On July 3rd, 2023, Sensex created history by reaching the 65000 mark; barely 16 days later, it breached the 67000 mark on July 19th, 2023. This upward trajectory of the Indian stock markets is a testament to the sentiment shared across the world that India has arrived! The bullish approach of international and domestic investors alike is the perfect space for IPOs to thrive and indeed they are back again. While the start of 2023 saw a lull in the IPO market, the past couple of weeks saw many IPOs coming out back to back. So should investors invest in all the IPOs? What should be considered to evaluate if an IPO is a good investing opportunity? Read on to get answers to these questions and also mistakes that investors should avoid while investing in IPOs. Read More: Social media impact on Investing

On July 3rd, 2023, Sensex created history by reaching the 65000 mark; barely 16 days later, it breached the 67000 mark on July 19th, 2023. This upward trajectory of the Indian stock markets is a testament to the sentiment shared across the world that India has arrived! The bullish approach of international and domestic investors alike is the perfect space for IPOs to thrive and indeed they are back again. While the start of 2023 saw a lull in the IPO market, the past couple of weeks saw many IPOs coming out back to back. So should investors invest in all the IPOs? What should be considered to evaluate if an IPO is a good investing opportunity? Read on to get answers to these questions and also mistakes that investors should avoid while investing in IPOs. Read More: Social media impact on Investing

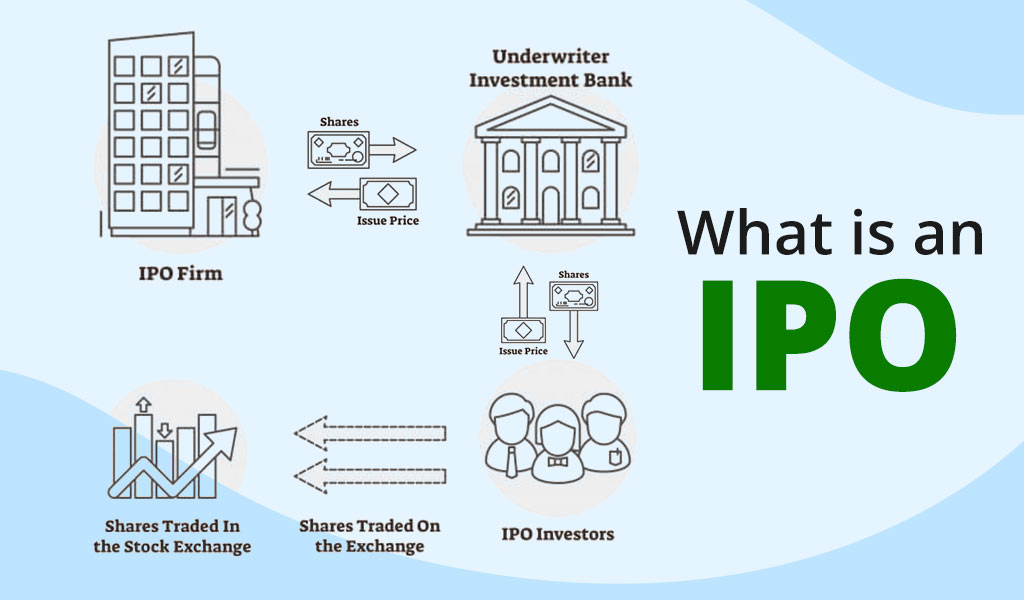

Let us start with the basics, the meaning of IPO. IPO or Initial Public Offer is when a company issues its shares to the public for the first time. Before an IPO, a company is considered private, and its shares are typically held by its founders, early investors, and employees. Companies use IPOs to raise capital to meet their target business goals like growth and expansion of the business or the investment in a new plant and machinery or new business division, subsidiary, etc. Companies intending to launch an IPO have to adhere to strict compliances set by SEBI and Companies Act, 2013. The details of the IPO are reflected in the RHP which is like a guideline for the investors about the IPO and the company itself to make an informed decision. The shares offered under the IPO are then listed on the stock exchanges like NSE and BSE at a specific price that is determined by the underwriters of the IPO and the company through either the fixed price method or the book-building method. The price at which shares are offered to the public is known as the issue price. Investors can invest in an IPO based on their applicable category in lots of shares as per the IPO through their registered brokers or through their bank’s net banking portal.

Let us start with the basics, the meaning of IPO. IPO or Initial Public Offer is when a company issues its shares to the public for the first time. Before an IPO, a company is considered private, and its shares are typically held by its founders, early investors, and employees. Companies use IPOs to raise capital to meet their target business goals like growth and expansion of the business or the investment in a new plant and machinery or new business division, subsidiary, etc. Companies intending to launch an IPO have to adhere to strict compliances set by SEBI and Companies Act, 2013. The details of the IPO are reflected in the RHP which is like a guideline for the investors about the IPO and the company itself to make an informed decision. The shares offered under the IPO are then listed on the stock exchanges like NSE and BSE at a specific price that is determined by the underwriters of the IPO and the company through either the fixed price method or the book-building method. The price at which shares are offered to the public is known as the issue price. Investors can invest in an IPO based on their applicable category in lots of shares as per the IPO through their registered brokers or through their bank’s net banking portal.

When a company launches its IPO, the sole purpose is to attract public funds to meet its goals. Therefore, on paper, every IPO will look like a lucrative investment opportunity. Here is a list of factors that investors should consider while evaluating an IPO.

When a company launches its IPO, the sole purpose is to attract public funds to meet its goals. Therefore, on paper, every IPO will look like a lucrative investment opportunity. Here is a list of factors that investors should consider while evaluating an IPO.

Before investing in an IPO, investors should meticulously study the company's fundamentals. This includes gaining a comprehensive understanding of the company's core business activities, products, and services offered. Examining the financial statements, including the income statement, balance sheet, and cash flow statement, is vital to assess the company's financial health. By analysing revenue growth, profitability, and debt levels, investors can evaluate the company's overall performance and stability.

Investors must carefully review the prospectus provided by the company before its IPO. The prospectus contains essential information about the company's background, financial performance, future plans, and risk factors associated with its operations. By studying the prospectus, investors can gain valuable insights into the company's strategy and potential challenges it may encounter in the market.

Understanding the prevailing market conditions is crucial when considering an IPO investment. Investors should evaluate the overall sentiment of the market and assess whether it is bullish or bearish. In a bullish market, IPOs generally tend to perform well due to high investor demand. Conversely, during a bearish market, new listings may face challenges. Considering the broader market conditions can provide valuable context for the IPO's potential performance.

Evaluating the company's management team is essential for an investor's decision-making process. Investors should analyse the expertise and experience of the key executives and board members. A competent and capable management team can positively impact the company's success and growth prospects.

The investor should conduct thorough research on the industry in which the company operates. Analyzing the industry's growth potential, competition, regulatory environment, and any macroeconomic trends that might affect the company's performance is crucial. Understanding the industry outlook helps an investor gauge the company's position within its market segment.

Assessing the IPO's valuation is a critical aspect of the investment evaluation. Investors should compare the issue price to the company's fundamentals, such as earnings, sales, and book value. Examining valuation ratios, such as Price/Earnings (P/E), Price/Sales (P/S), and Price/Book Value (P/B), can provide insights into whether the stock is overvalued or undervalued relative to its peers.

Monitoring the demand for the IPO during the subscription period is important for the investor. An oversubscribed IPO, where the number of shares applied for exceeds the shares offered, indicates high investor interest in the company. Strong subscription demand might signal positive market sentiment toward the IPO.

Investors should consider their investment horizon and risk tolerance before investing in an IPO. IPOs can be volatile in the initial days of listing, and investors should be prepared for short-term price fluctuations. Aligning the investment decision with personal risk preferences is essential.

After considering the various factors to evaluate an IPO, it is equally important to understand the mistakes to avoid while selecting them too.

The new investor should avoid the mistake of neglecting thorough research before investing in an IPO. Rushing into an IPO without understanding the company's fundamentals, industry outlook, and potential risks can lead to uninformed investment decisions. It is crucial to read the prospectus provided by the company, analyze its financial statements, and conduct in-depth research to gain insights into the company's operations and prospects.

The new investor should avoid the mistake of neglecting thorough research before investing in an IPO. Rushing into an IPO without understanding the company's fundamentals, industry outlook, and potential risks can lead to uninformed investment decisions. It is crucial to read the prospectus provided by the company, analyze its financial statements, and conduct in-depth research to gain insights into the company's operations and prospects.

Falling prey to the hype surrounding certain IPOs is a common pitfall for new investors. Making investment decisions based solely on media hype or popular sentiment can lead to impulsive choices. Investors should exercise caution and analyze the company's fundamentals and long-term growth potential, rather than being swayed by short-term market excitement.

Falling prey to the hype surrounding certain IPOs is a common pitfall for new investors. Making investment decisions based solely on media hype or popular sentiment can lead to impulsive choices. Investors should exercise caution and analyze the company's fundamentals and long-term growth potential, rather than being swayed by short-term market excitement.

Neglecting to assess the valuation of an IPO can lead to investing in overvalued stocks. Investors should critically evaluate the IPO's issue price in comparison to the company's earnings, assets, and industry peers. Investing in an IPO solely based on its perceived popularity without considering its fair value can expose investors to potential losses.

Neglecting to assess the valuation of an IPO can lead to investing in overvalued stocks. Investors should critically evaluate the IPO's issue price in comparison to the company's earnings, assets, and industry peers. Investing in an IPO solely based on its perceived popularity without considering its fair value can expose investors to potential losses.

Overlooking the risk factors disclosed in the IPO prospectus can be a grave mistake. The prospectus provides essential information about the potential risks and challenges that the company may face in the market. Investors should carefully read and understand these risk factors to make informed decisions and be aware of the potential downsides.

Overlooking the risk factors disclosed in the IPO prospectus can be a grave mistake. The prospectus provides essential information about the potential risks and challenges that the company may face in the market. Investors should carefully read and understand these risk factors to make informed decisions and be aware of the potential downsides.

Concentrating a substantial portion of one's investment capital in a single IPO is a risky strategy. Diversification is key to managing risk effectively. Investors should spread their investments across various sectors and asset classes to reduce the impact of any single investment's poor performance. They should further carefully assess the allocation of shares they wish to apply for in an IPO. Overcommitting funds to a single IPO can limit an investor's ability to participate in other potential opportunities. It is prudent to distribute investment across various IPOs to maintain a balanced portfolio.

Concentrating a substantial portion of one's investment capital in a single IPO is a risky strategy. Diversification is key to managing risk effectively. Investors should spread their investments across various sectors and asset classes to reduce the impact of any single investment's poor performance. They should further carefully assess the allocation of shares they wish to apply for in an IPO. Overcommitting funds to a single IPO can limit an investor's ability to participate in other potential opportunities. It is prudent to distribute investment across various IPOs to maintain a balanced portfolio.

The buzz around an IPO is often deafening for average investors compelling them to invest their funds in the IPO. The key however is to distance oneself from this buzz and ensure that IPOs are evaluated based on their merits, i.e., the macro and the micro economic factors which directly influence the investment decision. This blog is an attempt to help investors include quality IPOs in their investment portfolio and thereby meet their investment goals in a better or more efficient manner. Let us know if you need any further information about IPOs or Indian stock markets in general and we will take it up in our future blogs. Till then Happy Reading!

The year 2021 and 2022 have brought a string of IPOs from companies belonging ...

The year 2024 despite its despite its various ups and downs was a great year for...

What Is an Initial Public Offering (IPO)? AnInitial Public Offering(IPO) allude...