds from the broker. The broker requires an initial margin deposit of 50% to provide the margin trading facility. Before proceeding, Trader S and the broker enter into a margin trading agreement, as mandated by SEBI.

With a 50% initial margin requirement, Trader S needs Rs. 10,000 (50% of Rs. 20,000, the total cost of 100 shares of XYZ). The broker lends the remaining Rs. 10,000 to complete the purchase.

Trader S uses the combined Rs. 20,000 (Rs. 10,000 from the trading account and Rs. 10,000 borrowed from the broker) to buy 100 shares of Company XYZ.

Trader S now owns 100 shares of XYZ using the margin trading facility.

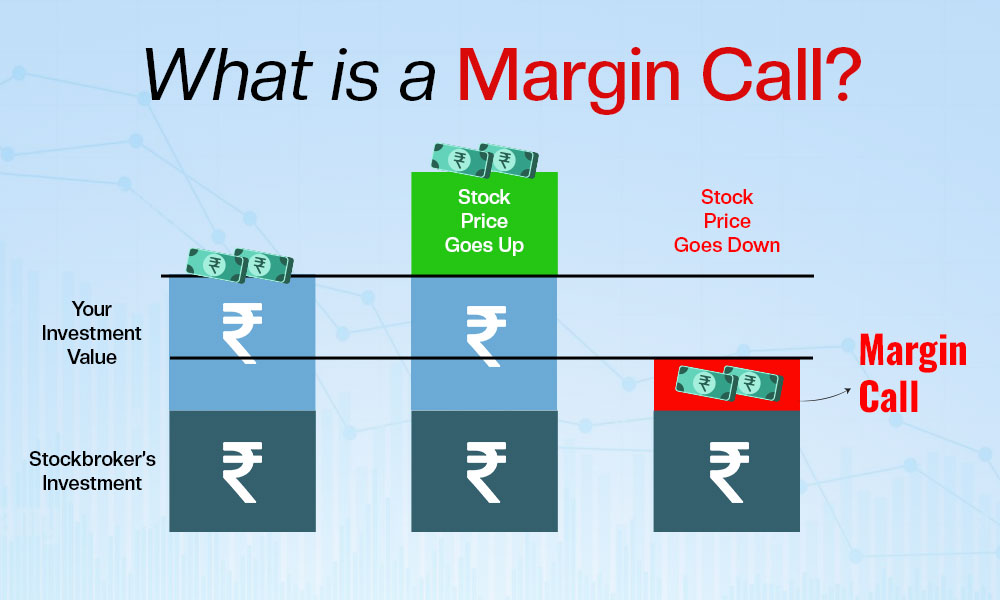

SEBI mandates a maintenance margin requirement to ensure that traders can cover potential losses. Let's say the maintenance margin requirement is 30%. This means that the value of the holdings must not fall below Rs. 14,000 (30% of Rs. 20,000).

If the value of XYZ shares falls close to the maintenance margin level, the broker may issue a margin call.

As the price of XYZ shares fluctuates, the profit or loss is calculated based on the difference between the purchase price and the current market price.

A margin call is a request or a requirement initiated by the broker to provide additional funds or securities when the value of your trading account falls below a certain threshold (known as the maintenance margin). A margin call is triggered due to the adverse price movements in the trading positions resulting in the shortfall. Failing to meet a margin call may result in the broker liquidating some or all of the current trading positions to cover such shortfall. Margin calls are designed to protect both the trader and the broker from excessive losses as well as ensure that traders have enough funds to cover potential losses in leveraged positions.

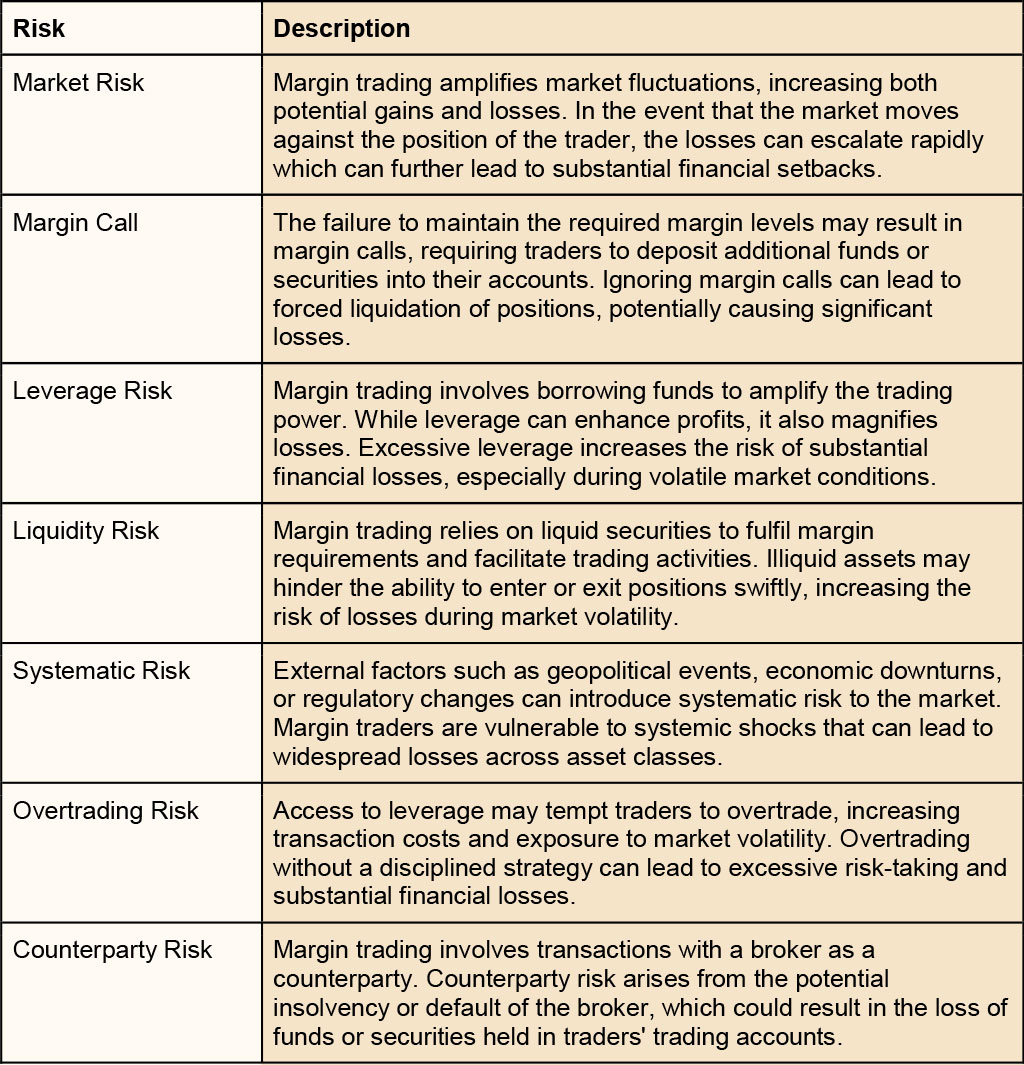

Some of the key risks of using the margin trading facility are provided hereunder.

Margin trading in the stock market is aimed at increasing participation in trading. This facility is regulated by SEBI and allows traders to leverage buying power by borrowing funds from brokers thereby amplifying both potential gains and losses. Therefore, it is important to monitor the trading account regularly and implement prudent trading strategies or risk management strategies to avoid any potential margin calls or losses from the margin trading facility.

This article provides a brief understanding of the margin trading facility in India and how it is facilitating traders to potentially increase the profitability from their trading capital. Let us know if you have any more queries regarding this facility or want to know the SEBI rules for the same in detail and we will address them soon.

Till then Happy Reading!

Read More: NSE Realtime Data Feed for Ninjatrader

In the world of high-speed trading, success often hinges on capitalising on even...

Did you know that stock trading is fast becoming one of the most popular searche...

Did you know the number of intraday traders in India increased by over 300 from ...