Imagine you are a fresher and at the start of your career. What you don’t realise is that you are at a crossroads. One way will take you to a financially secure future and help you meet your financial goals and the other will lead you to a lifetime of struggle and possibly living paycheck to paycheck. The defining factor between these two is the term ‘Financial Planning’. It may seem quite simple but requires a thorough understanding of various concepts and including them to have a robust financial plan. So are you confused about how to start with your financial planning journey? Do not worry we have got you covered. Check out this blog to learn all about financial planning and how to do it.

Read More: Emergency fund - why do you need it and how to build it?

To put it simply, financial planning is like a roadmap to manage your finances or money planning. Think of it as a systematic process of identifying short-term and long-term financial objectives and allocating resources to meet them. Well, this was the short answer. The long answer to effective financial planning is understanding the current financial position, ensuring optimum budgeting of resources, identifying the need and the potential for passive income opportunities, securing the financial future of oneself and their family through various insurance products, having a nest egg for a rainy day and ultimately having a secured retirement plan. It is therefore rightly said that a well-defined financial plan not only helps in achieving financial objectives but also ensures wealth accumulation and preservation.

There are various components of a robust financial plan. Some of these key components are explained hereunder.

Budgeting serves as the cornerstone of financial planning, constituting the meticulous tracking of income and expenditures to ensure alignment with financial objectives. In India, the culture of prioritising savings is instilled in individuals from a young age. This helps underscore the significance of budgeting and cashflow management by facilitating the optimum allocation of resources toward savings and investments while effectively managing day-to-day expenses and commitments. Moreover, adept cashflow management is pivotal in guaranteeing sufficient liquidity to meet short-term financial obligations without jeopardising long-term financial goals.

Investment planning involves selecting appropriate investment vehicles based on an investor's risk tolerance, time horizon, and financial goals. Investors have access to various investment options such as stocks, mutual funds, bonds, real estate, and gold. A key ingredient to having a good financial plan is a diversified investment portfolio that helps spread risk and optimise returns over time. In order to achieve this, it is important to note that understanding market dynamics, economic trends, and regulatory changes is essential for making informed investment decisions.

Tax planning is a critical aspect of financial planning, especially in a country like India due to its complex tax structure. Investors need to optimise tax liabilities by leveraging available deductions, exemptions, and tax-saving investments such as Equity Linked Savings Schemes (ELSS), Public Provident Fund (PPF), National Pension System (NPS), and tax-saving fixed deposits. Efficient tax planning ensures that investors retain more of their earnings, thereby accelerating wealth accumulation.

Mitigating financial risks is vital for safeguarding one's financial well-being. Investors should assess their risk tolerance and protect against unforeseen events through insurance products such as life insurance, health insurance, and general insurance (e.g., property insurance, vehicle insurance). Adequate coverage provides financial security to investors and their families in times of crisis, preventing unexpected expenses from derailing long-term financial goals.

Estate planning is not as popular in the masses of our country but it is an essential part of financial planning. Estate planning involves structuring the distribution of assets and wealth transfer to beneficiaries efficiently. The components of estate planning include drafting wills, setting up trusts, and understanding inheritance laws to minimise estate taxes and ensure a smooth transition of assets to legal heirs. Estate planning also includes healthcare directives and powers of attorney to manage financial affairs in case of incapacity.

Finally, we come to retirement planning. Having a secure retirement plan ensures a comfortable and financially secure post-retirement life is the ultimate goal of any financial plan. Investors can utilise retirement-focused investment vehicles like the National Pension System (NPS) and Employee Provident Fund (EPF) to build a strong retirement corpus. In order to effectively calculate retirement needs, investors should factor in inflation, and choose suitable investment strategies enabling investors to enjoy a fulfilling retirement without financial constraints.

The first step in financial planning involves setting clear and achievable financial goals. These goals may include short-term objectives like buying a car, medium-term goals such as purchasing a home, and long-term aspirations like retirement planning and children's education.

After defining financial goals, one needs to assess their current financial situation thoroughly. This assessment involves evaluating income sources, understanding spending patterns, analysing assets and liabilities, and assessing overall cash flow.

With a clear understanding of their financial standing, the next step is to create a detailed budget that allocates funds for various categories. Some of these categories in a budget can be expenses, including necessities, discretionary spending, debt repayments, savings, and investments. The use of the 50/30/20 budgeting rule can be quite beneficial for effective budgeting. Budgeting ensures disciplined financial management and helps prioritise spending according to financial goals.

Building an emergency fund is crucial in financial planning to deal with unforeseen expenses or emergencies such as medical bills or job loss. Financial advisors often recommend maintaining an emergency fund equivalent to 6-12 months' worth of living expenses to provide a financial safety net.

Do not forget insurance. It plays a vital role in mitigating financial risks and protecting against unexpected events. Therefore it is important to assess one’s insurance needs, including health insurance, life insurance, disability insurance, and property insurance, to safeguard their financial well-being and that of their dependents.

Developing an investment strategy is essential for wealth accumulation and achieving long-term financial goals. This involves determining risk tolerance, investment objectives, and time horizon, and selecting suitable investment vehicles such as stocks, bonds, mutual funds, and retirement accounts.

Financial planning is an ongoing process that requires regular review and adjustment. Individuals should periodically reassess their financial goals, evaluate the performance of their investments, and make necessary adjustments to their financial plans based on changes in personal circumstances, market conditions, and financial objectives. Regular review ensures that the financial plan remains relevant and effective in helping individuals achieve their financial goals over time.

The need for a financial plan is like the starting point for a secure financial future. While there is no correct age to start a financial plan, it is important to know that like investing, the earlier the better. When you have a financial plan right from the time you start earning, allocating it effectively over the years becomes easy which further helps in achieving the financial goals within the set targets.

This article was a brief insight into the importance of financial planning and why it is essential to start at the earliest. Let us know if you want to know more about such financial concepts and we will take them up in our upcoming blogs.

Till then Happy Reading!

The stock market in India has fascinated general Indian masses for long, perhap...

Most Often, gold and stocks are the investment showgrounds that attracts Indian ...

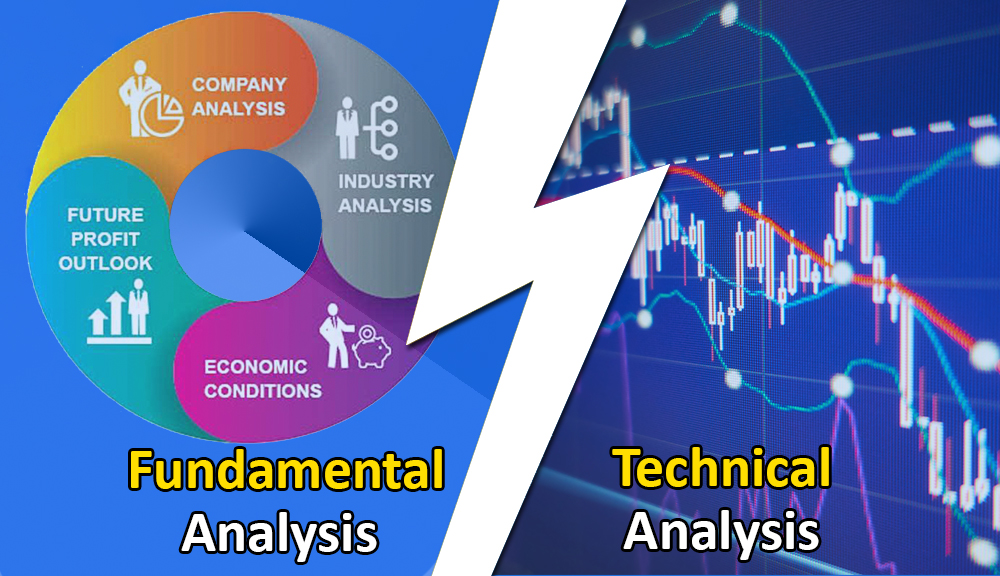

For analyzing the stock markets, Fundamental Analysis and Technical Analysis are...

A phenomenon of Open v/s high low When you are into the work of stock trading, ...