Most Often, gold and stocks are the investment showgrounds that attracts Indian investors. If you are someone looking to invest in shares and stocks (stock market) in India, and are just about to start off, here are some of the basic things you need to understand as a newbie.

In India, there are two primary exchanges; the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These are the only two exchanges in India where the buying and selling of shares and commodities happen. Usually, there is a minor difference in the price of shares at the two exchanges. Your broker can guide you here in case you do not understand where to trade.

When a company lands on stock exchange with an initial public offer (IPO) it is known as the primary market. The secondary market is the place where the actual trading of the shares takes place. The only purpose of an IPO is to list the stock or the company in the share market. Once the company gets listed, it starts trading in the secondary market. Buying and selling shares is largely like buying and selling any other commodity.

The share prices of any company are directly proportional to the growth of the company. Usually, share prices go up when the company is growing very fast, earning very good profits or it gets new orders. Therefore, the price of a share is determined by demand & supply and the growth of the company. Sometimes, some positive or negative rumors about the company affect its share prices. However this fluctuation is temporary and does not affect the position of the company in the stock market for the long term.

Investors can start trading with even 1 share of the company. There is no minimum investment required So if you buy a stock with a market price of Rs.100/- and you just buy 1 share then you just need to invest Rs.100. Of course, brokerage and statutory charges will be extra.

PAN (Permanent Account Number) is a primary requirement for entering any financial transactions in our country. The Tax Authorities assign this unique 10 digit Alpha-Numeric number assigned to an individual for calculating their tax liabilities

Brokers are the people who are authorized to buy and sell on the markets. One cannot just start trading in the stock market, without a broker. SEBI (Securities and Exchanges Board of India), which regulates the share markets provide license to the eligible individuals or agencies to trade in the stock market.

For buying or selling shares, an investor need to inform your broker about which share in what quantity you wish to buy at which price. If you are using an online trading system, you can set the price in the system at which you want to sell it.

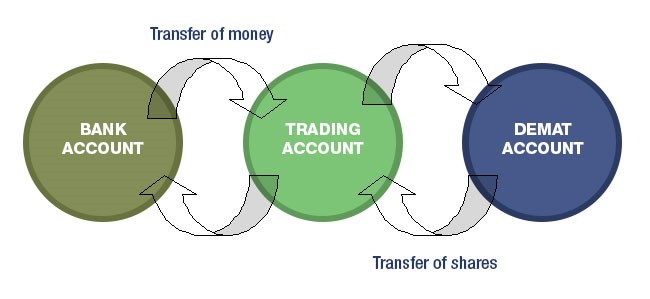

We cannot hold the shares in any physical form. It is the Demat account that will hold the stocks or shares in our name and the same will be reflected in the stock portfolio. All the shares have to be in Dematerialized state or a Demat state. For buying and selling shares, you need to have a Trading account. You need to open both a Demat and Trading account simultaneously, to trade in the Indian Stock Market Once you have a broker or broking company, it will help you in opening a Demat and Trading account

Statutory charges are government-imposed charges, just like GST or stamp duty that need to be paid. These charges go to the government, not the broker. The fee charged by the broker is known as brokerage.

Bottom Line

Once you step into the stock market, the brokers or the brocking firms provide all this information to you, but knowing these things will help you stay aware and invest carefully

Introduction The number of stock traders in our country has seen an unprecedent...

Beginner's Checklist for Stock Market - Let us begin with a very simple questio...

Did you know between 2019 and 2023, there were nearly 10 crore new demat account...