The dollar exchange rate is constantly in the news and is often seen as a measure of the economic progress of the nation. However, traders watch the currency rates carefully to effectively trade in their target currency pair. Do you also want to be among them? Then you have come to the right place. Learn the basics of forex trading in this blog and the basic strategies that you can adopt to create your currency trading portfolio. Read More: What is the Marubozu Candlestick Pattern?

The dollar exchange rate is constantly in the news and is often seen as a measure of the economic progress of the nation. However, traders watch the currency rates carefully to effectively trade in their target currency pair. Do you also want to be among them? Then you have come to the right place. Learn the basics of forex trading in this blog and the basic strategies that you can adopt to create your currency trading portfolio. Read More: What is the Marubozu Candlestick Pattern?

Forex Trading, also known as foreign exchange trading or currency trading, refers to the buying and selling of currencies on the foreign exchange market with the goal of making a profit. It involves trading pairs of currencies where one currency is exchanged for another, aiming to take advantage of the fluctuations in their relative values. This practice is particularly relevant for traders who wish to participate in the global forex market. In Forex Trading, the trader speculates on the price movements of currency pairs. Each currency pair consists of a base currency and a quote currency. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. The objective is to predict whether the value of the base currency will appreciate or depreciate against the quote currency.

Forex trading in today’s time is quite simple as the online trading portals provided by brokers enable traders to do real-time trading in a more efficient manner along with providing the technical support needed for the same. The primary requirement for any form of trading is to open a demat account. However, some brokers require traders to open a separate account for currency trading along with a stock trading or commodity trading account depending on the policies of the trader. The steps to start forex trading are broken down into simple points hereunder.

Forex trading in today’s time is quite simple as the online trading portals provided by brokers enable traders to do real-time trading in a more efficient manner along with providing the technical support needed for the same. The primary requirement for any form of trading is to open a demat account. However, some brokers require traders to open a separate account for currency trading along with a stock trading or commodity trading account depending on the policies of the trader. The steps to start forex trading are broken down into simple points hereunder.

Some of the common forex trading strategies that can also be used by beginners in forex trading are mentioned hereunder.

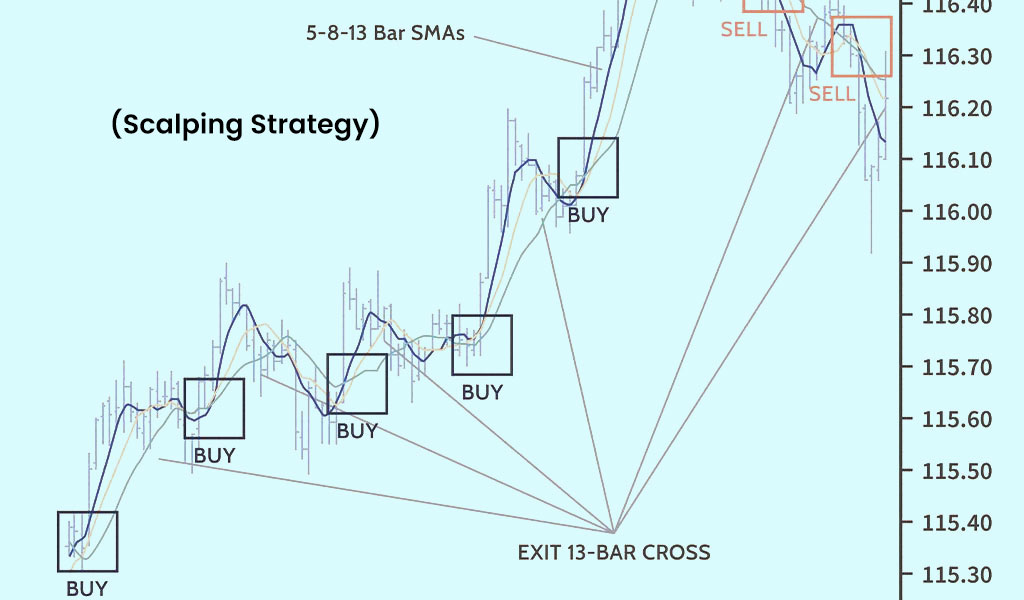

Scalping involves making quick trades to capture small price movements. Traders using this strategy aim to accumulate numerous small profits throughout the day. Scalpers often use short timeframes like 1-minute or 5-minute charts and focus on high-liquidity currency pairs. However, scalping requires quick decision-making, a disciplined approach, and excellent risk management.

Scalping involves making quick trades to capture small price movements. Traders using this strategy aim to accumulate numerous small profits throughout the day. Scalpers often use short timeframes like 1-minute or 5-minute charts and focus on high-liquidity currency pairs. However, scalping requires quick decision-making, a disciplined approach, and excellent risk management.

Day trading involves opening and closing positions within the same trading day. Day traders aim to take advantage of intraday price movements and avoid overnight risks. This strategy requires thorough analysis, quick execution, and the ability to adapt to changing market conditions. Day traders usually use technical analysis and shorter timeframes for their trades.

Day trading involves opening and closing positions within the same trading day. Day traders aim to take advantage of intraday price movements and avoid overnight risks. This strategy requires thorough analysis, quick execution, and the ability to adapt to changing market conditions. Day traders usually use technical analysis and shorter timeframes for their trades.

Swing traders aim to capture price swings or trends that occur over several days to weeks. They often use a combination of technical and fundamental analysis to identify potential trade setups. This strategy requires patience, as traders may hold positions for longer periods, but it allows for more flexibility than day trading.

Swing traders aim to capture price swings or trends that occur over several days to weeks. They often use a combination of technical and fundamental analysis to identify potential trade setups. This strategy requires patience, as traders may hold positions for longer periods, but it allows for more flexibility than day trading.

Trend trading involves identifying and trading with the prevailing market trend. Traders using this strategy believe that trends tend to persist, and they seek to enter trades in the direction of the trend. Trend followers often use indicators like moving averages to confirm and follow trends. However, it's important to manage risk, as trends can reverse unexpectedly.

Trend trading involves identifying and trading with the prevailing market trend. Traders using this strategy believe that trends tend to persist, and they seek to enter trades in the direction of the trend. Trend followers often use indicators like moving averages to confirm and follow trends. However, it's important to manage risk, as trends can reverse unexpectedly.

Range trading involves identifying areas of support and resistance where the price tends to oscillate within a range. Traders buy near support and sell near resistance, profiting from price fluctuations within the range. This strategy is suitable for markets that lack a clear trend but show consistent price levels.

Range trading involves identifying areas of support and resistance where the price tends to oscillate within a range. Traders buy near support and sell near resistance, profiting from price fluctuations within the range. This strategy is suitable for markets that lack a clear trend but show consistent price levels.

Breakout traders look for significant price movements beyond established support or resistance levels. They aim to capitalize on the momentum generated by such breakouts. Traders often use chart patterns like triangles, rectangles, or channels to identify potential breakout points.

Breakout traders look for significant price movements beyond established support or resistance levels. They aim to capitalize on the momentum generated by such breakouts. Traders often use chart patterns like triangles, rectangles, or channels to identify potential breakout points.

The carry trade involves taking advantage of the interest rate differential between two currencies. Traders buy a currency with a higher interest rate and simultaneously sell a currency with a lower interest rate. This strategy is more suitable for long-term traders and investors, as it involves holding positions over extended periods.

The carry trade involves taking advantage of the interest rate differential between two currencies. Traders buy a currency with a higher interest rate and simultaneously sell a currency with a lower interest rate. This strategy is more suitable for long-term traders and investors, as it involves holding positions over extended periods.

News traders base their decisions on the impact of economic data releases, geopolitical events, and central bank announcements on currency markets. They aim to profit from rapid price movements triggered by unexpected news events. However, news trading carries significant risks due to the volatility and unpredictability of market reactions to news.

News traders base their decisions on the impact of economic data releases, geopolitical events, and central bank announcements on currency markets. They aim to profit from rapid price movements triggered by unexpected news events. However, news trading carries significant risks due to the volatility and unpredictability of market reactions to news.

Hedging involves opening opposite positions to reduce or offset potential losses. Traders use this strategy to protect their investments from adverse market movements. Hedging can be especially relevant for businesses engaged in international trade to mitigate currency risk.

Hedging involves opening opposite positions to reduce or offset potential losses. Traders use this strategy to protect their investments from adverse market movements. Hedging can be especially relevant for businesses engaged in international trade to mitigate currency risk.

This strategy involves using moving average crossovers (e.g., when a shorter-term moving average crosses above a longer-term moving average) to identify potential entry and exit points. Traders view crossovers as signals of trend changes and use them to guide their trading decisions.

This strategy involves using moving average crossovers (e.g., when a shorter-term moving average crosses above a longer-term moving average) to identify potential entry and exit points. Traders view crossovers as signals of trend changes and use them to guide their trading decisions.

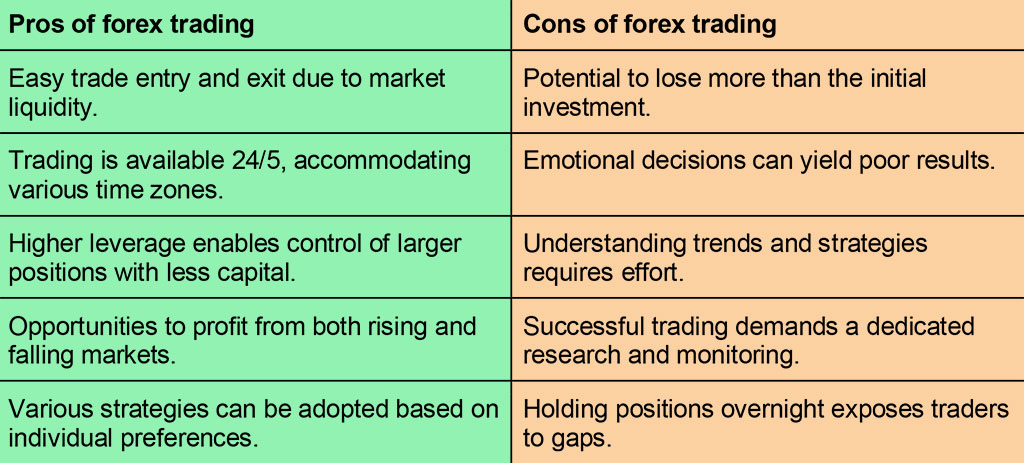

The pros and cons of forex trading are tabled below.

Forex trading is a popular form of trading across the globe and India is also seeing a huge increase in the number of forex traders over the past few years. This increase can be attributed to the increasing awareness about currency trading and stock markets in general and the abundant resources to learn the same that are available online as well as offline. We hope this blog was able to provide you with the basic details of forex trading and how you can begin shaping your currency portfolio. Let us know if you want further details on this topic or a better understanding of any of the above trading strategies. Till then Happy Reading!

Read More: Power Your Trading Decisions with TrueData’s Low Latency Web Socket APIs

If you are a regular trader you would have frequently noticed a gap in the price...

Stock trading is not a simple and straightforward concept and requires a detail...

When we take our first step into the trading game, we choose the best resource...

Mohit Kumar

December 05, 2023The great impact of your blog on performance is a testament to the goodness and rich wisdom it delivers.