How do Mutual Funds work - The most ideal way of earning cash is by investing in trade markets. In any case, the issue is, retail financial investors generally don't have a lot of information about the trade markets. Since they don't comprehend how it works, they wind up losing money by putting resources into financial exchanges.

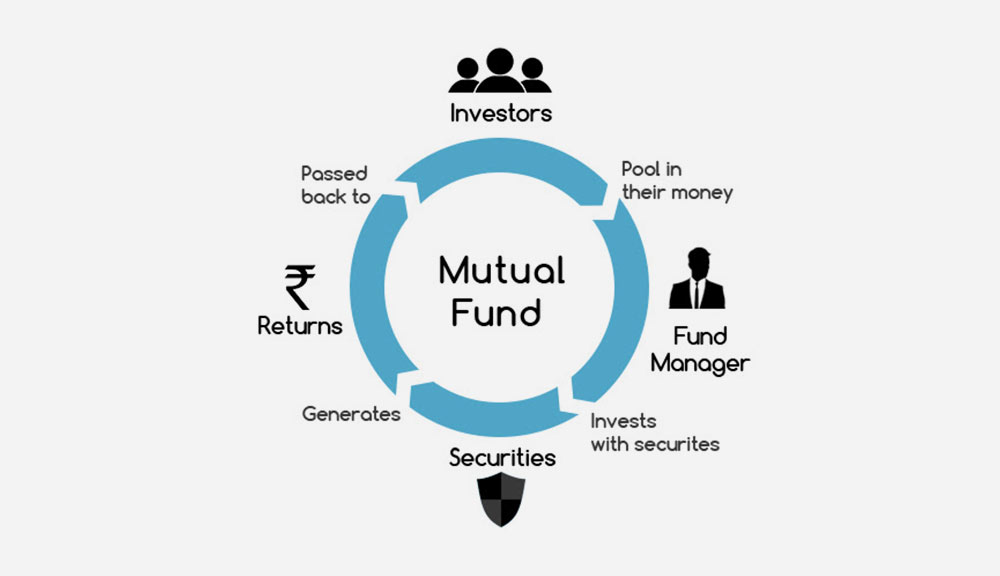

The least demanding way of putting resources into the trade market is by putting your cash in Mutual Funds. The money for Mutual Funds is dealt with by an asset supervisor who is a trade master. He/she has balanced information about the trade markets and handles your stocks as an expert.

Mutual Funds gather cash from a few economic backers and all the cash set up is then contributed. Presently, the ventures are made dependent on the subject of the Mutual Fund. For instance, enormous cap Mutual Funds will just put resources into huge cap stocks. So, on the off chance that you have placed your cash in a huge cap Mutual Fund, you know about where your cash is being contributed.

Mutual Funds are not just for securities exchange contributing: The greatest misguided judgment about putting resources into Mutual Funds is – traders generally expect that Mutual Funds just put resources into the trade markets. In case you are a moderate financial backer, and you don't like to take an excess of hazard, then, at that point, through Debt Mutual Funds, you can likewise put resources into debt instruments, where the danger factors are substantially less. Subsequently, you can pick Mutual Funds, according to your danger craving, venture skyline, or your speculation targets.

The asset chief of Mutual Fund leads the examination and investigation around the stocks and debt instruments. Presently if you invest into Mutual Funds, the Asset Management Company or AMC allocates you the units according to the NAV of the Mutual Fund. For instance, say that you have put Rs 2,000 in a Mutual Fund, for which the NAV is Rs 20. Now, the AMC will distribute you 100 units of that Mutual Fund Scheme. Your cash is invested into trade markets in which the fund assistant has invested the money.

Presently, we should expect you have contributed Rs 2,000 on a Mutual Fund conspire, for which the AMC has distributed you 100 units for the NAV of Rs 20. In the subsequent year, the NAV for the Mutual Fund becomes Rs 22. That implies over the most recent year, you have procured a 10% profit from your Mutual Funds. In this way you can follow your ventures to know what sort of profits you are acquiring on your speculations.

Here we might want to caution you that for a retail financial backer it is an incomprehensible undertaking to make a portfolio like Mutual Funds. This is basically because, when an asset supervisor makes a portfolio, he/she gives the greatest amount of significance to chance administration, which is hard for a retail financial backer to sort out.

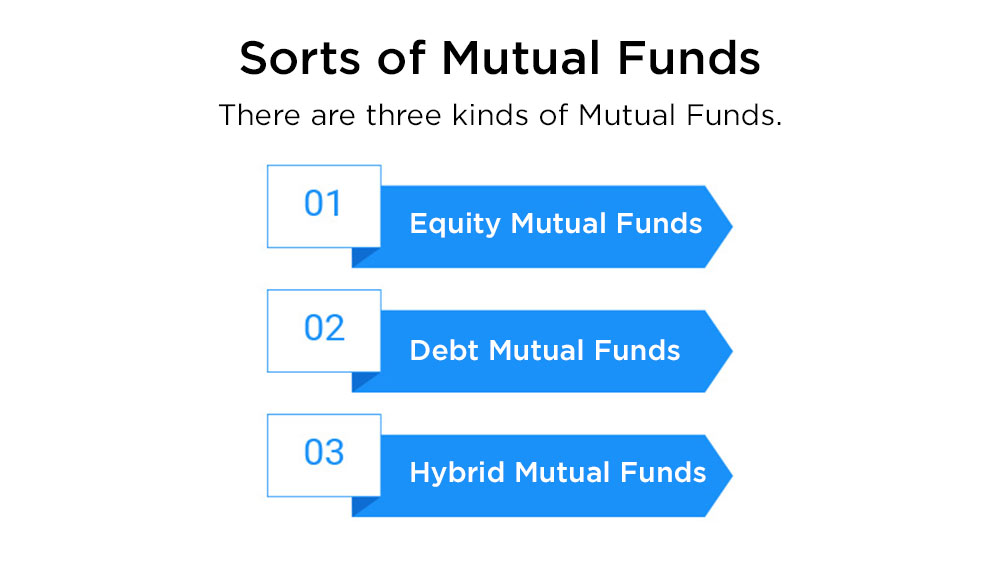

There are three kinds of Mutual Funds. Furthermore, it is fundamental to know about every one of the three to pick the right Mutual Fund for making your speculation. This characterization is made dependent on the basic resources.

These assets put resources into trade markets. On the off chance that the Mutual Funds are putting resources into enormous organizations, they can be characterized as Large Cap Mutual Funds. In the meantime, some reserves are put generally in little organizations, and they are portrayed as Small Cap Mutual Funds.

For Debt Mutual Funds, the characterizations are made dependent on loaning residency and the nature of the borrower.

On the off chance that we take the case of Short Duration Mutual Funds, these assets for the most part put resources into debt instruments whose development is inside one to three years. Likewise, for Gilt Mutual Funds, the cash is put distinctly in government protections. These are high evaluated protections and their credit hazard is low.

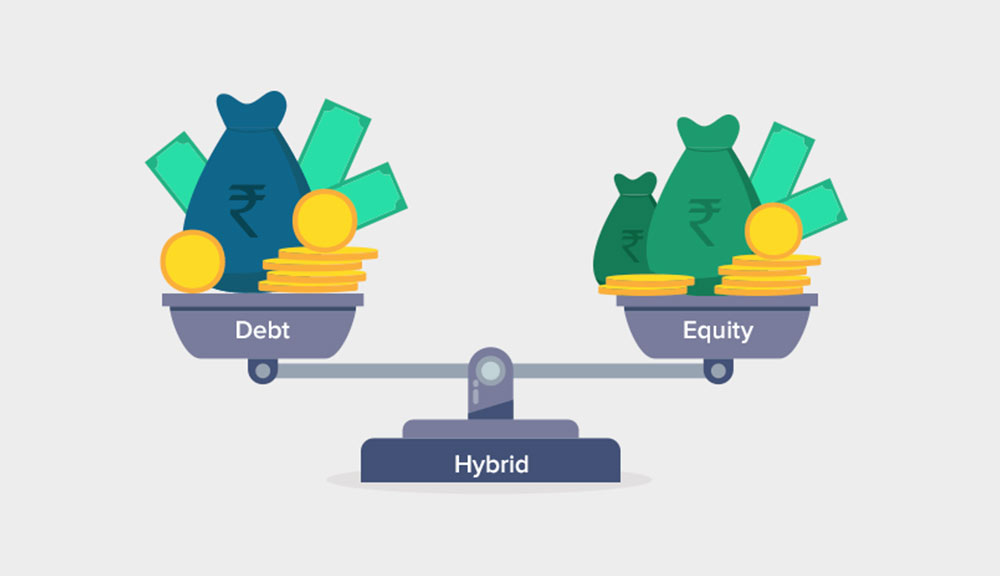

These assets are normally put both in equity and debt. They are additionally arranged based on what amount is put resources into equity and debt. Taking a gander at the extent of the venture, it tends to be ordered whether it is debt situated adjusted or crossbreed assets, or equity arranged adjusted assets.

Mutual Funds are charge well disposed: Presumptuous, you are in the most elevated duty section, the expense sum for your Mutual Fund ventures will be a lot of lower than conventional speculation choices like fixed stores.

Provide great long-haul returns: Assuming you put resources into Mutual Funds as long as possible, it is conceivable that the Mutual Fund plan will give better yields when contrasted with fixed stores. If you check out the drawn-out returns of Mutual Funds, however, there are no reliable returns, they typically give better yields than customary speculation choices.

Regulated by SEBI: All Mutual Fund plans are directed by the Securities and Exchange Board of India or SEBI. It guarantees that there is sufficient straightforwardness on the lookout.

Several assets to browse: More than 1000 Mutual Fund speculation plans are accessible on the lookout, and you can decide to contribute according to your venture skyline, hazard hunger, and speculation objective.

A mutual fund is an incredible tool to invest in. In any case, mutually financial backers avoid putting resources into Mutual Funds believing it to be hazardous, basically because they are market-connected. On the off chance that an investor picks an asset according to his/her speculation skyline and unbiased, then, at that point, it is nearly impossible that one can turn out badly by putting resources into Mutual Funds.

Introduction For the longest time, investment in stock markets was thought to b...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

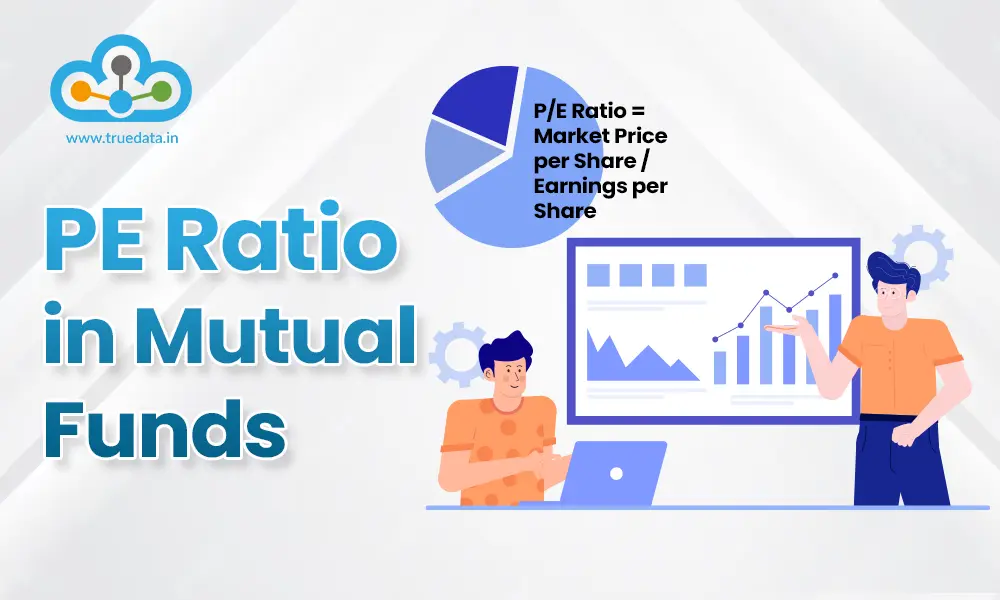

Every investor knows that the stepping stones to a good investment in thestock m...