The world is buzzing with the news of the Indian Sensex crossing 75000 points for the first time which has pushed in creating a huge wealth increase for retail and institutional investors alike. This news comes on the heels of India rolling out the fastest settlement cycle for Equity markets. This move is expected to create huge volumes of liquidity in the Indian stock markets and further push the fast-paced trading model that traders are increasingly favouring. SEBI has currently introduced the beta version of this settlement cycle. Know all about the T+0 settlement cycle in Indian equity markets and what it means for investors at large.

Read More: Financial Regulators in India

India has created a history by moving to the instant settlement cycle which is the T+0 settlement cycle. This change is considered revolutionary as the markets around the world are still functioning on T+1 days (for example, China) and T+2 days (USA and European markets). However, before learning all about this latest change in the Indian stock markets, let us go through the history of settlement cycles in India.

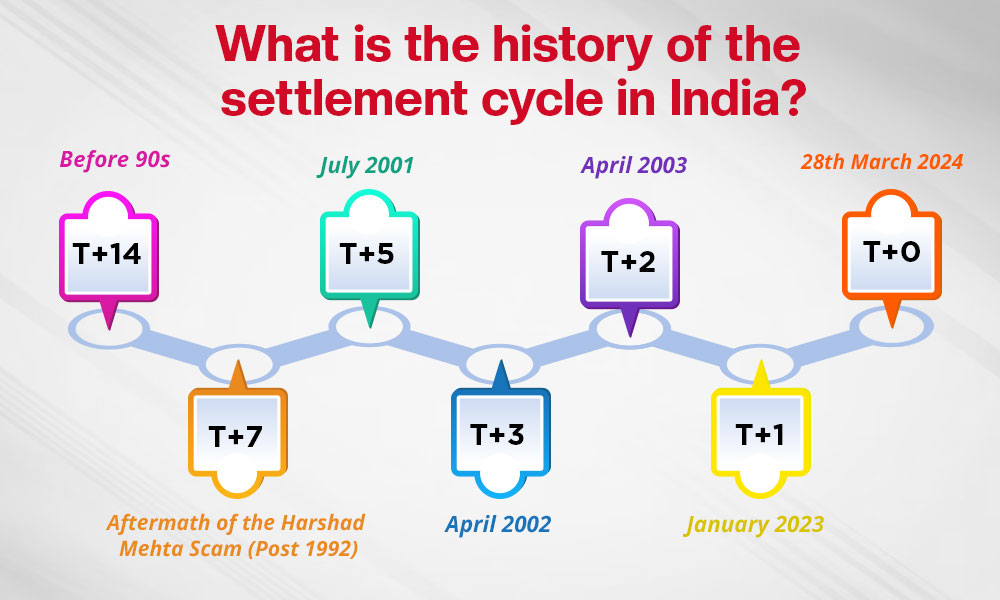

The stock market settlement cycle is the timeframe for transferring securities and funds between buyers and sellers after a trade, ensuring ownership changes and trade completion. The Indian stock markets used to function initially at the T+14 days settlement cycle before the 90s. However, when the Harshad Mehta scam rocked the Indian stock markets in the early 90s, the settlement cycle was changed for the first time to T+7 days as part of the aftermath. The next change that followed was in 2001 when the settlement cycle was changed to T+5 days. However, this change was shortlived and the settlement cycle was changed to 3 days i.e., T+3 days in April 2002 followed by a quick change to T+2 days in April 2003. The settlement cycle of T+2 days then continued for the next 20 years till January 2023 when the settlement cycle was further revised to T+1 days.

While the market participants were still adjusting to the latest change in the settlement cycle of T+1 days, SEBI proposed to achieve real-time or near real-time settlements with the T+0 settlement cycle.

Elevate your trading decisions with the Top real-time data vendor in India

The history of the settlement cycle in India can be summarised in the table below

.

Now that we have seen the history of the settlement cycle in India, let us now move towards the meaning of the T+0 settlement and why this is a significant move or a game changer so to speak.

Let us first understand the current scenario of the settlement cycle. Currently, Indian stock markets have the T+1 settlement cycle. This means that buyers have to wait for 1 business day after their transaction for the securities to reflect in their trading account and similarly sellers have to wait for 1 business day for the credit of funds in their account. Now with the proposed T+0 settlement cycle, there will be virtually no waiting time once the transaction is executed to reflect in the respective buyer and seller accounts. With the current T+1 system, sellers might get 80% of their money on the sale day and the rest the next day. But with the new T+0 system, sellers get all their money right away on the same day of the transaction. The T+0 settlement cycle will function in 2 phases. Transactions completed before 1:30 pm will be finalised by 4:30 pm on the same day. The next phase from 1.30 PM to 3.30 PM will take care of any pending transactions during the trading session while Phase 1 will be discontinued.

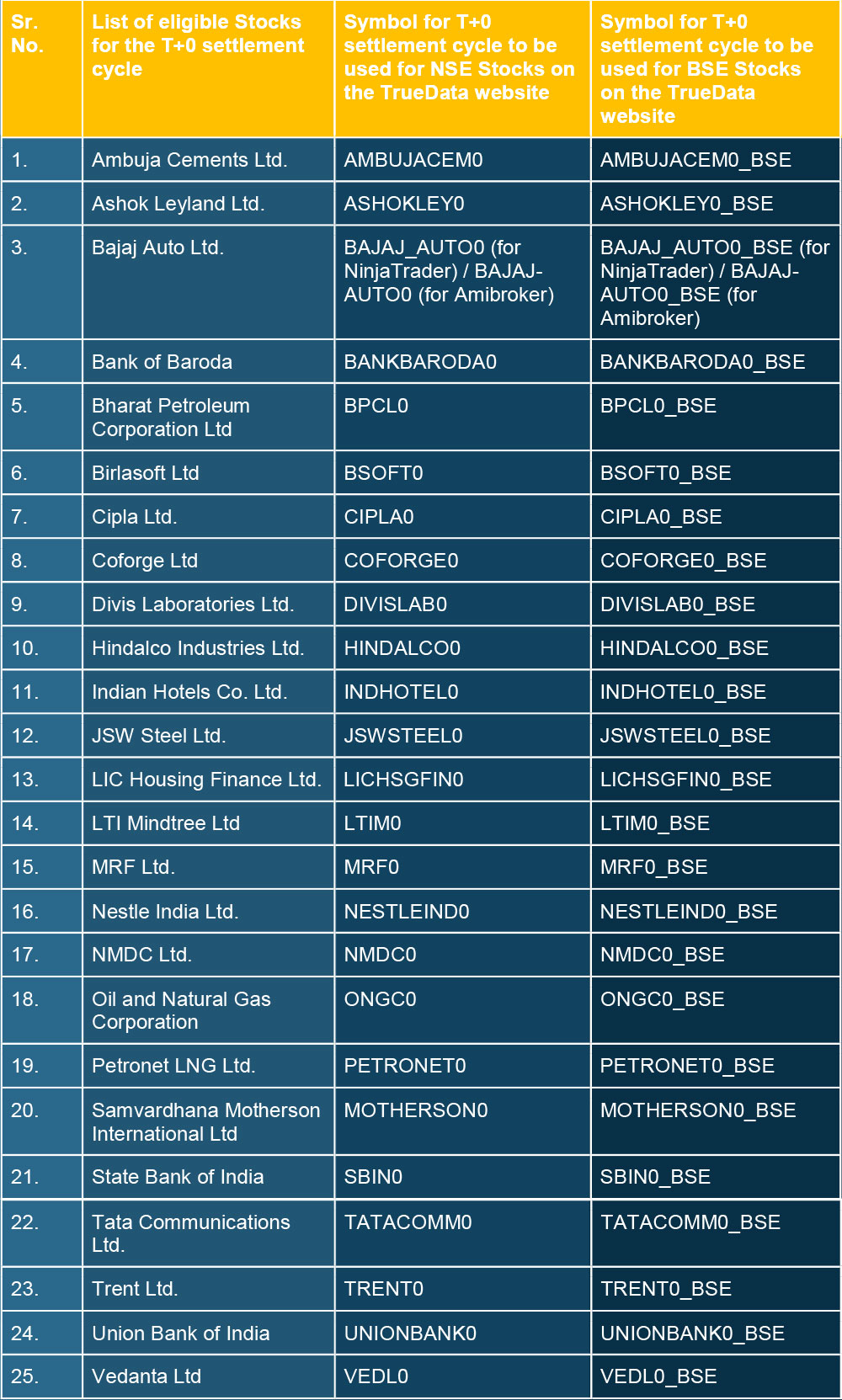

SEBI has rolled out the T+0 settlement cycle in the optional format or the beta version for stocks traded on the stock exchanges. In the initial phase, SEBI has listed 25 stocks that will be eligible for the T+0 settlement cycle. These stocks are also offered for trading under the T+0 settlement cycle on the Truedata website. The list of these stocks and the symbol to be used for the T+0 settlement cycle on the TrueData website is tabled below.

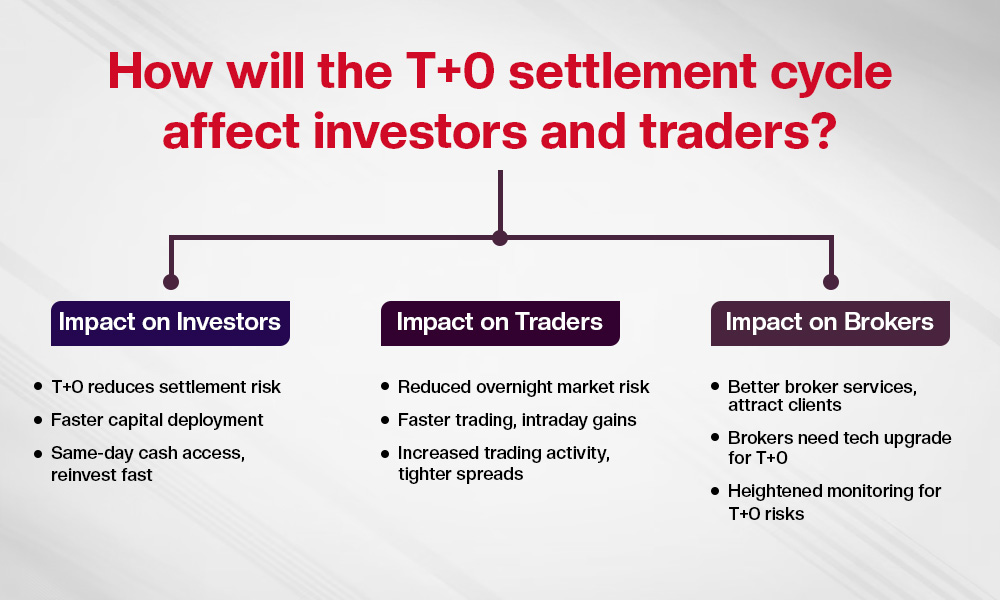

The T+0 settlement cycle is set to revolutionise the trading scenario for all the players in the stock markets. The impact of this monumental change in the Indian stock markets on investors and traders is highlighted below.

Investors will have access to 100% of their cash on the same day of the transaction which will allow prompt liquidity or reinvestment.

T+0 settlement will lead to minimal risk of default or counterparty risk as transactions will be settled instantly.

Investors will get the chance to deploy funds quickly for new investment opportunities. This will help them enhance portfolio management strategies and capitalise on market movements without delay.

T+0 settlement will lead to eliminating the overnight risk for traders. This will reduce the exposure to market volatility and unforeseen events during non-trading hours.

Traders can execute trades and receive funds instantly which will enable quicker decision-making and the ability to capitalise on intraday price movements.

The immediate availability of funds will encourage more active trading, leading to enhanced liquidity, tighter bid-ask spreads, and a more dynamic trading environment.

Brokers can offer enhanced services with immediate fund availability and faster trade settlements. This will lead to improved client satisfaction and attract more market participants.

Brokers will have to invest in robust technology and systems to support the T+0 settlement effectively in order to ensure compliance and efficient risk management practices.

Furthermore, brokers will have to maintain vigilant monitoring and control measures to mitigate risks (like market manipulation and operational risks) associated with increased trading activity and market volatility.

One of the biggest pushes for the T+0 settlement cycle is the potential for enhanced liquidity that will facilitate increased retail participation. However, it does pose a few challenges too. One of the biggest challenges or oppositions to the T+0 settlement cycle will be from the Foreign Portfolio Investors (FPIs) as was the case with the change from the T+2 settlement cycle to the T+1 settlement cycle.

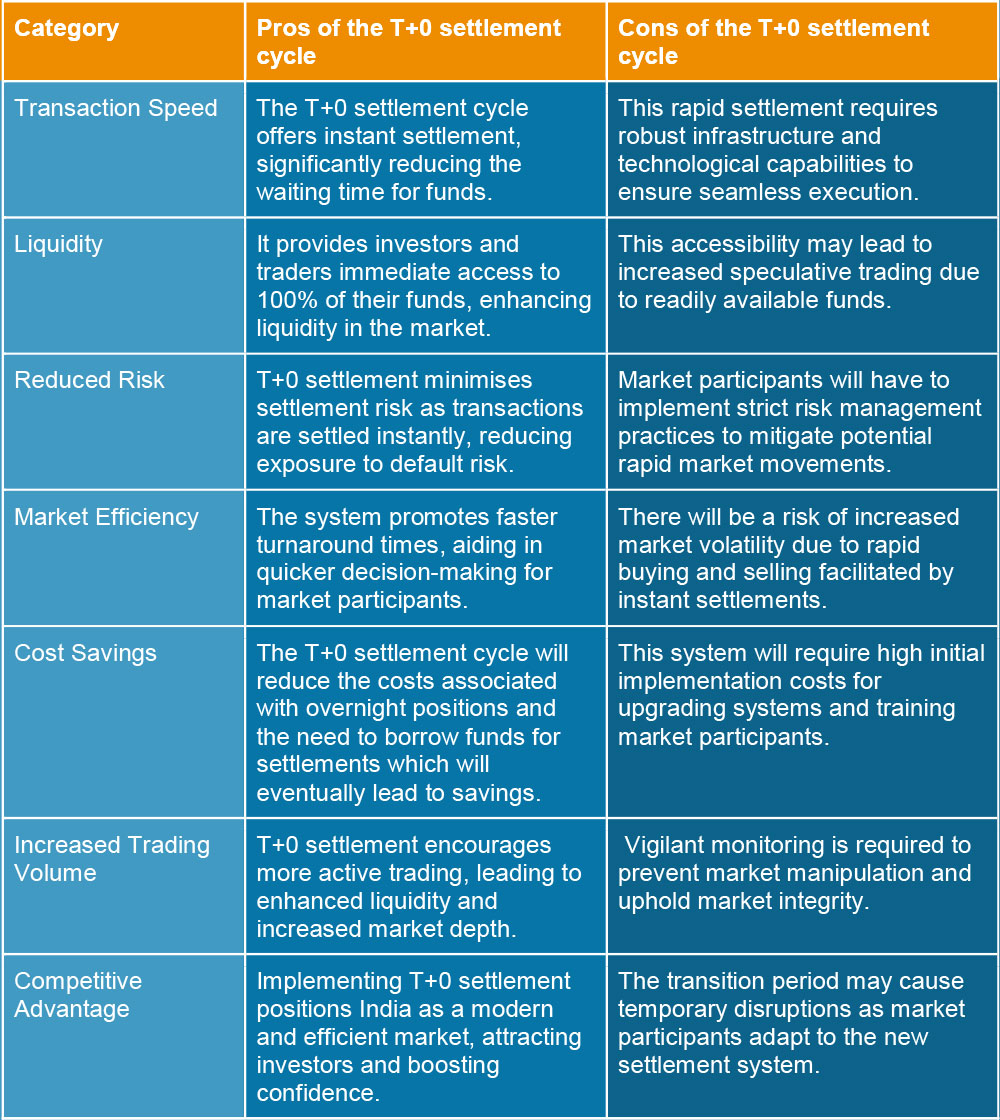

Here is a detailed list of potential pros and cons of the T+0 settlement cycle in India for better understanding.

The T+0 settlement cycle is said to be a watershed moment in the Indian stock markets. This change is set to further enhance India's growing stature across the world and the increasing confidence of institutional investors in the country's growth. While this change is not without its own set of challenges, this shortened cycle will eventually lead to increased investor confidence and participation in the stock markets which is still quite meagre when compared to global giants.

In this article, we have highlighted the meaning of the T+0 settlement cycle along with its impact on the major market players. Let us know if you need further information on this topic and we will address it soon.

Till then Happy Reading!

There has been a huge influx of investors and traders in the Indian stock market...

Another year, another Union Budget. On 1st February 2026, the Modi government pr...

The primary purpose of investment is to earn a more or less stable source of add...