There has been a huge influx of investors and traders in the Indian stock markets, especially during and in the post-pandemic scenario. For effective trading and investing, it is important to understand the core rules set up by SEBI and related legislation to have a successful portfolio. The latest rule to be implemented by SEBI is the change in settlement rules for trading and investing. The details of the same are explained hereunder.

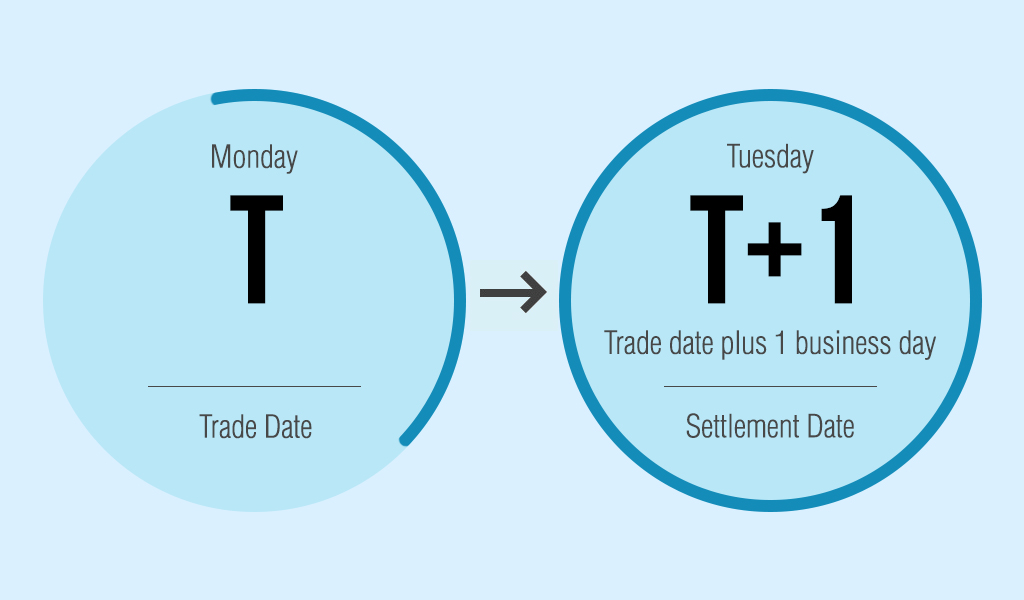

Let's begin with the basic meaning of the settlement cycle. The settlement cycle in stock markets is the time taken for the completion of the transaction or the time taken for the final credit of securities or the funds from the start of the transaction. Prior to 27th January 2023, India followed the T+2 settlement cycle where 'T' is the trading day or the transaction day. This implied that the investors/traders would get the credit of securities in their Demat account, or credit of funds from the sale of securities, dividends on their securities, etc. within 2 business days from the date of the trade.

According to the revised SEBI rules, Indian stock markets will now function based on the T+1 settlement cycle. Therefore, traders and investors will get the credit for their securities purchased or any funds due within 24 hours from the date of the trade. Following this move, India will be the second major economy to transition to the T+1 settlement cycle after China. The other major markets still follow the previous settlement cycle of T+2 days that was adopted by India to date.

The move to reduce the settlement cycle from T+2 days to T+1 days was initially proposed by SEBI back in 2021. However, it was met with severe backlash from the intermediaries and brokers as well as the FPIs. The reasons for the shift to the updated T+1 settlement cycle are multifold. Some of these reasons include,

Increase the retail participation in stock markets

Reduce the margin requirements for trading

Increasing operational efficiency and the speed of crediting the securities and funds for an average investor/trader.

Increasing the liquidity in Indian stock markets

Decreasing the exposure of the Clearing Houses by approximately 50% through a reduction in the number of outstanding unsettled trades at any given point.

Decreasing the default risk in pay-ins and pay-outs.

The Indian stock markets functioned on the T+5 day settlement cycle initially which was later shifted to the T+3 settlement cycle in 2002. The settlement cycle was later transitioned into the T+2 settlement cycle in 2003. The latest change in the settlement cycle was primarily due to the advancements and technical developments in the banking sector and the sector’s ability to handle large volumes of transactions, especially after the introduction of the UPI. This will be a crucial participant in the fast-paced stock market movements that are aimed at by SEBI.

The shift in the T+1 settlement cycle was heavily criticised by the many intermediaries in the stock markets like bankers, brokers as well as foreign portfolio investors (FPIs). The reasons for such backlash from the intermediaries and brokers included the changes needed in their systems and infrastructures. FPIs on the other hand cited challenges like the time differences faced by them in executing the transactions, foreign exchange booking which will have to be done either in the late evening or in the early morning to accommodate this cycle, procedural hassles in information flow as well as getting timely approvals from respective custodians and head offices. The severe pushback received from the FPIs led the SEBI to push the change of the T+1 settlement cycle from 2020 to 2022, however, seeing the commitment of SEBI to go ahead with the proposed T+1 settlement cycle, the FPIs are now onboard.

Keeping in view the various challenges faced by the different segments of the stock market, SEBI proposed the transition to the T+1 settlement cycle in a staggered manner, i.e., through various tranches of stocks. The first tranche of stock from NSE and BSE to be shifted to the new cycle in February 2022 was the bottom stocks on the exchanges in terms of market capitalisation. Following this, every last Friday of the month saw a transition of the next bottom 500 stocks in terms of market capitalisation to the revised settlement cycle.

The final tranche of the stocks that have to be moved to the T+1 settlement cycle will be the top stocks on the stock exchanges in terms of market capitalisation. These stocks are large-cap or blue-chip stocks and are also part of the Futures and Options trading or the derivative market segment. It was initially proposed to transition these stocks to the new cycle in two batches in December 2022 and January 2023. However, after careful consideration and to avoid confusion, the entire segment of the last tranche of stocks is transitioned to the T+1 settlement cycle on 27th January 2023.

The average investor or trader will not have much impact on their portfolio except for the faster processing of transitions and credit of their securities or funds in their accounts. This will enable faster release of funds blocked for margin requirements thereby effectively reducing the capital needs for trading. Short-term volatility and fluctuations in the volume are expected initially on account of the shift to the new system, however, investors with a long-term investment approach should not see much impact on their portfolio and thereby can ignore the market buzz.

The T+1 settlement cycle is expected to bring Indian stock markets to new heights in terms of the volume of transactions and exposure to the world markets. The Indian economy is expected to grow at a pace of approximately 6% of GDP in the coming decade. The stock markets with the increased pace of settlement are also expected to be in sync with these growth expectations and increase retail investor participation.

We hope this article was helpful in providing all the necessary background and key information related to the T+1 settlement cycle. For more information related to stock markets keep following this space.

Till then Happy Reading!

Read More: Expectations from Budget 2023

The world is buzzing with the news of the IndianSensex crossing 75000 points for...

Algo trading in India is growing exponentially, with a market size of USD 562.20...

India’s health insurance market is projected to more than double from USD ...