One of the top sources of passive income is the dividends from stocks, In fact, there are many investors that invest in stock markets with the sole purpose of creating an alternate source of income in the form of dividends and interest. So which are the top stocks in the Indian stock markets that provide the highest dividends and should be a definite addition to your portfolio? Check out this blog to get a few names that are among the list of the highest dividend-paying stocks and other details relating to dividend income. Read More: Blue-chip stock-Learn more about them

One of the top sources of passive income is the dividends from stocks, In fact, there are many investors that invest in stock markets with the sole purpose of creating an alternate source of income in the form of dividends and interest. So which are the top stocks in the Indian stock markets that provide the highest dividends and should be a definite addition to your portfolio? Check out this blog to get a few names that are among the list of the highest dividend-paying stocks and other details relating to dividend income. Read More: Blue-chip stock-Learn more about them

Let us not have an overview of the stocks with the highest dividend yield and their related details.

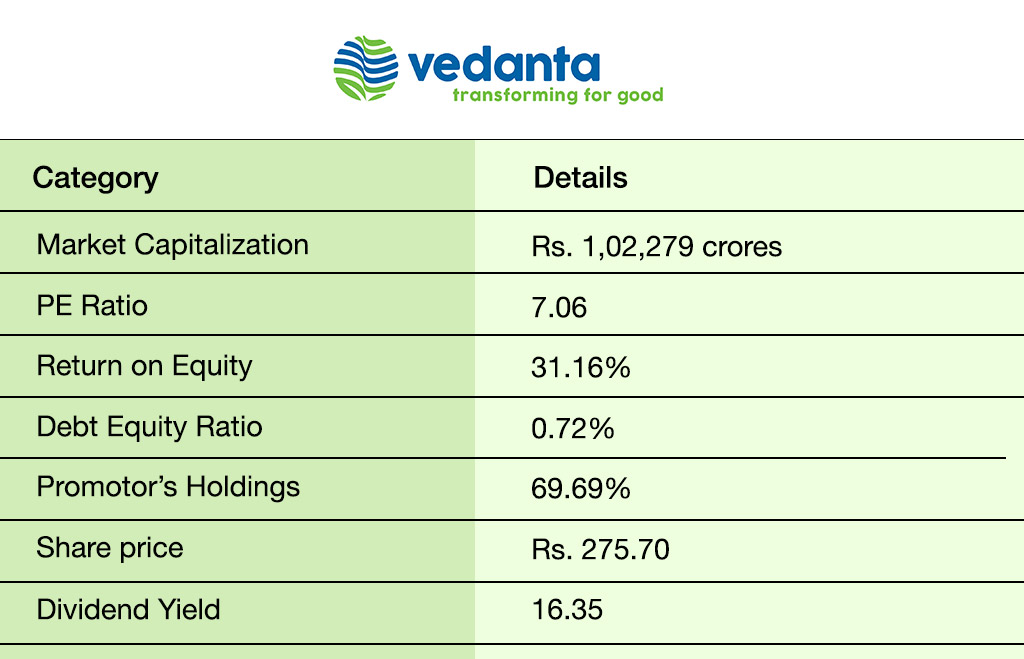

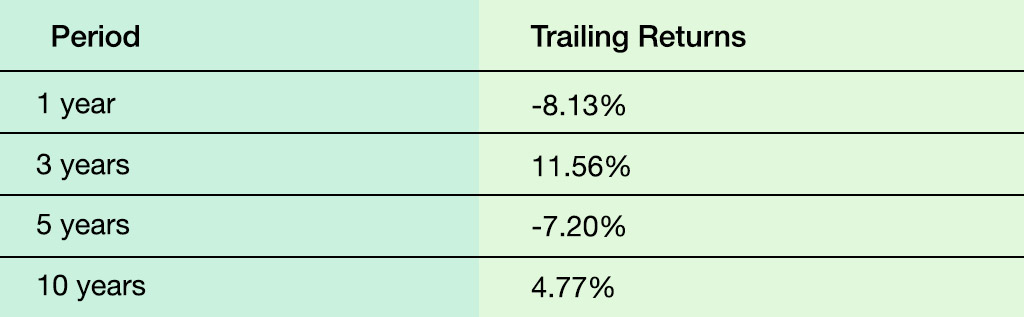

This company is engaged in the business of exploring, extracting, and processing minerals and oil & gas. The group engages in the exploration, production, and sale of zinc, lead, silver, copper, aluminum, iron ore, and oil & gas having a presence across India, South Africa, Namibia, Ireland, Liberia & UAE. The key details of this company are tabled below.  The trailing returns of Vedanta Limited are tabled below

The trailing returns of Vedanta Limited are tabled below

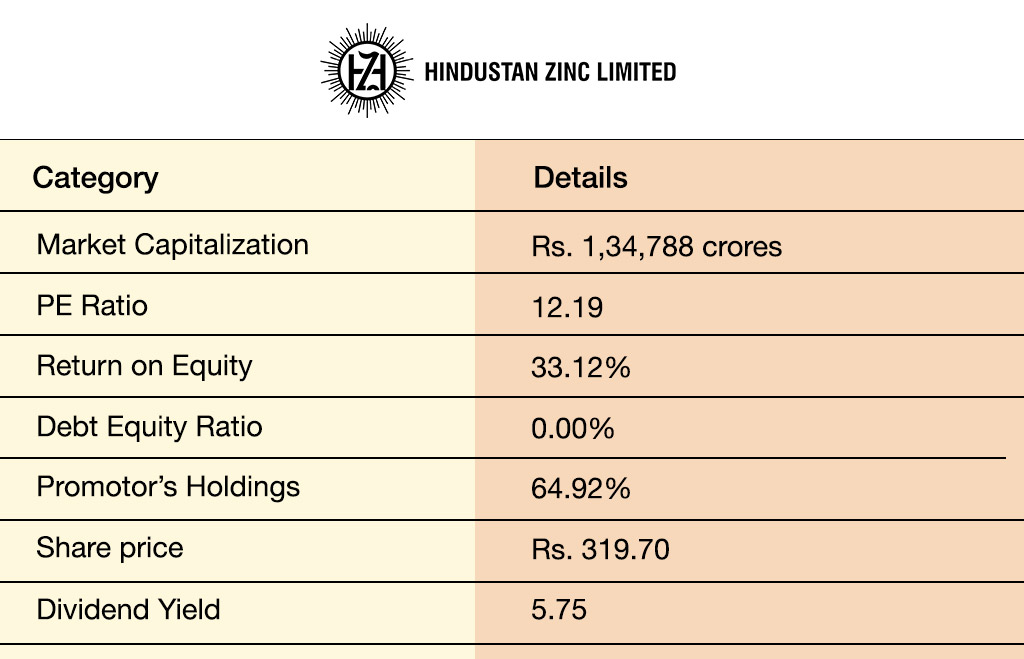

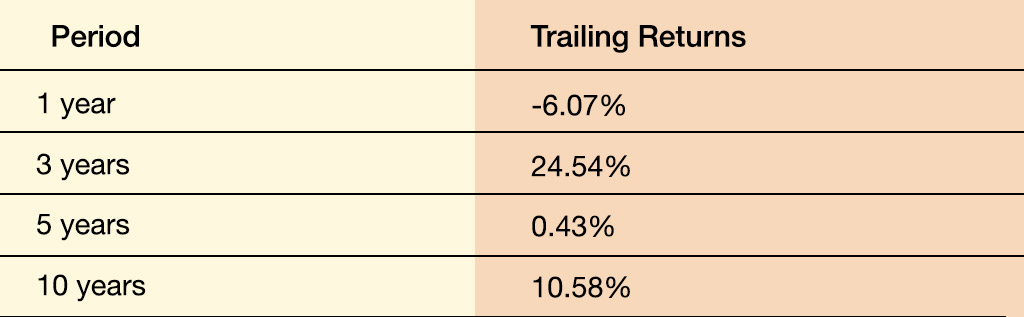

This company was incorporated in 1966 and has more than 5 decades of experience in zinc mining and smelting. HZL is one of the lowest-cost producers of zinc globally and it is India's Only Integrated producer of Zinc, Lead, and Silver. The key details of this company are tabled below.  The trailing returns of Hindustan Zinc are tabled below

The trailing returns of Hindustan Zinc are tabled below

This company is a PSU that is awarded the title of Maharatna Company. It is a market leader in the Oil refining & petroleum marketing sector of India and has business interests straddling the entire hydrocarbon value chain - from Refining, Pipeline transportation, and marketing of Petroleum products to R&D, Exploration & production, marketing of natural gas and petrochemicals. The key details of this company are tabled below.  The trailing returns of IOCL are tabled below

The trailing returns of IOCL are tabled below

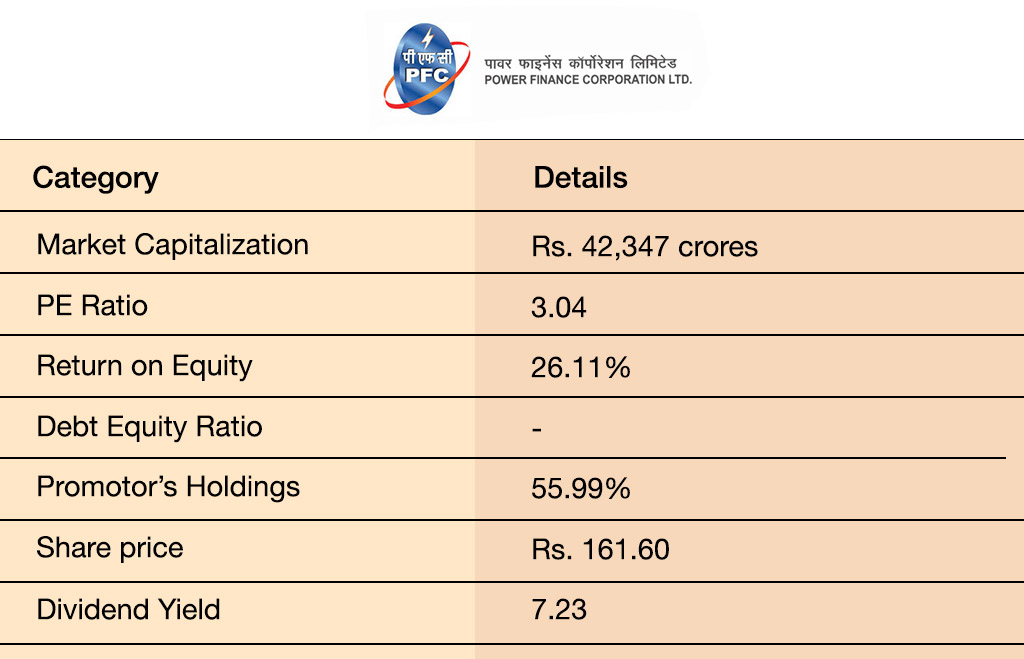

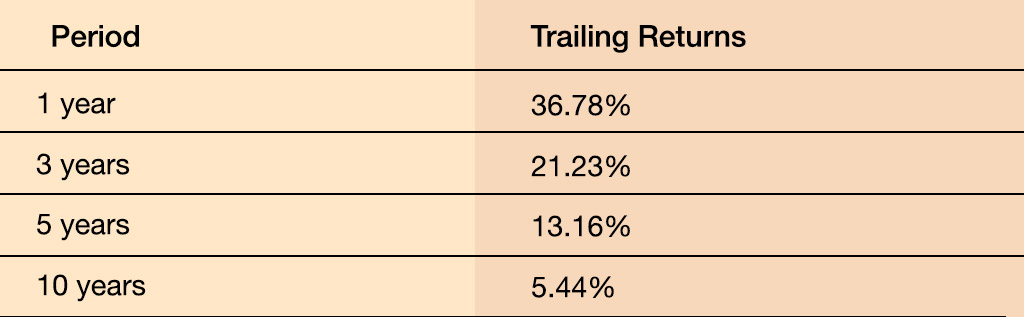

This company is a Systemically Important Non-Deposit taking NBFC registered with the RBI as an Infrastructure Finance Company. It is engaged in extending financial assistance to the Indian power sector. The key details of this company are tabled below.  The trailing returns of this company are tabled below

The trailing returns of this company are tabled below

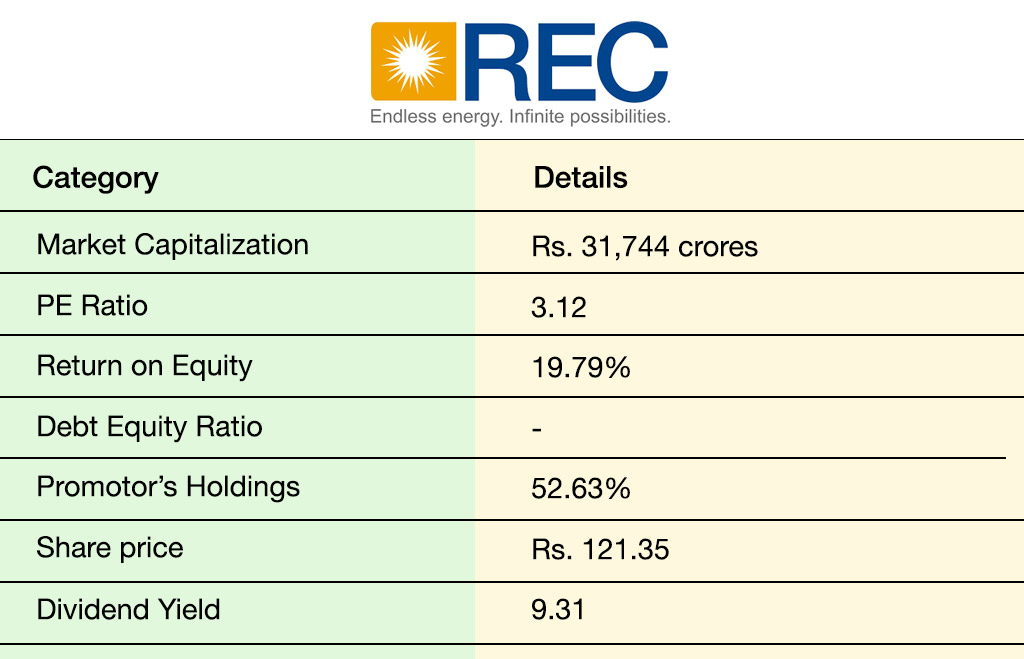

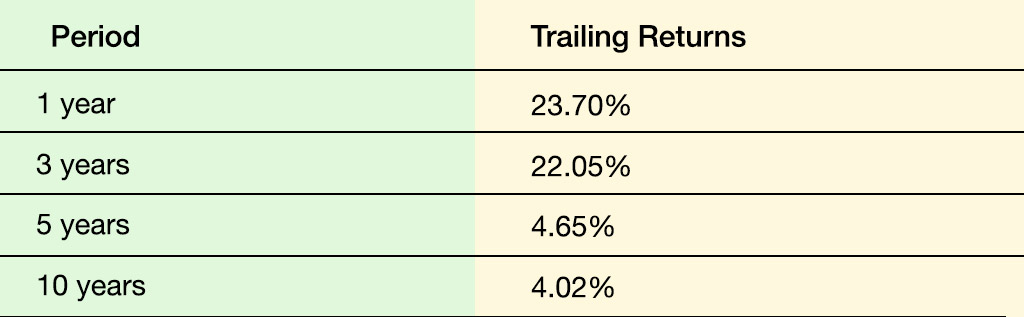

This company is a PSU that is engaged in financing projects in the complete power sector value chain from generation to distribution. The key details of this company are tabled below.  The trailing returns of this company are tabled below

The trailing returns of this company are tabled below

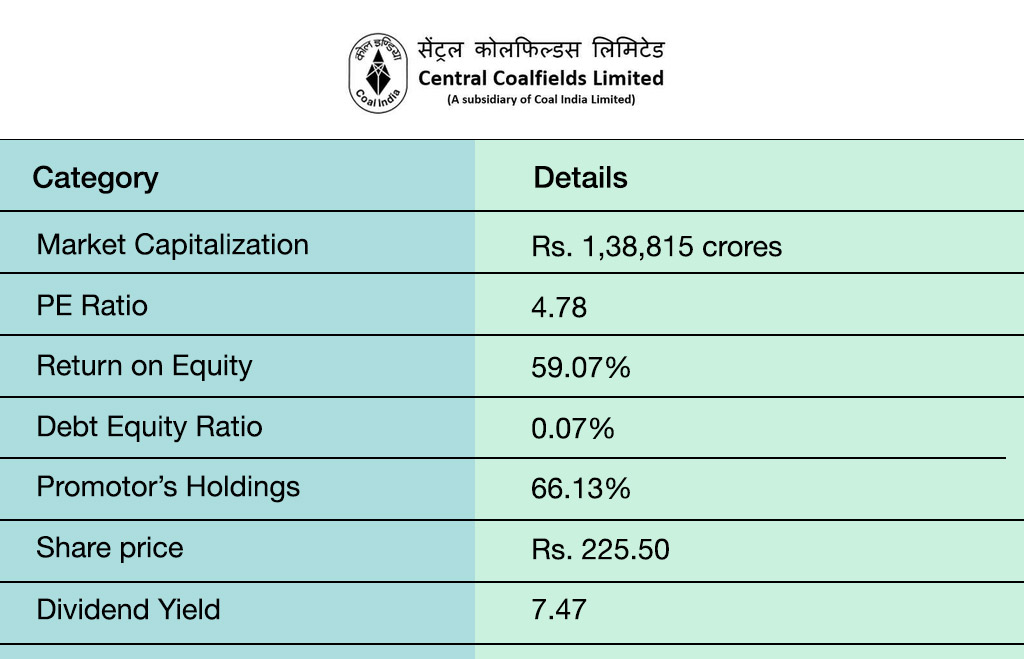

This is a PSU mainly engaged in the mining and production of Coal and also operates Coal washeries. The major consumers of the company are power and steel sectors. Consumers from other sectors include cement, fertilizers, brick kilns etc. The key details of this company are tabled below.  The trailing returns of this company are tabled below

The trailing returns of this company are tabled below

There are essentially two ways to go in stock markets either trading or investing. The basic difference between the two is the approach and the time horizon where trading is from the short-term view while investing is from the long-term perspective. In both cases, investors and traders can earn money either in the form of capital gains or from dividends and interest income. Capital gains are profits earned from the sale of investment and the gains are classified as short-term gains or long-term gains. Dividend income is the share of profits that the company distributes to its registered shareholders during an interim or an annual period. Such income is directly proportional to the size of the portfolio as well as its quality. A portfolio having more stocks with a high dividend yield will provide a good source of passive income to the investors. Such stocks are often preferred by risk-averse investors and investors with the aim to create a substantial source of passive income.

There are essentially two ways to go in stock markets either trading or investing. The basic difference between the two is the approach and the time horizon where trading is from the short-term view while investing is from the long-term perspective. In both cases, investors and traders can earn money either in the form of capital gains or from dividends and interest income. Capital gains are profits earned from the sale of investment and the gains are classified as short-term gains or long-term gains. Dividend income is the share of profits that the company distributes to its registered shareholders during an interim or an annual period. Such income is directly proportional to the size of the portfolio as well as its quality. A portfolio having more stocks with a high dividend yield will provide a good source of passive income to the investors. Such stocks are often preferred by risk-averse investors and investors with the aim to create a substantial source of passive income.

Stocks of companies that distribute a portion of their profits to a group of shareholders on a regular basis are known as dividend-paying stocks. An investor in these stocks becomes a shareholder of the company and is eligible to receive a share of its earnings in the form of dividends. These payments are usually made periodically and can be in the form of cash or additional shares of the company's stock. Typically, dividend-paying stocks are offered by well-established companies with a proven track record of consistent earnings and a commitment to sharing a portion of their profits with their shareholders.

Choosing dividend-paying stocks can be a good investment strategy for long-term investors who are looking for a steady stream of income from their investments. Here are some factors to consider when selecting dividend-paying stocks for an investment portfolio.

Choosing dividend-paying stocks can be a good investment strategy for long-term investors who are looking for a steady stream of income from their investments. Here are some factors to consider when selecting dividend-paying stocks for an investment portfolio.

Look for well-established companies with a solid track record of earnings and a history of paying dividends consistently over time. This can help ensure that the company will continue to generate income and pay dividends in the future.

The dividend yield is the annual dividend payment divided by the current stock price. A higher dividend yield can be attractive to investors looking for regular income. However, it is important to remember that a high dividend yield may also indicate that the stock price has fallen which could be a red flag.

This is the percentage of earnings that a company pays out as dividends. A lower payout ratio may suggest that the company has room to increase its dividend payments in the future. On the other hand, a high payout ratio may indicate that the company is using most of its earnings to pay dividends and may not have as much money left to invest in growth.

It's important to consider a company's growth prospects when selecting dividend-paying stocks. Therefore, investors should look for companies with a strong competitive advantage and a clear plan for future growth.

Economic conditions can have a significant impact on dividend-paying stocks. Therefore, it is important to consider the overall economic outlook and how it may affect the company's earnings and ability to pay dividends.

Now that we have talked about income or earnings from stock markets, the next obvious question is, are there any tax implications? Well, the government will never leave any source of income out of the tax ambit, so yes. As discussed earlier, there are majorly two sources of income from stock markets, capital gains (one-time income) and dividends or interests (recurring income). Capital gains are taxed based on the category of the asset and the period of holding. On the other hand, the taxation of dividend income has seen some change in recent years. Dividend income prior to April 2020 was subject to DDT (Dividend Distribution Tax) to be paid by the companies and therefore was tax-free at the hands of the investors. However, this changed after 1st April 2020 when DDT was abolished. Dividend income thereafter is taxable in the hands of investors at their applicable income tax slab rates. For example, if a shareholder falls in the 30% tax bracket, he or she will pay 30% tax on the dividend income plus surcharge and cess. However, there is an exemption for dividends up to Rs. 10,00,000 per year under section 115BBDA of the Income Tax Act 1961. Furthermore, dividend income is also subject to TDS under section 194 where TDS will be deducted at the rate of 10% on any dividend payment made by the company over Rs. 5000 per payee.

Now that we have talked about income or earnings from stock markets, the next obvious question is, are there any tax implications? Well, the government will never leave any source of income out of the tax ambit, so yes. As discussed earlier, there are majorly two sources of income from stock markets, capital gains (one-time income) and dividends or interests (recurring income). Capital gains are taxed based on the category of the asset and the period of holding. On the other hand, the taxation of dividend income has seen some change in recent years. Dividend income prior to April 2020 was subject to DDT (Dividend Distribution Tax) to be paid by the companies and therefore was tax-free at the hands of the investors. However, this changed after 1st April 2020 when DDT was abolished. Dividend income thereafter is taxable in the hands of investors at their applicable income tax slab rates. For example, if a shareholder falls in the 30% tax bracket, he or she will pay 30% tax on the dividend income plus surcharge and cess. However, there is an exemption for dividends up to Rs. 10,00,000 per year under section 115BBDA of the Income Tax Act 1961. Furthermore, dividend income is also subject to TDS under section 194 where TDS will be deducted at the rate of 10% on any dividend payment made by the company over Rs. 5000 per payee.

Dividend-paying stocks are a favourite among investors with low-risk appetites and retired investors or investors that are looking for more or less stable sources of income from stocks. These stocks majorly belong to PSUs and well-established companies. These stocks often do not give much capital appreciation but the returns in the form of dividends provide a consistent form of returns to the investors. Hope you find the information about dividend-paying stocks useful in building your investment portfolio. Do let us know if you have any questions in this regard or need more information. Till then Happy Reading!

Introduction For the longest time, investment in stock markets was thought to b...

The stock markets have seen massive volatility over the past few months. The ec...

The IT sector has enjoyed huge growth over the past decades, however, the past ...