Backtesting is one of the most key parts of trading. It helps you to be sure of your strategies that you are implying. Mainly, backtesting relies on the historical data of the trades in the past. It helps you to make sure that you are not blindly trading but using foolproof strategies. The question which revolves in the mind of traders is - Does Backtesting a new strategy really get results for successful trades? Go through the complete article and find out yourself! The fundamental theory is that any strategies used in the past if produced good results will work in the future. Similarly, any strategy used in the past if produced bad results will not work in the future. Backtesting takes into account the statistics of the strategies used in the past trades. The data obtained thus helps to calculate the productivity of the trading system. In a trading system, there are a set of rules which help you to decide when to buy and when to sell. In a backtest, you simply pretend to have the system before. You then use it to buy and sell stocks. If it makes money, it is a good system. If not, it is a bad system.

In a backtest, you need to pretend to have an account. You then put fake money in the account. This will help you to understand if your strategy will make you money or not. You use the past data of the strategy to see how the system works. You make a fake history and check the efficacy of the system with this fake history. More so, you can also put real money in the account while backtesting. But this might be a bit risky as you can lose money too.

In a backtest, you need to pretend to have an account. You then put fake money in the account. This will help you to understand if your strategy will make you money or not. You use the past data of the strategy to see how the system works. You make a fake history and check the efficacy of the system with this fake history. More so, you can also put real money in the account while backtesting. But this might be a bit risky as you can lose money too.

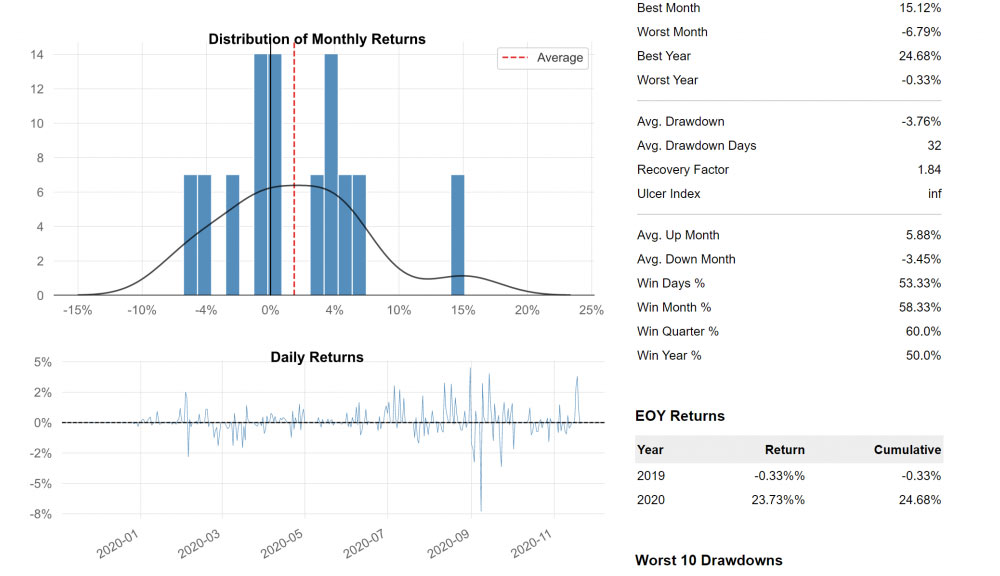

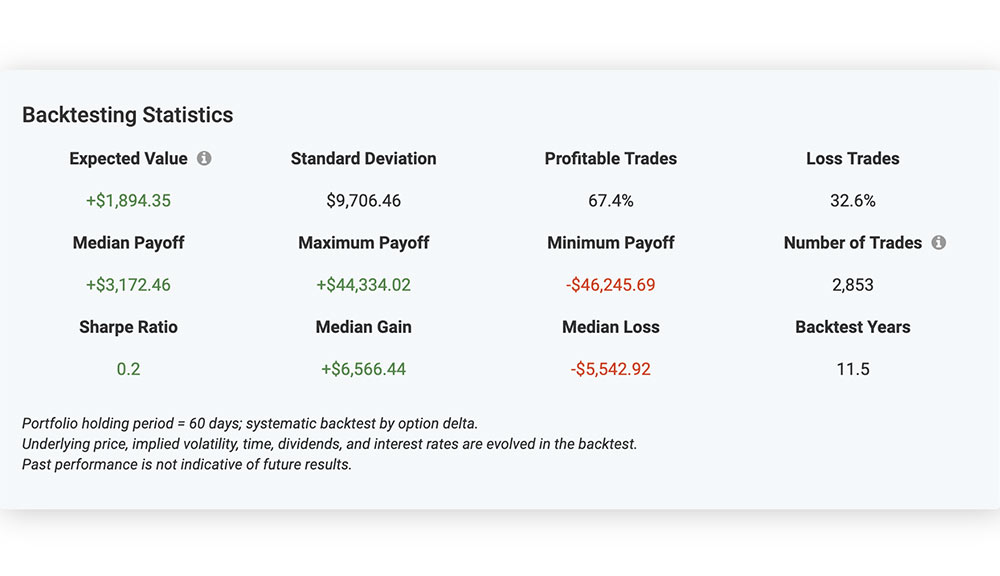

A trading strategy when backtested using the data and tools provides an analysis of and feedback about a strategy. Here are the statistics that are generally useful while backtesting:

A trading strategy when backtested using the data and tools provides an analysis of and feedback about a strategy. Here are the statistics that are generally useful while backtesting:

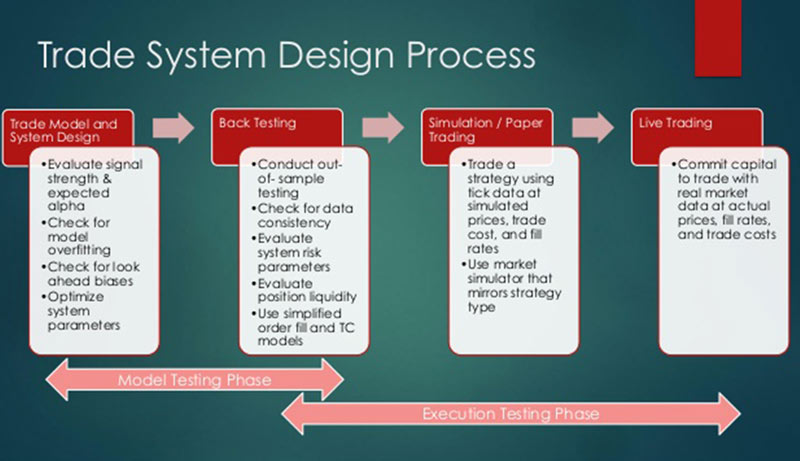

Step 1: Put together and plan all your trading strategy and the rules associated with them. For manual backtesting, there is no need for coding. But if you are using any automated backtesting software, you need to code your strategy. Step 2: Select the financial instrument(s) you want so that you can backtest your strategy on it. Step 3: Gather the historical price data for backtesting the strategy. Make sure it covers the different market conditions. Experts recommend using 5 years of data for a swing trading strategy. Step 4: The strategies obtained should be run through the historical data to see if they will work or not. Calculate important parameters like annual gross return, drawdowns and risk-reward ratio to gauge the performance of your system. Step 1 to 3 above can be done manually, but step 4 is a bit complicated and might take a longer time. At Step 4, you need to use automated software to perform backtesting.

The main reason to do Backtesting is to check how a certain strategy performed in the past. Thus it becomes important to consider all the data and all the trading costs. Otherwise, backtesting may show false profitability.

The main reason to do Backtesting is to check how a certain strategy performed in the past. Thus it becomes important to consider all the data and all the trading costs. Otherwise, backtesting may show false profitability.

Investor need to include all the factors while choosing a market for getting accurate profitability results. The kind of profits you want to make, the risks you are ready to take, time period of investment etc. Based on these factors, choose a segment or market for you with lower risks involved.

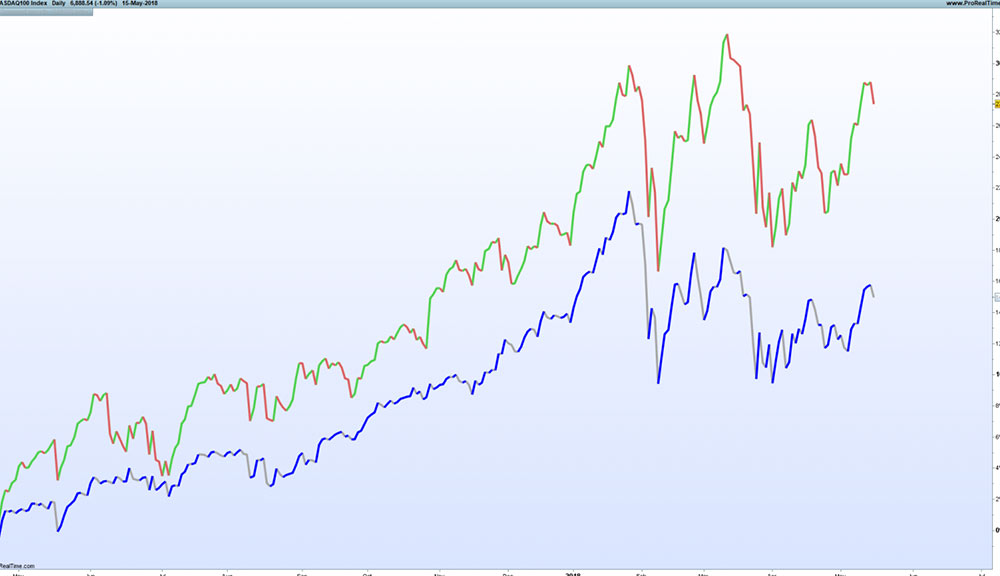

Market prices keep on varying according to the situations. Factors like inflation rates, monetary policies, annual reports of a company affects the market prices. Test your strategies in different markets under different situations to check the potential of your strategies.

You need to check for the asset classes which a backtesting platform uses before choosing one for yourself. What is the source of the market data feeds on a backtesting platform, which programming language is used should be considered.

There are special platforms for Backtesting. Some are Retail Backtesting Platforms like TradeStation, MetaTrader, NinjaTrader, Ambibroker. Some are also Web-Based like QuantConnect, Blueshift. Institutional Backtesting Softwares are Deltix, Quanthouse, AlgoTrader.

There are special platforms for Backtesting. Some are Retail Backtesting Platforms like TradeStation, MetaTrader, NinjaTrader, Ambibroker. Some are also Web-Based like QuantConnect, Blueshift. Institutional Backtesting Softwares are Deltix, Quanthouse, AlgoTrader.

Does Backtesting a new strategy really get results for successful trades? Backtesting helps the traders in two major ways:

Does Backtesting a new strategy really get results for successful trades? Backtesting helps the traders in two major ways:

Overall, Backtesting can be a very helpful process in the trading system. It can help in the improvisation of the strategies and trade better. The techniques used can also help to look for any mistakes reducing the risk of loss of real money. It helps to give you an idea about the possibilities of your strategy. The conclusion is that if implemented well Backtesting can get results for successful trades.

The joy of successfully implementing a trading strategy and creating asuccessful...

What Is Backtesting? Backtesting is the overall technique for perceiving how we...

Backtesting in AmiBroker Before getting into any technicalities or know-how, we...