The backbone of successfully navigating options trading is accurately understanding its nuances. This includes the various concepts and trading strategies for option trading. One of the popular names in this category is the covered call strategy. Have you heard of this term? Check out this blog to understand the covered call strategy and how to use it for successful options trading.

A Covered Call Strategy is a trading approach where a trader who already owns shares of a company sells a call option on those same shares to earn additional income. This strategy is considered ‘covered’ because the trader holds the underlying stock and can deliver it if required. By selling the call option, the trader receives a premium, which provides some protection against minor losses or stagnant price movement. It is generally used when the trader expects the stock to remain flat or rise only slightly, not make a big jump. The concept of covered calls has existed since the early days of the options market, formally starting with the Chicago Board Options Exchange (CBOE) in 1973. In India, with the introduction of derivatives trading on the NSE in the early 2000s, this strategy became popular among traders and investors looking to generate steady income from their existing stock portfolios. It remains a preferred strategy for conservative traders who want to make the most of stocks they already own.

The covered call strategy is a simple yet effective strategy that is used by traders across the globe. The working of this strategy is explained hereunder.

Owning the Stock - To use a covered call strategy, the trader must first own shares of a stock in their demat account. For example, they might own 100 shares of Reliance or Infosys. These shares are needed to ‘cover’ the call option being sold.

Selling the Call Option - Next, the trader sells a call option on those same shares. This gives someone else the right to buy the shares at a fixed price (called the strike price) within a certain time (before expiry). In return, the trader receives a premium, which is the income they get upfront.

Keeping the Premium - The trader keeps the premium no matter what happens to the stock. This premium acts like a small cushion as it reduces losses if the stock falls a little, and adds to profits if the stock stays flat or rises slightly.

What If the Stock Stays Flat or Falls? - If the stock stays below the strike price, the option will expire worthless. The trader keeps both the premium and the stock. This is an ideal result for the strategy, as the trader earns income without losing their shares.

What If the Stock Rises? - If the stock goes above the strike price, the option buyer may choose to buy the shares at that price. The trader must sell the shares at the agreed price, even if the market price is higher. The trader still keeps the premium and profits up to the strike price, but misses out on higher gains.

Ideal Market Conditions - This strategy works best in a sideways or slightly bullish market, where the stock does not rise or fall sharply. Traders often use this method to earn regular income from shares they already plan to hold.

Risk and Reward - A covered call has limited profit potential (due to the cap at the strike price), but also limited risk, since the trader owns the stock and receives the premium. It is a low-risk, income-generating strategy used by conservative traders and investors.

The working of the covered call strategy is explained in detail above. Let us now focus on understanding this strategy with an example.

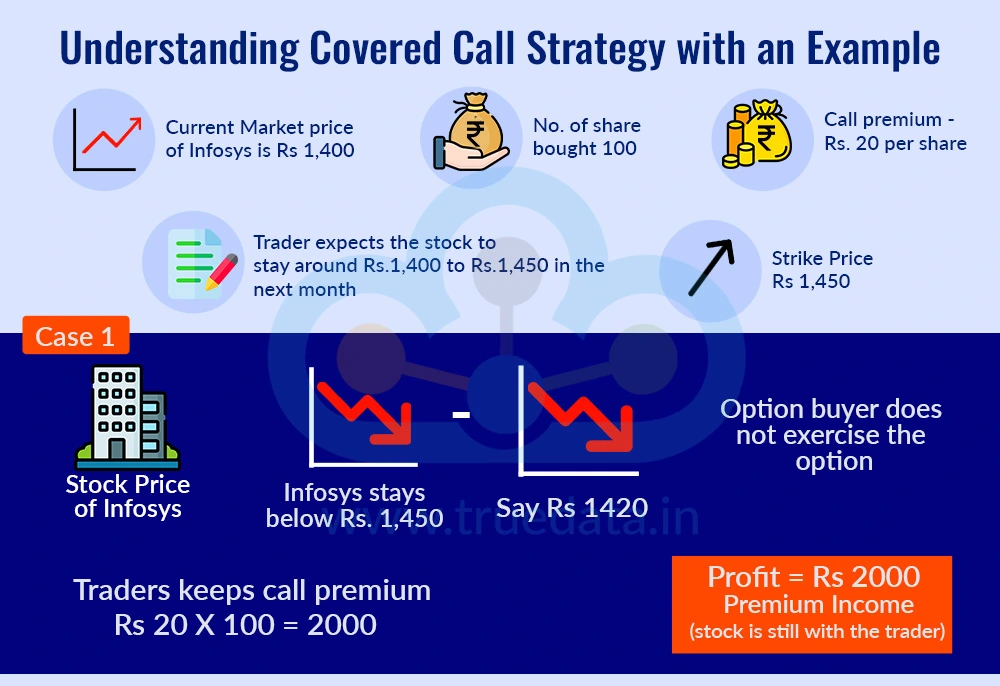

Consider a trader with 100 shares of Infosys and the following data.

The current market price of Infosys is Rs. 1,400 per share. The trader expects the stock to stay around Rs. 1,400 to Rs. 1,450 in the next month. So, the trader decides to sell a call option with a strike price of R. 1,450. The option premium received is Rs. 20 per share. Option expiry is 1 month later.

Case 1 - Infosys stays below Rs. 1,450 (say Rs. 1,420)

The option buyer does not exercise the option.

The trader keeps the Rs. 20 premium x 100 shares = Rs. 2,000 income

The trader also keeps the 100 shares.

Profit = Rs. 2,000 (premium income), stock is still with the trader

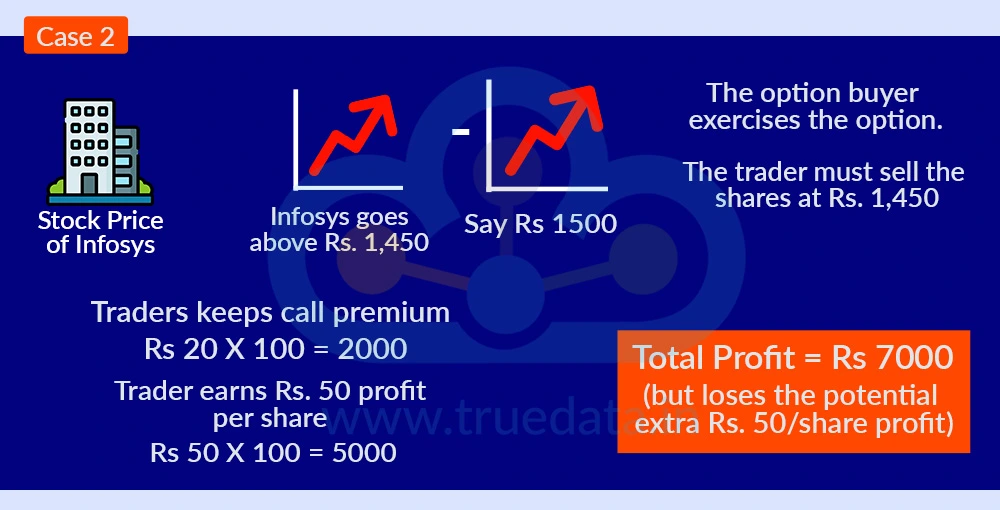

Case 2 - Infosys goes above Rs. 1,450 (say Rs. 1,500)

The option buyer exercises the option.

The trader must sell the shares at Rs. 1,450, not the higher market price.

Trader earns Rs. 50 profit per share (Rs. 1,450 - original Rs. 1,400 buy price) = Rs. 5,000

Plus, the trader keeps the Rs. 2,000 premium

Total profit = Rs. 7,000, but loses the potential extra Rs. 50/share profit

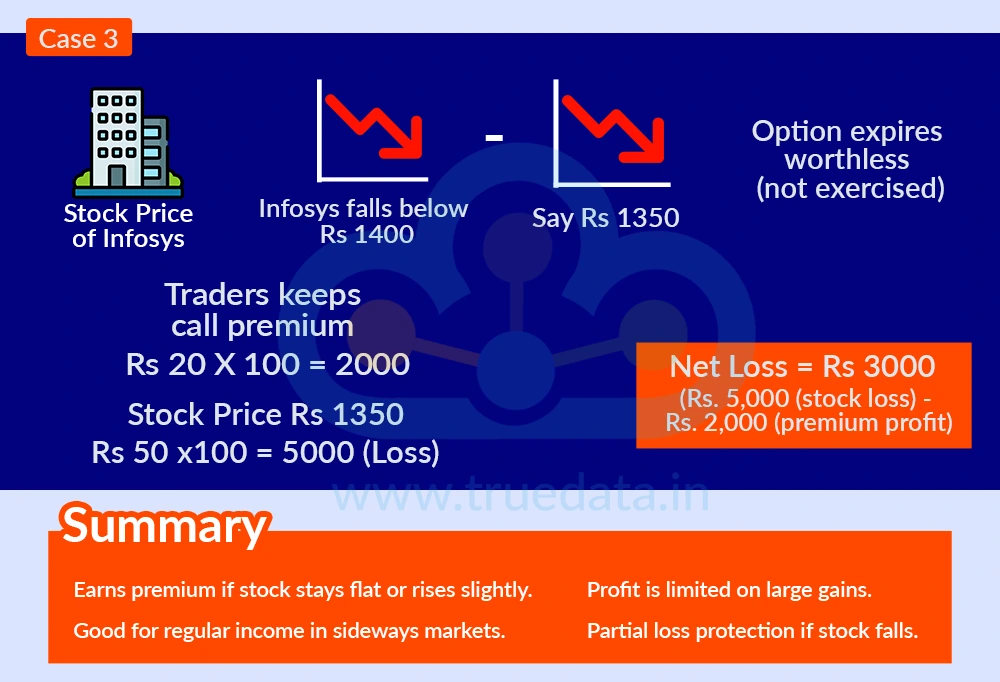

Case 3 - Infosys falls below Rs. 1,400 (say Rs. 1,350)

The option expires worthless (not exercised)

The trader keeps the Rs. 2,000 premium

But the shares are now worth Rs. 1,350, so there is a paper loss of Rs. 5,000

Net loss = Rs. 5,000 (stock loss) - Rs. 2,000 (premium) = Rs. 3,000

Summary -

The trader earns money (premium) if the stock stays flat or rises slightly.

The profit is limited if the stock goes up a lot.

The loss is reduced slightly if the stock falls, but not fully protected.

It is a good strategy for regular income from stocks already owned, especially in sideways markets.

Using the covered call strategy involves understanding the pros and cons of this strategy correctly. These pros and cons are explained below.

Extra Income from Premiums - Traders earn regular income by selling call options, even if the stock doesn’t move.

Lower Risk Compared to Naked Calls - Since the trader owns the stock, there is no fear of having to buy shares at high prices to fulfil the contract.

Partial Protection Against Small Losses - The premium received helps reduce the impact of small drops in the stock price.

Ideal for Sideways or Slow Markets - Works best when the stock stays flat or rises slightly, which is common in range-bound markets.

Makes Long-Term Holdings More Productive - Long-term investors can generate steady monthly income without selling their stocks.

Simple and Easy to Understand - Compared to other options strategies, covered calls are easy to learn and apply.

Limited Profit Potential - If the stock price rises sharply, the trader must sell at the strike price and misses out on higher gains.

Still Exposed to Large Losses - If the stock falls a lot, the premium helps only a little, and the trader can still lose big on the stock value.

Shares May Be Called Away - If the stock goes above the strike price, the trader must sell their shares, even if they wanted to hold them longer.

Requires Holding Stock - To execute this strategy, the trader must own shares, which may require a larger investment.

Not Suitable in Bull Markets - In strong upward markets, this strategy underperforms because profits are capped.

Margin or Capital May Be Blocked - Some brokers may require margin or hold capital when you write options.

The Covered Call Strategy is a smart and low-risk way for Indian traders and investors to earn regular income from stocks they already own. By selling a call option on their existing shares, traders collect a premium that offers partial protection against small losses and adds steady returns in sideways or slightly bullish markets. While the strategy limits profits if the stock rises sharply and does not fully protect against big losses, it is simple to use, safer than many other option strategies, and ideal for those looking to make their long-term holdings more productive. Overall, it is a useful tool for conservative traders seeking extra income with manageable risk.

This article explains a very basic options trading strategy and how to use it successfully. Let us know if you need further information on this topic, and watch this space for similar analysis of options trading strategies.

Till then, Happy Reading!

Read More: What is the difference between In-the-money, At-the-money and Out-of-the-money options

The world of trading is constantly evolving with the use of advanced technology ...

Technical analysis in stock markets is like playing a complex game with many rul...

The joy of successfully implementing a trading strategy and creating asuccessful...