Ask a new investor, what are the top factors to consider while buying stock, and they will say the risk-return analysis, capital required for investment, investment horizon, etc. Most novice investors will not give much importance to analysing or evaluating the company management and this is one of the major mistakes an investor can make. Given here are the reasons why it is important to assess the management quality and the points of evaluation that can be used by investors in this regard. Read More: Best trading strategies for Beginners

Ask a new investor, what are the top factors to consider while buying stock, and they will say the risk-return analysis, capital required for investment, investment horizon, etc. Most novice investors will not give much importance to analysing or evaluating the company management and this is one of the major mistakes an investor can make. Given here are the reasons why it is important to assess the management quality and the points of evaluation that can be used by investors in this regard. Read More: Best trading strategies for Beginners

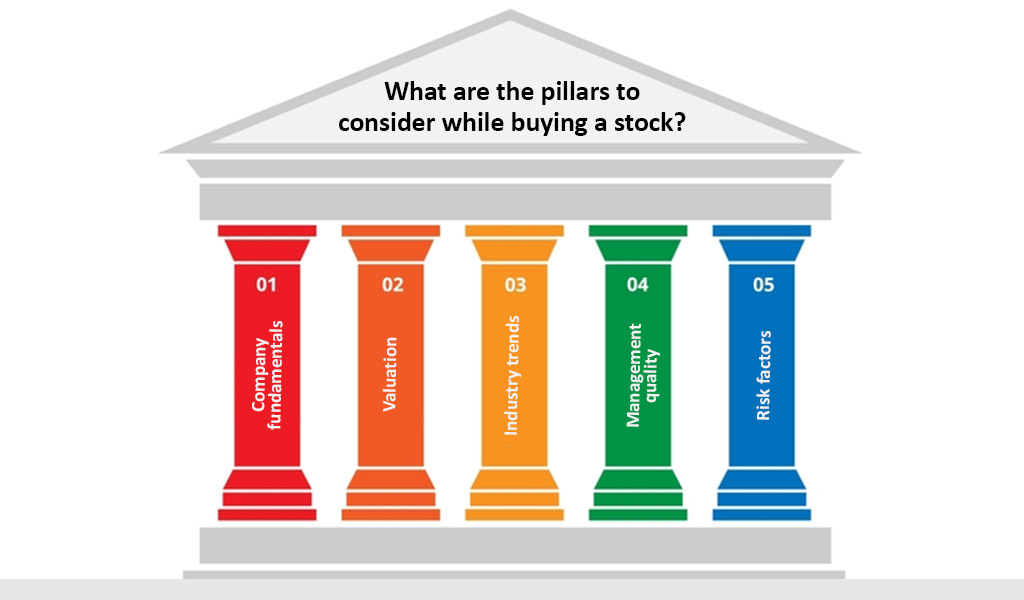

Buying a stock or expanding the investment portfolio is not a decision to be taken lightly. It requires careful planning and analysis of the market. So let us begin by understanding the major factors to be considered while buying a stock.

Buying a stock or expanding the investment portfolio is not a decision to be taken lightly. It requires careful planning and analysis of the market. So let us begin by understanding the major factors to be considered while buying a stock.

The first pillar to consider is the company's fundamentals. This includes its financial health, competitive position, and growth prospects. Investors should review the company's financial statements to assess its revenue, earnings, cash flow, and debt levels. Furthermore, investors also need to evaluate the company's competitive position in its industry and its potential for future growth.

The second pillar to consider is the company's valuation. This involves assessing whether the stock is priced fairly based on the company's fundamentals. Investors can use various valuation metrics, such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, or price-to-book (P/B) ratio, to determine whether the stock is undervalued or overvalued compared to its peers.

The third pillar to consider is broader industry trends. Investors should evaluate the growth prospects and competitive dynamics of the industry in which the company operates. This can help in assessing the potential risks and opportunities the company could face in the future.

The fourth pillar to consider is the quality of the company's management team. A strong management team with a clear vision and track record of success can help drive the company's growth and create value for shareholders. Therefore, it is important to have an objective evaluation of this aspect.

The fifth pillar to consider is the potential risks facing the company. This includes both company-specific risks, such as regulatory or legal risks, as well as broader market risks, such as economic downturns or geopolitical instability. Investors should assess the company's ability to manage these risks and mitigate their impact on the business.

The management of a company is like a captain of a ship. They are crucial for the success of a company because it involves the planning, organizing, and controlling of resources and activities to achieve specific goals and objectives. Effective management ensures that a company operates efficiently, adapts to changing market conditions, and remains competitive in its industry. Here are some of the key reasons why management is important for a company:

The management of a company is like a captain of a ship. They are crucial for the success of a company because it involves the planning, organizing, and controlling of resources and activities to achieve specific goals and objectives. Effective management ensures that a company operates efficiently, adapts to changing market conditions, and remains competitive in its industry. Here are some of the key reasons why management is important for a company:

Management is responsible for setting clear goals and developing strategies to achieve them. Without a clear direction, a company may struggle to make progress and achieve its objectives.

The company’s management is responsible for ensuring that products and services are of high quality and consistent with the company's standards, which can help maintain customer loyalty and satisfaction.

Furthermore, the company’s management is responsible for organizing the resources of a company, including people, finances, and equipment, to ensure that they are used efficiently and effectively.

A classic sign of good management is leading and motivating employees to achieve their full potential. This in turn can help improve overall productivity, job satisfaction, and the morale of the company as a whole.

The management is also required to assess the market continuously and adapt to changing conditions. This will ensure that the company remains competitive and relevant as per the demand and the requirements of its customers and not become obsolete. Overall, effective management is essential for a company to achieve its goals, grow, and succeed over the long term.

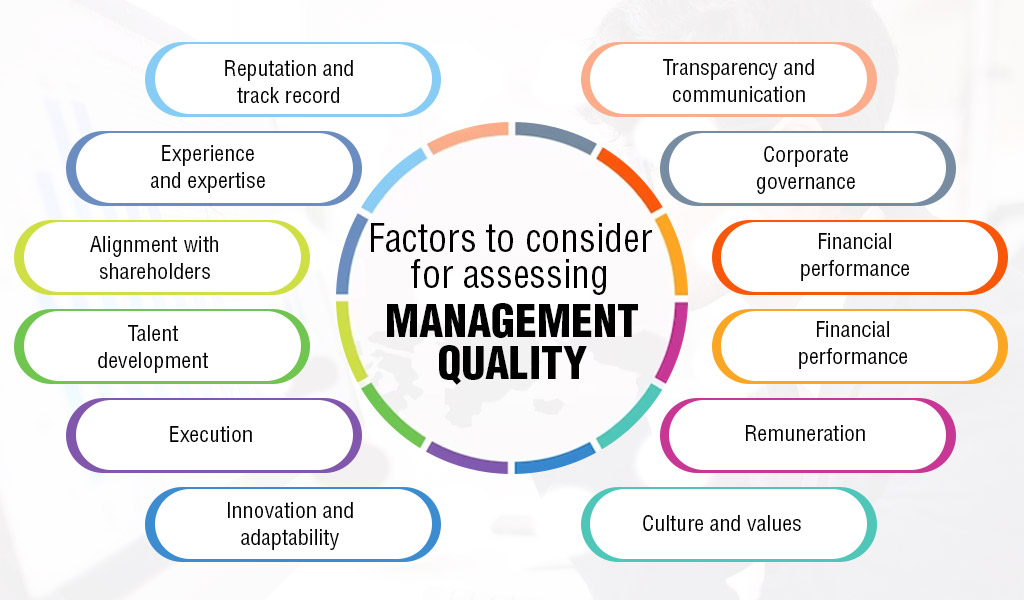

Assessing the quality of a company's management is an important part of investment analysis. As a new investor, there are several factors that you should consider when evaluating the management quality of a company. Some of the critical factors or the checklist to be considered to assess management quality include the following.

Assessing the quality of a company's management is an important part of investment analysis. As a new investor, there are several factors that you should consider when evaluating the management quality of a company. Some of the critical factors or the checklist to be considered to assess management quality include the following.

The primary step or quality to be assessed is the experience and expertise of a company's management team. This includes their educational and professional backgrounds, as well as their track record in managing similar companies or projects. This provides an overall idea of their competence and their ability to be at the helm of the company.

It's important to consider the reputation and track record of a company's management team. This includes their history of success, as well as any past controversies or negative publicity. It is also often the first point of reference for an average investor before digging in deep.

A classic sign of good management is transparency and effective communication across the organisation as well as with investors and other stakeholders. They should be willing to provide regular updates on the company's performance and respond to questions or concerns from investors.

Corporate governance refers to the set of processes, policies, and laws that govern how a company is managed and controlled. It is an essential factor in assessing management quality as it sets the standards for the behavior of a company's executives and ensures that they act in the best interests of the company and its stakeholders. Effective corporate governance ensures that a company's management is accountable to its shareholders and that the interests of shareholders are protected.

A company's financial performance is a key indicator of the quality of its management. A consistently performing and growing company is a testament to the fact that the management is able to steer it in the right direction. Investors should evaluate the company's revenue growth, profitability, cash flow, and return on investment to determine its financial performance among other factors.

The management is also responsible to identify assess and mitigating the risks effectively. Investors should evaluate the company's risk management policies and procedures, including its ability to mitigate risks related to competition, regulatory changes, and other factors that could impact the company's performance. Management’s ability to excel in this aspect is crucial for the survival of the company and thereafter its growth.

The management remuneration should be aligned with the performance of the company and the value it creates for shareholders. In situations where a company is experiencing losses or a decline in profits, an increase in management remuneration can signal to shareholders that the management's intentions and integrity are questionable. It may raise concerns about the alignment of the management's interests with those of the shareholders and their ability to prioritize the company's performance and value creation. Therefore, such an increase in management remuneration should be carefully evaluated and justified to ensure that it is in the best interest of the company and its stakeholders.

The culture and values of a company can have a significant impact on its success. Investors should evaluate the company's culture and values, including its commitment to social responsibility and ethical business practices.

A company's management team should have a clear strategic vision for the company's future and be innovative and adaptable to meet it. This involves a willingness to experiment with new ideas and adjust strategies in response to changing market conditions or new opportunities.

Ultimately, the success of a company depends on its ability to execute its strategy. A good management team should be able to set clear goals, allocate optimum resources, and execute initiatives in a timely and efficient manner to meet its goals. A good strategy is ineffective or useless if it is not executed efficiently. Hence, to assess the management quality its ability to execute plans and strategies is crucial.

The management team should also be committed to developing the talent of its employees. This includes providing training and development opportunities, as well as creating a culture that fosters learning and growth.

Finally, a good management team should be aligned with the interests of shareholders. They should be focused on creating value for shareholders over the long term, rather than pursuing short-term gains at the expense of the company's overall health and sustainability.

Evaluating the management quality of a company is an important part of investment analysis and should never be ignored. By considering the above factors investors can make informed decisions and select companies with strong management teams. This will assure them that the company can weather all storms and the ups and downs in the business cycle with optimum expertise and commitment of the management, thereby securing their investment in the company. We hope this article was sufficient to highlight the importance of assessing management quality and a roadmap to it. Let us know if you have any personal experience with evaluating a stock and the company management in the process. Also, do let us know if you want to know more about this topic or have any questions. Till then Happy Reading!

If you are a shareholder of a company, you would have seen its annual reports co...

Did you know more than 5000 companies are listed on theBSE and about 2000 on the...

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...