Indian stock markets have an array of sectors in which investors can choose stocks to create their portfolios. Among such various sectors, the FMCG stock is considered to be the Rahul Dravid of the Indian stock markets. It is one of the many defensive stocks that are often considered to be fail-safe stocks to protect the portfolio against market fluctuations or economic cycles like a recession.

Discussed hereunder are a few insights related to this sector and the top stocks to watch out for in terms of market capitalisation.

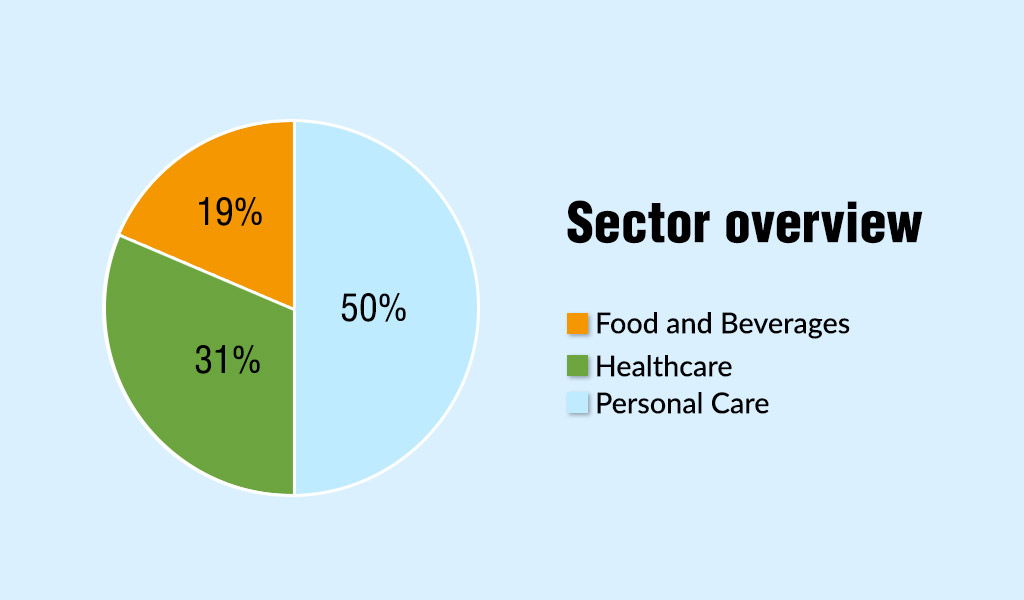

The FMCG (Fast-Moving Consumer Goods) market in India is expected to grow at the pace of 14.9% CAGR to reach US$ 220 billion by 2025. Even during the covid pandemic and nationwide lockdowns, this sector grew by 16% in CY21 which was a 9-year high for the sector. The FMCG sector is divided into a few key segments, namely, Food and Beverages (which accounts for about 19% to 20% of the sector), Healthcare (approximately 31% of the sector), Household and Personal Care segment (which is the largest segment accounting for about 50% of the sector). The consumption pattern of the Indian population is fast changing in recent times, especially in Tier III, Tier IV, and Tier V cities in the country. Keeping in view this changing demographic and demand of the country, industry giants like Brittania, HUL, and Dabur have laid out plans for heavy investments in these areas. The volatility in the FMCG sector is usually minimal and therefore they are considered to be evergreen stocks in the stock markets. Therefore, although investors may not be able to make huge short-term gains, they are a good addition to the long-term investment portfolio as well as good options in the dividend stocks category.

The FMCG sector has the benefit of 100% FDI permission from the government and has gained hugely from this. The total FDI inflow in this sector was US$ 20.84 billion from April 2000-June 2022. This investment is aimed to be used in creating and strengthening supply chains throughout the country as well as diverse job opportunities, especially in semi-urban and rural areas. The e-commerce side in the FMCG business is a fast-booming market that is expected to reach US$ 120 billion by 2026. There have also been strategic takeovers and investments by industry giants like ITC, Dabur, Emami, Marico, Adani Wilmar, Tata Consumer Products, etc. to boost their production and manufacturing capacity as well as increase their overall market presence in the FMCG industry.

The Union Budget 2023 following the lines of the previous budget has some major announcements for the FMCG sector. The allocation for the FMCG sector in FY 23 was about Rs.1.55 trillion which was majorly aimed to stabilise the inflationary impact in the sector on account of rising fuel prices and supply chain breakdowns in the recent past. This Budget 2023 has announced the extension of the Free Food Scheme for another year along with various other incentives for pushing capital investment in the remote markets of the country. The FMCG sector was one of the highest beneficiaries on the stock markets post the budget announcement and was up by 1.13% with stocks like ITC, Tata Consumer Products, etc. The government has given a major boost to the companies for exports through the PLI scheme with an outlay of approximately US$ 1.42 billion. The Government has also drafted the Consumer Protection Bill with a special focus that will ensure simple, speedy, accessible, affordable, and timely delivery of justice to consumers. The reduction of GST on various products in the sector is also expected to boost overall demand in the sector.

The focus of the FMCG sector is systematically increasing demand in rural and semi-urban areas. This will help in realising the untapped potential of these markets and ensuring that the consumers in these regions can be part of the progress of the nation. The demand for the sector is also expected to see an increase on the backs of the digital boom in the country and the push to the e-commerce sector. As per the latest models, it is expected that approximately 40% of the demand in the FMCG sector will be met through online business and the total share of e-commerce in the total FMCG sales is expected to increase by 11% by 2030.

There are multiple FMCG stocks that are traded on the NSE (National Stock Exchange). Some of the top stocks that are traded on NSE and their details are given below.

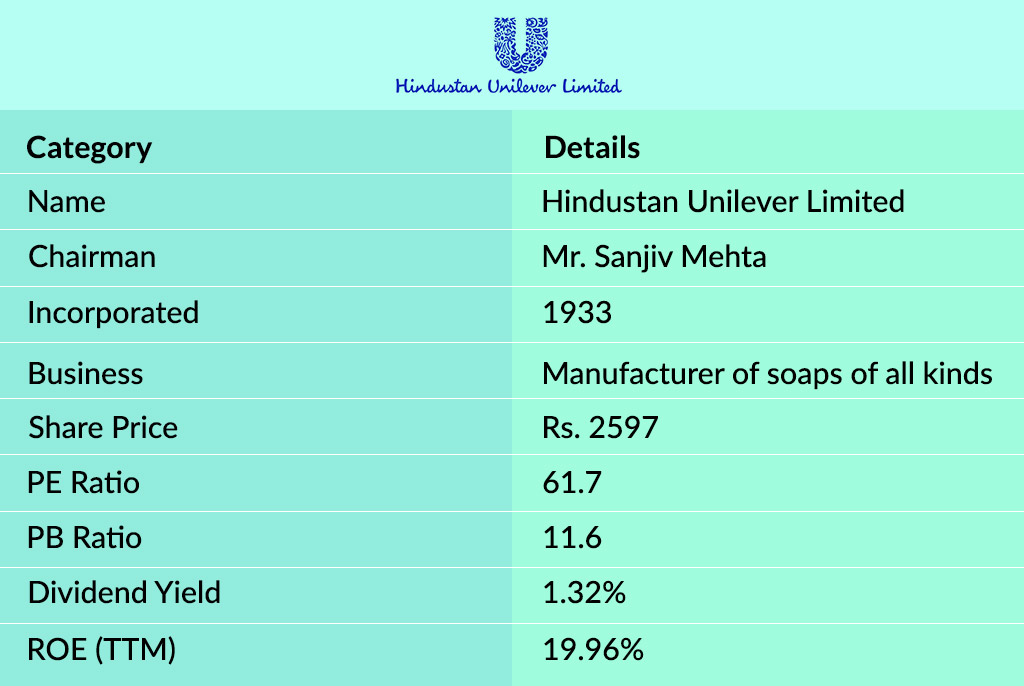

HUL is the top company in the FMCG sector in terms of market capitalisation. The key details of this company are tabled below.

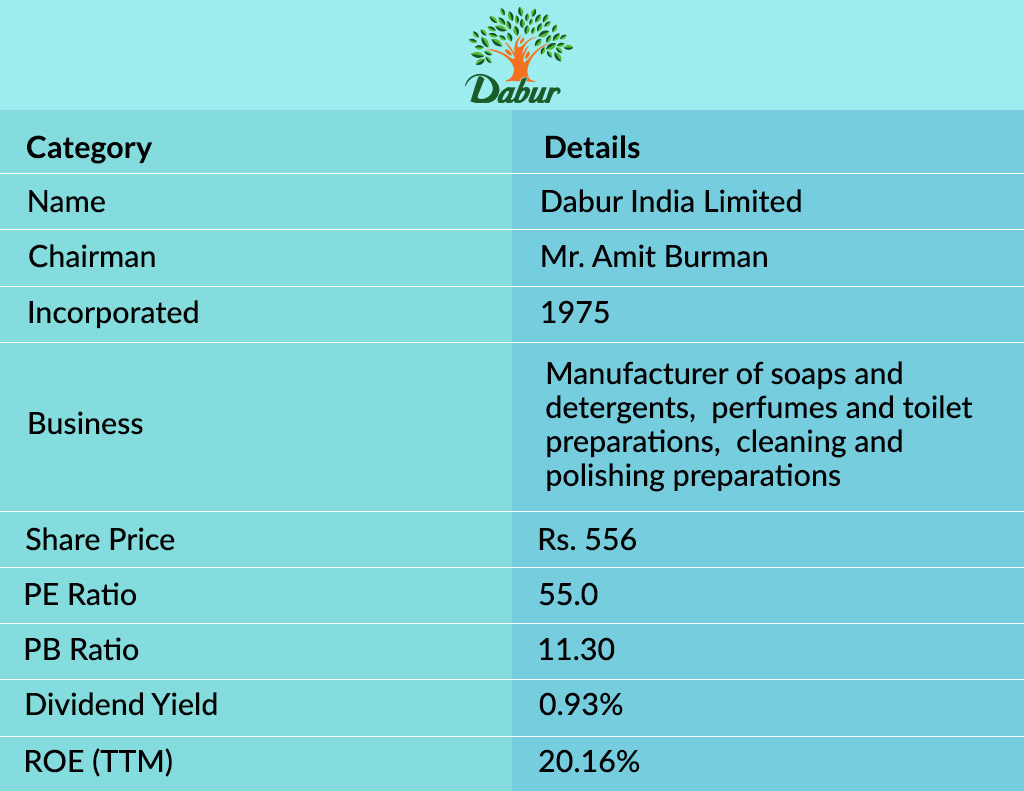

Dabur is one of the oldest names and most trusted names in this sector and has a diverse range of products belonging to the FMCG category. The key details of this company are mentioned below.

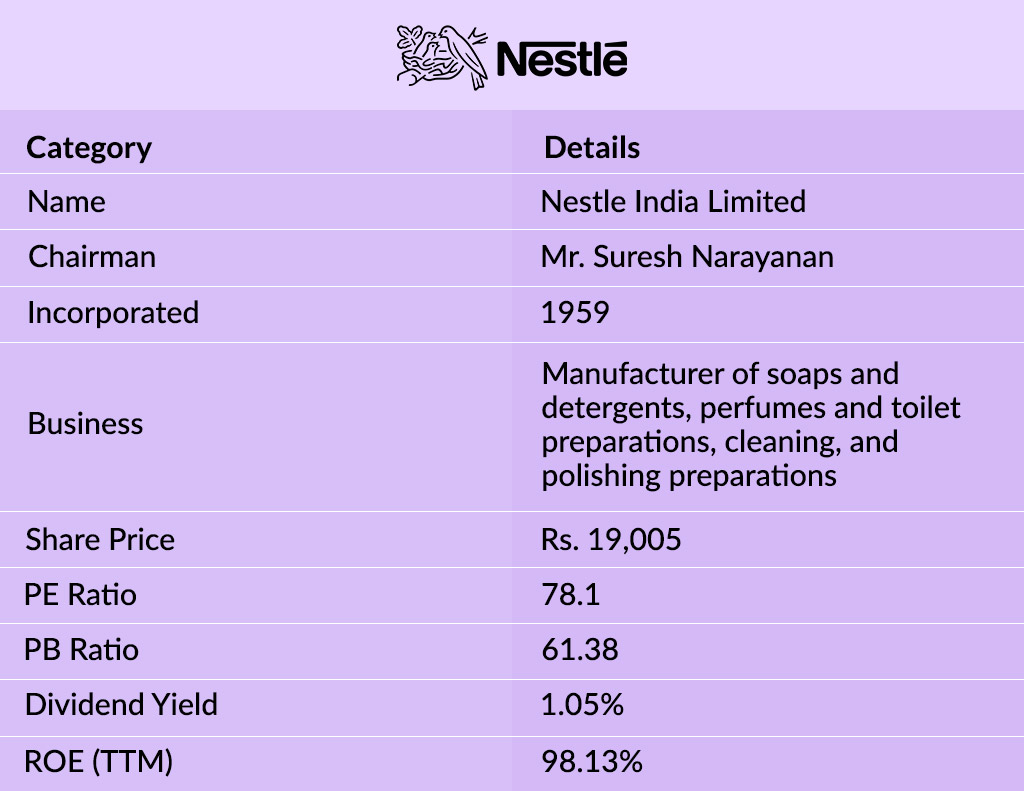

Nestle is a global name in the FMCG sector and is a Swiss conglomerat. The key details of the company are tabled below.

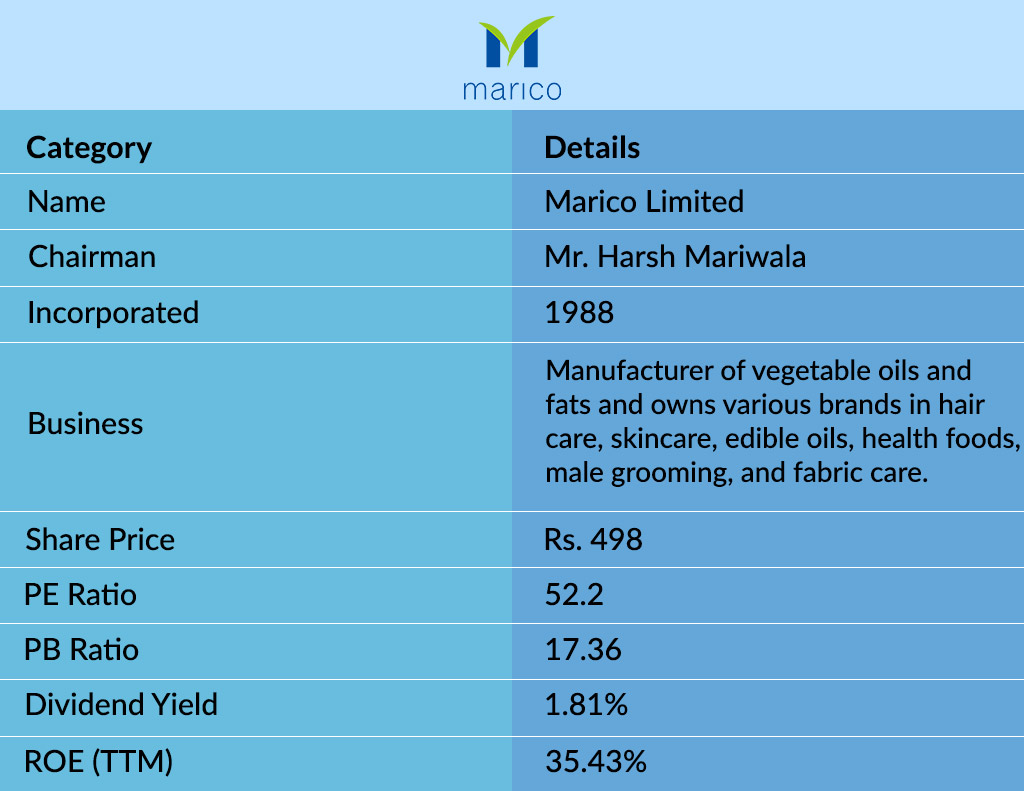

Marico is a global company with a presence in 25 countries across emerging markets in Asia and Africa. The key details of this FMCG giant are mentioned below.

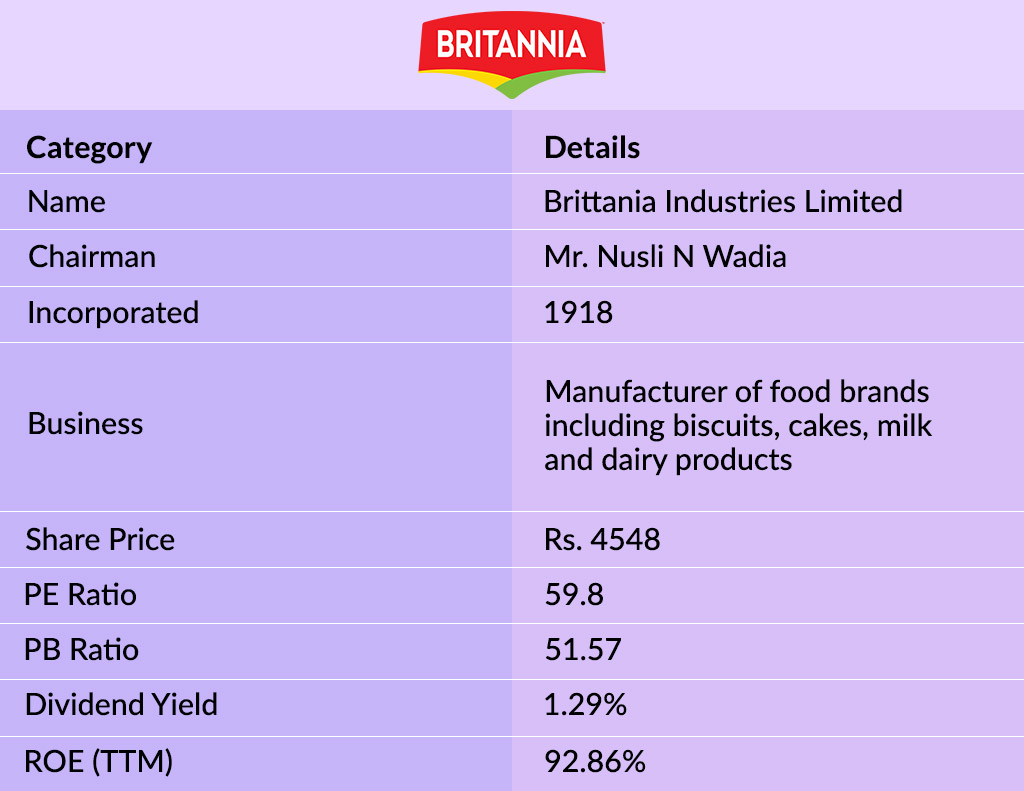

Brittania has a 100 year legacy and is a well-known name in the FMCG sector. The company has annual revenues of over Rs. 9,000 crores and is an American multinational company. The key details of this company are tabled below.

The FMCG sector is one of the strong pillars of the Indian economy and is a good addition to the portfolio that can act as a hedge against market volatility. This sector is set to grow in demand and volumes in the backdrop of the increasing demand, especially from the young population of the country. Industry experts agree that the FMCG sector is set to be a monumental part of the economic growth trajectory that is expected of the economy in the coming years.

Hope you gained valuable insights into the FMCG sector and the biggest names in the industry through this article. Do let us know if you want to know more details about these companies or other top names in the sector.

Watch this space for similar details of other emerging and key sectors of our economy and the stocks to watch out for in each such sector.

Till then Happy reading

Read More: World Consumer Rights Day-15th March

The IT sector has enjoyed huge growth over the past decades, however, the past ...

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric v...

The recent Union Budget 2023 had a special focus on renewable energy and the go...