Railways are often said to be the country's lifeline and connect even the remotest parts to be part of the growing economy. Once known as a white elephant of the Indian economy, the railway sector is seeing colossal transformation and significant budget allocation to amp up the speed of revolution in the sector. But did you know you can grow your portfolio too with the progress of railways? That’s right, you can invest in railway stocks set to gain the mist with the progress of the sector as a whole. Check out this blog to learn about these stocks and their key details.

Railways are often said to be the country's lifeline and connect even the remotest parts to be part of the growing economy. Once known as a white elephant of the Indian economy, the railway sector is seeing colossal transformation and significant budget allocation to amp up the speed of revolution in the sector. But did you know you can grow your portfolio too with the progress of railways? That’s right, you can invest in railway stocks set to gain the mist with the progress of the sector as a whole. Check out this blog to learn about these stocks and their key details.

Read More: IT Sector in Focus - Stocks to watch out

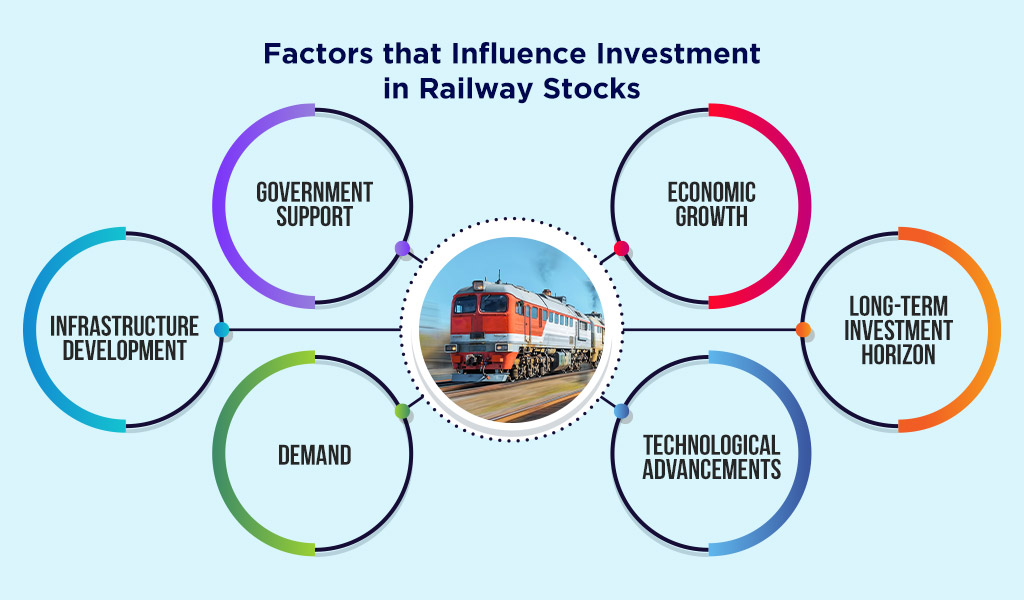

Government support plays a pivotal role in influencing investment in railway stocks. The extent to which the government prioritizes and invests in the railway sector can significantly impact the financial prospects of railway companies. Policies, reforms, and financial allocations for infrastructure development and modernization can directly influence the profitability and growth potential of railway stocks. Positive government initiatives can attract investor confidence by signalling stability and growth prospects within the sector.

The level of economic growth in India has a direct bearing on the investment attractiveness of railway stocks. During periods of robust economic expansion, there tends to be an increased demand for transportation services, including railways. Higher economic activity leads to greater movement of goods and people, which can translate into higher revenues and profitability for railway companies. As a result, sustained economic growth often correlates with a favourable environment for investing in railway stocks.

The development of railway infrastructure is a crucial factor influencing investment in railway stocks. Significant investments in constructing new railway lines, upgrading existing ones, electrification, and modernizing stations can enhance the efficiency and capacity of the railway system. Improved infrastructure can lead to increased operational efficiency, reduced costs, and expanded service capabilities, all of which contribute to the overall financial health of railway companies and their stocks' performance.

The willingness of investors to adopt a long-term investment horizon can impact their decisions to invest in railway stocks. The railway sector often involves substantial capital investments and relatively longer project gestation periods. Investors with a patient outlook who are willing to hold onto their investments for an extended period can benefit from the potential growth and stability offered by railway stocks as the sector progresses and matures.

The demand for passenger and freight services on railways significantly affects the financial performance of railway companies and, consequently, the investment appeal of their stocks. A growing population, urbanization, and increased industrial activity can drive higher demand for railway services. Robust demand positively impacts revenues and profitability, making railway stocks more attractive to investors seeking exposure to sectors with consistent and expanding demand.

Technological advancements can substantially influence investment in railway stocks. Incorporating innovative technologies such as digital signalling, automated systems, and data analytics can enhance operational efficiency, safety, and customer experience. Companies that effectively integrate technological advancements into their operations can gain a competitive edge, potentially leading to better financial performance and increased investor interest in their stocks.

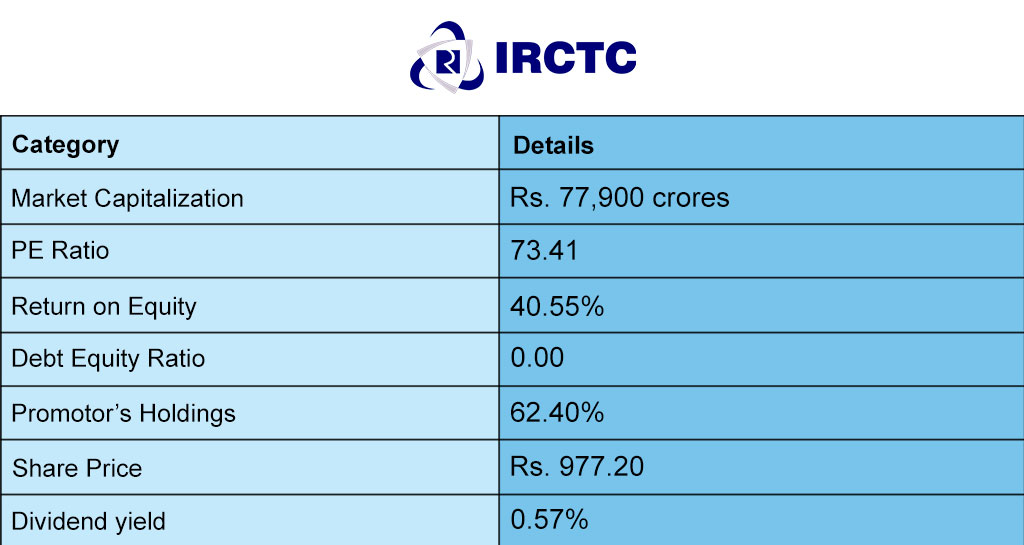

IRCTC is the premier company established under the Ministry of Railways in the year 1999. They are responsible for the catering and hospitality operations of Railways in India. The IRCTC mobile app and website enable users to book tickets, hotels, and organize tours. They offer features such as the IRCTC Zone, iPay Payment Gateway, Wallet services, and a loyalty program.

The financials of the company are as below. Figures as of January 31, 2024

The trailing returns of IRCTC are,

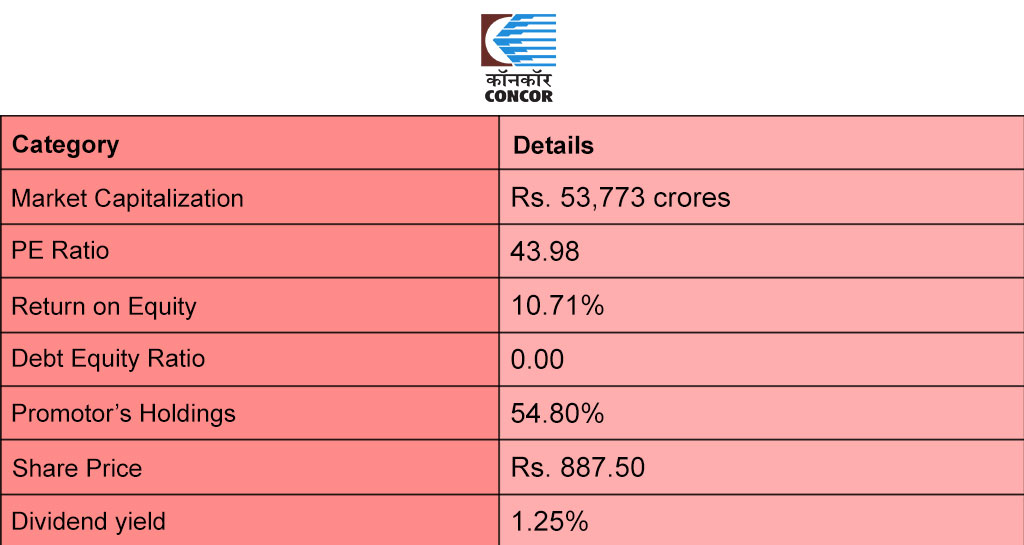

Container Corporation of India Limited (CONCOR) was established in March 1998 and is primarily owned by the Government of India. Its services includes air cargo movements, bonded warehousing, reefer and cold chain services, along with factory stuffing and de-stuffing.

The financials of the company are as below. Figures as of January 31, 2024

The trailing returns of CONCOR are,

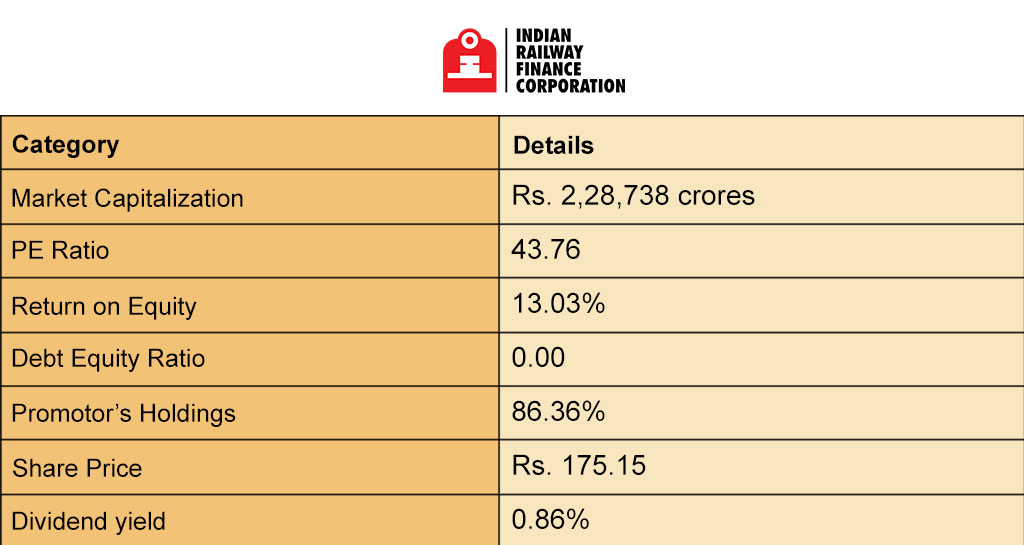

This company was established in 1986 and the government holds 86.4% in this company. The core objective of IRFC is to secure funds at reduced costs to bolster the railway sector. The key aspect of its operations is the financial leasing of diverse rolling stock assets, encompassing coaches, wagons, trucks, electric multiple units, containers, cranes, and other integral railway components.

The financials of the company are as below. Figures as of January 31, 2024

The trailing returns of IRFC are,

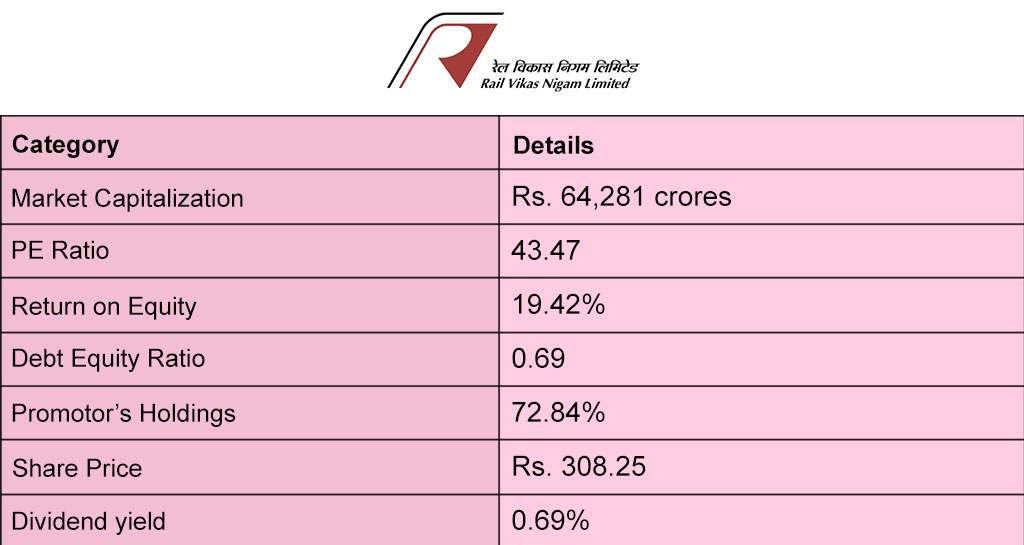

Formed in 2002, Rail Vikas Nigam Limited (RVNL) is a government body entrusted with executing railway infrastructure projects. It emphasizes activities like track installation, upgrades, electrification, bridge building, workshops, production units, and metro rail initiatives.

The financials of the company are as below. Figures as of January 31, 2024

The trailing returns of Rail Vikas Nigam are,

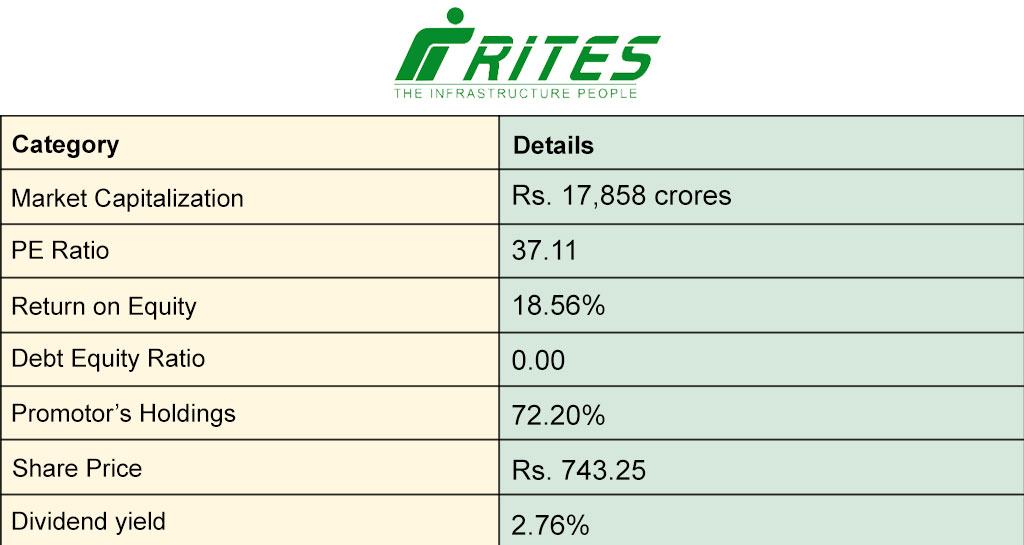

RITES Limited, an Indian engineering and consulting entity, specializes in transportation infrastructure solutions. RITES caters to clients in varied sectors such as railways, highways, airports, ports, urban transport, ropeways, and inland waterways, spanning 55 nations. It provides a spectrum of services including domestic and global consultancy, turnkey construction undertakings, leasing, and power generation.

The financials of the company are as below. Figures as of January 31, 2024

The trailing returns of RITES are,

The recent addition of the Vande Bharat trains across the length and breadth of the country has put the country on the global map with respect to the technological advancements and the improved quality of trains in the country. The sector is set to see further developments in the coming years which makes an investment with the long-term perspective attractive for investors. We hope this blog was able to give you key details of the top railway stocks and help you in your investment decisions. Let us know if you need any further details of these stocks or the sector as a whole. Till then Happy Reading!

Introduction For the longest time, investment in stock markets was thought to b...

The world today is more aware of the need for insurance than it was ever before....

The term stock is the starting point to invest or trade instock markets. While m...