The Indian aviation sector is broadly categorised under two branches of civil and military aviation. While the military aviation segment is gaining heights with notable contributions like the Tejas aircraft, the civil aviation industry in India also has the world talking. India is the third-largest domestic aviation market in the world today and is expected to grow at a CAGR of 12.03% to reach approximately USD 40.81 billion by 2033. This shows the growing scope of the aviation stocks in India. Are you looking to invest in these stocks too? Here is all you need to know about the aviation sector in India and the top stocks to look out for.

Aviation stocks are shares of companies that operate in the aviation industry, including airlines, aircraft manufacturers, airport operators, and related service providers. These stocks are part of a growing industry where the stocks are influenced by numerous factors like the fuel prices, government policies, or even global events like pandemics and wars. Aviation stocks are thus known to be volatile and part of the high-risk, high-return investments.

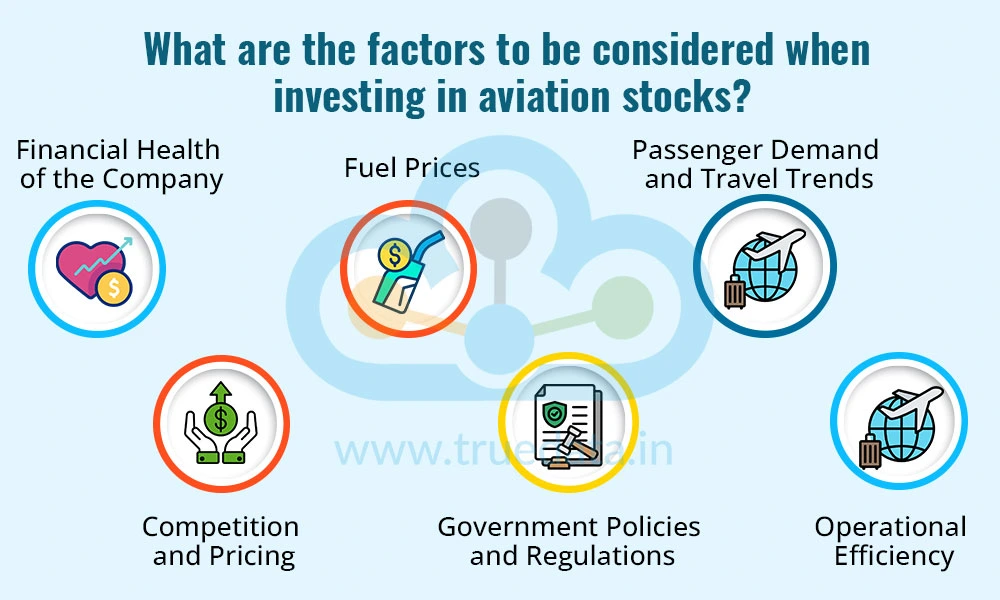

Like any other sector, investment in aviation stocks requires a thorough analysis and understanding of the individual risk-return parameters. A few factors that need to be considered while investing in aviation stocks are explained below.

The first step for investing requires reviewing the company’s financial statements. Key parameters to check include profit margins, debt levels, and whether the airline is consistently making money or relying on loans. A strong balance sheet means the company can handle difficult times better.

A large part of an airline’s cost is aviation fuel. If fuel prices rise, the company’s expenses increase, which can reduce profits. Since fuel prices often fluctuate due to global oil trends, it is important to watch how a company manages these costs. Airlines that use fuel-efficient aircraft or have long-term fuel agreements may handle price rises better.

More people flying means more revenue for airlines. Factors like rising middle-class income, tourism, and business travel boost demand. Air travel is growing in India as more people choose flying over trains or buses due to factors like convenience, affordable fares, etc. However, events like pandemics, natural disasters, or travel bans can sharply reduce demand, affecting the financial health of a company.

India’s aviation market is very competitive, with several airlines trying to attract the same passengers. Thus, to stay ahead, airlines often lower ticket prices, which can hurt their profits. Investors should, hence, check if a company has a strong market position, loyal customers, or unique services that give it an edge over its competition.

The operational efficiency for an airline is important for its survival and growth. This includes things like on-time performance, aircraft usage, cost control, and employee productivity. Companies with operational efficiency usually have better profits, as it can result from better allocation and utilisation of resources.

The aviation sector has been a government-controlled sector for decades, with private players entering the space at a much later stage. Even after the presence of private players, the Indian aviation sector is heavily influenced by government rules, taxes, airport charges, and regulations. For example, high taxes on aviation fuel increase operational costs. Thus, any change in government policy, whether positive or negative, can affect the entire industry.

The operational airports in India doubled from 74 in 2014 to a staggering 157 in 2024. There is also an increase in the number of domestic and international passenger traffic, with an approximate 3% CAGR. This increase has translated into rising stock prices of companies in this sector. Here are a few key details of the top stocks from the aviation sector in terms of market capitalisation.

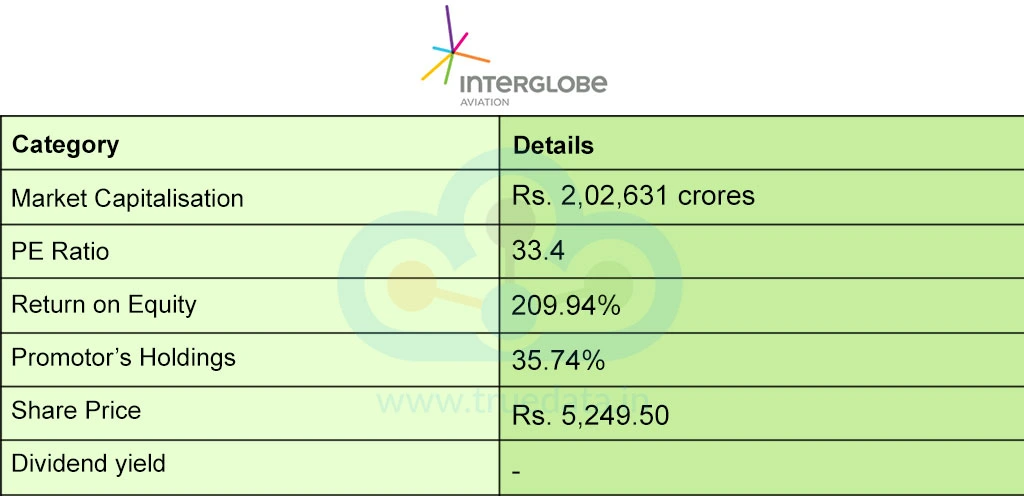

InterGlobe Aviation Ltd, popularly known as IndiGo, is India’s largest airline by passenger volume. Operating as a low-cost carrier, IndiGo offers straightforward, no-frills services focused on three core promises: low fares, on-time performance, and a hassle-free travel experience. Since starting operations in August 2006 with just one aircraft, the airline has seen rapid growth. By the end of FY24, IndiGo’s fleet had expanded to 367 aircraft, serving 86 destinations, including 24 international ones.

The key details of this company are,

The trailing returns of Interglobe Aviation as of 30th April 2025 are,

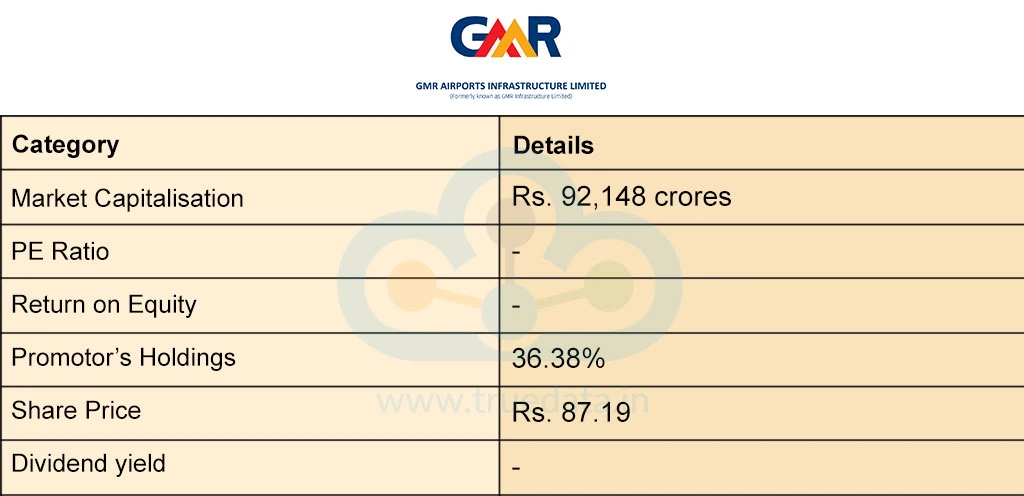

GMR Infrastructure is an Indian company involved in several sectors, including airport development and operations, power generation, coal mining, highway development, special economic zones (SEZs), and construction through EPC (Engineering, Procurement, and Construction) contracts. It is India’s largest private airport operator, the biggest in Asia, and ranks second globally. As of FY24, GMR handled 27% of India’s total passenger air traffic and holds the 9th position worldwide in terms of the number of airport assets either operational or under development.

The key details of this company are,

The trailing returns of GMR Airports as of 30th April 2025 are,

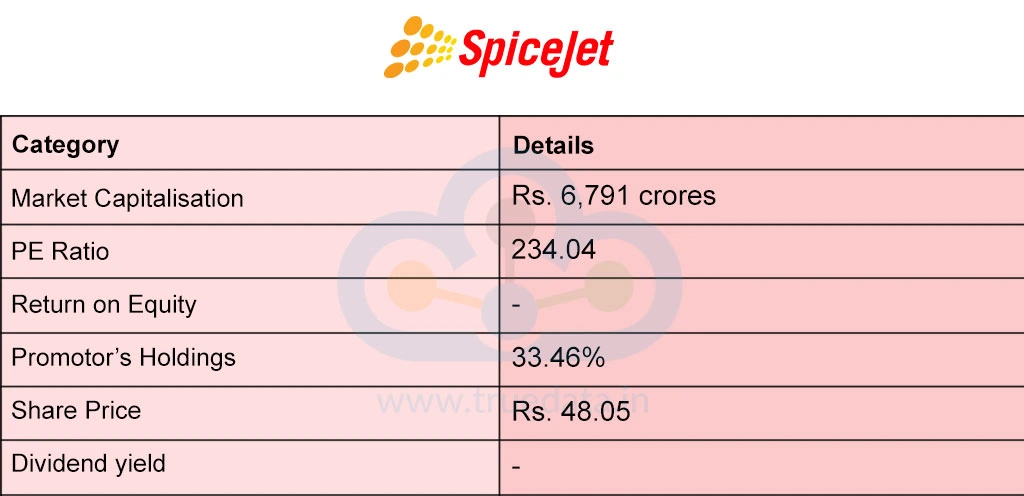

SpiceJet is a low-cost Indian airline known for operating the highest number of flights under the government’s UDAN regional connectivity scheme. It runs around 250 flights daily, covering 48 domestic and several international destinations. Its fleet consists of Boeing 737 Max, Boeing 700, and Q400 aircraft. As of the calendar year 2023, SpiceJet held about 5.5% of India’s domestic aviation market, making it the fifth-largest player in the sector.

The key details of this company are,

The trailing returns of SpiceJet as of 30th April 2025 are,

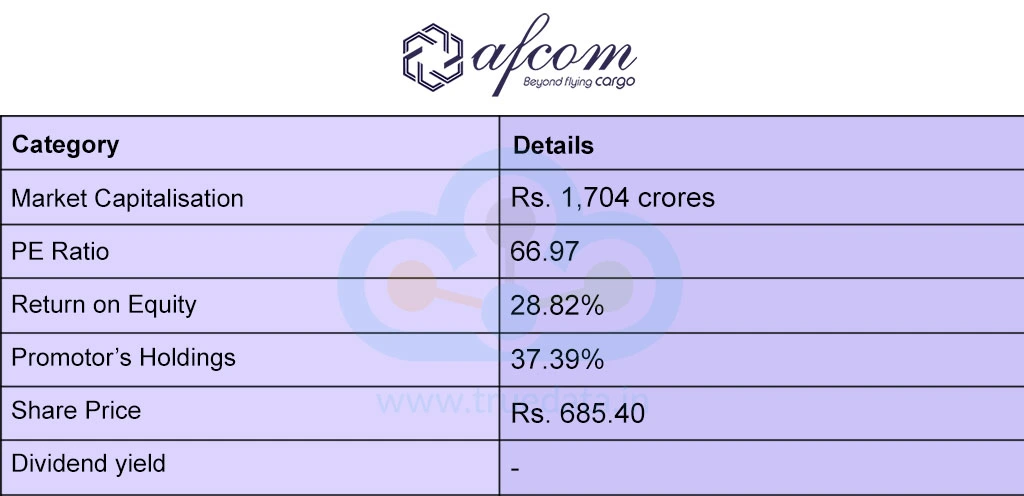

Afcom Holdings Limited, established in February 2013, is a cargo airline that provides airport-to-airport freight services. The company mainly operates in ASEAN countries, with a strong focus on Singapore, and also serves destinations like Indonesia and Brunei. In FY24, Afcom's business became more concentrated, with 98.5% of its revenue coming from its top five customers, up from 85% in FY23.

The key details of this company are,

The trailing returns of Afcom as of 30th April 2025 are,

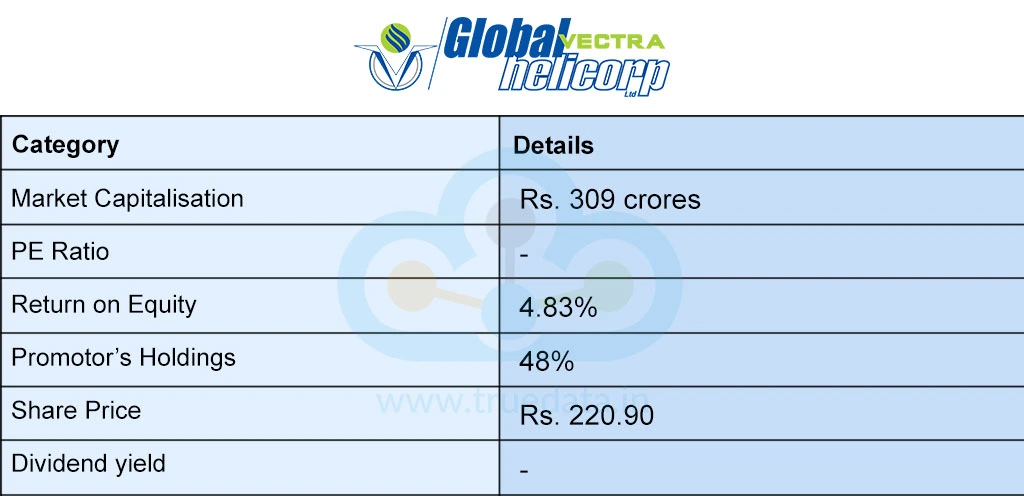

Global Vectra Helicorp Ltd (GVHL), part of the Vectra Group and incorporated in 1988, is India’s largest private helicopter services company. It offers chartered helicopter services for both offshore and onshore operations, mainly catering to the oil and gas exploration and production sector. GVHL has a strong safety record, with over 2.6 lakh hours of accident-free flying and the safe transport of more than 46 lakh passengers.

The key details of this company are,

The trailing returns of Global Vectra Helicorp as of 30th April 2025 are,

The Indian aviation sector has been growing in both the civil and military segments over the recent years. Private players like Indigo have made air travel quite affordable, making it accessible to the country’s wide middle class, making them its huge customer base. Here is a brief analysis of the sector as a whole and the various government initiatives and programs that will affect the sector as a whole, thereby affecting the various stocks belonging to this sector.

India’s civil aviation industry is one of the fastest-growing sectors in the country. It includes scheduled airlines (domestic and international), non-scheduled services like charter and air taxi operators, and air cargo services for goods and mail.

The industry has fully bounced back from the COVID-19 impact, with air traffic reaching 327.28 million passengers in FY23, up from 188.89 million in FY22. According to the International Air Transport Association (IATA), India is expected to become the world’s third-largest air passenger market by 2030, ahead of China and the U.S.

With growing demand, the number of aeroplanes in the country is expected to rise to 1,100 by 2027. Credit rating agency ICRA has projected that the Indian aviation industry will see a revenue growth of 15–20% in FY24 and 10–15% in FY25. However, profits may recover slowly due to high fixed costs. The Indian government is also expanding airport infrastructure to support the growing demand and passenger traffic, and aims to increase the number of operational airports to 220 by 2025.

Aviation is a capital-intensive and highly sensitive sector. This sector has previously seen high losses due to various reasons, like high costs, close government control, as well as mismanagement of resources. The government has taken cognisance of the increasing demand and importance of the sector, which is reflected in the recent budgets through high allocation of resources and dynamic government policies. Here is a brief overview of the recent government initiatives for this sector.

UDAN Scheme

The UDAN scheme is improving regional air connectivity:

519 operational routes so far

Includes 53 tourism and 48 helicopter routes

Over 133.86 lakh passengers benefited

More than 2.56 lakh flights operated

13 airlines, including startups, are participating

NABH Nirman Initiative

The government’s NABH (NextGen Airports for Bharat), Nirman plan aims to expand airport capacity over the next 10–15 years to handle billions of trips annually.

Aircraft Expansion

Air India and IndiGo have received approval to import 470 and 500 aircraft, respectively, between 2023 and 2035 to support their growth plans.

Investment in Aviation Infrastructure

India plans to invest around US$ 11.88 billion by 2025 to build new airports and upgrade existing ones, mainly to improve regional connectivity.

Dehradun Airport Upgrade

The new terminal at Dehradun Airport was inaugurated by Civil Aviation Minister Jyotiraditya Scindia. It can now handle 3,240 passengers at peak hours and up to 47 lakh passengers annually. The design reflects Uttarakhand’s culture, with features inspired by the state flower, ‘Brahmakamal’.

As mentioned above, the government has made significant budget allocations to the aviation sector to cater to its increasing demand. Here is a brief analysis of a few key investments in this sector.

Budget Allocation

The Ministry of Civil Aviation has been allocated Rs. 2,400 crore in the Union Budget 2025–26, which is 10% lower than last year.

Drone City in Andhra Pradesh

Garuda Aerospace plans to invest Rs. 100 crore to build a 'Drone City' in Orvakal village, Andhra Pradesh. The project aims to boost drone innovation and make India a global leader in drone technology.

Bagdogra Airport Expansion

The government has approved a new civil terminal at Bagdogra Airport in Siliguri, West Bengal.

Investment - Rs. 1,549 crore

Terminal size - 70,390 sqm

Capacity - 3,000 passengers during peak hours and 10 million annually

Will follow green building standards for efficiency

Adani Airports Investment

Adani Airports will invest US$ 7 billion to expand and improve its airports in India, focusing on infrastructure and passenger facilities to bridge the gap in aviation services.

Water Aerodromes

Two water aerodromes have started operations under the UDAN scheme, improving air connectivity to remote regions.

FDI in the Aviation Sector

100% Foreign Direct Investment (FDI) is allowed in the Maintenance, Repair, and Overhaul (MRO) sector through the automatic route.

In domestic airlines, 100% FDI is allowed:

Up to 49% through the automatic route for foreign investors

100% through the automatic route for Non-Resident Indians (NRIs)

Now that we have seen a few key details of the aviation sector and the top stocks in this sector, let us now focus on the pros and cons of investing in these stocks.

The aviation sector is one of the strongest pillars of the Indian economy. In 2022, the travel and tourism sector contributed Rs. 15.7 trillion to the economy, and it is expected to grow to Rs. 16.5 trillion by the end of this year. Furthermore, this figure could rise to around Rs. 37 trillion over the next 10 years, showing strong long-term growth. With the travel boom post-COVID and the increasing globalisation, the Indian aviation sector is set to soar in the coming decades.

This article is an analysis of the aviation sector and part of our sector focus series. Let us know your thoughts on this topic or if you need further information on the same.

Till then, Happy Reading!

Read More: Best Shipping Stocks 2024

The world today is more aware of the need for insurance than it was ever before....

When we talk about public sector companies, the first thought is loss-making com...

The world today is riddled with multiple conflicts in different parts of the wor...