Indian Stock market has two leading stock exchanges - BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). Both of these exchanges have considered the scrips to provide distinction and ease. Despite that, sometimes it may appear confusing to beginners in the Stock Market. In this post, let’s understand what the NSE series is. NSE Series - The National Stock Exchange (NSE) started trading in the equities segment (Capital Market segment) on November 3, 1994. Within a short span of 1 year became the largest exchange in India in terms of volumes transacted.

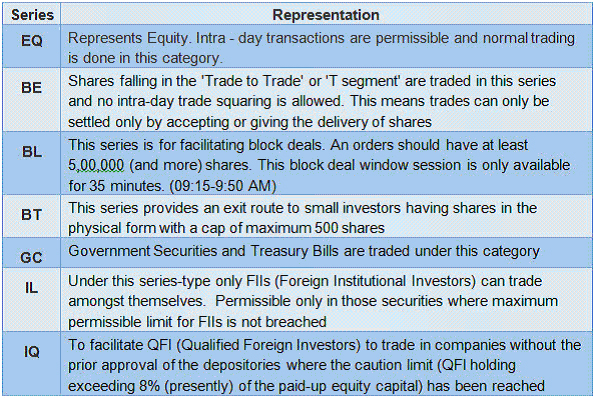

A Permitted asset class is a collection of investments that show alike characteristics and are subject to the same laws and regulations. Equities (stocks), fixed Income (bonds), cash and cash equivalents, real estate, commodities, futures, and other financial derivatives are some examples of permitted asset classes. In the capital market, various products are traded; which include Equity shares, Preference shares, Warrants, Debentures, Exchange-traded Funds, Mutual Funds (close-ended), Government Securities, and Indian Depository Receipts. Each Series distinguishes the scrips and/or the people who can trade in those series. When you search for a scrip through your trading terminal you see that the same scrip has a suffix at the end of NSE. These suffixes are EQ, BE, BL, and a lot more. Let’s understand them one by one. Following are the symbols that denote the various types of series traded on the NSE:-

Points to be Noted:-

Points to be Noted:-

We hope, this post gives you clarity about different NSE Series. Please leave a message if you have a query or more information on this topic.

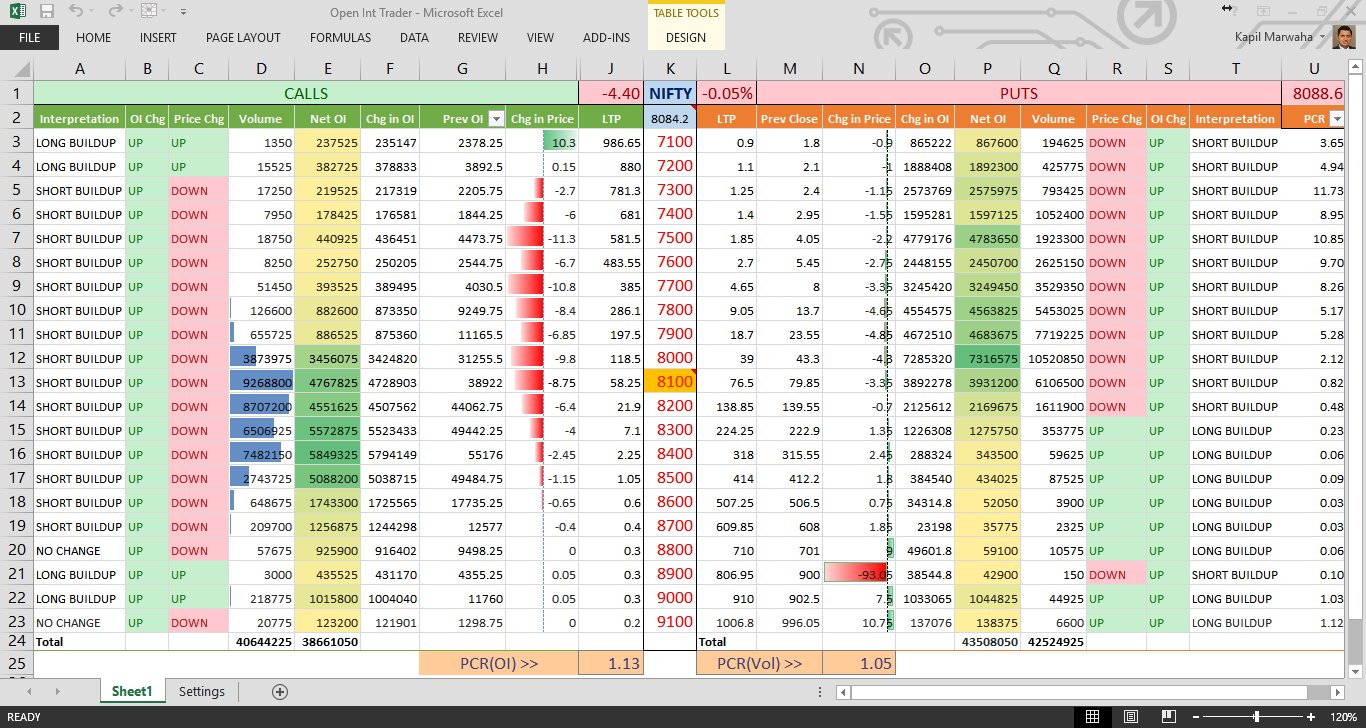

Read More: Real-time API for NSE EQ, NSE Indices, NSE F&O, NSE CDS & MCX

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Algo trading in India is growing exponentially, with a market size of USD 562.20...