An economist's guide to navigating India's growth story from a time when 2G licenses cost just $2 to the modern investment landscape that's poised to become the world's next major profit center.

While much of the world faces significant headwinds, India presents a stark contrast:

Demographic Dividend: Average age of 28 compared to rapidly aging populations in developed economies

Strong Financial Foundation: Savings rate of approximately 30% of GDP, creating substantial domestic capital base

The Transformation: India is rapidly evolving from a "promising demographic" to "the last large profit pool" on the planet.

These foundational shifts are creating unprecedented investment opportunities across multiple sectors of the Indian economy.

These trends aren't merely theoretical - they're manifesting in tangible ways that are transforming everyday life for India's 1.4 billion citizens while creating structural opportunities for investors with a long-term horizon.

As global tensions between major powers increase, multinational companies are actively diversifying their supply chains away from complete dependence on China. India has emerged as the primary beneficiary of this strategic shift.

Geopolitical tensions between US-China

European concerns about supply chain resilience

India's manufacturing incentive programs (PLI schemes)

Skilled workforce at competitive wages

Improving ease of doing business metrics

This trend has accelerated dramatically post-pandemic, with major global players like Apple, Samsung, and pharmaceutical giants expanding their Indian manufacturing footprint.

The shift is especially pronounced in electronics, pharmaceuticals, and specialty chemicals creating investment opportunities across the manufacturing value chain.

India has built digital public infrastructure at unprecedented scale and speed.

Unlike the Silicon Valley model of private platforms, India has pioneered public digital infrastructure:

UPI (Unified Payments Interface): Processes over 10 billion transactions monthly, democratizing digital payments for even the smallest vendors

ONDC (Open Network for Digital Commerce): Creating an open protocol for e-commerce to challenge platform monopolies

Account Aggregator Framework: Revolutionizing financial data sharing with consent-based architecture

This infrastructure is creating a level playing field where innovation can flourish without being trapped in walled gardens. The result is visible on street corners where vegetable vendors accept digital payments and in rural areas where financial inclusion is accelerating.

India's UPI processed more digital transactions in 2023 than Visa and Mastercard combined globally, while maintaining near-zero transaction costs.

Solar Economics: Transformation For new power plants, solar has become cheaper per watt than coal, driving massive investment in renewable capacity

Policy Support: National Solar Mission and Production Linked Incentive schemes have created a favorable environment for green energy investments

Consumer Adoption: EV two-wheelers now competitive with petrol variants on EMI basis, driving mass-market adoption

India's energy transformation is occurring at a pace that surprises even veteran observers. The country is set to add more solar capacity in the next five years than it had total power generation capacity in 2000.

For investors, this creates opportunities across the value chain -from solar panel and battery manufacturing to EV components and charging infrastructure. The shift is structural rather than cyclical, supported by both economics and policy.

Both central and state governments have recognized that infrastructure development is not just about economic capacity but also about employment generation. This has led to a coordinated push to accelerate infrastructure projects nationwide.

Key Areas of Development:

Metro rail systems in tier 1 and 2 cities

National highway expansion (over 40km/day)

Port modernization and capacity expansion

Dedicated freight corridors for railways

Airport development (including smaller cities)

The fiscal discipline imposed by rules at both central and state levels has actually accelerated rather than constrained infrastructure development, as governments prioritize productive capital expenditure over consumption subsidies.

"More metro lines have been opened in the past 8 years than in the previous 60 years combined a testament to the acceleration of infrastructure development across India."

This infrastructure development creates investment opportunities not just in construction but in the entire supporting ecosystem - from cement and steel to logistics and urban development.

If a sector's India revenue is today ≥ 20% of the world's present demand and the top-3 global players together have < 20% Indian market share, the sector can compound 20% per year earnings growth for a decade.

This elegant framework helps identify sectors poised for sustained, above-average growth. The rule identifies opportunities where:

India already represents a meaningful portion of global demand (≥20%)

The market remains fragmented (top global players have <20% share)

These conditions create space for local champions to emerge and global players to expand

Sectors currently matching these criteria include pharmaceuticals, two-wheelers, specialty chemicals, and select technology services segments.

The Rule of 20s helps identify markets where India has already achieved critical mass in global terms, but remains under-penetrated by established players - creating the perfect conditions for sustained growth.

The Core Principle: Buy when a stock's predictable free-cash-flow yield exceeds the 10-year Indian g-sec yield + 4% margin. Current threshold: 10-yr g-sec ≈ 7% → look for > 11% FCF yield

Simplified Implementation: No need for complex spreadsheets: Value Research MF screener already shows equity funds beating this hurdle in industrial & IT manufacturing names.

Practical Application: This approach provides a disciplined entry point that balances growth potential with valuation protection -particularly important in high-growth markets where.

This valuation discipline is particularly important in India, where growth stories can sometimes command premiums that outpace their near-term cash generation ability. The Price-Growth Window creates a margin of safety while still allowing participation in the country's structural growth trajectory. Currently, this approach highlights opportunities in industrial manufacturing, IT services, and select financial services companies with established cash flow patterns. It naturally steers investors away from the most speculative segments of the market.

Five key themes present compelling opportunities in India's evolving economy, each accessible through different investment vehicles.

Focus: APIs, Electronic Manufacturing Services

Examples: Syngene International, Dixon Technologies

Due Diligence: Check if China still accounts for >70% of global volume yet company has a 'green-field expansion plan' on Indian soil. Prefer companies with already built factories (brown-field) so FCF yield emerges fast.

Focus: IT services with emerging Al capabilities

Examples: Tata ELXSI, Nippon India NIFTY IT ETF

Due Diligence: Track INR depreciation vs USD - each ₹1 fall adds ~0.75% to IT margins, creating a natural hedge against currency movements.

Focus: Solar power, electric vehicle ecosystem

Examples: National Solar Mission ETFs, Aditya Birla Sun Life PSU - Infra ETF

Due Diligence: Look at Power-purchase-agreement (PPA) tenor. Contracts longer than 20 years give predictability = higher FCF.

Focus: Infrastructure supporting India's growing trade

Examples: Indiabulls Real-Estate Infra ETF (includes ports)

Due Diligence: Eye volume growth of ports > 2x India GDP growth, indicating outperformance in trade infrastructure.

Focus: Self-reliance in military equipment

Examples: Mazagon Dock Shipyard, Bharat Dynamics via Bharat 22 ETF

Due Diligence: Government's revenue share in order book should be > 95%. The primary risk is policy shift, not tariff constraints.

These thematic opportunities represent structural shifts in the Indian economy, not merely cyclical trends. Each is supported by policy continuity, changing consumer preferences, and global realignments that are likely to persist regardless of electoral outcomes.

For investors seeking exposure to India's growth story, these themes offer entry points that balance sector-specific potential with the broader economic transformation. Each theme offers both pure-play options for sophisticated investors and diversified vehicles for those seeking more balanced exposure.

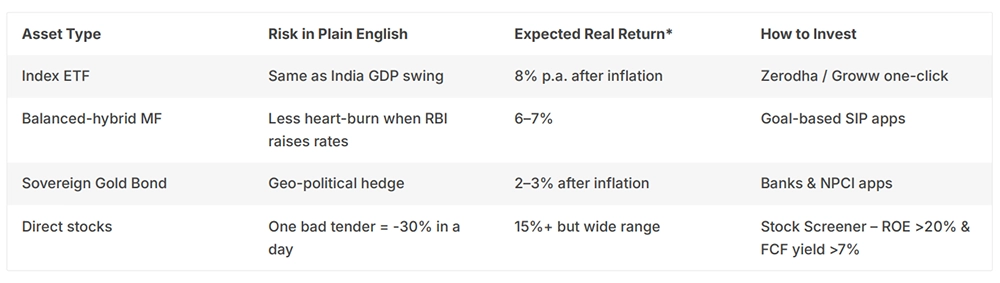

* Real return = assumes 5% CPI inflation and ignores taxes

This menu provides a spectrum of options based on investor sophistication and risk tolerance. For most non-expert investors, a core allocation to index ETFs supplemented with balanced-hybrid mutual funds offers an optimal combination of participation in India's growth story while managing volatility.

The key advantage of this approach is simplicity - sophisticated concepts like the Rule of 20s and the Price-Growth Window are effectively implemented by professional fund managers, while individual investors can focus on consistent allocation and disciplined investment behavior.

Modern investment platforms have dramatically simplified access to Indian markets for both domestic and international investors. What once required complex paperwork and multiple intermediaries can now be accomplished with a few clicks.

Dixon Technologies exemplifies the contract manufacturing opportunity in India. Starting as a modest TV assembly operation, the company has transformed into a diversified electronics manufacturing services (EMS) player with global ambitions.

PLI Scheme Beneficiary: Qualified for Production Linked Incentives across multiple electronics categories

Diversified Client Base: Manufacturing for Samsung, Xiaomi, Motorola and other major brands

Expanding Product Categories: From TVs to mobile phones, washing machines, and LED lighting

Scale Advantages: Achieving economies of scale that smaller players cannot match

Dixon's revenue CAGR of over 40% in the last five years demonstrates the potential of the contract manufacturing theme as global companies seek alternatives to Chinese manufacturing. Dixon's success illustrates how Indian manufacturing is moving up the value chain from simple assembly to integrated manufacturing with increasing local value addition a journey that creates investment opportunities at multiple points.

The Rule of 20s in Action: The electronics manufacturing sector in India accounts for over 20% of global demand, yet the top three global EMS players have less than 20% market share in India.

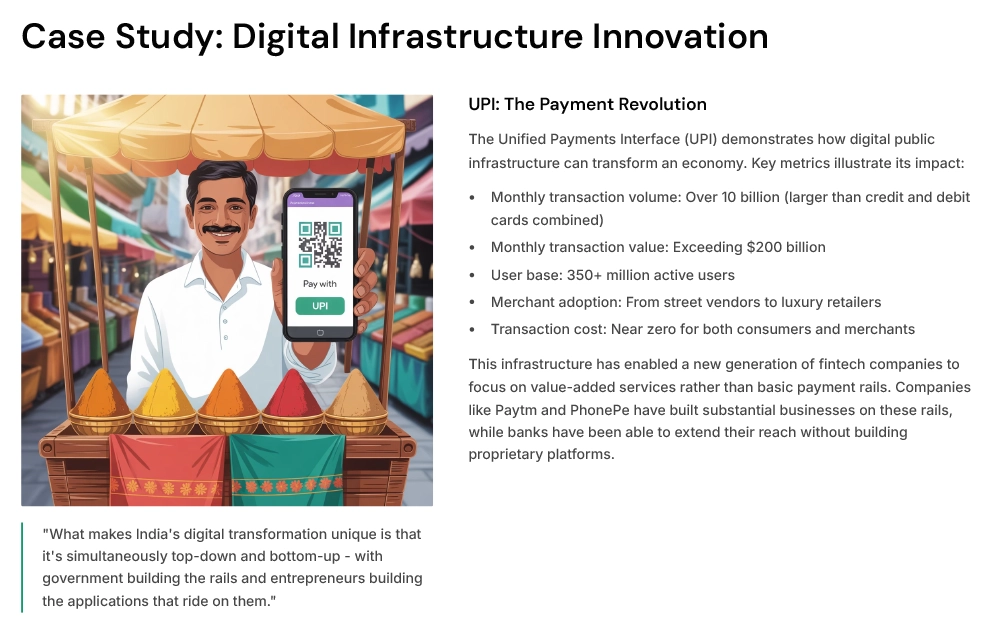

"What makes India's digital transformation unique is that it's simultaneously top-down and bottom-up - with government building the rails and entrepreneurs building the applications that ride on them."

The Unified Payments Interface (UPI) demonstrates how digital public infrastructure can transform an economy. Key metrics illustrate its impact:

Monthly transaction volume: Over 10 billion (larger than credit and debit cards combined)

Monthly transaction value: Exceeding $200 billion

User base: 350+ million active users

Merchant adoption: From street vendors to luxury retailers

Transaction cost: Near zero for both consumers and merchants

This infrastructure has enabled a new generation of fintech companies to focus on value-added services rather than basic payment rails. Companies like Paytm and PhonePe have built substantial businesses on these rails, while banks have been able to extend their reach without building proprietary platforms.

Oil Dependency Risk: Every $10 rise in Brent crude oil prices reduces GDP growth by approximately 0.3 percentage points and complicates budget mathematics. Hedge Strategy: Own SBI ETF-Nifty Energy which includes both ONGC and Reliance in one click, providing natural exposure to companies that benefit from higher energy prices.

Federal-State Fiscal Friction: Coordination challenges between central and state governments can slow infrastructure rollout and policy implementation. Hedge Strategy: Infrastructure trusts (InvITs) often bypass state gridlock. Example: IRB InvIT gives annualized 9.5% dividend yield payable in cash.

Capital-Flow Volatility: Sudden changes in US interest rates can trigger capital outflows from emerging markets including India. Hedge Strategy: Keep 10% allocation in Sovereign Gold Bond; it is liquid on exchange despite carrying a "lock-in" label.

While India's growth trajectory appears robust, prudent investors should acknowledge these structural vulnerabilities and implement appropriate hedging strategies. These risks are manageable but ignoring them entirely could lead to unnecessary volatility in portfolio returns.

India's investment case has demonstrated remarkable resilience to political cycles over the past two decades. Key reasons include:

Bipartisan Consensus: Core economic reforms enjoy broad support across the political spectrum

Institutional Stability: Independent central bank, judiciary, and election commission

Federal Structure: Power distribution across levels of government creates checks and balances

Civil Service Continuity: Professional bureaucracy maintains implementation continuity

The most significant economic reforms of the past 30 years have been initiated by different political parties but carried forward by successive governments, creating policy predictability that transcends electoral outcomes.

While election cycles may create short-term market volatility, the long-term investment thesis for India remains intact across political administrations a crucial consideration for investors with multi-year horizons.

India conducts the world's largest democratic exercise, with over 900 million eligible voters. Despite this scale, power transitions have been remarkably smooth, with peaceful transfers of authority between different political parties.

Growth Potential: India's projected 6-7% GDP growth over the next decade outpaces most large economies, developed or emerging.

English Proficiency: Widespread English usage facilitates integration with global economy and reduces friction for international investors.

Demographic Advantage: Unlike China, Russia, and many Eastern European markets, India's population is young and still growing, creating a multi-decade consumption tailwind.

Institutional Strength: Independent judiciary, central bank, and electoral system provide governance advantages over many peer markets.

While all emerging markets offer growth potential, India's combination of scale, stability, and structural drivers creates a uniquely compelling long-term investment case. Unlike many markets that are primarily commodity-driven or export-dependent, India offers a more balanced growth model underpinned by domestic consumption, services exports, and manufacturing growth.

STEP 1: Pick Two ETFs - Select one broad market Index ETF and one infrastructure/green energy focused ETF. This provides exposure to both the general economic growth and specific sectoral opportunities.

STEP 2: Set Monthly SIP - Establish a Systematic Investment Plan (SIP) equal to your monthly mobile phone bill. This creates a psychological anchor that most people find sustainable.

STEP 3: Annual Rebalance - Once yearly, rebalance your portfolio so neither ETF exceeds 60% of the total. This maintains diversification while allowing for outperformance.

STEP 4: Use NPS Tier-2 as Zero-Cost Parking - Utilize the National Pension System Tier-2 account as a zero-cost parking facility, withdrawing only when market PE exceeds 22 (a valuation indicator).

This simple four-step approach provides a structured entry into the Indian market without requiring complex analysis or constant monitoring. It harnesses the power of disciplined, regular investing while maintaining sufficient flexibility to adjust based on market conditions.

India is not just an investment destination but a laboratory for solutions to global challenges - from financial inclusion to climate adaptation and affordable healthcare.

While investment returns are certainly important, India's development story represents something more profound a test case for whether democratic institutions and market economies can deliver broad-based prosperity at scale in the 21st century.

Innovation Ecosystem: India is developing solutions for challenges faced by the Global South - from affordable healthcare to financial inclusion

Climate Leadership: Despite development needs, India has set ambitious renewable energy targets and is pioneering low-carbon growth models

Demographic Dividend: Success in creating opportunities for India's youth has implications for global stability and prosperity

Democratic Development: India's trajectory offers an alternative model to authoritarian capitalism

Investors in India are not just participating in a market but in one of the defining economic transformations of the 21st century with implications far beyond financial returns.

Structural Growth Drivers: India's growth is underpinned by demographics, digital infrastructure, energy transformation, and manufacturing shift - creating a multi-decade opportunity.

Analytical Frameworks: The Rule of 20s and Price-Growth Window provide disciplined approaches to identifying specific opportunities within the broader India story.

Accessible Entry Points: From ETFs to mutual funds, investors of all sophistication levels can participate in India's growth trajectory with appropriate vehicles.

Managed Risks: While risks exist - from oil dependency to political cycles - they can be managed through diversification and strategic allocation.

India has transitioned from being merely a "promising emerging market" to becoming "the last large profit pool" in a world of aging demographics and slowing growth. This structural shift creates opportunities that extend beyond cyclical market movements.

For investors willing to take a long-term perspective, India offers not just returns but participation in one of history's great economic transformations - the rise of the world's largest democracy to economic prominence on the global stage.

"If these four lines get you curious, the 'complicated' bit ends there. India's investment story can be as simple or as sophisticated as you choose to make it."

India's chemical industry stands at a pivotal point of growth and transformation...

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric v...

The recent Union Budget 2023 had a special focus on renewable energy and the go...