What Is Backtesting?

Backtesting is the overall technique for perceiving how well a methodology or model would have done. Backtesting surveys the suitability of an exchanging methodology by finding how it would play out utilizing authentic information. In the case of backtesting works, dealers and investigators might have the certainty to utilize it going ahead.

Backtesting and Understanding

Backtesting permits a broker to recreate an exchanging methodology utilizing verifiable information to produce results and break down hazards and productivity before taking a chance with any genuine capital.

A very much directed backtest that yields positive outcomes guarantees merchants that the system is generally solid and is probably going to return benefits when executed actually. Conversely, an all-around led backtest that yields problematic outcomes will provoke merchants to adjust or dismiss the system.

A few brokers and traders might look for the skill of a certified software engineer to form the thought into a testable structure. Ordinarily, this includes a software engineer coding the thought into the restrictive language facilitated by the exchanging stage.

Backtesting is a critical part of powerful exchanging framework improvement. It is refined by remaking, with authentic information, exchanges that would have happened in the past utilizing rules characterized by a given methodology. The outcome offers measurements to check the viability of the system.

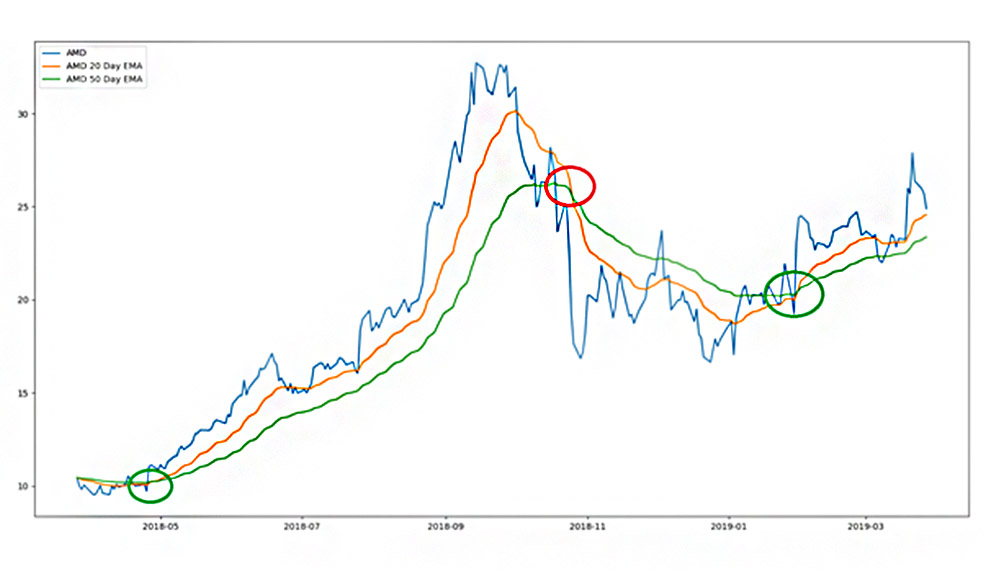

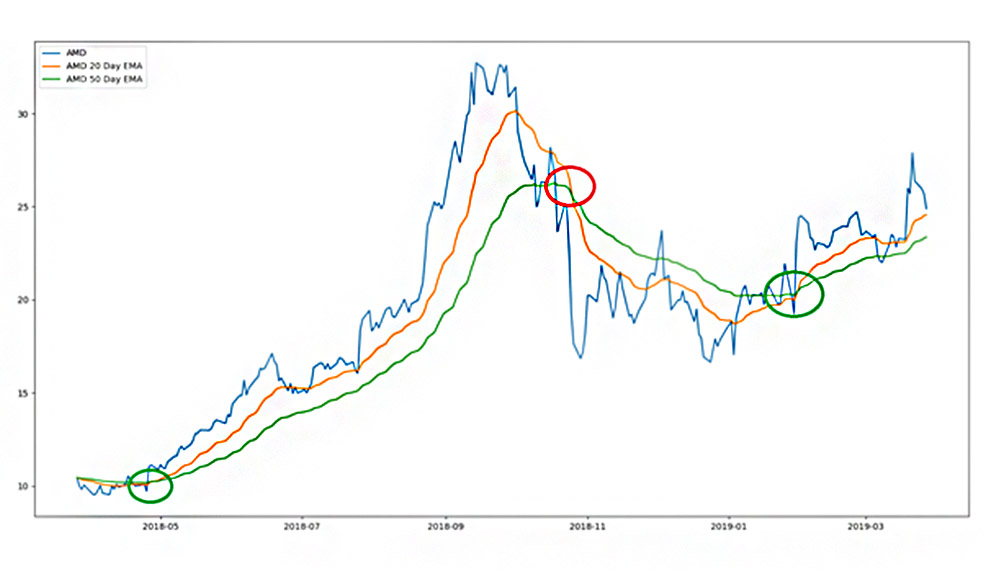

Instructions to Backtest a Trading Strategy: Backtesting strategies can give a lot of important factual criticism about a given framework. Some widespread backtesting insights include:

Net benefit or deficit: Net rate acquired or lost

Instability measures: Maximum rate potential gain and drawback

Midpoints: Percentage normal increase and normal misfortune, normal bars held

Openness: Percentage of capital contributed (or presented to the market)

Proportions: Wins-to-misfortunes proportion

Annualized return: Percentage return longer than a year

Hazard changed return: Percentage return as a component of hazard

Backtesting Strategies

Ordinarily, backtesting programming will have two significant screens. The first permits the broker to alter the settings for backtesting. These customizations incorporate everything from period to commission costs.

There are many elements to focus on when brokers are backtesting exchanging systems. Here is a rundown of the main things to recollect while backtesting:

- Considering the wide market patterns in the time, a given technique was tried. For instance, if a procedure was just backtested from 1999 to 2000, it may not toll well in a bear market. It isn't unexpected a smart thought to backtest over quite a while outline including a few unique sorts of economic situations.

- For instance, if a wide market framework is tried with a universe comprising of tech stocks, it might neglect to do well in various areas. When in doubt, if a system is designated toward a particular classification of stock, limit the universe to that type; in any remaining cases, keep an enormous universe for testing purposes.

- Unpredictability measures are critical to consider in fostering an exchanging framework. Brokers should look to keep instability low to lessen hazards and empower simpler progress all through a given stock.

- The normal number of bars held is likewise vital to watch when fostering an exchanging framework. On the off chance that conceivable, raising your normal number of bars held can diminish commission costs and work on your general return.

- Openness is a two-sided deal. Expanded openness can prompt higher benefits or higher misfortunes, while diminished openness implies lower benefits or lower misfortunes. As a general rule, it is a smart thought to keep openness underneath 70% to diminish hazard and empower simpler progress all through a given stock.

- The normal increase/misfortune measurement joined with the successes to misfortunes proportion, can be valuable for deciding ideal position estimating. Dealers can take bigger positions and diminish commission costs by expanding their normal gains and expanding their successes to-misfortunes proportions.

- Annualized return is utilized as an instrument to benchmark a framework's profits against other speculation settings. It is significant not exclusively to check out the generally speaking annualized return yet additionally to consider the expanded or diminished danger. This should be possible by checking out the danger changed return, which represents different danger factors. Before an exchanging framework is embraced, it should beat any remaining speculation scenes whatsoever or less danger.

- Backtesting customization is critical. Numerous backtesting applications have input for commission sums, round (or fragmentary) parcel sizes, tick sizes, edge prerequisites, loan fees, slippage suspicions, position-measuring rules, same-bar leave rules, (following) stop settings, and substantially more.

- Backtesting can now and then prompt something known as over-streamlining. This is a condition where execution results are tuned so high to the past they are no longer as precise later on.

- Backtesting isn't generally the most reliable way of checking the adequacy of a given exchanging framework. Now and again methodologies that performed well in the past neglect to do well in the present.

CONCLUSION

- Backtesting surveys the practicality of an exchanging procedure or valuing model by finding how it would have played out reflectively utilizing verifiable information.

- The basic hypothesis is that any technique that functioned admirably in the past is probably going to function admirably later on, and on the other hand, any system that performed ineffectively in the past is probably going to perform inadequately later on.

- When testing a thought on chronicled information, it is helpful to hold a time of authentic information for testing purposes. In case it is fruitful, trying it on substitute periods or out-of-test information can assist with affirming its expected practicality.

Backtesting is one of the main parts of fostering an exchanging framework. Whenever made and deciphered appropriately, it can assist brokers with upgrading and working on their procedures, observe to be any specialized or hypothetical defects, just as gain trust in their technique before applying it to this present reality markets.