Algo trading in India is growing exponentially, with a market size of USD 562.20 million in 2024. As per a report from the IMARC Group, this number is expected to increase at a CAGR of 9.5% between 2025-2033 to reach the projected market size of USD 1,274.48 million by 2033. With the increasing retail participation in the algo trading, SEBI had earlier issued a few guidelines to safeguard retail participation, and now NSE has issued a separate circular to address the concerns regarding the use, liabilities and registration requirements of retail traders for algo trading. Check out this blog to understand these new NSE regulations and their impact on algo trading.

Let us begin with the meaning of algo trading for those who are new to arena.

Algo trading, short for algorithmic trading, means using computer programs and software to automatically buy and sell stocks or other financial products based on pre-set rules. These rules can include price, timing, volume, or other market conditions. Algo trading is widely used in the stock market, especially by big financial institutions, brokers, and high-frequency traders. It helps make faster decisions than a human can, reduces errors, and can lower the cost of trading. The Securities and Exchange Board of India (SEBI) regulates algo trading to ensure fair and safe practices, along with stock exchanges like NSE and BSE, offering special services and systems for algo traders to connect directly with the market for quick execution. As more technology becomes available, algo trading is also growing among retail traders who want to automate their strategies.

The latest National Stock Exchange (NSE) Circular is issued to establish clear and secure guidelines for retail investors engaging in algorithmic (algo) trading in India. These rules, effective from August 1, 2025, aim to make algo trading more accessible while ensuring safety and transparency for individual traders. The key details of this circular are explained below.

Retail traders are now permitted to use API (Application Programming Interface) access to connect their algorithmic trading systems directly to their broker’s platform. However, under the NSE’s May 2025 circular, this access is only allowed if the trader provides a static IP address. This fixed internet address ensures that trades originate from a verified device, thereby increasing security and traceability. Each trader is allowed to register one primary static IP and one secondary (backup) IP. Under the circular, any changes to the registered IP are permitted only once per week, unless there is a technical emergency. This move is to strengthen accountability and help prevent unauthorised trading activity.

According to the NSE’s guidelines, algorithms that send less than 10 orders per second are called low-frequency algos and do not need to be registered with the exchange. This rule is helpful for small and mid-level traders using basic automated strategies. However, brokers still need to do basic checks to make sure these algos follow safety and trading rules. On the other hand, algorithms that place more than 10 orders per second are considered high-frequency algos and must be registered with the NSE. These advanced algos are given a unique ID so the exchange can watch their activity closely. If the algorithm’s logic or trading style changes, the broker has to submit the updated version for approval. These steps help the NSE keep fast-moving trading under control and protect the market from risky behaviour.

Retail traders who do not want to or do not know how to build their own algorithms can use ready-made algos provided by their brokers. These broker-provided algos are already approved by the stock exchange and come with their own unique IDs, making them easy and safe to use. The broker is fully responsible for how these systems work and whether they follow the rules. Traders can also use algos from third-party software providers, but only if the vendor is officially approved (empanelled) by the stock exchange. These third-party algos must also be registered before they are given to clients. Brokers working with such vendors must check the algorithm’s quality and follow proper reporting rules. This system helps ensure that all algos, whether from brokers or outside vendors, are safe, legal, and reliable.

The NSE has implemented a clear order speed limit of 10 orders per second per exchange. Any algo that exceeds this threshold without being registered will have its orders rejected by the broker. Some brokers may also set tighter limits based on a client’s risk profile. This policy ensures a stable market environment by preventing reckless high-frequency trading.

Whether an algorithm is registered or not, each algo order must include a unique Algo ID. This creates an audit trail, allowing the exchange to track the source of each trade. In the event of a technical issue or unusual market activity, this system helps regulators quickly identify the responsible algo.

Security is a major component of the NSE circular. According to this circular, all API connections must be protected through secure login protocols, including two-factor authentication (2FA). Each API key must be tied to a specific static IP and user ID. Furthermore, brokers are required to maintain logs of all API activity for a minimum of five years. These measures ensure that trades cannot be executed without the trader’s knowledge, reducing the risk of hacking or unauthorised access while maintaining an audit trail for the trades.

The NSE has also permitted multiple family members to share a static IP if they are using the same home internet connection. However, in order to do this, the trader must submit a formal request to the broker and obtain approval. This exception supports genuine family trading setups while preserving overall security standards.

If an algorithm misbehaves, i.e., by generating excessive orders, causing errors, or negatively impacting market operations, etc., the exchange has the authority to shut it down immediately. This power allows the exchange to maintain stability and prevent market disruptions caused by malfunctioning or rogue algorithms.

At the close of each trading day, all API sessions will now have to be subjected to automatic logout. This rule ensures that no API connections remain active overnight, which could otherwise lead to unintended trades, security risks, or system errors. Traders must re-establish their API sessions each morning to resume trading.

Brokers are allowed to charge additional fees for API access and the use of algorithmic trading tools. These charges may cover technology setup, third-party software integration, data services, or customer support. Traders should check pricing details with their brokers in advance to avoid any hassles.

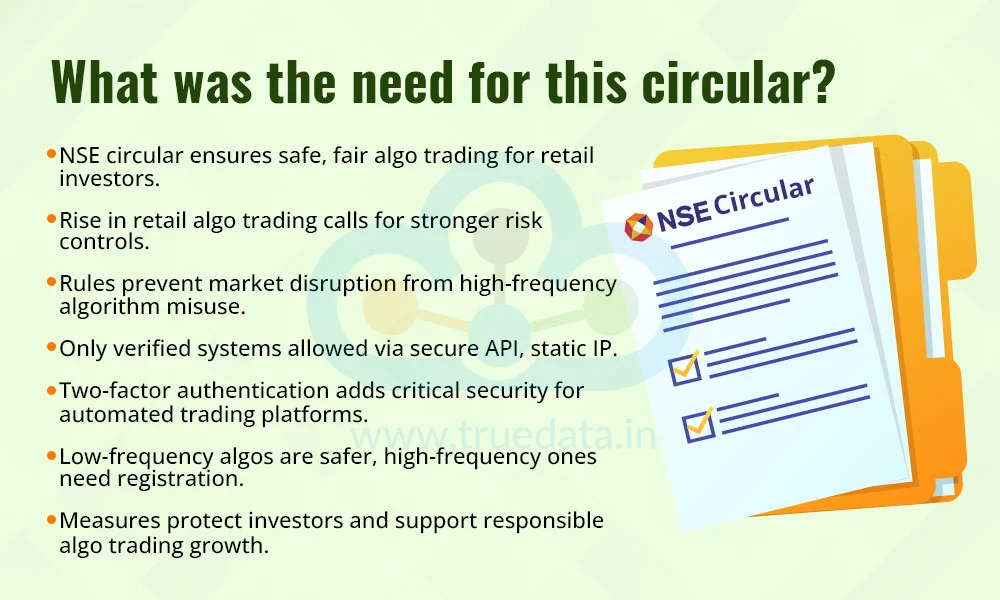

The NSE’s circular on algorithmic trading was introduced to create a safe, transparent, and fair environment for retail traders using automated systems. As algo trading becomes more popular in India, especially among retail investors, there is a growing need to manage the risks linked to speed, automation, and misuse. Without proper rules, high-frequency algorithms could disrupt markets or cause technical errors that affect all investors. The circular ensures that only secure, verified systems can connect through APIs, using static IP addresses and strict security like two-factor authentication. It also separates low-frequency algos, which are simpler and safer, from high-frequency algos, which must be registered and closely monitored. The various measures and restrictions implemented under the NSE circular are thus needed to protect traders, prevent misuse, reduce technical risks, and support the safe growth of algo trading in India’s fast-changing financial markets.

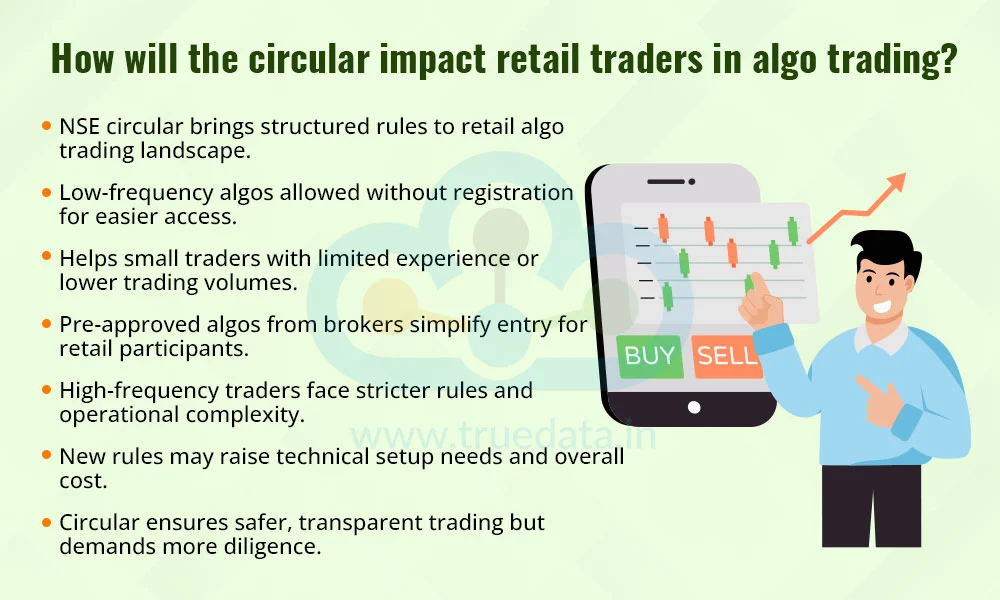

The NSE’s circular will have a significant impact on retail traders engaging in algorithmic trading by introducing a structured framework that balances accessibility with regulatory oversight. It is aimed to facilitate broader participation by allowing the use of low-frequency algos without the need for registration, which benefits less experienced traders or those operating at smaller volumes. Additionally, retail traders can now access pre-approved algorithms from brokers or authorised third-party vendors, which can lead to lowering the technical and compliance barriers to entry.

However, the circular also introduces stricter requirements for those using advanced or high-frequency strategies. This may increase operational complexity and regulatory responsibility, while some of the requirements mentioned under the circular may involve additional technical setup and cost. Overall, the circular promotes safer and more transparent algo trading practices and requires increased diligence, technical readiness, and cost awareness on the part of retail participants.

The NSE’s May 2025 circular introduces a comprehensive framework to regulate algorithmic trading among retail investors in India. It enables broader participation by simplifying access while enforcing strict safety, registration, and monitoring measures. Whether a trader is using a self-built system, a broker-provided tool, or a third-party solution, adherence to these rules is essential. The overall goal is to support innovation and automation in trading while maintaining fairness, transparency, and market integrity.

Read More: SEBI Norms on Sharing Real-Time Price Data

Did you know that stock trading is fast becoming one of the most popular searche...

Investment in the securities market is rising, even asvolatility keeps investors...

SEBIs primary mission has always been to protect investors while creating a secu...